Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

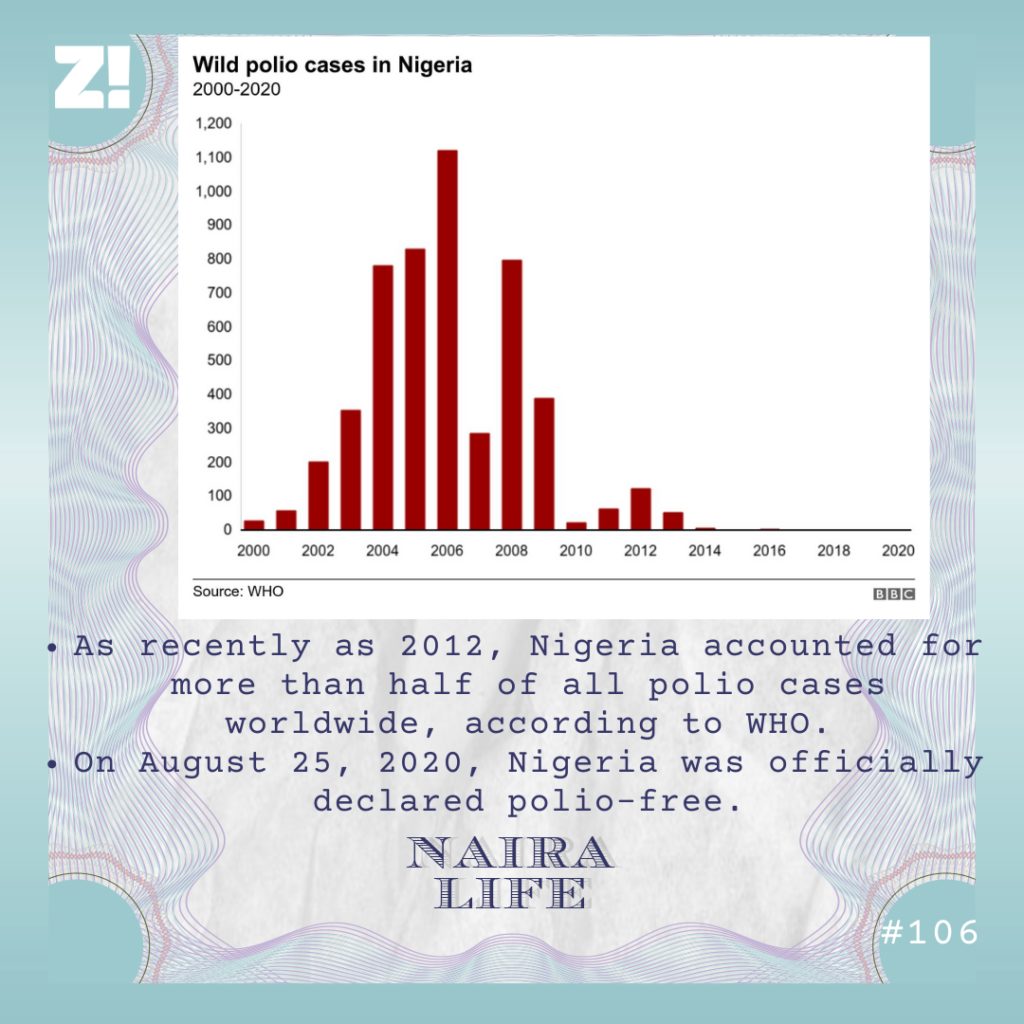

At least 25 million Nigerians are living with a disability. This #NairaLife is about one of them. The subject survived polio when he was young, but that’s not the only significant life event he has had to deal with. This one is about resilience and hope.

What’s your oldest memory of money?

I don’t remember the year, but there was a time I went out to buy a bar of soap. The money was in my pocket when I left the house, but when I got to the store, it was no longer there. I was so stressed. A woman who lived in the neighbourhood came to the store before it got embarrassing and offered to pay. On my way back, I saw the missing money right by my house gate.

Lmao. Don’t we all have this story? What was it like growing up?

When I was four years old, I was hit by polio. It turned out to be a significant life event. Although I survived, I lost the use of my legs and have been in a wheelchair since that time.

Oh wow. I’m sorry.

It’s fine. I don’t think it changed a lot. At least, my parents and the neighbours I grew up with it didn’t make it seem like such a big deal. I had a normal childhood. My parents brought me up with the same level of love, care and empathy they showed to my siblings.

How did having polio affect your family’s finances?

When it happened, nobody thought it was polio. When the hospital didn’t work, they thought it was a spiritual attack and went for traditional treatment. Those things weren’t cheap. From what I heard, my dad spent a fortune. He even had to sell a couple of his properties to raise money. When they eventually discovered that it was polio, things slowly went back to normal. We weren’t super-rich, but we were comfortable. My mum was a businesswoman — she sold clothes, but she also did this cocoa business on the side, and my dad was a cleric. The family was stable.

Did you have open conversations about money?

I don’t think this ever happened. They didn’t tell us anything about personal finances or talked about the importance of knowing how to make money. They were happy to provide.

Ah, so you didn’t feel the need to earn money?

You could say that. I mean, I made money for the first time when I was 17. This was 2005 or thereabout, but it wasn’t out of a need to earn. I was just doing something for the fun of it and it brought in money. This is the story: I couldn’t walk, but I loved sports, especially football and table tennis. So I founded a U-13 grassroots football club. I managed its operations and led the team to local tournaments, and when we won, we got up to ₦5,000 in prize money. This money, I shared with members of the team and kept the rest.

Interesting. How long did you do this for?

About three years. I moved to a new city after secondary school in 2008. The football club didn’t have any structure, so it crumbled once I left. I took a break for two years from school, and during that time, I learned a computer course at a rehabilitation centre for people with disabilities. In 2010, I got admitted to the university, and that began some of the toughest years of my life.

Why, What happened?

My dad died when I was in 100 level. He was sick for some time. Unfortunately, it was one of those health issues that drain money. By the time he passed, my family had spent so much taking care of him, we had run out of money.

I’m sorry about your dad.

It was that time I first understood what disappointment meant. Uncles and aunts promised to take over and sponsor my education. But when the time came to do that, they all disappeared.

That sounds tough. How did you navigate the period?

My mum did her best to take care of school, but there was only so much she could do. My grandmother and a few family members were the angels God sent: she chipped in and ensured that I didn’t have to drop out of school. It wasn’t the best — my monthly allowance was always late, and it was never enough. ₦25,000 was what I needed to live comfortably in a month, and I always got less than that. On top of that, I had to spend so much on transportation.

But the only other option was to drop out of school and start begging. I’d promised myself not to be that person who begged to survive.

Why did you have to spend so much on tfare?

The cab drivers at my school always charged me more than they did the other passengers. I paid ₦500 where others paid ₦200. Also, when I chartered a vehicle, they would ask me to pay more because I was in a wheelchair. They just didn’t care and that made things tougher for me. Most of what I had was spent on transportation.

That’s disturbing.

Point is, there was hardly enough to cater for all the things I needed. I once sold my computer to raise money for tuition. It was the first time I realised I was poor.

But I needed to get through university. I started writing to organisations I felt could help me. Writing these letters was one of the hardest things I’d done in my life. I understood that anyone could use my disability against me. People see me and assume that I’m there to beg for something, so I find it difficult to ask for help.

In my final year, I wrote to a professor at my school, and thankfully, he and one of his friends funded my project. I graduated from university in 2017.

Phew. What came after uni?

Most of my friends were going for their masters, but I couldn’t. The next best thing was to look for a job, which was hell. I was so broke that I struggled to feed myself each day. I had to do something I hated again — depend on people. My siblings, mum and family members were sending me money. The problem with this arrangement is that, when people send you money consecutively for three months, they get tired, and you will notice it even if they try to hide it. I was also tired of asking people to send me money.

That’s tough. So what did you do?

I started volunteering for NGOs working with people with disabilities. They didn’t pay a salary though — just a stipend every now and then. The amount of work I did in a month was a factor to what I got paid. Usually, it was between ₦10,000 and ₦20,000.

I started making money on the side too. I’d learned how to make shoes a few years before, but I left it to focus on school. I was making between ₦30,000 and ₦50,000 each month. Sometimes, it was more. Sometimes, it was less.

Interesting. What has happened between 2017 and now?

I’m a problem solver. Working with other people with disabilities has always prompted me to look for what I could do to add value to their lives. A lot of these NGOs I work with are big on skills, but mostly technical skills and not creative skills. Me, I love entertainment, and I love talented people. So, I thought: “Why don’t you start something where you can find and promote these talents?” I started working on starting an entertainment company.

Nice.

I registered the company, and it became operational in 2019. Right now, what I do is to organise events where talented people living with disabilities can show off the creative thing they know how to do best.

That’s interesting. How much did it cost you to set this up?

About ₦500,000. That was the limited resources I had. Also, I didn’t put all the money in at once. It was bits by bits. ₦50,000 here. Another ₦30,000. Buy a few things. Hire one or two staff. At the time of the launch, what I spent had run into ₦500,000.

Ah, I see.

After launch, we got down to organising events. It was a lot of paperwork. Making budgets and writing proposals. For one of our earliest events, I had only 10% of the ₦1.5m budget. So, we had to partner with other organisations. Unfortunately, everything was in place when Covid happened, and we had to postpone the event.

Damn Covid.

But after I saw how the world moved to virtual events, I tried to do something like that too. I decided to do a virtual workshop. The strategy had to change because no company wanted to sponsor a virtual event. Our events had been free, but for this one, we sold tickets, which brought in ₦150,000.

Did you turn in a profit?

Not exactly, no. Most of the money we got went into paying artists we invited and persons with disabilities that performed at the event. I didn’t mind. It was the first time I did something on that scale.

Lit.

Another interesting thing happened in 2020. You know how people say they did something that changed their lives forever? For me, it was applying to the MTN Revv Programme for SMES. I’m not even sure how I got in, but it was such a rewarding experience. Listening to experts talk about how to be better managers and entrepreneurs helped. It couldn’t have happened at a better time because the effect on Covid on my company was enormous. It’s harder to get sponsorships or even organise virtual events. But now, I think I have more clarity on how I intend to scale.

Another thing I learnt was how to navigate personal finance, especially savings. Now, If I don’t need something, I don’t buy it. It’s a life-saving tip.

Lmao. You said that the pandemic slowed things down for you. How do you make money these days?

Ah, I’m into so many things to survive. I still make and sell shoes. I work with real estate agents and market properties. That gets me a commission. On the side, I consult for NGOs and get a token from some of them. On a good month, I make between ₦80,000 and ₦100,000.

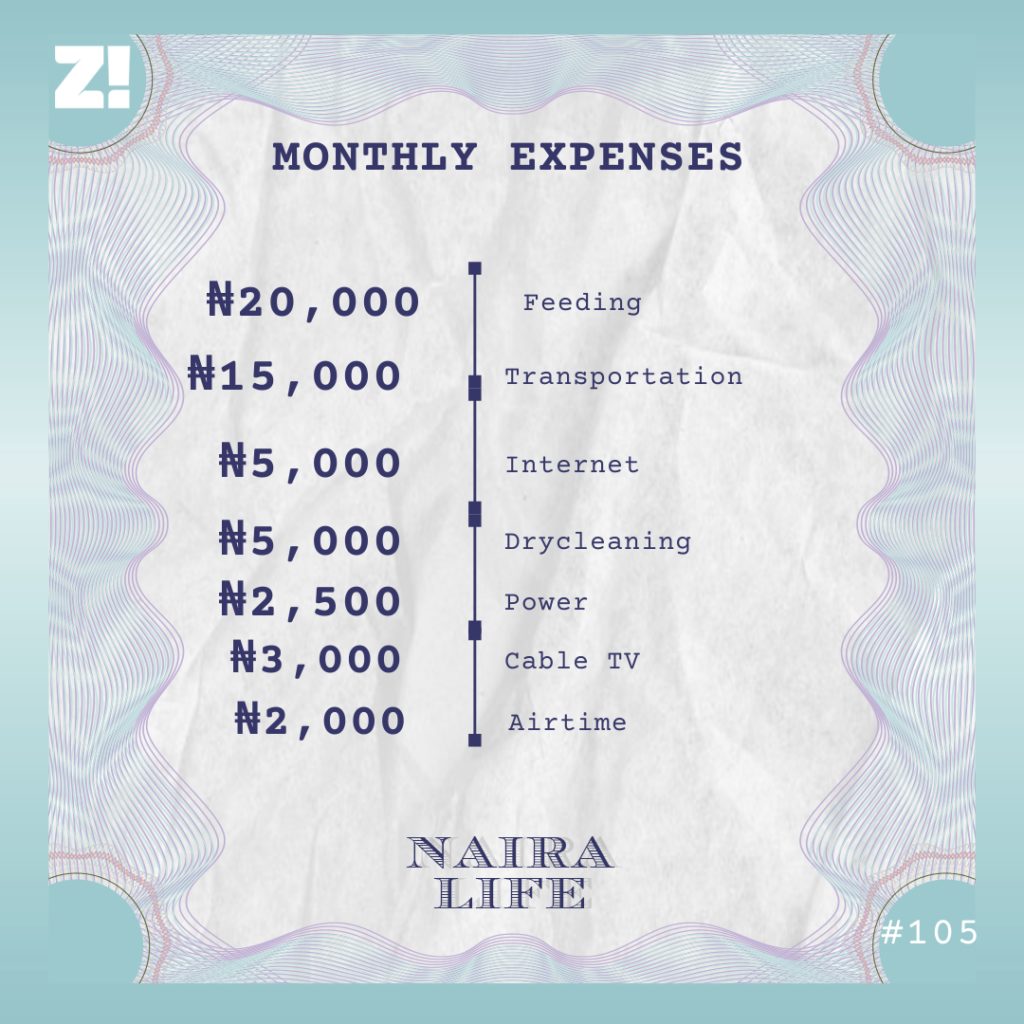

Interesting. Can we break down your monthly expenses?

What about your savings?

Until recently, when I started learning more about personal finance, I wasn’t big on saving. I have a bank account I rarely use or linked to an ATM card. After settling my monthly expenses, I transfer the “change” that remains to this account. For the most part, this goes to rent and other emergencies.

How much do you have in your savings account now?

I’m not going to lie, I have less than ₦20k in that account. I just moved to a new apartment and had to do a couple of things to make the place comfortable for me. Everything took about ₦450,000. There’s no other way to say it: I’m currently broke. I’m just hoping that things will pick up again in the next couple of months, and I can start saving again.

Realistically, how much do you think you need to be earning to stop worrying about money?

At the moment, ₦200,000 will do. This will definitely solve most of my troubles. But since it’s not happening, I can only plan for the future. In five years, I want to see myself earning more than ₦1m every month.

Is there a plan to do this?

People pay for value, and I know I have a lot to offer. Accessibility and mobility is a problem for people like me who are in a wheelchair, so I’m in the middle of setting up a new business installing ramps in offices and public places. I’ve been working with a team and submitting proposals to organisations. However, it’s capital intensive, so I haven’t done so much on it yet. But I’m really excited about it. Fingers crossed.

I’m rooting for you. How would you say your experiences have shaped your perspective about money?

It’s important to have money. If I had the best financial support when I needed it the most, maybe I’d be in a position to do more and touch more lives. It’s unfair how only a few people have access to all the money they need. But that’s the way it is, so it’s necessary to strive. I wasn’t born into wealth, but maybe I can become rich and start something better for my own family.

Is there anything you want right now but you can’t afford?

A lot. Mobility is a huge problem for me. If I have a car, moving around will be so much easier. I can also help other people I work with get around easily, especially when we have events.

When Covid hit, I couldn’t continue paying the people I hired. I’m currently sourcing for funds to make sure we return to work and continue planning all the things I have in mind. That would be great too.

I feel you. What was the last thing you bought that significantly improved the quality of your life?

I bought a laptop recently for ₦195,000, and it was money well-spent. It’s been helping me market my services better and do a whole lot of other things.

That’s great. Where does your financial happiness rank on a scale of 1-10?

Maybe a four. It’s not even so much about my personal finances now. I manage just fine with what I have. It’s more about the people I work with. I see the smile on these kids faces at the events, and I wish I could do more. I need money to do that. The more I can do for them and other people like me who live with a disability, the higher this number will be.