Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This is proudly brought to you by PayApp by UCL. Let’s solve your payment issues. PayApp is a global cross-border tuition payments platform dedicated to helping students and educational institutions streamline the international payments process. Start here.

What’s your earliest memory of money?

Money was a big part of my childhood. My mum’s a hairdresser, and growing up, my siblings and I spent our extra time at her shop. At the end of the day, we’d organise my mum’s money from the smallest to the highest denomination.

My mum also sold hair products and drinks at her shop. She always told us how much she bought and resold each item, so I understood how money worked pretty early. I knew I had to add a particular percentage to items before reselling to make a profit, and to only calculate the profit as the money I made.

I applied that same knowledge to my first money-making attempt, when I sold beads at 10 years old.

10 years old?

My dad made sure his kids learned multiple skills early. He’s a well-to-do data engineer, but it was never a “My dad has money, so I’m okay” situation. He’d always tell us, “My money is my money. Learn skills so you can make your own money.”

I remember one time I sold a lot of red bracelets during Valentine’s season in school. Then I needed to buy a textbook, so I asked my dad for money. He was like, “Aren’t you making money? Use your money.” It didn’t make sense to me. In my head, my parents’ money should attend to my needs, while my money should go into my savings. But my dad thought differently. That’s the kind of person he is.

Hmmm

Anyway, back to my skills. I learnt a bunch of them. At 10, I learnt how to work with beads, which I made into bracelets and sold to my classmates. I can’t even remember how much I sold them. In JSS 2, I upgraded my skills to include wirework jewellery.

Then, in uni, I attended a two-month goldsmith training course. I’ve always loved jewellery, so I guess I followed the natural order and acquired skills related to it.

Did you try to make money from jewellery in uni?

Interestingly, I didn’t actively try to sell jewellery in uni. I may have made a few pieces, but I focused on and made a lot more from fitness.

Let me break it down. In 2019, I was in 200 level and very broke. My ₦20k monthly allowance barely covered my food, data and textbooks, so I felt like a poor church rat.

It was so bad that I literally counted how many pure water sachets would take me till the end of the month and planned around the number. Whenever my best friend came to my hostel and drank water, I’d get destabilised because it’d throw my entire ration off and trigger my anxiety.

For context, I’ve been diagnosed with anxiety and depression for years. I had my first mental breakdown after secondary school because I had to wait seven months at home. I graduated at 15, a year younger than the minimum age requirement for uni, so I had to wait and then get into a diploma program before I could get into uni.

So, when I started feeling the same way again, I saw a doctor, and at the first appointment, he said, “I know you suffer from anxiety and depression, but your biggest problem now is your finances. If you can earn more now, half your problems would go away.” He told me to think of something I could teach people to make money, and I picked fitness.

Were you already a fitness enthusiast at the time?

I’d picked it up after my mental breakdown. The doctor advised me to get into something, and I decided to try exercise. Plus, it was a way to lose weight. After a while, I tried a fitness trainer but wasn’t satisfied with the process.

It didn’t make sense to me why a trainer would tell me to squat, and when I asked why they added squats to my routine, they’d be like, “Why are you asking? I’m the professional here.” I’m someone who likes to know why I’m asked to do stuff, so I ditched the trainer and became best friends with Google.

I did my own research and learnt everything I needed about building muscles, training people, and even exercises to avoid when you have injuries or how to modify exercises based on different medical conditions.

So when the time came to pick a skill I could monetise, fitness was the easiest option. I already had a pretty good idea of what I was doing.

How did monetisation work?

I started with one person. One thing I’ve learned from business is, you see extroverts? Hold them tight. My first client was an extrovert, and I charged her ₦5k for a month. My uni had a gym, so we’d both go there, and I’d show her exercises to do.

When my client’s friends started seeing results, they asked her, and she told them I was her trainer. That’s how I got more clients. I charged between ₦5k and ₦7k for a month, then I’d make the clients register at the gym I used so we could both attend and train. Some clients preferred morning sessions, while others preferred evening. I only had to be there whenever they were at the gym.

I had about seven regular clients, and it was my major source of income until I got to 400 level and added hairdressing and locs to my hustle.

Tell me about that

I started hairdressing by chance. I knew how to do it because that’s my mum’s job, but I grew up in an area where my mum would do hair for six hours and make ₦1500 or ₦2k. She was even one of the most expensive hairdressers. It felt like a lot of work for little money, so I never planned to do it.

Then, one day, a friend randomly posted a hairstyle on her WhatsApp status, asking for people who could do it. I told her I could, and she became my first client. It was a very complicated, niche hairstyle, and I think she paid me ₦17k or ₦20k.

Remember what I said about extroverts? This friend was an extrovert, and she brought me three more clients. And those ones also brought more people. That’s how I kept getting customers. At one point, I did my best friend’s hair, and it went viral on TikTok. That hairstyle brought me so many customers.

I also started getting requests from people who wanted to install locs. In my final year, I comfortably made between ₦50k and ₦100k/month from hairdressing and fitness training.

Did you have to learn how to install locs?

Yes and no. There are about three installation methods for locs; I already knew two and learnt the third one on YouTube.

Some context: I wanted to install my locs in 2022, but locticians charged ₦50k. That was big money for me, so I learnt how to do it, taught my mum, then had her install my locs for me.

I respect the dedication to not paying a dime. Did you continue both hustles after uni?

Yes, I did. Instead of returning home after graduating in 2023, I rented a ₦20k/month hostel around school and continued my work. Managing both gigs was pretty seamless. I could do hair in the morning and then go to the gym in the evening. I just made the appointments work around my schedule. Plus, I didn’t always have clients every day.

My rates for fitness training remained in the ₦5k – ₦7k range because I had the same set of clients.

But I made more money from hair and installing locs. My rates for locs were a flat ₦20k for installation and ₦7k for retie. I typically got at least one new client monthly. I also got the occasional food and allowance from home. My dad slashed the latter to ₦10k as punishment for refusing to return home.

I’m curious, was there a reason why you didn’t want to return?

All I can say is, that neighbourhood isn’t a place for young adults who want a lot from life. It’s full of Yahoo boys and their girlfriends, whose goal in life is to own a frontal hair and an iPhone XR. It’s a shitty way to live, and I can’t go back there.

In September 2023, I dropped the fitness training gig because I got a 9-5 job and couldn’t handle everything together.

What was the job?

A telemarketing, commission-based role at a fintech. My income was typically between ₦50k and ₦80k monthly. The job was hybrid, so I’d work two days onsite, three days remotely, and then take on hair clients during the weekend.

In January 2024, I moved from telemarketing to a growth intern within the same company. My salary became a fixed ₦76,500/month. The plan was to become a full-time staff member, and they said the easiest way was to go through an internship.

However, office politics entered the matter, and even after my internship ended in October 2024, they said something something “hiring freeze”. Meanwhile, they made another intern a full staff member. Then they moved me to another team and made promises. It was a lot.

The straw that broke the camel’s back was when they added multiple new KPIs to my responsibilities in February 2025. One of them was a monthly revenue target of ₦5m.

For someone who wasn’t even earning ₦100k?

See. My job title was still intern, and I was managing 25 people in POS operations. I complained to my line manager, who promised to see what he could do, but I’d already checked out.

At this point, I was earning about ₦150k – ₦200k monthly as a loctician. I honestly should’ve left the 9-5 much earlier, but anxiety is a terrible thing. I’m very risk-averse, so I hesitated. It was like a “the devil you know is better than the angel you don’t know” situation.

One day, I gathered strength and resigned.

My manager tried to get me to stay and promised I’d become a full-time staff member in the same month, but I was tired of hoping. Plus, my salary would’ve only increased to ₦200k, which I was already getting from making hair. I’d also started taking some clients during the days I worked from home, and a full-time role would mean cutting down on the hours I could manage.

I considered all that and decided I’d rather focus on increasing my efforts as a loctician and making more money.

What’s your income like these days?

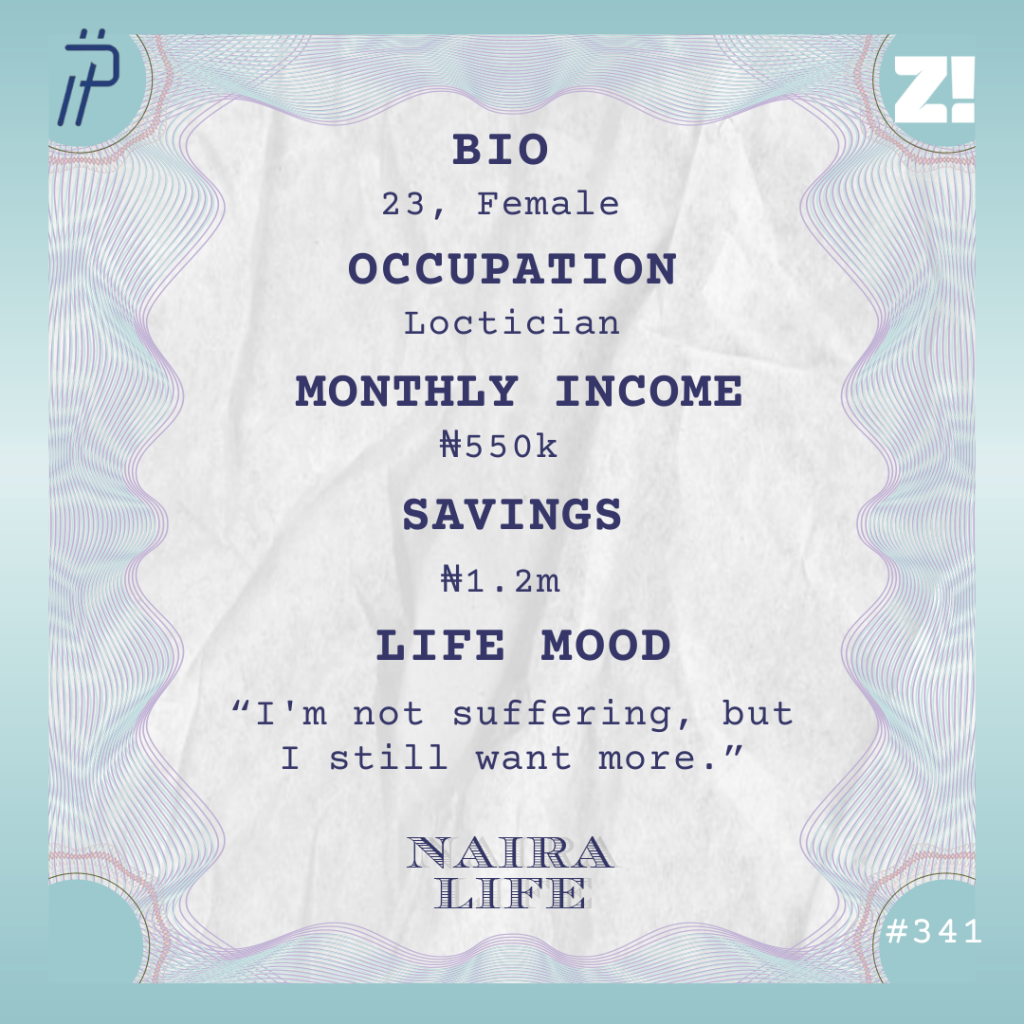

I currently make at least ₦550k/month from doing hair and locs. Since I left the 9-5, my clients have noticed that my work has become faster. Maybe it’s because I no longer have to worry about my line manager calling or feeling guilty that I’m neglecting my 9-5 duties. I’m at peace. There is no stress.

That said, I have an insatiable need to earn more. Once I notice I’m earning in the same range for three months in a row, I start brainstorming how to increase my income in the coming month. This especially applies to my business. I’m always thinking about what I can do to improve my earnings. I use social media extensively; I even walk into the DMs of people who have locs and pitch my services to them.

My income has been around ₦550k for about three months, and my next move is to look out for events targeted at creatives, attend and start conversations with as many people as possible. I also plan to run social media ads as the year ends, especially as the IJGBs will soon begin planning their return.

Sounds like a plan. Are your charges still within the ₦20k range?

Ah. God forbid. Installation rates now range between ₦50k – ₦200k depending on the loc style, size and hair length.

Dying at “God forbid”. You mentioned living with anxiety. How does it impact your work?

Therapy and medication help me a great deal. I used to have really bad anxiety and depressive episodes. I like to describe it as having a random person in your head who’s always trying to gaslight you. So, I had to learn a lot of coping mechanisms.

In school, I practised complimenting people to overcome my anxiety. Now, I find it easy to strike up conversations with people, and I get a ton of clients that way. I’ll live with anxiety and depression forever, so I just learn to manage them.

How would you describe your relationship with money?

It’s pretty good. I live within my means. I’m an introvert who doesn’t go anywhere. So, 50% – 60% of my income typically goes to savings, and then I use the rest for my upkeep.

I can also ascribe my financial habits to anxiety. I grew up with a dad who could wake up one day and be like, “My prayer in life was to do better than what my father did. My father stopped paying my school fees in secondary school. Now you’re in 200 level. I’ve definitely done more than what my father did. You should start paying your school fees yourself.”

I never knew when he’d wake up and actually decide he wasn’t financially responsible for me anymore. I never want to live with that kind of anxiety due to being dependent on another person again, so I guess that’s why I save so much.

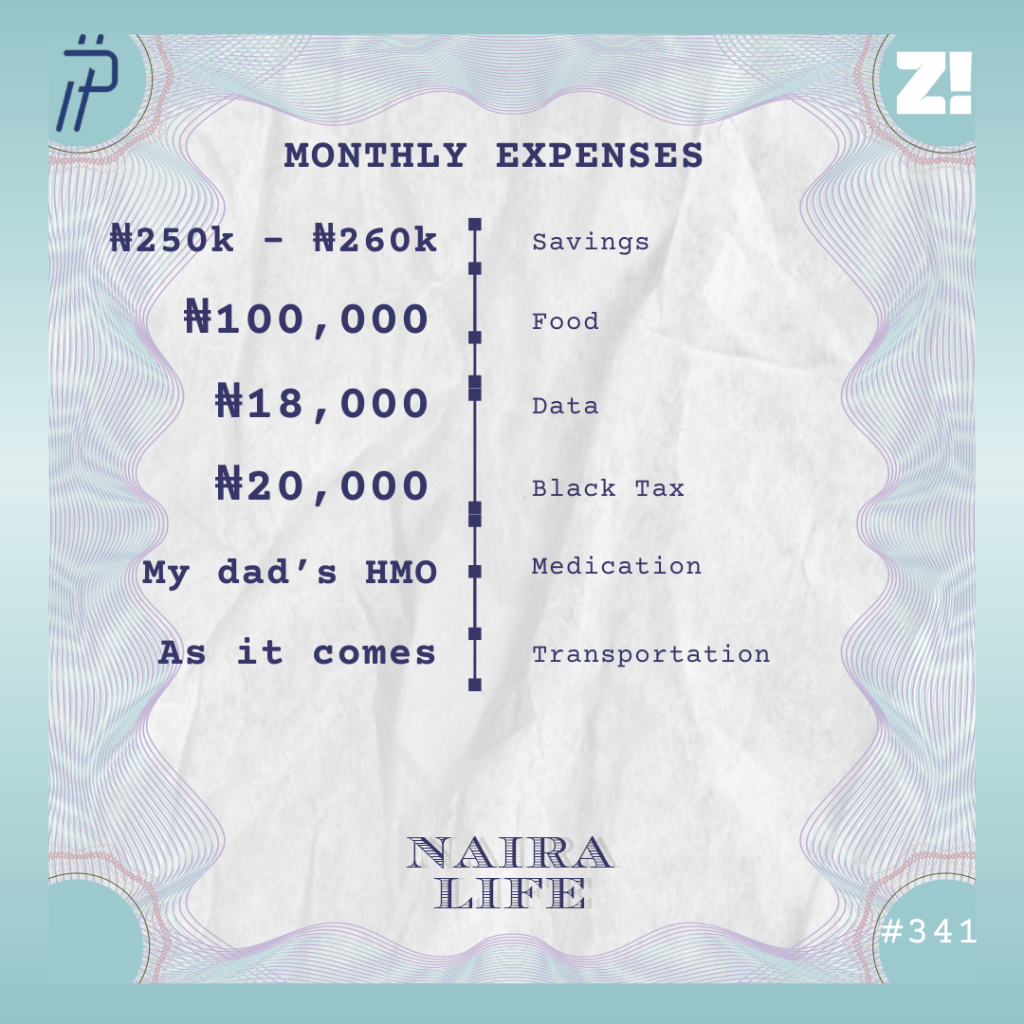

Let’s break down what your typical month in expenses looks like

This is an estimate because I don’t receive my income all at once at the end of the month. So, what I typically do when a client pays me is to save 50% and use the remaining 50% to cover living expenses, transportation and anything that comes up.

I have about ₦1.2m in my savings and $35 in stocks via an investment platform. I’m just starting to build my stock portfolio, though. I still don’t really have an idea what I’m doing, but I have financial analyst friends who help answer the questions I have. I’m hoping, from next month, I can put at least ₦50k in stocks monthly and see where that takes me. I hope to have at least $1k in stocks by the end of next year.

You’re a full-time loctician now. Do you think you’ll stay that way for much longer?

I don’t know really. Anxiety is a goddamn bitch. My doctor still asked me the same question recently.

I know my heart is more at peace right now that I don’t have a 9-5. But the economy isn’t smiling, so I don’t know. I know I need more than one income source to survive in this country, but I’m not sure what to do right now.

There’s also the fact that I’m an Oliver Twist who just always wants more. I’m not suffering, but I still want more. I was talking about this with a friend, and when she asked why I wanted more, I said, “I just want to be looking at it in my account.”

Is there an ideal amount you’d like to earn monthly?

At least ₦700k – ₦800k/month, and I’ll see where I can go from there.

Is there anything you want right now but can’t afford?

A better apartment. I currently share a ₦300k/year room with someone. I want a room and a parlour or a mini flat — I could work out of my parlour and live in the room. But the rent prices these days? It’s like the government wants us to work just to pay rent.

Phew. I can relate. Is there anything you’d like to be better at financially?

Investments. I hate being risk-averse so much, and I’m actively trying to be better at taking risks.

Rooting for you. How would you rate your financial happiness on a scale of 1-10?

6.5. I’m happy, but I’d like to save more. My rating will increase when I earn more and have more in investments.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.