Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Grow your wealth in both dollar and naira, earning up to 15% in USD and 25% in naira. With flexible rates that move with the market, you can switch between wallets anytime to match your financial goals. Start here.

What’s your earliest memory of money?

In SS 3, a bank came to my school and opened accounts for the students. Mine remained inactive until it was time for JAMB lessons. I can’t remember how much the lesson fee was, but my dad transferred the money to my account, and I paid the lesson fees for the period I spent there.

It was the first time I handled money. Before this, I hadn’t thought much about money because my parents handled all I needed.

Does that mean there was money growing up?

We weren’t Otedola-level wealthy, but we were okay. My dad was into construction, and my mum had a provision store. We had enough to meet our basic needs and extras like going to Apapa club to swim once a month.

When was the first time you worked for money?

2018. I was in 300 level and did a three-month stint with a radio station for SIWES (Students Industrial Work Experience Scheme). They paid me a ₦10k monthly stipend. My job was to tweet what was happening on air. If a song was playing, I had to tweet, “Now playing: XYZ.”

I also managed their WhatsApp sometimes. Other times, they sent me to buy food. I didn’t like the job at all. The moment my SIWES ended, I told them I wasn’t returning the next day.

Haha. Was it that bad?

It was a toxic environment. Interestingly, before my SIWES, I wanted a career in radio. But I experienced it and decided, “Nah.” Also, the salary was terrible.

My salary as an intern was ₦10k, but full-time staff earned only ₦80k. The stress was a lot, too. Imagine entering hours of traffic to come on air, talk for hours, and go home on ₦80k.

After SIWES, I returned to school and lived on my ₦10k monthly allowance. I’m not entrepreneurial, so there was no hustle to want to make money. My goal has always been to get a 9-5 job and be comfortable with my consistent source of income.

However, in 400 level, I started battling anxiety about what I wanted to do with my life. Radio was out of the picture, and I needed other options. So, I started applying for different jobs, hoping to find something that’d stick.

Did you find any?

Yes. My sister introduced me to someone who wanted a content manager. They were starting a travel blog on Instagram and wanted someone to create content calendars and post content. It was a remote role, and the pay was ₦20k/month, so I took it.

The work was so overwhelming, though. I had to create and post all the content. I was also juggling my final-year project, so I barely slept. I didn’t last a month. To be fair, I wasn’t good at the job. I had no experience, and I was doing rubbish.

My boss complained about the content, too. One day, she just said, “Don’t worry,” and paid me ₦10k for the half-month I worked with her. I was so excited when she took the job back. I was already tired but didn’t want to quit, so her sacking me was very welcome. I think that was my confirmation that I’m not a hustler like that.

I’m dying. What did you do next?

I just focused on school. In my final year, my allowance increased to ₦20k/month, plus provisions from my mum, so I was comfortable. On days when I was really broke, I went home — I schooled in the same state where my parents lived — and collected more provisions.

I wrote my last paper in uni in 2019 and suffered another round of anxiety and panic attacks. I had no clue about what to do with my life, and it bothered me. NYSC was next, and even though I wasn’t sure what I wanted, I knew I didn’t want to teach.

I started applying for jobs so I could serve at the organisation when it was time for NYSC. I applied to anything and everything until I landed a ₦40k/month customer service internship at a music distribution company. Two months later, I started NYSC, and the ₦33k stipend increased my income to ₦73k/month. This was 2020.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

Was that good money?

Ah. I felt like a millionaire. I got the first allawee at the orientation camp and ate all the money. After the excitement died down, I committed to saving the ₦33k stipend and living on my ₦40k salary. I was living with my sister, so I didn’t worry about rent or major bills.

In early 2021, my graphic designer colleague at the office switched careers to UI/UX design. One day, I saw him working on Figma and asked about it. He explained it. I was just like, “Wow. I love this. I want to design apps, too.” I decided there that UI/UX was what I wanted to do with my life.

What made you love it?

I just liked user experience. I was already good at customer service, and I thought UX was a bit similar to what I already knew. User experience involves researching people’s behaviour and designing what you think they need based on this information. I honestly just loved the idea of working with Figma and designing. Also, I was getting tired of customer service.

My colleague trained me on UI/UX, and I learnt like my life depended on it. I also started applying to product design internships, and in March, I got one with a marketing agency. They paid me ₦50k/month, and since it was remote, I could do it with my customer service job.

I’d literally resume work at my 9-5 and be doing my product design side gig in the same office. So, at this point, I had three income sources: allawee, my customer service 9-5 and my product design internship.

Nice. How did you juggle both jobs, though?

My 9-5 job wasn’t very demanding; I’d answer two or three calls, respond to five emails, and then sit at my desk for the rest of the day.

The product design job was more demanding. I was a design novice, so I was learning and working simultaneously and getting feedback. It was a lot of work, but I enjoyed it. It was a three-month internship, so I only worked there until June.

After the internship, I continued my job search. A few weeks before my service year ended, I landed a job at a fintech. It was also a customer service role, but my salary was ₦150k/month.

I thought you wanted product design?

I had to collect customer service like that for the money. Also, it was a popular fintech, and I thought it’d be a great addition to my CV. I reasoned I could hold the job for a while and switch departments later.

I worked at the fintech till the middle of 2022, when I unfortunately lost the job.

Ah. What happened?

I did something stupid. A customer complained about something, and instead of sharing a screenshot to show we had fixed their problem, I sent someone else’s account information. Then the person went to tell the CEO, “Is this how you train your customer service staff?” and it became a whole thing. In summary, I lost my job.

I thought it was the end of the world. It was my only income source, and I thought I’d just die. I was only about a year into adulthood and ready to end everything. I had about ₦350k in my savings, but losing my income overnight really messed with my head. Honestly, it was very dramatic, but I was so traumatised.

Phew. Sorry you went through that

Thanks. I moved back in with my parents, so the job loss didn’t have much financial impact on me. I didn’t have responsibilities, but I couldn’t imagine not earning an income. So, I jumped into job search again. In fact, the very next day after they fired me, I was applying for jobs.

It took me four months to land my next job. Funny enough, I didn’t apply for the job. Someone from a bank just called me and asked, “Did you apply for this customer service role at XYZ bank?” I said yes, even though I was sure I didn’t.

The person sent me the interview details; I did the interview and got the job. At this point, I needed money more than any career or passion. I just wanted to be independent and afford what I wanted again.

Real. How much did the role pay?

₦316k/month. Towards the end of 2022, the bank did a general salary increase, and my salary moved to ₦400k.

In 2023, I got tired of customer service again. I started considering branching into tech and doing something more product and user-experience-inclined. Fortunately, one of the product managers resigned during this period, and the bank started trying to fill the role.

I just went to my boss and told her I wanted the opportunity. Although I had no experience in product management, I was willing to learn on the job. She agreed and gave me the job.

They didn’t mind that you had no experience?

I was already a superstar in customer support, so they trusted that I could learn easily and do well. Plus, I had experience with the product I was supposed to manage, which was also essential.

That switch was the scariest thing I’ve ever done. I left my comfort zone entirely for something I knew nothing about. However, I was determined to succeed because I wanted to leave the monotony of customer support.

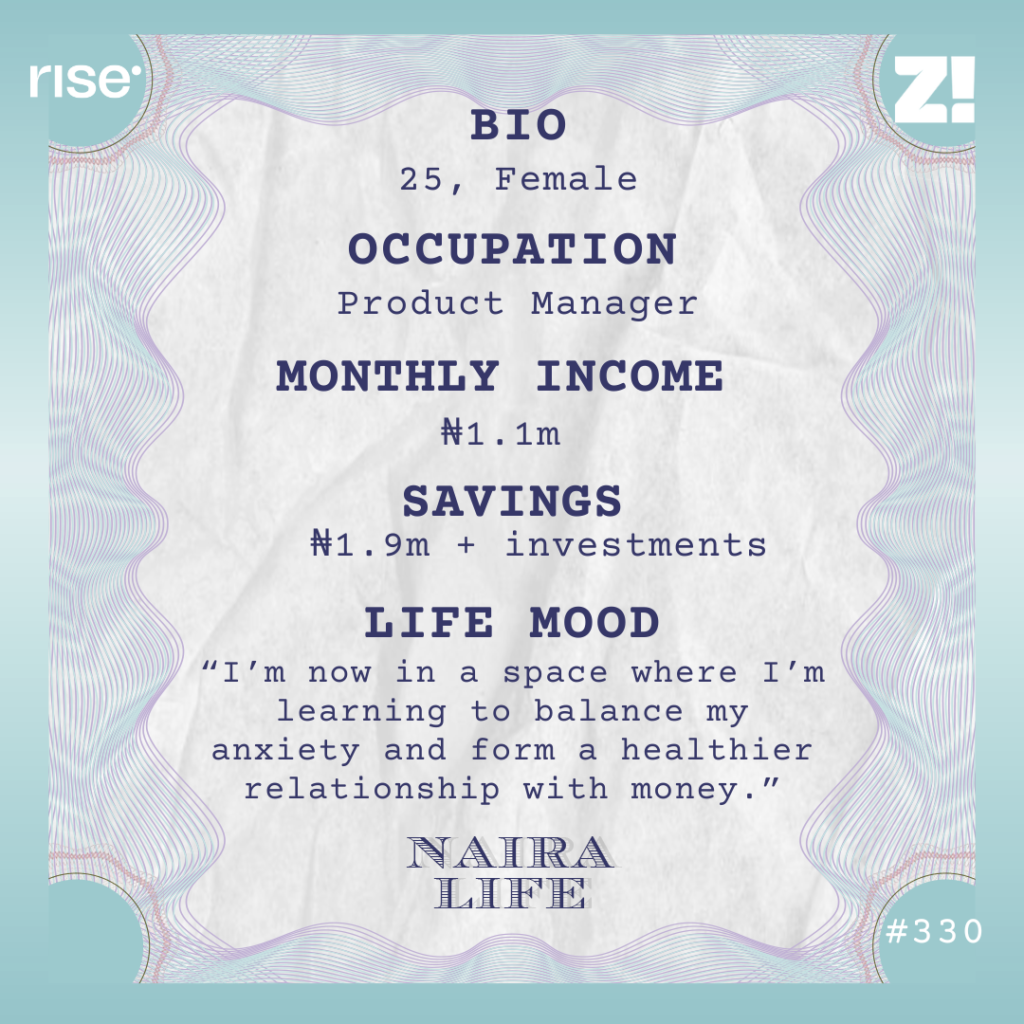

The career switch also came with a salary jump. It increased to ₦615k at first, then ₦699k after a company-wide review in 2024. Then, a few months ago, I got a promotion and now earn ₦1.1m/month.

That’s an interesting jump

It is. If I didn’t make that career switch when I did, I’d probably only be earning around ₦600k because the bank doesn’t promote people in customer support.

I didn’t even believe the promotion until the money hit my account in June. I’d never received a ₦1m alert at once, and it felt surreal. I still don’t know what to do with the money.

How would you describe your relationship with money?

I used to have a very toxic relationship with money. In uni, I was so scared of going broke that I’d starve myself to save.

That behaviour followed me for most of my life, and it got worse when I first got the customer support job at my current workplace. I started living independently for the first time in 2023 and was always anxious about money.

I had to worry about meeting my ₦800k rent and covering my living expenses alone. To deal with my anxiety, I spent only on food and rent. I never left my house or did anything with my money because I didn’t want it to finish. Still, the money always finished. It was a very toxic situation.

However, I’ve gotten more comfortable spending money since I started earning more. I do a lot of retail therapy now. I can just enter a supermarket, walk around and put things in my cart. I also visit restaurants and hang out with my friends. It also helps that I left my place and moved in with my brother in 2024. My landlord was moving mad, so I left and haven’t gotten another place since. So, no rent anxiety.

I think I’m now in a space where I’m learning to balance my anxiety and form a healthier relationship with money. My increased income has contributed to this. I even started investing for the first time this year.

How are you going about that?

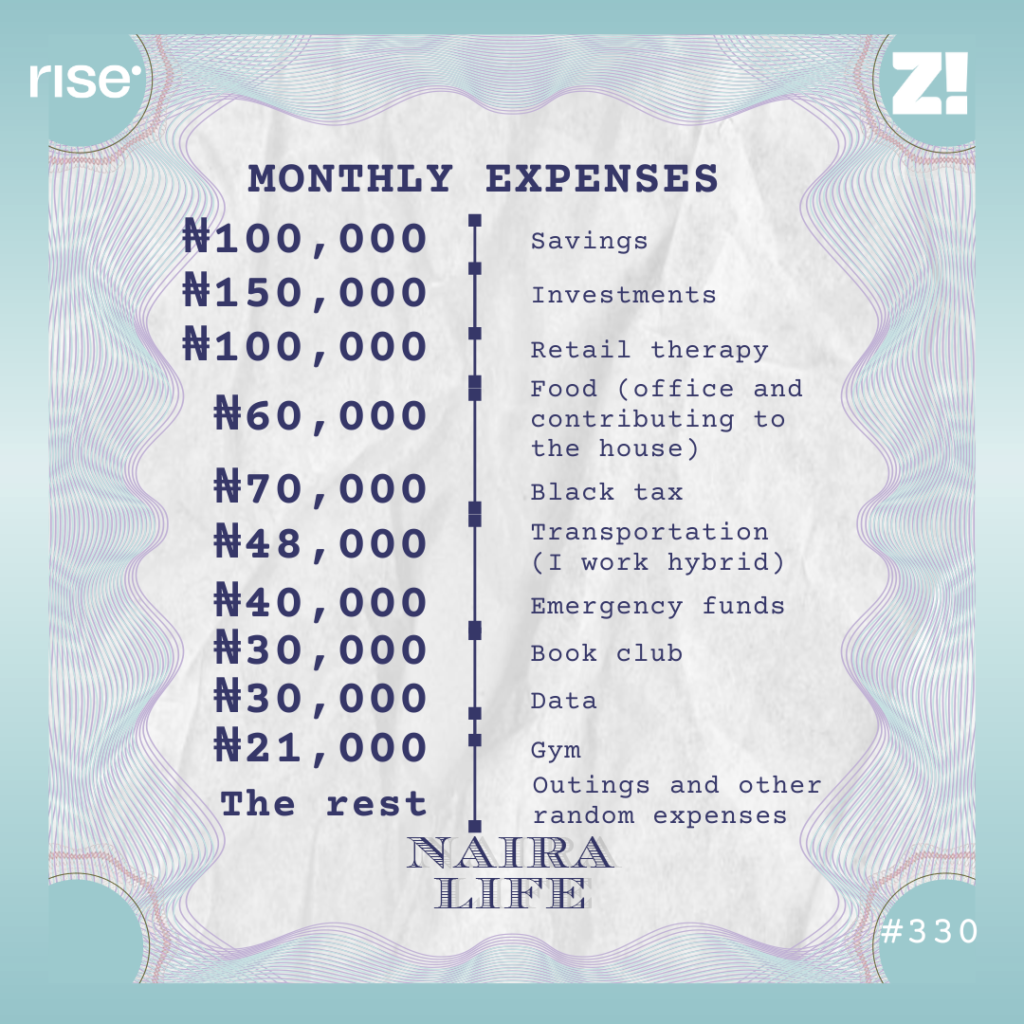

A friend introduced me to an investment platform I started using in February. I try to put ₦150k monthly into it: ₦50k in US stocks and ₦100k in mutual funds.

I’ve not been consistent with it, though. Right now, I only have $80 in US stocks and ₦150k in mutual funds.

My core savings account is healthier than my investments. I save an average of ₦100k monthly and currently have ₦1.7m saved. Then, there’s another ₦200k in my emergency fund. I started the emergency fund two months ago because life showed me pepper.

My laptop spoiled, and I had to spend almost all the money in my account to fix it. That incident taught me never to be unprepared again, so I’m intentionally planning for emergencies. After I save, invest, and sort out my bills, I put around 10% of what’s left into my emergency fund.

Let’s break that down into typical monthly expenses

What do the next few years look like for you?

Honestly, I’m confused about what I want to do with my life. When I moved in with my brother, I planned to stay for six months and see if I could process japa to leave the country.

However, the process was more complicated than I thought. I wrote IELTS and entered the Express Entry pool for Canada, but my scores were too low. My travel consultant said I should learn French or do Agric or nursing. It was too complicated.

Plus, I got a salary increase, and now I don’t know if I want to leave the country or get an international job. I know most Nigerian companies can’t match what I currently earn, so my options are either to leave or get a job that pays in foreign currency sometime later. I don’t know what I want to do yet, and it’s bothering me.

No one is pressuring me, but I’m pressuring myself. I need to figure out what I want to do quickly. I’m doing well professionally and financially right now, but what’s the next step? What’s the next phase of my life and career? Do I need to acquire more skills to earn more? I have so many questions.

I also don’t want to live with my brother for too long. Either I get my place by the end of the year, or the japa plan works out, and I relocate. I just need to know where I’m supposed to go from here.

I feel like I don’t have to ask, but why do you want to leave the country?

I just want to experience a normal, stable country. Financially, this country isn’t working for me. No matter how much my salary climbs, I find myself struggling. Tell me why I’m earning ₦1.1m but can’t afford a decent mini-flat in Yaba, Lagos? I have to save for a couple of months to rent an apartment. How are the people who earn less surviving?

I also don’t want to regret not leaving this country. Things keep worsening, and the people who could’ve left during Jonathan’s regime now regret missing the opportunity. I don’t want to be in their shoes.

I get you. What was the last thing you bought that made you happy?

My phone. I got it in May for ₦750k without stress. I saved for two months to make that purchase, and I didn’t go broke after I bought it. It was the first time I’d made a big purchase without struggling. When I bought my laptop for ₦1.2m in 2024, I starved for three months just to make up for the amount I spent. I almost died.

I’m screaming. What’s one thing you want right now but can’t afford?

I want to get a tech MBA abroad, which should cost at least $25k in tuition, accommodation, and other expenses. Who has that kind of money? Not me.

How would you rate your financial happiness on a scale of 1-10?

8. My current lifestyle isn’t so bad. That figure will reduce to 6 if I start paying rent today.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.