Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was money like growing up?

My dad was the typical example of a struggling Nigerian.

At one point, he was a journalist. But when he lost his job, he got into furniture making and later worked at a bakery. My mum was a teacher, but their income combined wasn’t enough for us to escape poverty.

Money? We didn’t have it. It was bad.

How bad?

For starters, I have five siblings, and we all lived in one room. For many years, I thought “tea” was warm water and sugar because that was what I grew up drinking.

You know the kind of poverty that’s an identifier? The type where everyone knows you’re poor? That was what we had. Once, we went three days without food until church members brought us rice and other essentials to save us.

Another time, my landlady knocked on our door and asked my mum if she wanted leftover eba from an event she’d hosted. My mum took the eba, and for the next two days, we dipped the eba in water because we had no soup. Till today, I hate eba because of the PTSD from that time.

I’m sorry you went through that

There were many, many more instances like that, and those experiences left me with a resolution to never be poor for the rest of my life. I just wanted to make money.

I got into uni in 2009. My dad’s friend helped pay my first year’s tuition — ₦152,500. Tuition for subsequent years didn’t come that easily, and I struggled financially and academically. I could be writing a test or exam when the list of debtors would be called out, and I’d be asked to leave the hall. Of course, that meant an automatic carryover.

I was desperate and joined a cult in my second year. The person who recruited me told me that the cult would support me financially. He was like, “School fees is small thing. We usually raise money for members.” Out of ignorance, I believed that.

Let me guess: The reality was different

Very different. In fact, they were the ones collecting money from me in the name of dues. Whenever a leader saw me on the road, they would ask me for something, and I had to comply.

This was money I made from doing odd jobs to survive in school. I did everything from being a farm hand to working on construction sites and cleaning bird droppings in a poultry. Still, the cult took the little money I made.

Beyond the money aspect, I didn’t like the lifestyle cult members had to keep. It was all about alcohol, weed and violence. There were also a lot of deaths, but I avoided getting involved in that.

Two years into my membership, I started avoiding them altogether. I even joined a church and made it look like I’d taken it seriously and become a “pastor” so I wouldn’t have to associate with them anymore.

Did they let you go that easily?

It wasn’t easy at all. I faced threats and pressure. I was in my extra year when I started avoiding them.

For context, I got two extra years because of my multiple carryovers. So, I didn’t need to be in school all the time, and when I was, I actively avoided the cult members. I think they eventually decided I wasn’t interested, and just left me alone.

I eventually graduated from the university in 2015. I say “graduated” because my name came out on the graduation list. I didn’t actually get my certificate and wasn’t mobilised for NYSC.

Wait. Why?

My outstanding tuition debt. About ₦650k. It was that high because of the extra years, and the school added an extra ₦20k on every late payment. That figure is most likely to have increased since I left over 10 years ago. I just told myself the certificate was a piece of paper. The main thing was the education, which is in my head.

After I left uni, I got a job as a reporter at a newspaper through a friend in 2016. My salary was supposed to be ₦30k/month, but my employer showed me shege. The man would owe salaries and then come to the office one day to give ₦7k.

It got to a point where we didn’t even know how much we were owed. This month, oga would pay ₦7k. Next month, ₦15k and ₦13k the following month. Whatever dropped, you had to take it like that.

Phew. How were you surviving on that?

I supplemented my income by working part-time as a tutor at JAMB and WAEC tutorial centres.

Those paid me between ₦100 and ₦200 per period. Sometimes, ₦750. The rates depended on the subject I taught. Periods were usually an hour. So, if I had two periods, I would teach for two hours. I worked every day of the week, except Sunday.

I worked at the newspaper for about two years and resigned in 2018.

Got another job?

Nope. I resigned out of anger. It was a very toxic work environment. One Saturday, the editor called the team to a meeting and started lambasting everyone. Then he said, “If you want to leave, you can leave.”

The statement triggered something in my head. I thought, “Am I a slave?” I turned to my co-worker and told him. “Today’s my last day in this place.” He thought I was joking. On Sunday night, I sent the editor an email titled, “Dear Sir, I quit.”

Can’t lie, that was epic. But did you have a backup plan?

I had nothing. I’d even stopped the tutorials because the pay no longer worked for me. When I got home that Saturday, I told my dad I was quitting, and I saw respect in his eyes. He knew what I had gone through.

After I resigned, I set up my own version of a media company. While at the newspaper, I worked on stories focused on a particular sector in Nigeria and also maintained a personal website, which I occasionally wrote on. So, I just started writing more on that niche for my website.

Around this time, the industry began to pay more attention to my niche, and I occasionally earned a little money from my writing. People would pay me to cover news, conduct interviews with industry professionals, and write articles.

How often did you make money from this?

I could make a few thousand today and not see anything for the next four months. The money wasn’t stable at all.

I did this for about three years. I also started living on my own at some point, and it was tough. There were many times I didn’t know where my next meal would come from.

When I realised that focusing solely on the website wasn’t sustainable, I decided to try freelancing from another angle.

What angle?

I started looking for clients on LinkedIn. Interestingly, I didn’t even try other freelance platforms; I already had a LinkedIn presence, which helped me secure my first opportunity there in 2022.

A France-based company hired me to write articles about my industry in Africa and paid me $400 per article. I wrote one article per month, and our contract lasted a year. Then I got another contract with a US client that paid me $1 per word. My articles for this client typically ranged between 500 and 700 words, so my income was also around that figure. I worked with this client for four months.

Around the same period, I had another client who paid me 50 pence per word. I had several gigs like that, which occasionally brought in money. Of course, my income wasn’t stable, but at least I knew some money would come in every other month.

In 2023, I finally secured a full-time job, marking the end of my freelancing streak. A US company hired me as a content marketer on a $1500/month salary. Unfortunately, that didn’t last long.

Ah. What happened?

I didn’t know much about content marketing. I’d worked in journalism all my life, and I didn’t realise content marketing was more than just writing. I really wasn’t pulling my weight, and they terminated my employment after three months.

I was unemployed for another six months. I applied and applied, but nothing came out of my efforts. I only survived this period with the help of my wife. I’d gotten married and had a child before this happened, and my wife supported the home with her income. She really carried the family, and I’ll forever be grateful for her.

In July 2024, my job hunting efforts yielded success, and I finally had a breakthrough.

Whoops! Tell me more

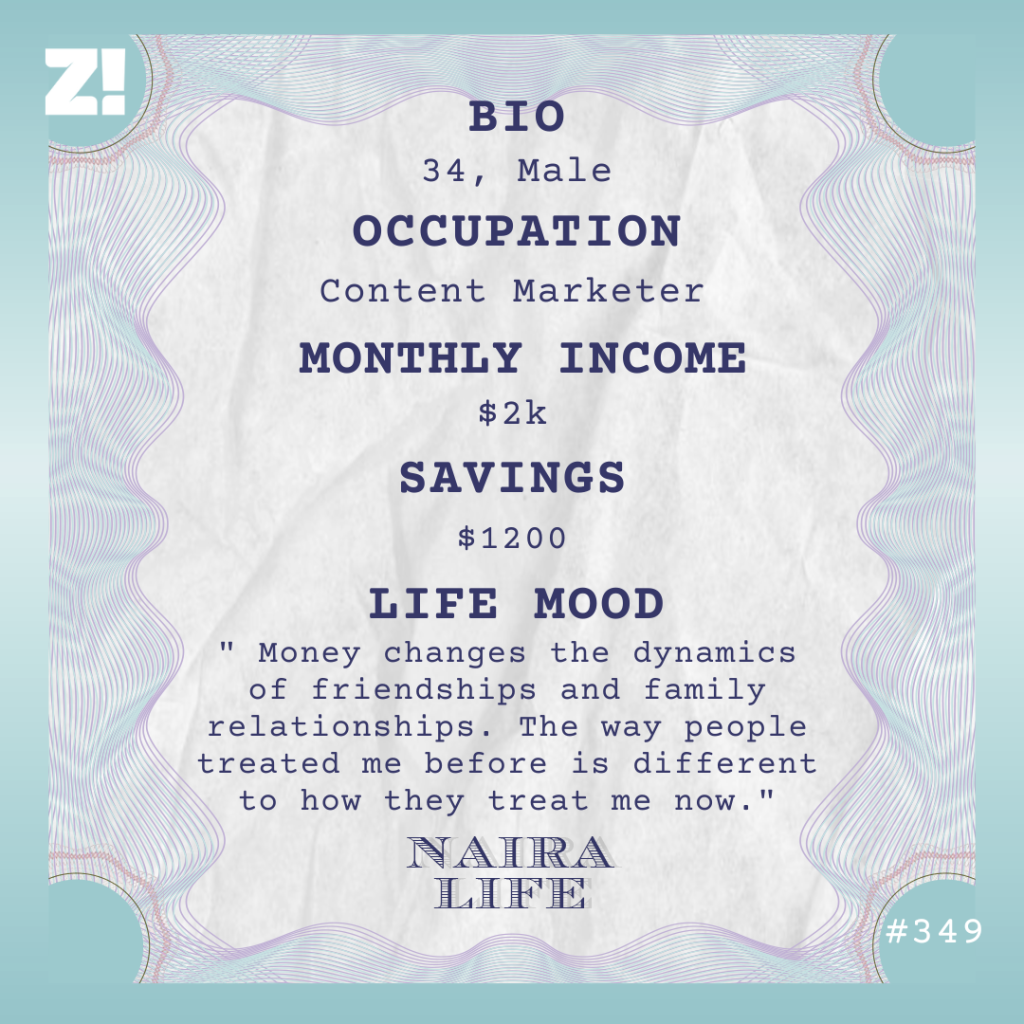

I secured a content marketing manager job with a European company. They pay me $2000/month, and I still work there, so you can say I learnt from my first content marketing experience.

Haha. You’ve had a fascinating income growth trajectory. What has that meant for you?

My life has changed. I told my wife recently that this is the first time I’ve earned a stable income in my life, and to think that everything changed in less than two years. I desperately don’t want to return to my old life. Omo, I suffered.

When I got my job, I moved out of my neighbourhood because I wanted stable electricity. Also, the place wasn’t safe for remote work. People start to look at you a certain way if you’re earning well but sitting at home. Money made it easy to move.

Previously, I struggled to pay ₦250k rent, but now I can comfortably afford my ₦2 million rent — it’s less than my monthly salary. I also got a car within six months of working.

Another thing about money is that it changes the dynamics of friendships and family relationships. The way people treated me before is different to how they treat me now.

That’s interesting

It’s true. No one wants to associate with a poor person. I never billed anyone, but my friends ran away.

I remember, during one of my lowest days, I came across a passage in the Bible. I think it was in the Book of Proverbs. It said something like, “The brothers of the poor hate him. How much more his friends?” That passage really scattered my brain, but I saw it happen in real life. I don’t blame anybody, though.

Now that things are better, the dynamics have changed, which I expected. I just know not to expect too much of people. They see the money, not me, so I act accordingly. I do my part out of responsibility, not necessarily love. The only person who really has my back is my wife, and I don’t play with her.

Hmm. How would you describe your relationship with money now?

I’m wiser, and I pay close attention to how I manage my money, especially saving and investing.

Let me paint a picture of how my money moves. I earn $2000; half of this is used to cover home expenses and black tax. Then the other half stays saved in dollars. Every few months, I take it out to acquire land. For the most part, all my savings have been invested in landed properties. I currently own a couple of acres in various choice locations, which I purchased for a total of around ₦12 million.

Three months ago, I started investing in Nigerian stocks. I don’t completely trust Nigerian companies, and I’m still learning the stock market, so I just put ₦100k there monthly to learn and gradually build my portfolio. I currently have ₦500k there.

For the rest of my savings, I’m building them up to have sufficient liquidity to invest in US stocks and acquire actual property, not just land. I have only $1200 in my savings now. I’ll need about $8000 – $10,000 to do anything serious. If I have that, I can put $1000 towards US stocks and use some of it to get property. Beyond the investments, I want to be really liquid.

What does “really liquid” mean for you?

At least $10,000 in liquid assets. I just want to have it. I believe illiquidity limits one to the kind of investment opportunities they can take advantage of. I can see an opportunity now, but can’t immediately jump on it because there’s no money. But liquidity gives me that freedom.

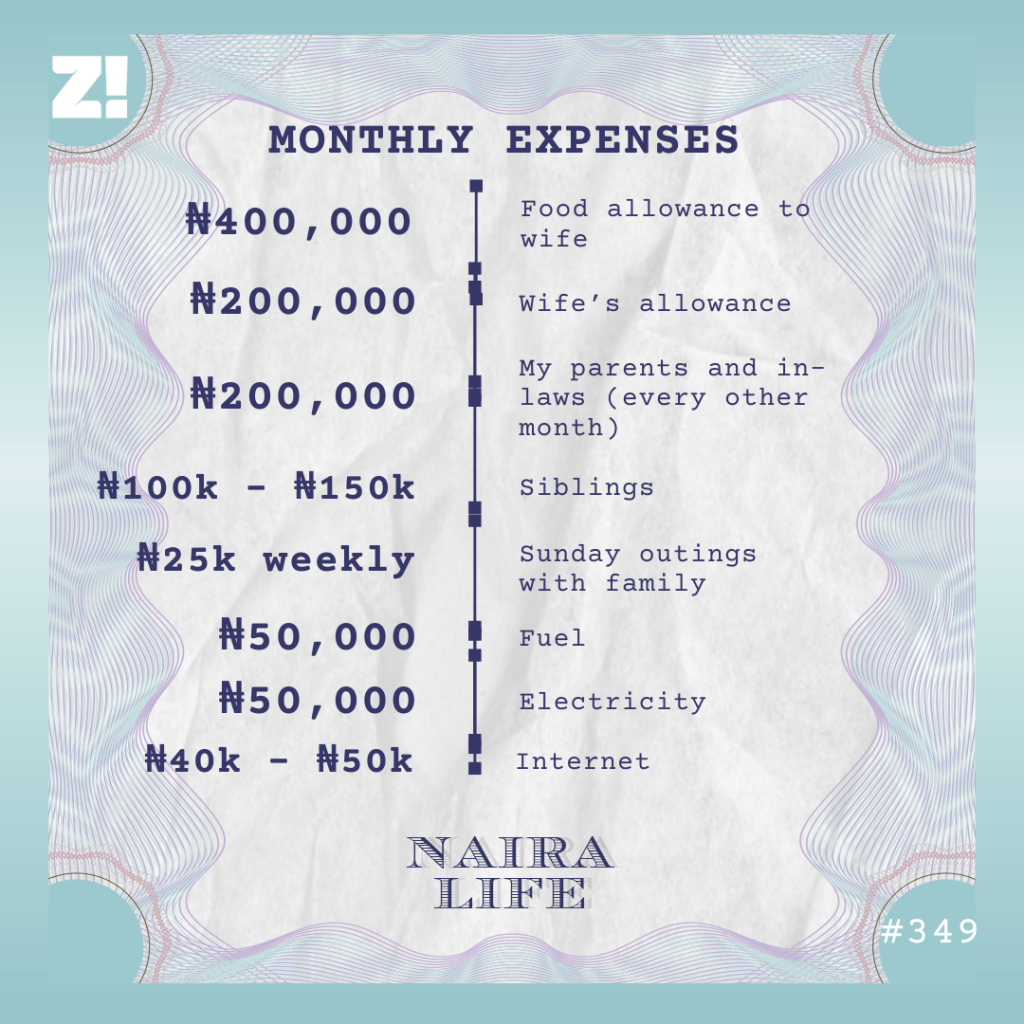

Interesting. You mentioned budgeting $1000 for your monthly expenses. Could you break that down?

After conversion, $1000 is around ₦1.4 million, and I allocate it this way:

What kind of life does your income afford you?

As you may have noticed, I didn’t factor personal expenses into my monthly budget. I hardly spend on myself. I don’t drink or party; the only pleasure in my life is good food. I think that’s a major factor I got from my childhood. Food was a challenge, so now I must eat good food. I used to tell myself growing up that turkey wasn’t sweet. It’s sweet o, I just couldn’t afford it.

I’m screaming

That said, I live a good life. One thing my experiences have taught me is that when it comes to opportunities, face the opposite direction of wherever the majority of people are facing.

Most of the people I knew were journalists, so I decided to focus on something else. My decision is still paying off today. My former colleagues who stayed in journalism are still struggling to this day.

I’m curious. Is there an ideal amount of money you think you should be earning right now?

God bless you for that question. As I am now, I believe I should be earning at least $5k/ month for the level I am currently at. I’m actively seeking job opportunities and sending cold emails to potential employers. If you know of any jobs like that, please send them my way.

I was just about to ask you to help me

Haha. There’s something I must mention. Naira Life actually opened my eyes to opportunities in content marketing. In 2021, I read a story about someone who switched to content marketing. They were earning thousands of dollars, and I told myself I would earn that one day too. So, it’s like I’m living in my answered prayers.

Love it! Is there anything you want right now but can’t afford?

I want to leave the country with my wife and children. I may not leave permanently; I just want the freedom to come and go whenever we want. It might cost us approximately $40,000 to relocate to Canada or a European country.

How about the last thing you bought that made you happy?

Maybe my car. I got it in December and it cost me ₦8 million.

How would you rate your financial happiness on a scale of 1-10?

6. I don’t have the liquidity I want. If I start earning $5k today, the number would increase to 7/10. I know I’ll be rich soon. There are signs now. Very soon, there will be wonders, haha.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.