Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Put your money to work with as little as ₦5,000. Invest Naija’s SEC-registered Money Market Fund delivers quarterly income, liquidity, capital preservation, and returns that beat savings and fixed deposits. Start here.

What’s your earliest memory of money?

Sometime between primary and junior secondary school, I had a small wallet in my room where I kept money. I also had foreign currency, as my uncle, who lived abroad, visited and gave me a few $1 bills.

Anyway, we had some maintenance staff in the house one day for deep cleaning, and by the time they finished and we returned home, the money was gone. I told my mum, but we couldn’t pinpoint who did it. So, we had to let it go.

That’s wild. What was money like growing up?

We were comfortable. My dad worked with the government, and my mum owned a business. This isn’t a yardstick for our financial situation, but I remember thinking my parents were really important because church associations often held meetings at our house.

Now I know it wasn’t a big deal, but I thought at the time that it was an indicator of how comfortable we were. I had everything I needed, though. That counts for something.

It does. When was the first time you made money?

2020. I was in my second year in uni and had built a decent Instagram following — less than 5000 at the time — and my pictures often did well. I also have clear skin, so a skincare brand reached out to me to offer a brand partnership.

They paid me ₦50k to create content for their skincare products three times a month for three months. It was my first paycheck, right in the middle of COVID, and I was pretty excited. I didn’t know it was possible to make money that way. I thought, “This is interesting. I can keep doing this.”

Did you?

Oh, yes. I started curating my social media pages, created a media kit and reached out to brands. I honestly can’t remember what my next brand deal was, but as my page grew, I gradually got more deals.

In addition to my content creation income, I also received an allowance from home. There was no set amount, but I have a lot of siblings, whom I called when I needed money. My mum also gave me money when I visited home on weekends.

By 300 level, I had an established social media presence and a recurring brand partnership model. It involved negotiating with different brands and getting a ₦250k – ₦300k three-month contract. Some of these brands renewed the contracts after the original arrangement had elapsed, and I earned around ₦250k every three months up until my final year.

Was that good money for you?

It was good enough money. My expenses were mostly skincare, food, and other random things. I was alright.

But I began to lose interest in content creation in my final year. There was pressure to post and compare myself with others. I didn’t have a healthy relationship with social media, and I grew tired of dedicating all my time to growing the page and creating content. I wanted to do other things.

So, I deactivated my account. People told me not to delete because I had 100k followers and might need the account in the future. However, after several months of deactivation and considerable thought, I took the plunge and permanently deleted it. This was in 2024, a year after I graduated from uni.

That was a huge step. How did it feel?

Like a lot of weight off my shoulders. When I still held on to the account, it always felt like there was a bucket of ice water over my head, and I didn’t know when it’d pour on me. I was so relieved.

I wasn’t prepared to have that kind of account and that kind of following. I mean, I had put in a lot of effort to grow the page, but it stopped serving me, and I had to let go.

What about the income it brought you?

I never really made crazy money from influencing. I think the most I made was ₦250k for three posts. I also had my regular ₦250k every three months skincare contracts and occasional PR packages. It was fun while it lasted.

Did you have another income source besides influencing at this point?

Oh yes. After I graduated in 2023, NYSC came next, and my Place of Primary Assignment (PPA) was a media company that paid me ₦250k/month to handle their social media. I also had the ₦33k monthly stipend from NYSC, so my income was pretty stable when I deleted my account.

I worked at the media company for about a year. By the time I left in late 2024, my salary had grown to ₦262k. My next job — which is my current job — was in social media too, but more like digital marketing. I started that in February 2025, and my salary is ₦300k. For most of the year, I supplemented my income with contract social media management gigs. I had several one to three-month stints that paid me between ₦150k and ₦350k extra almost every month.

However, I’ve scaled back on the contract gigs because I picked up an extra full-time job with a US-based company in October. The role pays me $1,200 monthly for content and community management. Depending on the exchange rate, that comes down to approximately ₦1.7m, bringing my total monthly income to about ₦2m.

Nice. How would you describe your relationship with money now?

I’m in my financial girl era. I’ve been learning more about money and financial education throughout the year, and I think it’s showing.

For context, I spend a lot of money. I don’t like the idea of wasting anything, including my time. So, if I use my time to earn money, I’m going to spend it. When I was influencing, I could earn ₦250k, set aside ₦100k and use the remaining ₦150k as free game to do whatever I wanted.

I still have that same mindset. I’m just 22. I don’t want to be stingy or hold money to the extent that I can’t enjoy it. What if I die tomorrow? What would happen to the money? Let me enjoy it now. Plus, I don’t have any bills at the moment. I live with my family, so I don’t pay rent or other bills. My siblings are trying to get me to chip in for fuel, though. I’m avoiding that for as long as I can.

Haha. I can’t even fault that

That said, while I’m focused on enjoying my money, I’m also trying to strike a balance. Yes, enjoy the money, but also save, invest and plan for the future.

Before I got the US job, I didn’t have a fixed amount of money that I set aside for savings. I just did slightly above 50%. In the months when my earnings from the contract gigs increased my income to about ₦850k, I saved between ₦500k and ₦600k, spread across a savings app and a real estate investment plan. I’m a moderate risk-taker; I don’t take on too much.

However, I’ve now created a strategy based on my new income stream. I’ll split the $1200 into two. Half goes into my real estate investments; I also want to test stocks. The other half goes to my savings spread across a dollar savings account and an account I have with an asset management company. Then, I’ll use my ₦300k Nigerian salary to ball.

Sounds like a plan. What does your savings and investment portfolio look like right now?

I’m starting from scratch again because I recently spent my savings on a ₦2.1m MacBook and some cute designer bags. Funny story about the bags: I bought them online, but they lost the shipment and refunded me the money. When they eventually found it, I had to pay again, but this time the exchange rate had gone up. I had to pay ₦500k for what initially cost me ₦300k.

Yikes

Anyway, I only started saving again in the last three months, and I’ve been doing at least ₦500k monthly. I’ll start my new investment strategy soon, though.

My big goal is to have $100k in savings and investments by 2030. It’s one of the two big financial goals I want to achieve within the next 10 years. The second goal is to own a house (or put a down payment on one) in the UK.

This is the first time I’m actually saying this out loud, but I think it’s doable. I usually get what I want because I plan towards it and work hard for it. My income growth is proof of that. This shouldn’t be any different.

Speaking of your income, what has this growth meant for you in this little time?

The first obvious change is that I can afford more things. It’s nice to be able to get nice things for my friends and siblings without thinking too much about it. I live within my means, and spending my money comes easily to me.

Also, ₦300k to ₦2m is a lot of growth, but I think it’s something I deserve. I know other people in this situation may feel out of depth and think, “Maybe I don’t deserve this.” But me? I deserve it. I’m fine with earning this, and I claim more for myself. I want to make even more money.

Inject it. What’s an ideal amount of money you think you should be earning right now?

Given my current career stage, I should be earning between $3k – $5k monthly.

Do you ever feel like you’re missing a possible income source from influencing?

I don’t think so. I still don’t regret deleting my account. I’ve toyed with the idea of creating a new one, but I haven’t gotten around to actually doing it.

Besides, I still create content, just in a more professional manner. I write on my LinkedIn, Substack, and I have a YouTube channel. I don’t create content regularly for the latter; it happens like once a year. I approach content creation as a means to build a digital archive for myself, rather than for other people.

If I ever return to “influencing,” I’d have to focus and keep my mind grounded so that my content serves both myself and others.

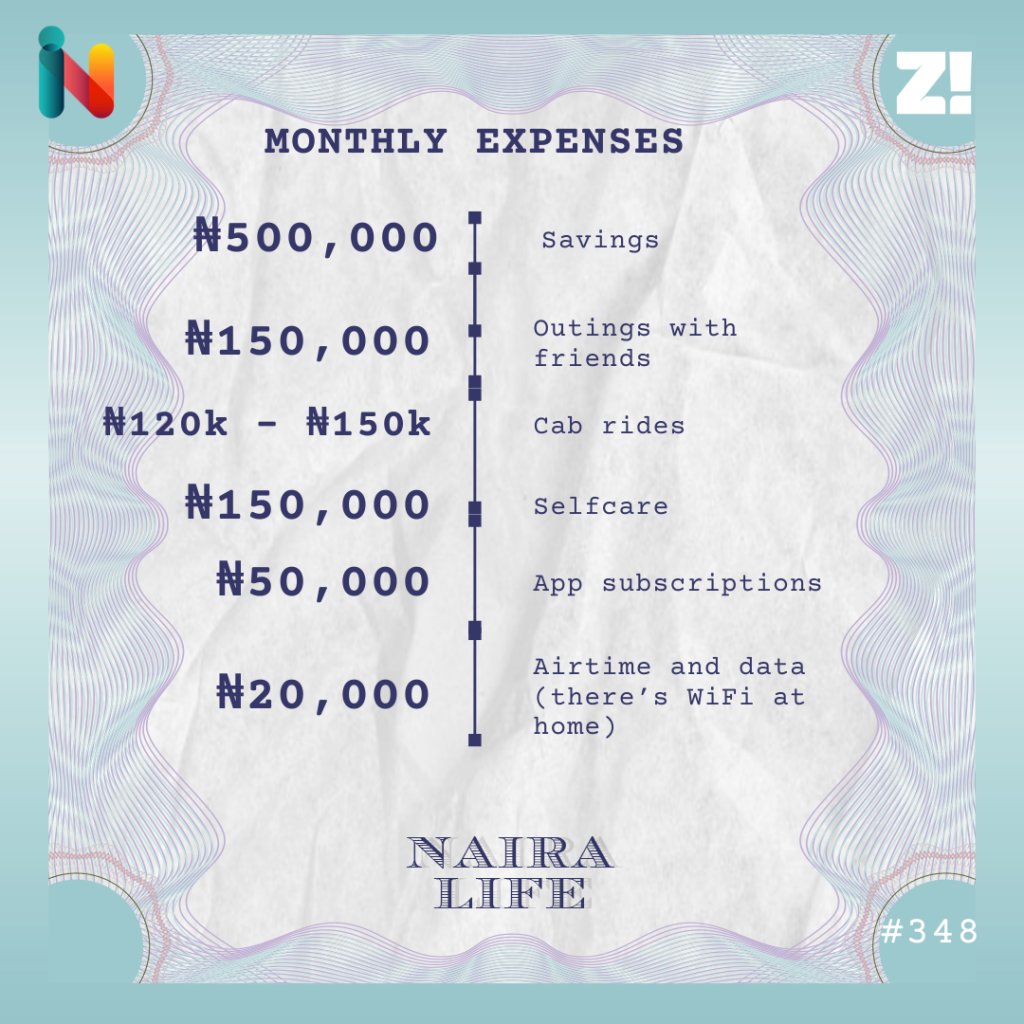

Let’s talk about where your money goes every month

Each month is different since my income was all over the place all year. Plus, I’ve not actually started making the ₦2m. So, I’ll break down my expenses from last month, when I earned ₦1m (salary + contract gigs).

Is there anything you want right now but can’t afford?

I would like to travel. I can afford that, but money can’t solve every problem you have. I can’t travel alone right now because of my upbringing and the fact that I’m a “young Nigerian woman who just finished uni.” So, I can’t really do that right now.

I’m in my great lock-in era, though. By the time I achieve all I want by 2035, we’ll see what happens then. While I wait for that, I intend to start small: travelling around Nigeria and other African countries next year.

How would you rate your financial happiness on a scale of 1-10?

7. My perfect life would have been getting born into generational wealth, so all of this wouldn’t matter to me. But I’m not, so I think I’m doing well with the resources and opportunities I’ve had.

That said, I still don’t know what it’s like to pay hard-hitting bills, such as rent and all those other expenses. I feel like by the time I experience that and learn about the toll it can take on my finances and planning, I’ll have a better idea of how finances really work.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.