Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Everyone’s financial journey is different; Piggyvest gives you the tools to plan, save, and invest, so you can create your own money story. Start now with as low as ₦1,000!

What’s your earliest memory of money?

I started helping my dad at his spare parts shop when I was in JSS 2. We had a deal: I could pocket whatever profit I made when I managed the shop on Sundays. For instance, if I sold a ₦200 bulb for ₦250, I could keep the ₦50.

That was my first experience earning money. Besides that, I think I’ve always been aware of how money worked. At least I knew we didn’t have it like that at home. One of the first stories I heard as a child was how my dad went from having money to going broke.

Oh. How did that happen?

According to my mum, he surrounded himself with people of small minds. They weren’t thinking about the future; instead, they carried girls, drank and partied. That affected how he spent his money, and he never really recovered.

All that happened when I was really young, so I don’t have firsthand recollections of how well-to-do my dad was. All I knew growing up was that we could only afford the bare necessities. My mum also supported the home with her income as a hairdresser.

Back to managing your dad’s shop, how long did this last?

I did that until I got into SS 2, then my brother took over. The next thing I did to earn money was to take advantage of the Ponzi scheme craze.

This was in 2017, and numerous sites promised to help people make money online. I think this was around the MMM and Racksterli time. A site would spring up today, people would make money quickly, and then it’d crash.

I had the idea of creating a Facebook group and charging people to help them scour the internet and find new money-making platforms. That way, they could quickly make money before others found the platforms, and they inevitably crashed.

I created the group and charged people ₦1k/month to join.

And people paid?

They did. In the first month, 60 people paid, and this number grew to 115 by the third month. Each month, I would usually give them three or four new platforms. I also included platforms that paid people for doing online tasks because I didn’t want people to say they put their money somewhere and then lost it.

I mostly saved what I earned during the three months this lasted. Then, ironically, I put ₦100k — almost all I made — inside one Ponzi scheme that promised me ₦130k in return, and they scammed me. I lost the whole thing.

Yikes. Sorry about that

Thanks. It was so painful because it was the first time I’d earned hundreds of thousands. I actually knew it was a risky move to put my money there, but money-making is always risky. If the risk had paid off, I wouldn’t complain.

After that, I went back to work with my dad again for about two months to get extra money. Then, my friend introduced me to another platform, and I decided to risk it again. This time, I only had about ₦15k. I put it there and collected ₦19,800 after a month. Then I put the whole amount back. I kept doing that for three months and grew my money to ₦30k.

This same friend also introduced me to crypto, and since he was always hyping it, I decided to give it a try. I put the ₦30k in a cryptocurrency project. I’m not even sure what they did with it. Maybe they traded the coin or something. But in two months, the value of my coin grew to almost ₦300k. This was in 2018, and I was in SS 3.

Wild. What did you do with the money?

I could have left the money in the crypto project to keep growing, but I’d learnt from the Ponzi event. So, I took my money out and spread it across different coins. I must have bought at least 20 coins.

I didn’t have any strategy; I just followed my guy. He was the one who told me which coin to buy and hold. I had a small Lenovo phone at the time, which I used to download my crypto wallet and track my investments.

Following my friend’s advice, I kept the investments intact and didn’t take out any money for about six months. At the end, my investment grew to ₦320k. I even took ₦50k out of it to buy clothes and shoes for my valedictory service in 2019. My parents couldn’t afford to get me anything, but I had to look good.

Inject it. What happened after secondary school?

I learnt graphic design at a printing press for about two years. My parents bought me a laptop and paid for the training, but there wasn’t a specific period I had to stay to “complete” the training. I guess I just stayed because I didn’t have anything else to do.

During my time there, I made a little money here and there helping customers with design tweaks. I wasn’t exactly a staff member. I was just the guy who sometimes helped with designs. This also helped me expand my network of contacts. Whenever I helped someone, I plugged in that I could assist with their graphic design from scratch.

So, when I left the printing press in 2021 to do my own thing, I already had potential customers. I just had to call and tell them to give me work.

How much were you making?

Not much. I typically charged ₦2k – ₦3k per social media design and ₦4k – ₦5k for banners and other designs that required printing. On average, I earned at least ₦50k monthly. Sometimes up to ₦100k.

I got customers back-to-back for the first four months, but the graphic design industry is saturated. There was always someone willing to take a lower price. So, when I refused to cut my price, customers moved to the next person. My income started to reduce to ₦10k – ₦20k levels.

I managed for three more months before I stopped entirely. I wasn’t getting customers, and I was losing money paying for design software and buying data. Also, I lived in an area that didn’t have good electricity, so I paid to charge my laptop and power bank. It wasn’t worth it anymore. So, I dumped it and went to learn product design.

How did product design enter the picture?

It was still design. Plus, some of my friends were in tech, learning web design and software development. I wanted to get a tech skill too, but I didn’t have the brain to handle coding, so I opted for product design because it felt more straightforward and similar to what I already did.

Remember the money in my crypto wallet? I emptied it to pay the ₦250k fee for the six-month product design course. It was a huge investment, but it felt worth it. My tech friends kept singing about the possibility of earning a lot from foreign clients, and that was a huge motivator.

I mean, what’s a better motivator than money?

Exactly. After completing the course in 2022, I got a job at a Chinese company that sold solar panels and also had an app. They were looking for someone who could handle both product and graphic design, so I applied and got the job — ₦200k/ month. I was so excited. It was the first time I’d worked in a corporate environment, and it felt like my investment paid off.

At this time, I still lived with my parents. I handled small utility bills occasionally, but I generally had minimal expenses. I worked there for close to two years and left in 2024.

Why did you leave?

Partly because they were trying to give me more work beyond what we agreed, and partly because I had been admitted to the university. I’d been trying to get into uni since I left secondary school in 2018, and it finally clicked.

Congrats! How do you fund your education?

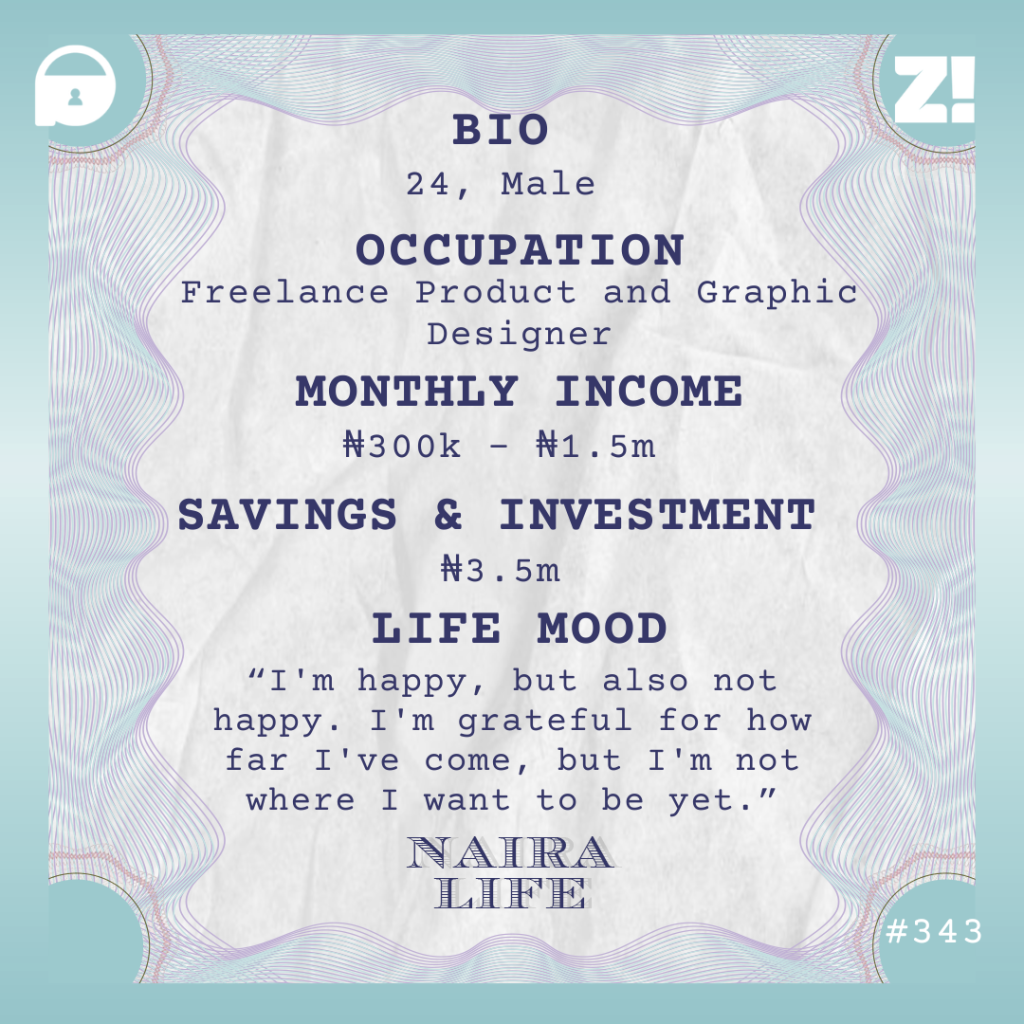

I pay my ₦250k/year tuition and ₦600k/year rent from my freelance product and graphic designer income. I’ve worked freelance since I got into school, and my clients come from Upwork, Fiverr, Twine, and basically anywhere I can find work. My monthly income ranges between ₦300k and ₦1.5m. So far, there hasn’t been a month when I didn’t make money at all.

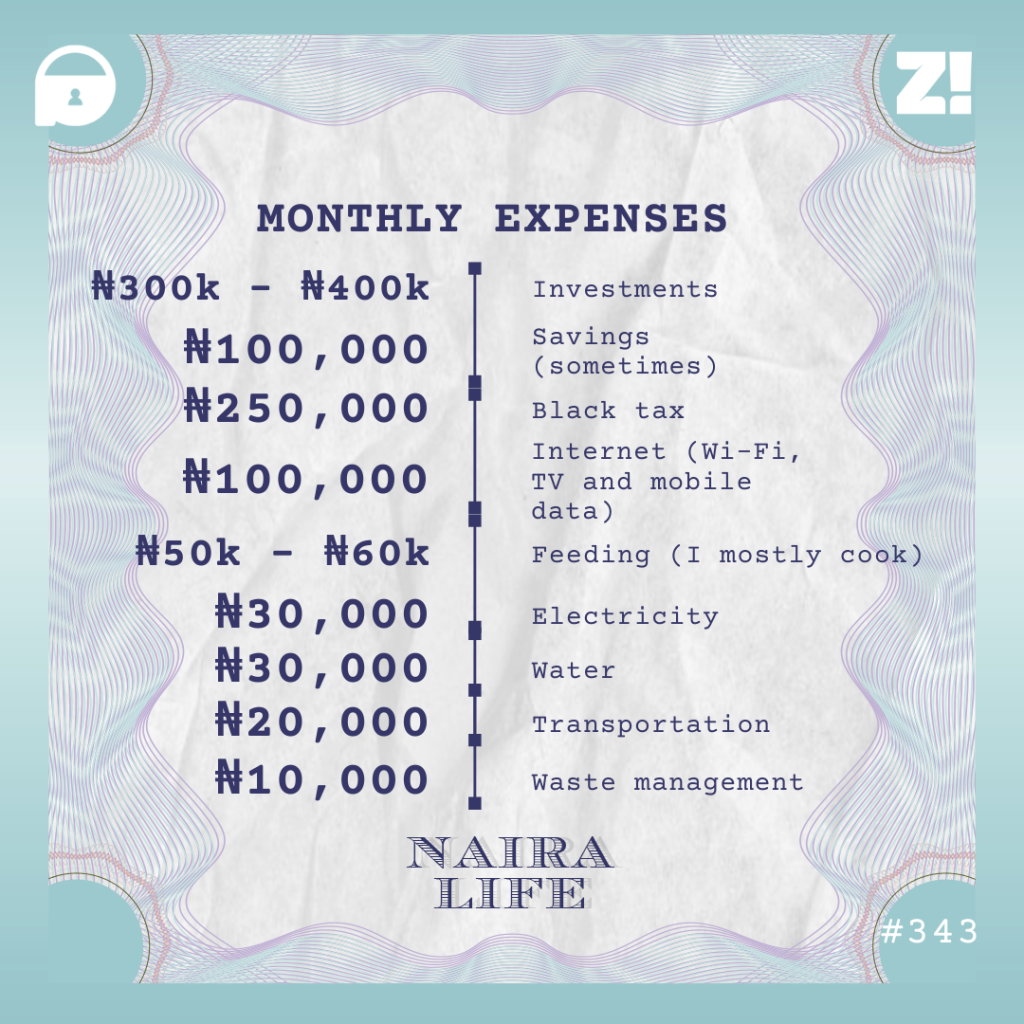

Let’s break down your typical monthly expenses

Wait. Why do you spend so much on internet and black tax?

I’m sort of a social media addict, and I use the internet a lot for my work, too. So, it takes a huge chunk of my money.

Black tax is that high because my dad had a stroke last year, so I often have to send money for his medication. My siblings also tax me from time to time.

Sorry about your dad. You mentioned investments. What does your portfolio look like?

My investment portfolio is primarily cryptocurrency and stocks. My crypto is currently worth ₦2.5m spread across Bitcoin, Dogecoin and Ethereum. I also have approximately ₦700k in stocks, including Dangote Sugar, Zenith Bank, GT Bank, MTN, and Google. I’m essentially just investing to have something to fall back on; I don’t really have plans for them.

For my savings, I use an app, and I currently have ₦300k saved. I’m not really consistent with savings.

How would you describe your relationship with money?

I definitely live above my means. I tend to spend more than I earn in a month and have to dip into my savings. Ideally, I should be able to live within a ₦500k/month spending limit. In fact, that’s my goal, but it’s hard for me to do because I’ve become used to a certain lifestyle.

For instance, I spend a lot on clothes. It’s not in the breakdown above because I don’t allocate a particular amount to it. I just spend what I can see in my account at the moment. Also, my ₦100k data should last three months, but it only lasts three weeks.

Are there specific measures you’re taking to curb your expenses?

I recently opened a Piggyvest account, and I plan to split my money into two and lock half there. So, if I make ₦1m, I lock ₦500k and force myself to live on the remaining. I just started a few weeks ago. Hopefully I’ll be able to follow through.

What do future plans look like?

I might stay freelance for the near future. I don’t think I’ll be returning to the corporate world. Freelancing can be unpredictable, but I haven’t had any bad months so far. Also, I’m building a savings and investment portfolio as a backup in case something happens. At least I’ll have something to sustain me.

If I ever stop freelancing, it’ll be to start my own business.

Is there an ideal amount you think you should be earning?

₦3m/month. I’m not there yet, but I hope to reach that level soon. I plan to enrol in an advanced product design course soon. I have one in mind already, and it costs over a million naira.

Is there anything you want right now but can’t afford?

A car. I would need at least ₦10m for that.

How about the last thing you bought that made you happy?

I got a PS5 for ₦800k in July. It made me really happy.

How would you rate your financial happiness on a scale of 1-10?

6. I’m happy, but also not happy. I’m grateful for how far I’ve come, but I’m not where I want to be yet. It might be closer to a 10 when I have a car, a three-bedroom apartment and earn over ₦15m monthly.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.