Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

The lunch money I got from my mum in nursery and primary school. ₦10 could get me ₦5 buns and a plate of rice.

Those were the days. What was growing up like financially?

Terrible. You know how people say their parents weren’t financially well off? My case was different. The roof of our house was once removed because we couldn’t pay rent. It was that bad.

My dad was an artisan; he painted buildings for a living, and my mum was a petty trader. I noticed early that my mum was the risk-taker. If my dad didn’t get an opportunity he wanted, he was fine with what he had. He hardly pushed for more, but my mum was different.

She was constantly hustling, seeking new opportunities and exploring additional trades to try. I think I’m more like my mum in that regard. I started hustling at the age of 10.

Tell me about that

I hawked sachet water in the market to make money. I even raised the business capital myself.

Here’s how: I grew up in a rural area with many cocoa farms nearby. Cocoa merchants bought cocoa pods from farmers and dried them in their stores. When these stores closed at night, they’d pack the cocoa inside, but a few cocoa beans would fall on the ground.

Then, the town children and I would go pick up the beans. If we gathered up to one kilogram of the beans, we could sell them for ₦500. If you could gather two or three kilograms, that was very good money. This gathering often took weeks to reach a decent size.

Anyway, I sold my small stash of cocoa beans and started the business. My dad was against it, but I didn’t care. I bought a bowl for ₦130 and a bag of sachet water for ₦100. The first day I started didn’t end well.

What happened?

I didn’t know much about the business, so I made a few mistakes. After I sold the first batch of water, I went to buy more and repeated the process after selling them off. The sun went down, and I ignorantly bought another batch. Everyone who has sold sachet water knows that it was a wrong move because there was no way I’d sell off the water by that time.

When I inevitably couldn’t sell them, people advised that I return the stock to the person I bought it from. Most pure water sellers had agreements with their “suppliers” that allowed them to exchange warm sachet water for cold ones if they couldn’t sell. I tried to do the same, but unfortunately, the person who sold it to me wasn’t a good person. He refused to change them and even beat me up.

Oh my God

It was discouraging. I had to throw the remaining water away because we didn’t have a freezer at home. It was a big loss, and I was only able to start again because my friend gave me ₦200.

I sold sachet water every day after school for about two years. I could make ₦200 – ₦500 profit daily, and that was big money in school. The business also taught me a great deal, particularly how wicked people could be.

A sachet of water cost ₦10, and someone could take the water, drink it, and then give a 10-year-old ₦1000 to go and look for change. They knew I wouldn’t have change for them, and they’d ask me to come back for my money. I never saw them again.

That’s wild

I stopped the business when I was in SS1 or SS2 because my school started dismissing us late at 4 p.m., and I couldn’t keep up.

In SS3, I dropped out of school altogether because my dad couldn’t afford to register me for WAEC. While exploring what else I could do, I decided to apprentice at a business centre since I was naturally skilled with phones and computers. Plus, having briefly worked as an apprentice typist at a similar place a few years prior, it made sense to continue in that line of work. This was in 2014.

The place I worked was popular with lawyers. They often came to type processes and court judgments.

Was it a paid apprenticeship?

No o. I was essentially learning, so I didn’t have a salary. My dad encouraged me to be patient and just get the skill.

I quickly became popular due to my fast typing skills, and the lawyers always wanted to work with me. Some even started asking me to come work for them, offering to pay more than what I earned at the business centre. I couldn’t even tell them I wasn’t being paid.

My popularity didn’t sit well with the business owner; he didn’t like people praising me and always called me weird because I read a lot. I’d install PDF readers on the computers to read random things like philosophy. I often obsessed over learning random things. For instance, I could think about something like YouTube videos and go all in with learning everything about creating them.

So, I was really good. I could say I even knew more than the owner. I worked with him for about two years. During that time, he repeatedly promised to start paying me, but it never happened. I finally left in 2016, because I was considering returning to school and needed to save money. I went on to work with one of the lawyers who’d been trying to poach me.

How much did the new job pay?

₦15k/month to work as a typist for the firm. I also occasionally did some secretarial duties. It was the first time I earned a salary, and the money was okay for me. I was a 17-year-old living with my parents, so I didn’t pay rent or any major bills and was able to save. In 2017, I was able to raise enough money to write WAEC.

Besides the money, working with that lawyer was such a blessing. I still mirror his lifestyle to this day. He was very calm and organised. He taught me how to live a balanced life, and I really enjoyed working with him.

In 2018, while still working with him, I found another income source. One of the other lawyers in the firm gifted me a laptop, and I began using it for research. Every day after work, I’d buy ₦100 data and explore the internet for different things I could learn. I also created a blog using one of the free hosting platforms; I think it was Blogger. I knew it was possible to monetise the blog and start earning from Google Ads, but I also knew it would take a considerable amount of time, effort, and web traffic.

Fortunately, I found a way.

What did you do?

Around this time, a betting company was really popular, and people were always looking for information on how to become a company agent and open a betting shop. So, I wrote a post about the process on my blog and used it to sell an ebook I created about becoming an agent.

My post ranked well on Google, and people started buying my ebook. At first, I sold it for ₦1k, then increased the price to ₦2500 when I noticed it was selling quickly. In a month, I could sell 10 ebooks. At the same time, my blog got monetised, and I could make $100/month — about ₦32k — using Infolinks to display ads. In addition to the ebook sales and my salary, I was making over ₦80k monthly.

I wrote the JAMB exam that same year and had even gotten admission into the university when my income took a hit.

What happened?

Google regularly pushes out updates, and that year, one of these updates hit my site and affected my blog’s traffic. I stopped ranking, and revenue dropped. After gathering all I had (which was about ₦120k), I still needed about ₦350k to complete school payments and rent a place close to campus. The blog wasn’t bringing in money anymore, so I needed to shift direction.

I came across a European site that sold football betting tips for gamblers. The tips were quite expensive at $499/month (approximately ₦140k at the time), and I had a crazy idea of reselling them. I took all the money I had, added my salary and sent it to the guy selling the tips. I could’ve easily been scammed, but fortunately, I wasn’t. The guy added me to a group where he sent the games. I noticed the tips were actually genuine and profitable, but I wasn’t interested in playing them.

Instead, I went on Facebook, made a video and started running ads. In the video, I explained how, instead of $499/month for that site, people could just pay me ₦7k/month for the same genuine tips. I also showed proof that I bought them from the $499 site.

Omo, the kind of money I started seeing.

Too much sense wanted to finish you

My offer was too stupid for anyone to refuse, and people were just buying left, right and centre. I just created a Telegram group, added them, and sent them the games. By the end of the first month, I had almost ₦600k in my account.

The money helped me resume at uni and rent an apartment. I was still young and didn’t know a lot about money, so I was just spending. The iPhone 7 was in vogue at the time, so I bought one. I even changed my laptop.

In early 2019, Facebook started disabling sports betting ads. Luckily, I’d grown an email list of subscribers who trusted me. The thing about betting is, it’s very difficult to find someone who is not a scammer. Since I didn’t scam them, they kept resubscribing. Plus, people were winning too, which was good. Sometimes, they even dashed me money. So, my income was stable and almost passive due to the monthly subscriptions.

However, towards the end of 2019, I suddenly lost interest in the betting business. I don’t know why; I just stopped liking the idea and gradually stopped. My subscribers even reached out asking why I stopped, but I didn’t have a valid reason. That’s how that income source dried up.

Interesting. What did you do next?

My school was close to one of the most prominent markets in Nigeria, so I started going there, looking for products I could sell online and make 3x the cost.

I mostly sold household products. I could buy an item for ₦1k, and list it on JiJi and Facebook ads for ₦4k. That became a major income source for me. I hardly attended class because I was always at logistics companies to sort out deliveries.

The money wasn’t as good as sports betting; that one was unlimited money. I could sell a game one million times. However, with physical products, I could only sell as much as the available stock allowed. Still, I was making around ₦500k – ₦800k monthly, which wasn’t bad. I lived a comfortable life in school.

I’m also glad I started dealing with products instead of relying on sports betting because it set me up for what I do today. I still work with products, just on a very different level.

What do you do these days?

I’d say it’s e-commerce. I look at the market trends and bring in possible solutions in the form of products. For instance, insecurity has been a significant challenge for Nigerians lately. As a business, I can decide to start selling security gadgets, and people would buy in volumes. If I make ₦3k from each gadget and sell 10,000 units, that’s ₦30 million profit.

I use ads to push my products on Facebook, YouTube and MGID. It’s a thriving business now, and I work with a team of 12 people, generating an average monthly profit of around ₦12 million to ₦15 million. The expansion didn’t happen overnight.

In 2020, I recorded my first ₦1 million profit in a single month from selling a specific mosquito product, and we continued to grow from there. We also sold fitness equipment during that period.

The business faced a small struggle in 2021 when Apple released the iOS 14.5 update. It came with a privacy update that made it difficult for third-party platforms to track user behaviour and show them targeted ads. Now, users had to give permission before an app could track their data, and if they clicked “no,” it was all over.

Ad performance was terrible during that period, but fortunately, we started to recover in late 2022, and it’s been going well ever since.

How do the business operations work?

I have a way of knowing that a product will do well. I think it’s a muscle formed by how long I’ve been doing this. After picking the product, we’ll conduct a test run of like 100 units and use the performance data to determine whether we’ll scale or not.

I have an office where I work with a few full-time employees, but I also have agents in different states in Nigeria who get the products and handle delivery. 90% of the orders we receive work with the pay-on-delivery model because Nigerians don’t trust the internet. When the agents deliver, they remit the money to the business.

I decided to operate this way because I believe there’s a limit to how well a business can perform if it’s a one-man operation. If I’m doing it all alone and making a total revenue of ₦100k, 20% net profit of that is just ₦20k. However, if I’m running a ₦100 million business and I achieve that same 20%, I’ve just made ₦20 million.

Both the ₦100k and ₦100 million could be the same personal level of work, but for the latter, I’m using the leverage of getting more people involved to scale faster. It’s better to own the leg of an elephant than a whole ant.

Hmm. That’s a lot to think about. You mentioned a monthly profit of about ₦15 million. How much of that is your income?

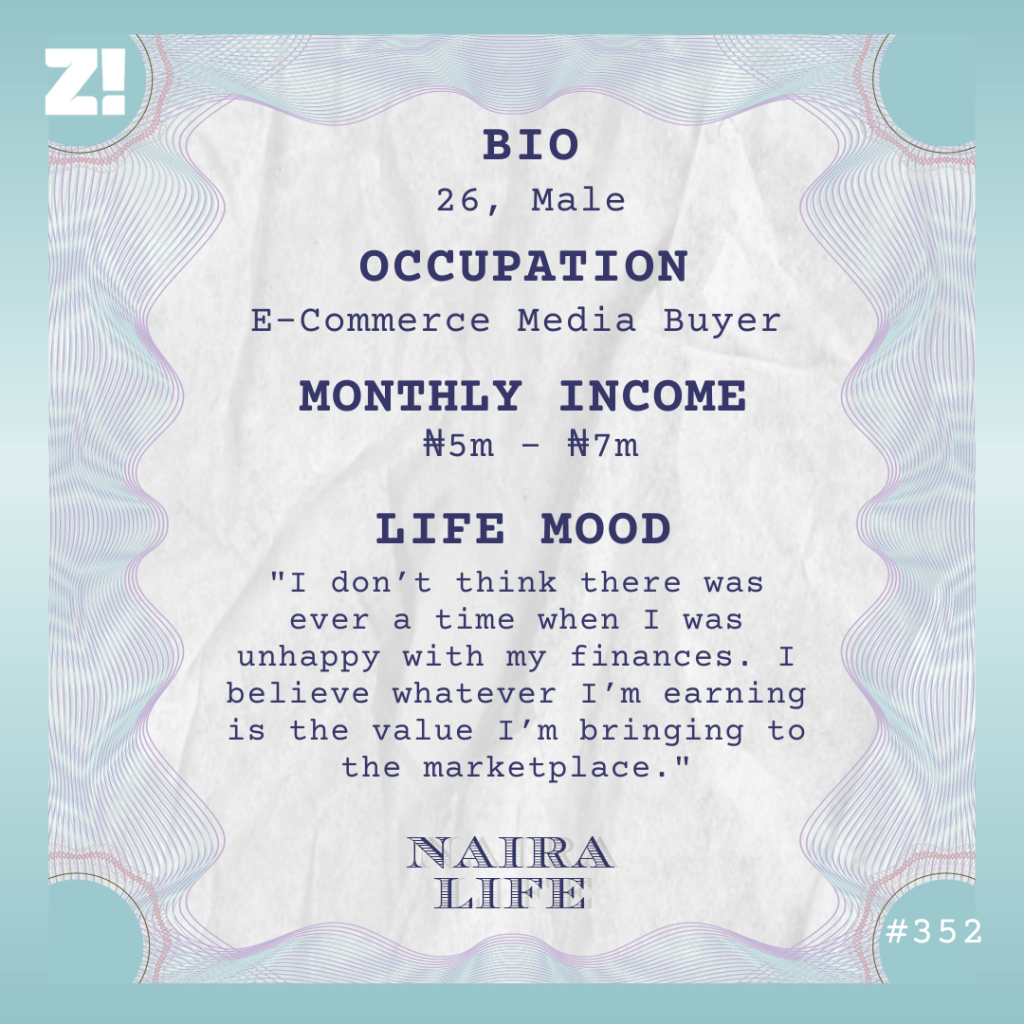

After removing operating costs, salaries, and returning capital to the business, my “salary” is usually about ₦5 million to ₦7 million monthly.

I’m specific about always returning money to the business because it’s easy to lose an opportunity if there’s no available capital to allocate to it. I also don’t joke with expansion. Every extra money returns to the business.

You’ve had massive income growth over the years. How has that impacted how you think about money?

I believe fear is a significant reason why many people struggle to make money. It’s the truth. If you don’t take some kind of risk, you won’t make money. Also, money is a reward for helping people out.

If you aren’t solving a need, making someone’s life better or offering value, it’s almost impossible to make money. I never had any doubt about whether I’d make money or not. It was always a matter of time.

How would you describe your relationship with money?

I have a problem. Once people around me start sharing their problems, I feel an obligation to help solve them. Recently, I calculated how much money I’d given out this year, and it was almost ₦10 million. I’m not happy about that, and I plan to stop giving money away so much.

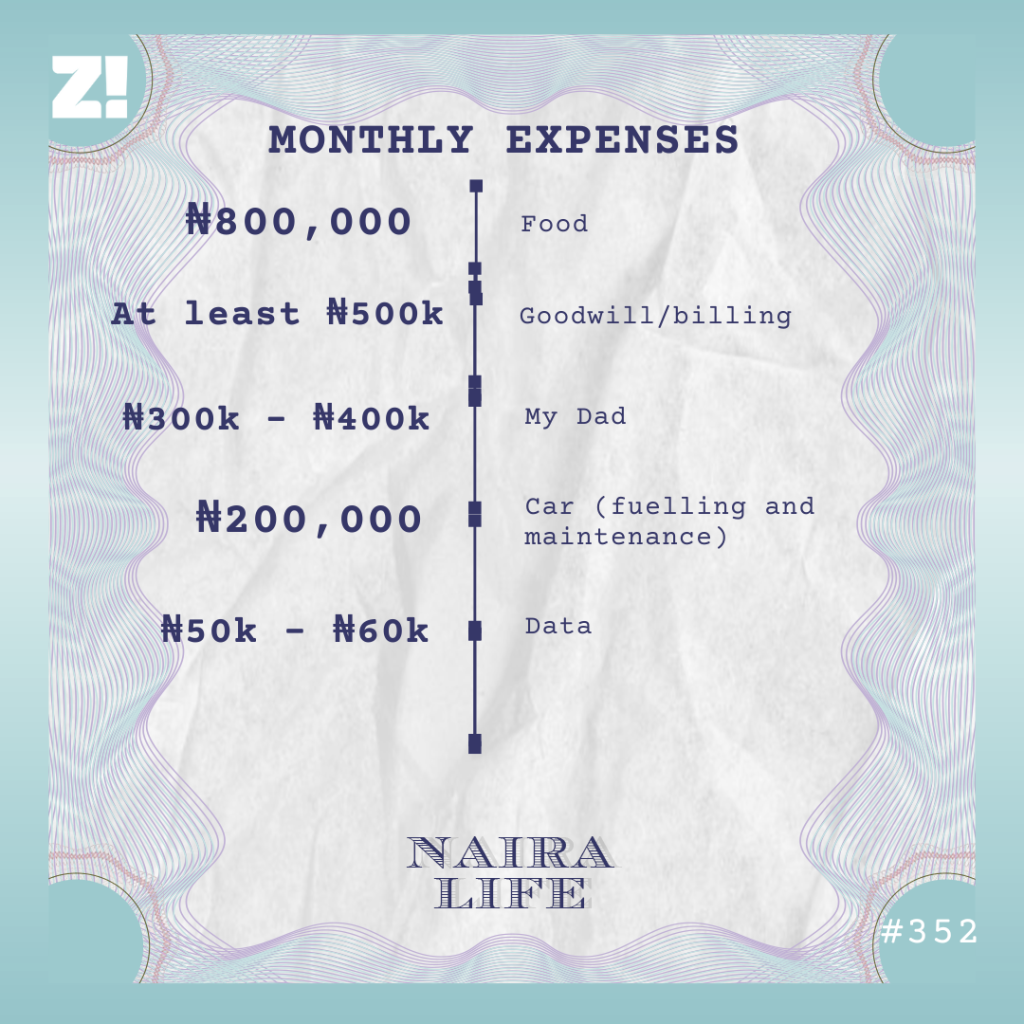

Beyond that, I’m not the materialistic type. My only guilty pleasure is food. It sounds unbelievable, but I spend at least ₦800k on food monthly. It’s that expensive because we (I live with my brother) have a chef whom I pay ₦180k monthly. I also eat out a lot and still spend at least ₦150k on protein powder every month.

Now would be a good time to walk me through your typical monthly expenses

I don’t save money. Whatever reserve I have is reinvested in my business. Another thing that takes my money is travel. I believe travel helps me learn, so I typically spend ₦4m – ₦5m on an annual trip within Nigeria or to an African country. My rent is ₦4 million, but I don’t save for it. Once it’s time, I just pay.

Is there anything you want right now but can’t afford?

Honestly, nothing. I would like to move to the US, but money is not what’s holding me back. It’s the visa; I know it’ll be hard to get as a young person right now.

Is there an ideal amount of money you think you should be earning right now?

I always think in terms of the business, so I think we should be doing a net profit of ₦100 million monthly. We’re currently working towards that, already planning structures and hiring needs to guide expansion to more countries. We already sell in some African countries, but the goal is to scale. By the grace of God, we should have hit over 50% of that ₦100 million goal before 2027.

Rooting for you. What was the last thing you spent money on that made you happy?

A vacation package to Southwest Nigeria in September. It cost me ₦3 million. I’m almost always working, so I don’t go clubbing or things like that, so it’s nice to enjoy travel experiences.

How would you rate your financial happiness on a scale of 1-10?

10. Even if you’d asked me this when I earned ₦15k, it’d still be a 10. I don’t think there was ever a time when I was unhappy with my finances. I believe whatever I’m earning is the value I’m bringing to the marketplace. Therefore, if I want to earn more money, I must bring more value. I might sound unconventional, but that’s just the way it is.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.