Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Put your money to work with as little as ₦5,000. Invest Naija’s SEC-registered Money Market Fund delivers quarterly income, liquidity, capital preservation, and returns that beat savings and fixed deposits. Start here.

What’s your earliest memory of money?

My dad’s a pastor, and from when I was 5 or 6, I’d join the ushers to put the offering baskets together and arrange everything. The church was my earliest memory of seeing so much cash in one place.

Are the rumours of pastors’ kids growing up poor true?

We weren’t rich, but we were okay. I didn’t miss out on anything. My mum was a teacher, and I attended good schools. I’d say we were a pretty average family.

When was the first time you did something to earn money?

2015. I was in 100 level, and my roommate said he knew a shipping platform where we could import shoes to Nigeria. There were about four students in our room, and he convinced us to put money together to buy a batch, sell it, and split the profit.

I contributed about ₦10k or ₦20k, but didn’t see any profit. We had about 8-10 shoes in our first (and only) batch, and managed to sell only one. We eventually shared the shoes among ourselves. Unfortunately, we didn’t buy my size, so I didn’t even get anything.

TBH, that would pain me more than not making a profit

Right? That part was painful. The money, not so much. I just attributed it to loose cash. To be fair, I regularly got pocket money from home, so I always had something in my account.

I could get ₦30k today, another ₦20k in the middle of the month, and then ₦30k again in a few weeks. I never even had to ask for money in 100 level. Pocket money in subsequent years wasn’t so random, but I was still comfortable.

Must be nice. Did you try another business after the shoe fail?

I tried to run one or two showbiz events in school and make money from ticketing, but most of them didn’t pass the idea stage. The one I managed to host ended up in a loss because students preferred free events or wouldn’t come at all. After this happened, I just left the events idea alone.

I also played the keyboard and occasionally made some money playing it in church. The pastor could just say, “Oh. You’ve done well today. Take this envelope,” and I’d find ₦10k or ₦15k inside. But this money only came once in a while, so I lived on pocket money throughout my time in school.

What did you do after school?

So, my set finished in 2021, but I had an extra year, which meant I had some business in school until I officially left in 2023.

During the wait, I paid ₦30k for a three-month community management and paid advertising course, which came with a post-training internship. I did the three-month internship at a digital marketing/advisory startup and got paid ₦15k/month.

They retained me after the internship ended and increased my salary to ₦40k. At this point, I lived with a family friend because the job had taken me to a different state. I didn’t have a lot of expenses, but my salary was barely enough. However, I feel like the job gave my career a solid foundation. The skills I acquired helped me land my next job and still help me today.

Tell me about that next job

I was hired as a sales development representative at a health tech company in 2023 for ₦120k/month.

The job was like a career pivot; I previously worked in community management and paid ads. However, my previous role had also introduced me to sales — mainly because of the paid ads — so I wasn’t exactly a newbie.

I worked there from 2023 to mid-2025. In that time, I switched to sales operations and received a few salary bumps. By the time I left the job in May 2025, my salary had grown to ₦224k/month.

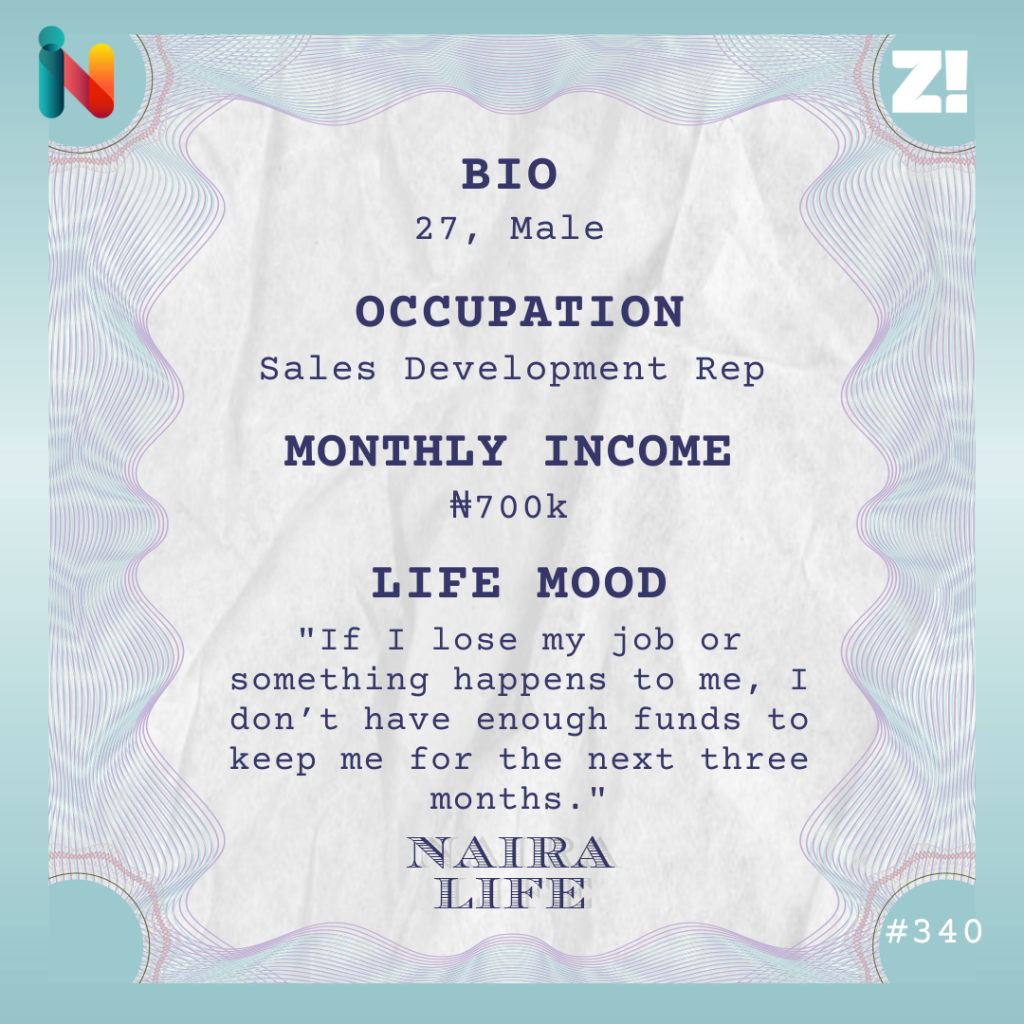

I moved on to my current job — sales development rep at a tech company, where I earn ₦700k/month.

That’s a nice jump. How did that feel?

It felt good initially, but I now want more. I think it’s a case of me now realising the value of the work I do. Also, I had to relocate to Lagos because of the job and now live alone, so my expenses have increased as I’m now financially responsible for myself.

That said, the income growth has given me some leverage. I wouldn’t say I’m comfortable, but at least I can plan towards the things I want and get them for myself.

Speaking of relocation, what were the moving costs like?

Fortunately, I had savings from a three-month cold-calling gig I did earlier in the year for a foreign company, which paid €250/month (around ₦450k after conversion).

So, when it was time to move, I had over ₦1m and used it to get my ₦800k/year self-contained apartment. Of course, I still had to pay about ₦500k more for the agent and all the other extra fees.

Also, I had to make some heavy purchases in the months following the move because I made the foolish decision of moving to Lagos with only my clothes. I wanted to come and start a “new life” in Lagos, forgetting I needed things like curtains and a mattress. Omo.

Let me guess, you discovered they were expensive?

Very expensive. I must’ve spent ₦2m – ₦3m on basic furniture, cooking utensils and a workstation. I don’t even want to calculate each of them because the figures will just annoy me. I still need things like an inverter, sound bar and air conditioner, but those will come later. They aren’t really pressing needs right now.

How has your income growth impacted your lifestyle?

There hasn’t been much change. I’m a very calm person. I don’t do too much, and I’m careful about spending my money.

Once my salary comes in, I remove my tithe and internet cost, then divide the rest into three parts of ₦200k each: The first ₦200k goes to my savings, the second ₦200k is what I spend as living expenses, and I keep the rest as a cushion in case an emergency need comes up within the month.

I often spend out of this emergency fund before my next salary comes in, but I try to keep it as much as possible.

Let’s break that down for a typical month

I save on a savings app, and whenever I get my monthly interest, I use it to buy dollars on the app. I’m not sure if it’s a good strategy; I just do it. I currently have about ₦1.5m in my savings portfolio.

I’m curious. Do you have a goal for your savings?

I’m beginning to shift towards japa. I forgot to mention I spent about ₦1.2m on a postgraduate diploma (PGD) program I started at the beginning of the year. I should be done with that in a few months, and the current plan is to finish and try to go abroad for a full-blown MBA.

I’m not entirely sure how I’ll go about that yet, so there’s not a lot of clarity right now. I don’t want to think too much about it until I finish the PGD. I actually got admitted into a program abroad before I started the PGD, but I didn’t have enough money to provide proof of funds to get a visa, and it didn’t work out. So, I’ll just pray and figure out the steps one at a time. Who knows? Maybe God will shock me.

Maybe He will. How would you describe your relationship with money?

I live within my means, which is probably tied to my personality because I have colleagues in the same income bracket who are like social butterflies. They’re always out spending money.

In their defence, they’ve been in Lagos longer. I’m still very wary of the city. I feel like one wrong move can wreck me.

How so?

The city is crazy, and it’s a new location for me. If I lose my job or something happens to me, I don’t have enough funds to keep me for the next three months. I have limited support here, so I don’t have much cushion for me to do stupid things or spend anyhow.

Hmm. Makes sense. What’s an ideal amount you think you should be earning right now?

₦5m/month won’t be bad, and I think I’ll get there soon. A senior colleague at work just left the company, so a potential promotion might be in the works. Also, my friend wants to start a company and we’re working together on it. It’s still bootstrapped now, but things will look up soon.

What was the last thing you bought that made you happy?

My 32-inch TV. I like watching shows after a long day of work, and now I can do that without killing my eyes trying to watch on my laptop. I got the TV for ₦120k last month. It’s that cheap because someone linked me up with a factory.

Is there anything you’d like to be better at financially?

I need to earn more to explore stock investments and get to the point where money begins to work for me.

How would you rate your financial happiness on a scale of 1-10?

5. I don’t feel so bad about my finances, but I don’t feel so good either. It’s just there.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.