Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When would you say you figured out the importance of money?

In 2006. It was the year I got into a private boarding secondary school. One of the first things I learnt was that there’s a set of people who have money and others who don’t. It was my first lesson in “social class”.

What was it about secondary school that brought this into full view?

The school had a fair population of rich kids and children from comfortable but not quite rich homes. There was a constant show of money — little things like the quality of provisions students brought to school and big things like the fancy places they travelled to for holidays.

I was in the “kid-from-a-comfortable-home” category. My parents ensured I got the nicest things, so I didn’t feel out of place. But by the time I graduated from secondary school in 2012, my biggest realisation was that I needed money to get nice things. While I could rely on my parents to provide for me, it was also top of mind that it’d be my job to make money and provide for myself at some point.

When was the first time you made money?

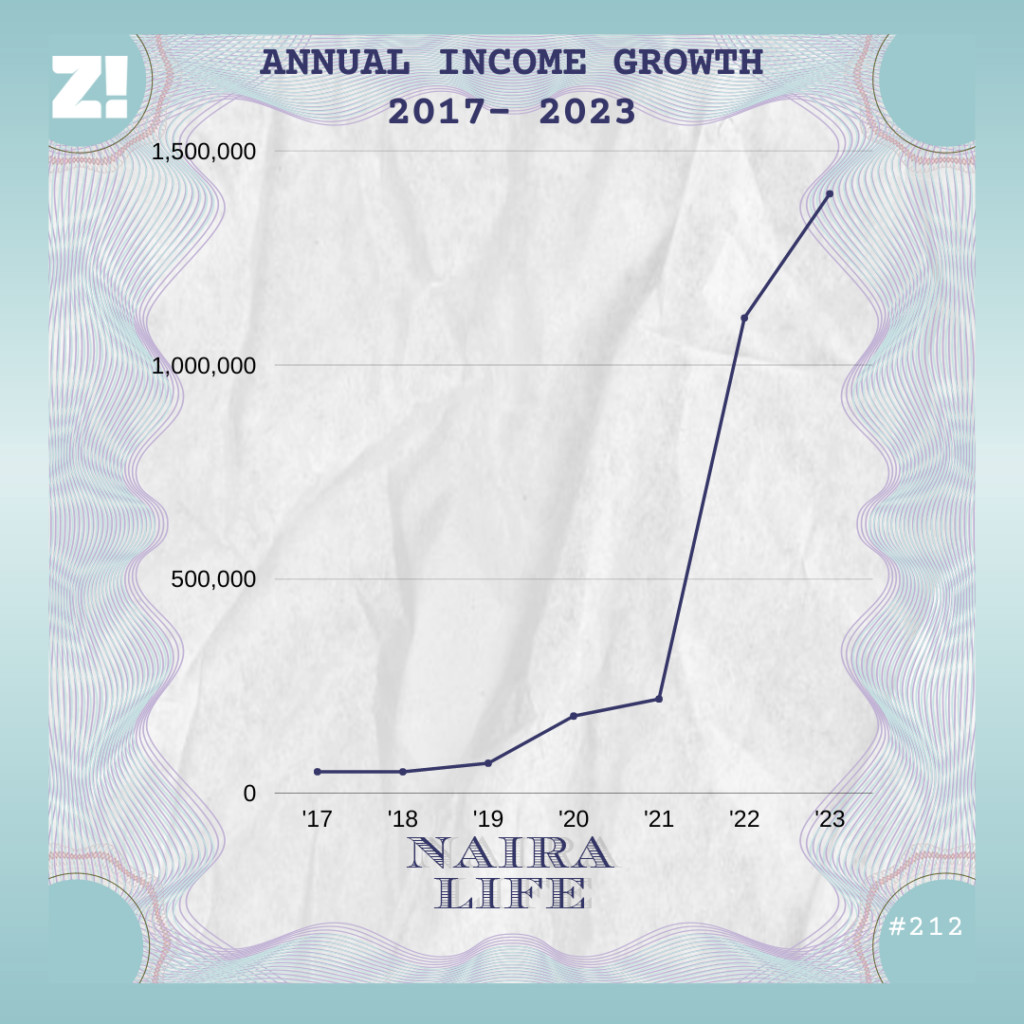

2013. I got into university in 2012, and ASUU went on strike barely a year after. Sometime during the strike, I worked as a lesson teacher and earned ₦5k/month. My first salary was my first fruit offering.

First what?

I was raised in a Christian home, so this was important to me. I believe that when you get a job or an increase in earnings, you should give out the first payment to someone who could use it or to the church.

I spent two more months at the job before the strike ended and I returned to school. Subsequently, I lived on my monthly allowance of ₦20k – ₦30k until I found another opportunity to make money in my second year. My motivation was having enough money to save up for a phone I wanted.

What job did you find?

My roommates had ushering gigs, so I started tagging along and working with them. I started with the small ones, usually at wedding ceremonies, which paid ₦5k. I got a two-week job advertising brewery products and got paid close to ₦30k. It completed the amount I needed for the phone — a Blackberry Z10.

I started working with an ushering agency where I was paid ₦15k for every job I did for them, an average of two events per month. I was with this agency until my third year in the university; it was a good place to work until it wasn’t. In 2015, I did one job for them, and they ghosted me. It was the last I heard from them.

Wild. How was money moving in and out at this point though?

My monthly income at that time — allowance and earnings — was ₦50k – ₦60k. My major day-to-day expenses were feeding and school bills. Once these were sorted, I saved whatever remained, about ₦10k/month. I always dipped into my savings to make big purchases — clothes, accessories, random gifts to my boyfriend.

When the ushering jobs stopped, I lived on my monthly allowance and occasional money gifts from my boyfriend — he had a business, so he had more money.

I didn’t bother to find another job until I graduated in September 2017. By this time, my savings were at zero. Whatever I managed to save, I ended up spending on a want.

A familiar struggle. What came after graduation?

My parents wanted me to return home, but I was determined not to. I was in Lagos; the job opportunities and my friends were here. So I struck a deal with my parents: they’d send my allowance for three more months, but if I didn’t find a job within that window, I’d return home.

I moved in with a friend and started job and internship hunting. I studied computer science, but I couldn’t code to save my life, which complicated my chances. Luckily, I found a job in December — a week before the three-month deadline my parents gave me.

Must’ve been a relief

It was. It was a telemarketer role at a startup, and my salary was ₦50k/month. About four or five months later, I was mobilised for NYSC. The plan was to continue working at the startup after I left camp, but they pulled an interesting move.

What did they do?

They wanted to slash my salary in half; something about how I was now a corps member and would be paid ₦19,800/month by the federal government. It didn’t make sense to me, so I quit. NYSC reposted me to a government agency, but there was nothing to do there. I was pretty much a ghost worker who only showed up once a week. The good thing about it was it gave me the time I needed to job hunt again. Multiple applications and rejections later, I got a job at a tech startup. My salary was ₦25k.

The universe said you must take a pay cut by force

They had the same argument — I was a corps member. But I took it because they seemed to have more structure than the previous startup.

Three months after I started working there, they increased my salary to ₦30k. For the rest of my service year, my combined income was ₦49,800, and I was saving ₦10k – ₦15k.

How long were you at the job?

Until 2020. After my service year ended in 2019, they retained me and increased my salary to ₦70k. My idea of a decent income for an entry-level role was ₦200k. Since I wasn’t earning that, I felt very insecure about my finances. I knew I wasn’t doing badly, but I thought I could be doing better. Another source of my discontent was the job itself; it was almost like I was stuck there.

Why?

I was doing business development — which I didn’t like very much. Sadly, I couldn’t quit because I didn’t have much to leave with. The plan was to transition into something I’d enjoy more, which was product management. However, I hadn’t built the skills, so I couldn’t apply for product management roles. I spent the next year taking courses.

How much did this cost you?

I took two paid courses. One on Udemy which cost $9.99, and the other was a ₦150k course on Product Dive. I also took any free course I could find.

Nice

On the work front, my salary was reduced to ₦50k when COVID hit in 2020. I knew I had to find another job. Thankfully, a friend came through and linked me up with a product management role in another company in August 2020.

Whew. How much did it pay?

₦180k. I probably would’ve earned more if I didn’t mess up during negotiations. I asked for ₦250k, but they asked what would be a fair amount if they couldn’t pay that, and I told them ₦180k. They sent me an offer letter almost immediately after.

It felt like the world had stopped because it was a bump from my previous salary. Then I started my new role and found out that my colleagues were earning about ₦270k. If I’d insisted on ₦250k, they would’ve paid it.

This plot!

While I felt cheated, I was still happy with my ₦180k. For starters, I could conveniently save ₦100k/month. However, the job was the absolute trenches. The work culture wasn’t great. There were lots of organisational issues and we were often running behind on projects. This took its toll on my mental health — there were lots of tears. But I was doing the job and money was entering my account.

The experience boosted my technical skills and put me on a path to earning more. First, I got a raise to ₦220k in April 2021. Two months later, I got another job in an American startup I applied to earlier in the year.

*Drum roll*

The offer was ₦600k/month. I felt like I’d arrived. I called my family, and everyone I know, to let them know there was a new boss in town.

DFKM

See, I started the job with my shoulders up. Then I was laid off in my first week. My opps were working hard.

Wait, what?

That was my exact reaction. The company was closing down because the CEO had mismanaged investors’ money.

Omo

I thought I’d left the ghetto, but now, I was in the proper trenches with zero income. My routine during the weeks that followed was waking up in the morning, crying, ordering food, watching Netflix and crying some more.

My savings from my previous job — about ₦600k — saved my life until I felt ready to hit the job market again. As short-lived as that job was, it taught me one thing — I didn’t have to limit my search to Nigerian companies. I was international material now.

So you were looking for remote roles?

Yes. Linkedin was my main job search platform. I’m not sure how many I applied to, but I got a few leads. After a series of interviews with one, I got an offer from a company in Europe in August 2021.

How much was it this time?

$1500. Again, I called my parents to let them know.

A sidebar, but it’s interesting that your parents know how much you earn

It’s just the dynamics of our relationship. Although I’ve told them my salary at every job, it’s not information they keep in mind. They also don’t reach out often to ask for money or put me under pressure, so there’s no reason why I can’t tell them how much I earn.

Back to the job. Has your salary evolved since you started working there?

I got a raise to $2k sometime last year. At the moment, I save about $1500/month and live on the rest. I haven’t considered investing because I like seeing the money in my account. Besides, I’m afraid I don’t know much about putting money to work. The crypto bust of last year has only worsened this fear. Maybe there’s a version of the future I have “fuck you” money and can use that to test the waters.

What lifestyle changes have happened in the past year?

My lifestyle didn’t change much during the first few months because I was afraid to touch my salary, just in case what happened at my last job happened again. Save for improving the quality of the food I ate, fashion accessories and occasional money gifts to members of my family, I wasn’t spending on anything else.

I didn’t make any major purchases until December 2021 when I bought a new wig for ₦300k. I waited until March 2022 before I made another purchase — an iPhone 13 Pro Max for ₦660k. By this time, I was sure I’d saved enough money to get me through any rough patch. I still live in the same apartment. My roommate has moved out, and the rent has increased to ₦350k/year.

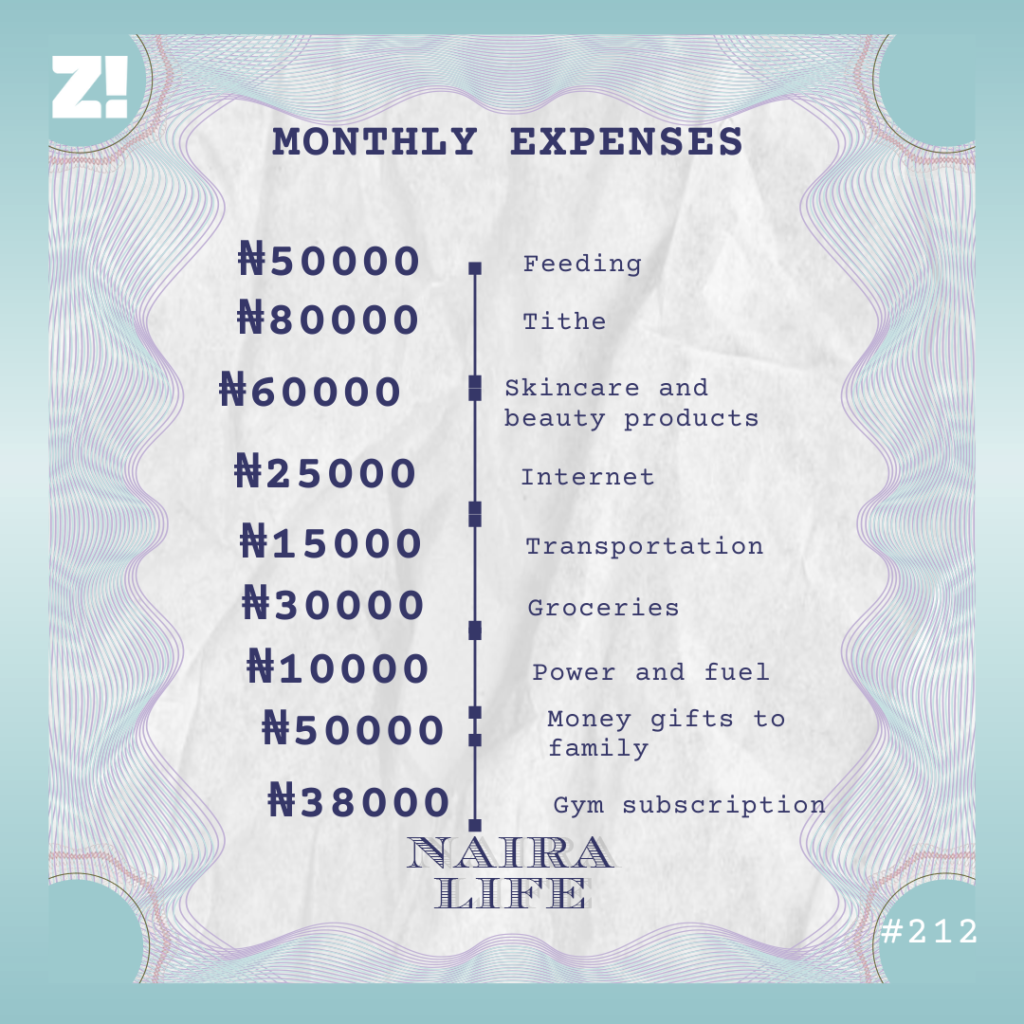

Where does your money go every month?

I live on about ₦400k on a regular month.

I keep ₦50k aside for miscellaneous expenses. Also, I don’t save for rent monthly. I just pay when it’s time. This extends to other things. I’ve always had to plan for the big expenses. But now, I don’t have to think too much about them. I just close my eyes and pay.

Energy! How have all of your experiences shaped your perspective on money?

There’s money to be made, and I can make it. There’s this confidence that a regular stream of income gives you. I used to think I wasn’t good enough to make decent money, and while I haven’t gotten to where I want to be, I now know I can.

I’m curious. How much is good money to you right now?

$5k/month. I’m grateful I have this job, but I can’t help feeling I’m a little underpaid too. I’m expecting another raise soon, though.

I’d planned to leave but decided against it. I thought the better strategy would be to get my master’s degree before looking for a new job. Hopefully, it will give me more leverage and negotiating power. I’ve been saving $1500 a month because I want to school in the UK. I already have $14k, and my target is $20k.

Well done. Where do you see yourself in five years?

I hope I’ll be married, and my partner and I will be raking in a joint income of $400k – $500k. Omo, I feel like a thief saying it out loud. But it’s not impossible — difficult, but not impossible.

Back to the present, what do you want right now but can’t afford?

I’d like to go to France, Spain and Italy in one trip. But I can’t do that right now because it’d mean touching my master’s savings. It can wait until next year.

What do you think you could be better at in terms of managing your finances?

Saying no when people ask to borrow money from me. In 2022, I had almost ₦3m outside. I’ve only recovered about ₦500k. I might still get ₦1.3m back. But I’m not sure about the rest. I’ve learnt to say no. Everyone will be all right.

On a scale of 1-10, how would you rate your financial happiness?

I’ve always wanted to afford nice things, and now, I can. So anything less than a 6 would be disingenuous. That said, I’ll be spending my life savings on tuition and school expenses in a couple of months, so I feel a little exposed. But I’m confident it’s the right move. I’m not worried about getting a job after I get my master’s degree. I believe this number will go up to an 8 in the next two years.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.