Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Saving doesn’t stop life from happening. When things come up, Carbon doesn’t force you to choose between progress and survival. Your locked savings keep growing, and you can use it as collateral to access a loan at just 3% interest. It’s saving, built different so you can move different. Create a savings plan here.

When was the first time you realised the importance of money?

2020 was when I had my financial “awakening.” I was in my second year at uni, and the world was on lockdown due to COVID. That meant I had to stay home for a while. For the first time, I noticed my parents struggling to make ends meet because they couldn’t go out to work.

It was my wake-up call to learn how to manage my finances and make money, so I wouldn’t go through something like that.

Just how bad did things get for your parents at that time?

Things had been bad for a long time. The changes just didn’t really register with me; it was almost like they weren’t affecting me.

My dad had lost his big corporate job when I was 8, and we moved back to our hometown. There were periods when my school fees went unpaid, and I couldn’t get as many clothes as I wanted. But I always just thought it was my dad’s problem to figure out. It was his job.

However, during the lockdown, our financial situation became my problem too. Whenever I asked my parents for something, they’d flare up and be like, “You’re getting older. You should learn to figure things out yourself. Why are you asking me for money to buy data?” I began to feel like a burden and knew I needed to find a way to make money.

So, what did you do?

I started looking up ways to make money online. The first time I went on LinkedIn, I saw 16-year-olds and 17-year-olds talking about landing gigs and making money. I felt overwhelmed and left the app.

Then I stumbled on a platform called “Online Book Club” that paid people to read and review books.

This is how it worked: After registering on the platform, you’d have to do multiple free book reviews before getting promoted to paid reviews. They paid like $5 for every accepted review.

It took me five months of reviewing free books before I made that $5. The naira equivalent was less than ₦3k, but it made me feel so proud. It was the first money I ever made, and I was excited about the thought of buying things without having to ask my parents for money.

However, I earned money from the reviews only a few more times before PayPal issues prevented me from earning on the platform.

Sigh. The streets remember when PayPal was every Nigerian freelancer’s nightmare

It was annoying. When that happened, I decided to give LinkedIn another shot. My main problem was: I didn’t know what to post there. I didn’t have a skill and couldn’t exactly write about the time I reviewed books.

Still, I was determined to make LinkedIn work for me as it did for others. I bought a ₦5k eBook to learn how to optimise and create content for LinkedIn. I applied the learnings — writing about my life — and began getting followers.

It took two years and 10k followers before I made money on LinkedIn. In 2023, I got a DM from someone who said he liked my writing and wanted me to do the same for his personal page. I told him I didn’t know much about managing and creating content for others, but we decided to give it a try. The man was an American, and he paid me the equivalent of ₦99k/month. We worked together for about five months before we stopped.

That gig made me start to think about personal branding. I began watching YouTube videos to learn how to better position myself for more opportunities. I like to learn multiple things at once, so I was also learning SEO and content writing.

Did these help you get more gigs?

Oh, they did. That same year, I got a ₦30k/month personal branding gig to write weekly for a client’s LinkedIn profile.

I was also constantly writing about personal development and branding on LinkedIn. This effort got me a referral to work as a digital marketing specialist for a company. They (the company) wanted to attract the kind of community I’d grown on LinkedIn, so I was the best fit for the role. This was in 2024, and they paid me ₦100k/month.

Around the same time, I got another ₦250k/month digital marketing job with a fintech company. In that role, I handled everything from social media management to email marketing and YouTube video creation.

I was doing all these jobs and still navigating university.

Phew. That sounds like a lot to juggle

It was, but the money made up for it. In fact, I developed an impulse spending habit. I was still asking my parents for money because somehow, I couldn’t live on a ₦380k monthly income.

I was just spending anyhow, and most of it went to eating out. I was often exhausted after work and school, so I didn’t want to cook. It got so bad that even when I ran out of money, I’d borrow more to order food. I also gained a lot of weight during that period.

I graduated from uni in 2025 and dropped the ₦100k role.

Why did you drop it?

It became too overwhelming. I was managing many responsibilities and had reduced the effort I put into growing my personal brand on LinkedIn. It felt like I was missing something I wanted out of life. I kept thinking, “What is the point of doing all this work when I’m barely making ends meet?”

At the same time, two of my younger siblings were entering the university, and my mum was constantly calling to complain about finances. It was all too much to handle, and I believed I deserved more than what I was getting for the work I did.

I moved on to work for an Indian company as an SEO manager. They paid me ₦450k/month. Four months later, I got another SEO manager role that drastically increased my income. They pay $1000/month, which is about ₦1.4 million.

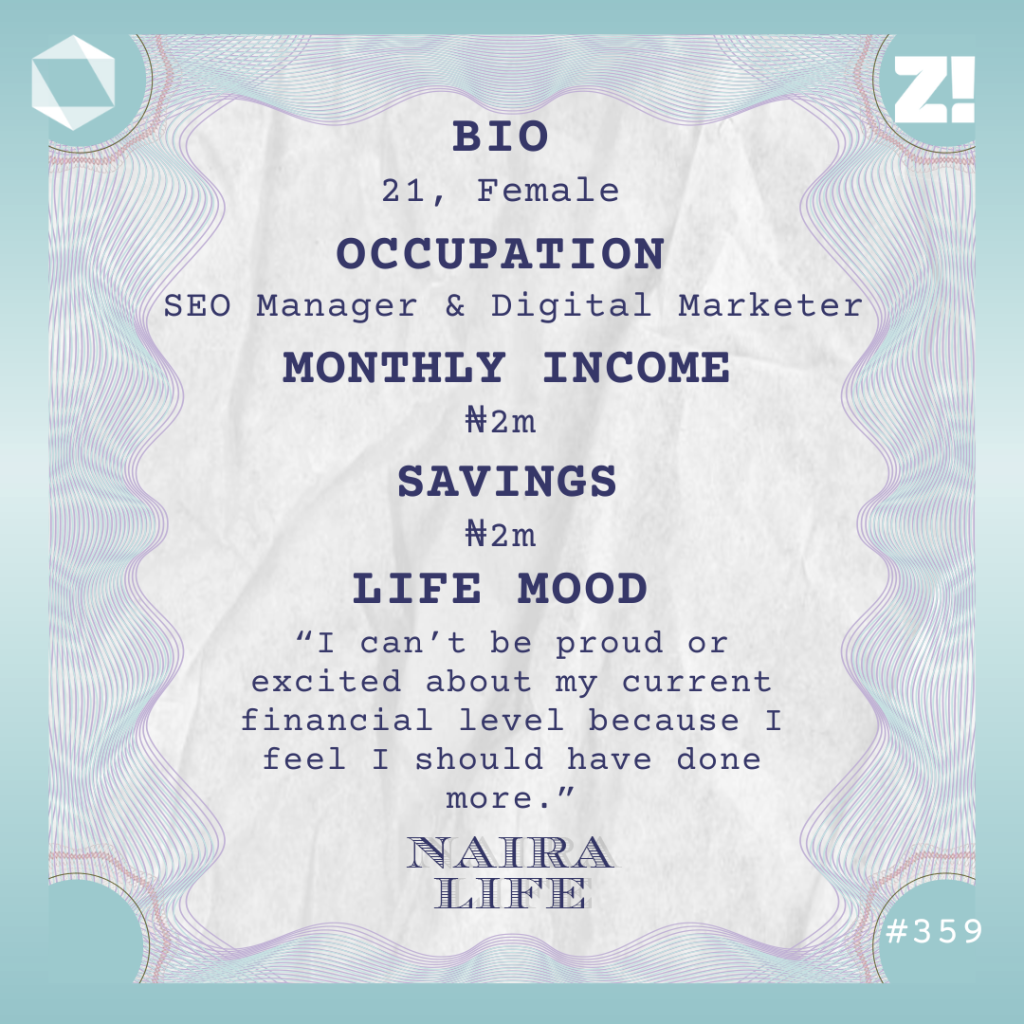

I currently work three jobs: a ₦250k digital marketing role with a fintech, and two SEO manager roles that pay me ₦450k and ₦1.4 million, respectively. These bring my monthly income to just over ₦2 million. I still do the ₦30k/month LinkedIn personal branding gig, but I don’t really count it as income.

Those are a lot of jobs. How do you manage them all?

I often have little time for my friends. Since I work remotely, I hardly go out. It’s like all there is to my life is: work, deliver and make money.

I’m not complaining, though. Sometimes I’m amazed at how my financial situation has completely changed, and how I moved from ₦380k to over ₦2 million in 10 months. My new income has also taken me out of debt, so that’s an advantage.

Debt? When did this happen?

Just before I got the $1k job, my generator broke down beyond repair. I couldn’t live without one as a remote worker, so I borrowed ₦350k from my bank to buy another. Unfortunately, in the previous month, I had borrowed money from a loan app to fund my eating out habits.

When the loan app came for their money, I had to borrow from yet another loan app to repay the first one. Before I knew it, my debt was over ₦500k. Out of frustration, I uploaded all my bank statements to ChatGPT and explained my debt situation, and it drew up a plan to help me pay off the debt and improve my finances.

It told me first to create a ₦50k emergency fund, then gradually pay off each debt. I couldn’t stick to that plan until I got the new job and a higher income. The first thing I did with my new salary was pay off my debt, then build a ₦300k emergency fund in three months. I also replaced my malfunctioning laptop.

Then, around October 2025, I decided to take savings seriously.

Did something trigger that?

The debt situation was one reason I decided to take my finances seriously, but my LinkedIn brand also played a role.

One day, it occurred to me that I had multiple followers and that people often came to me for advice on career advancement. It wasn’t like I didn’t have jobs. Why then couldn’t I pay my bills or even loan a friend ₦10k?

I thought about it deeply and concluded I didn’t have a “source of income” issue. My problem was how to manage the income.

What’s your approach to savings these days?

I don’t have a specific percentage that I save. Once I subtract my monthly expenses, I divide what’s left between my regular savings and retirement savings. I’m working on reducing my impulse spending, so I give myself a ₦100k buffer for impulse expenses.

I mostly lock my savings in a savings app. If I can’t touch it, I can’t spend it. Right now, my total savings are about ₦2 million: ₦400k for a new phone, ₦600k for land, ₦800k for retirement/pension, and ₦200k in my emergency fund.

How would you describe your relationship with money now?

I’m in a healthier headspace with money, and I’m learning to discipline myself and delay gratification. Right now, I know I’ll end up in debt if I don’t plan properly; it doesn’t matter whether my income increases or not. So, I’m consciously learning to calm down and spend wisely.

I have a lot of money regrets, though. It’s very painful that I had the opportunity to make money online early, but I spent it anyhow. I feel like I wasted three years of my life. If I’d started saving early, I would’ve made so much in interest and be in a better financial situation by now. I would have had at least 8 figures in savings or investments.

I feel you. Do you have savings and investment goals right now?

I want to buy my first piece of land before my birthday this year. My mum is on my neck to invest in land, so I’m planning to save up to ₦3m for that. Left to me, I’d just continue buying stocks and digital gold on my investment app.

I don’t know if this qualifies as an investment, but I’m working towards my retirement goal. I recently opened a pension account and randomly send money there monthly. Since I mostly work with international brands, they don’t contribute to my pension, so I have to pay it myself.

One more thing: I want to have a good birthday this year. I couldn’t celebrate myself the way I wanted last year, and I want to fix that. I estimate about ₦1 million for that. I feel weird for saying I want to save more and spend wisely while still planning a million-naira birthday.

I mean, you still have to enjoy your money reasonably. What’s been the hardest part of your new approach to managing your finances?

Delaying gratification. It’s not easy, especially as someone who used to buy things whenever she wanted. I haven’t fully gotten the hang of financial management yet. For instance, I once grew my emergency fund to ₦800k, but it’s now down to ₦200k due to a few expenses. It’s tough, but I’m trying my best.

I even had to change my circle of friends from the ones I had before, who always loved going out and having fun. I’m generally learning to be more intentional with my life and hobbies. Now, when I’m bored, I read books or find hobbies to avoid the draw of online shopping.

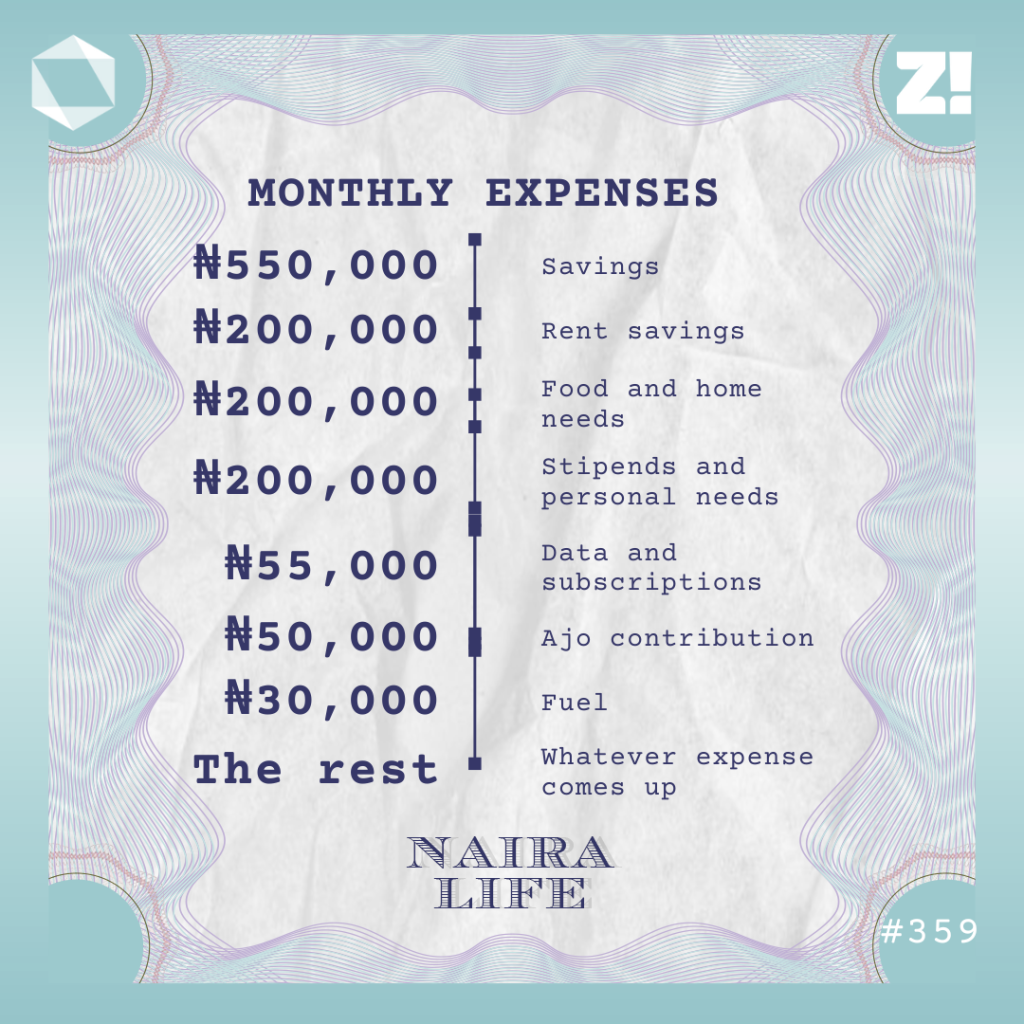

Let’s break down your typical monthly expenses

Every month is different, and I use a spreadsheet to budget and track expenses. However, my recurring expenses typically look like this:

My annual rent is ₦450k, but I plan to move out next year, so I’m saving ₦200k monthly for it. I also sometimes work with graphic designers and video editors on my work projects, which isn’t included in this breakdown because it doesn’t happen every month.

I’m curious. How has your impact growth impacted how you see money?

I think it’s inevitable that one’s mindset changes when they start earning more. Now, I think about money that grows with the more value you put out there. Like, the more services and value I can offer, the more money I’ll attract.

Is there an ideal amount of money you think you should be earning now?

I’d like to cross ₦3 million/month this year, and maybe even push to ₦5 million. I’m working on expanding my brand to YouTube, and if I can monetise that, I’ll earn more.

Is there anything you want right now but can’t afford?

Yes, a new phone, a car, and international holiday trips. I’ll need like ₦12m to clear off a phone and a car off my wish list.

How about the last thing you bought that made you happy?

My laptop. I bought it in October for ₦1.1m.

How would you rate your financial happiness on a scale of 1-10?

5. I can’t be proud or excited about my current financial level because I feel I should have done more. I started early, but didn’t save at all. On top of that, I keep seeing success stories of young people making 8 and 9-figure figures. I can definitely do more than what I’m currently doing.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.