Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

What’s your oldest memory of money?

When I was eight years old, I found a big bar of soap at home and dissolved it in water. The younger kids in the compound were fascinated by the bubbles it formed, and they wanted it. I told them they had to pay ₦5 for a handful. They all went to their apartments and brought the money. However, their mums found out and confronted me. I had to return the money.

I liked how I felt when I thought I was going to make some money, and I wanted to feel that way again. I told my mum, and she said I could sell something tangible and she would help me get it started. During the next holiday, she helped me set up my first business — selling homemade zobo drinks. A cup went for ₦10, and I sold it in a neighbour’s shop. I don’t remember how much I made at the end of the holiday period, but I gave everything to my mum.

I sold a couple more stuff when I was in secondary school. My mum owns a primary school and during the summer lessons, I’d make snacks and sell them to her students.

However, I got my first real job at my mum’s school after I finished secondary school in 2008.

Tell me about it.

I wrote an application letter to my mum, asking to work as a staff, and she agreed to bring me on as a teaching assistant. My salary was ₦6k and I stayed for two months. Then I got into a pre-university programme in a state in the north-central and moved in with a family friend living in the state. My parents put me on a ₦10k monthly allowance.

The programme lasted for seven months, and I returned to my parents after that. When I didn’t get into uni that year, I returned to working at my mum’s school. My salary was now ₦10k. On the side, I was making and supplying snacks to the school and some of my mum’s friends and making a monthly profit of ₦5k and ₦8k.

Baller.

Hehe. In 2010, I quit my job and went for a diploma programme in another university, which meant I had to go back to being on a ₦10k allowance. The family friend I lived with gave me an additional ₦5k every month.

A year later, I finally got an offer to study biochemistry at the university where I did my diploma. I moved out of the family friend’s home and into the hostel.

I renegotiated a new allowance with my parents, and they started sending me ₦10k every two weeks. This was what I was on until I finished university. When I settled into school, I looked for ways I could make extra money but that happened only once. I constantly had to figure out the best way to manage my allowance. Funny story. . .

Yes?

Sometime in 2012, a friend introduced me to a lady who was looking for students to help sell her magazines. A copy of the magazine sold for ₦300, but she said we could add a markup and keep the extra money. It sounded easy, so I signed up for it and I took some copies off her. I walked the length and breadth of the city and couldn’t sell one. As I was returning home, tired and frustrated, I met a group of people and one of them was like, “Fine girl, what are you doing out so late?” I told them that I was out selling magazines and hadn’t sold any all day. They asked for the price and for some reason, I said it was ₦5k. They took one magazine and paid.

Oh wow.

There’s more. I decided to make one last stop at a country club close to where I was. I approached two guys who were leaving and told them about the magazines. When they asked for the price, I told them it was ₦10k, and they also paid. They didn’t even take the magazine with them. On some level, I think they just felt some pity for me. Anyway, I made close to ₦15k that day.

Mad.

I didn’t do anything else for money until I left university in 2015.

NYSC was next?

I took a gap year before I went for NYSC. My parents had started a publishing company when I was in uni, and they needed someone to manage the place. I took it up since I was available, and I was put on a ₦30k salary. Also, I started selling hair products by the side and made about ₦20k in profit every month. I was saving my salary and living on what I made from the hair business.

Towards the end of 2016, I was mobilised for NYSC and went on to serve in the north. My Place of Primary Assignment (PPA) was a health centre, and they paid a monthly stipend of ₦5k. There was also the federal government ₦19,800 allowance. But I thought I could do better than that, so I started looking for a new job. I got a part-time job at a primary school where I taught two days a week, and they paid ₦7k. A few months later, I got a better paying offer at another school — ₦12k per month, but I had to go in every day. Not long after, I found another job in a spa as an attendant. This paid ₦15k.

Interesting. How did you juggle three jobs?

I had stopped going to my PPA because there was hardly any work to do. I worked at the school from morning until afternoon and resumed at the spa afterwards.

It worked for me, and I was able to save as much money as I could. When NYSC ended in 2017, I returned home with about ₦240k in savings.

Lit.

My parents still wanted me to work at their publishing company. My starting salary was ₦50k, but it was going to increase to ₦100k after my first six months. I agreed, but I didn’t spend up to six months there.

Why?

I got restless after five months and wanted to do something else. My parents weren’t happy with it because they thought I was abandoning the family business, but they respected my decision. I actively started looking for a job in FMCG companies and banks. I applied to a few places and landed some interviews. I joined a bank in 2018. In their training school, I was paid ₦30k. After training school, my salary increased to ₦80k.

A few months later, I realised that the money wasn’t a lot. But it was fair in comparison to what a lot of my friends were earning.

I was spending a lot on transportation too, and the best thing to do was move closer to my workplace. I found a mini-flat and the total package was ₦600k. I got ₦240k from a monthly contribution scheme I was a part of. My parents took care of the rest and I moved into the apartment.

What’s happened between then and now?

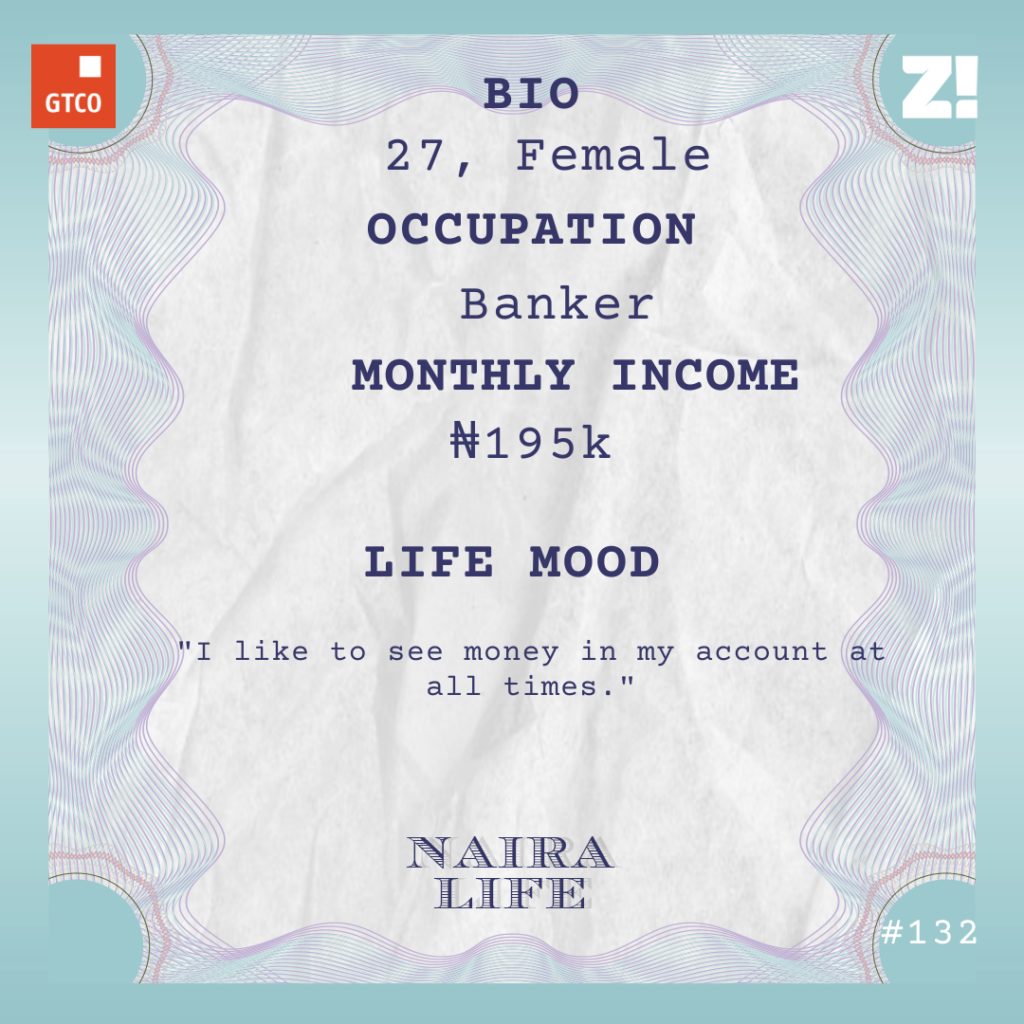

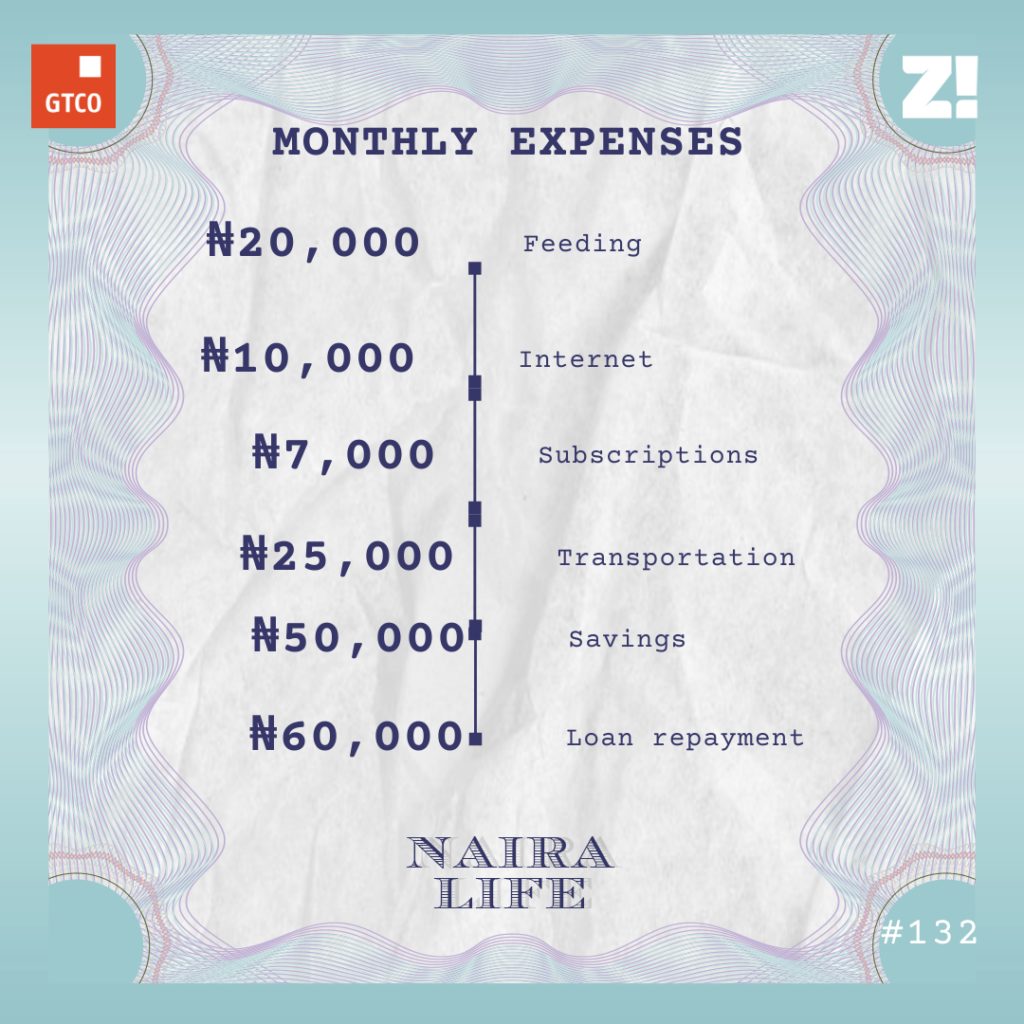

I was promoted for the first time in 2019 and my salary was bumped up to ₦100k. My standards of living remained the same, and I started saving ₦20k every month. In January 2020, I got another promotion and my salary increased to ₦195k. This meant I could save more, so I joined another contribution scheme with a few people and started putting ₦50k away every month. Three months after my promotion, the pandemic hit.

How did that affect you?

It didn’t affect me directly, but my parents felt the heat. Shortly before the lockdown started, they had invested heavily into publishing some new books, hoping to recoup their investment when schools opened, but that didn’t happen and they had salaries to pay.

My parents are proud people, and I knew they would never ask me for money even though they needed help. During the height of the pandemic when they were out of business, I sent about ₦300k home to them.

I don’t think my savings took a big hit because, at the end of the year, I had ₦1.2m in savings.

That’s lit.

Then I blew everything away.

What happened?

I got married and the wedding wiped out my savings.

Lmao. How much did your wedding cost?

About ₦4m. It’s weird it cost that much because it was a small wedding, and we invited only 100 guests. My parents were recovering from the effect of the pandemic and couldn’t do a lot. My husband’s family did what they had to do, but I had to chip in something too.

Fast forward to January 2021. I started the year with nothing. I tried to save more but realised that it was going to take some time before I recovered. So I did something different.

What was that?

I took a ₦700k small interest loan from work and I invested in a mutual fund, which yields anything between 7% and 14%. Now, you’d expect me to have more than ₦700k in my mutual funds account, but I have ₦500k in it. I have access to the account and can liquidate it at any time. This has happened a few times in the last couple of months.

I’m curious about how you approach savings and investments.

At the moment, I only have investments in mutual funds. I like to have emergency funds too, so I used to take ₦30k out of my salary and save somewhere. But I kept dipping into that because I needed to do something before my salary came in. Recently, I started another ₦50k a month contribution scheme with a few people, and that money will probably go into starting a new business. I’ve been thinking about starting one because I’m not making as much money as I’d like to.

How much do you think you should be earning now?

The number I have in mind is ₦400k, but it’s tricky. On one hand, I feel like I can’t ask for that much because I have only my BSc certificate. I have a couple of skills, but there’s no certification to back them up, and I work a job where certification is important.

What do you need to do to unlock your next level of income?

For starters, I need to upskill. I was going to start getting the certifications I needed a few weeks ago, but my laptop gave up on me. Can you believe it?

Also, I need to return to having a side business. Working in the banking industry has shown me that having one source of income can be dangerous. Last year, I saw people with families and responsibilities come into work in the morning and before the day ended, they lost their jobs. It was horrible. I’m sick and tired of my job and thinking strongly about returning to my family business. I feel like I will be better appreciated there, and it wouldn’t even affect my finances. My parents have agreed to pay me what I currently earn, and I’ll have more time to focus on starting and running my side business. However, it’s not an easy decision to make.

I get that. What part of your finances do you think you could be better at?

Making more money. I don’t have a bad savings habit, but I end up dipping into my savings because I’m not making enough. I could do better with following a strict budget, but the priority is to get my earnings up.

This feels like a good point to talk about your monthly running costs.

There’s not a lot left after all of this, so I’m mostly surviving on vibes. Thankfully, my husband comes through when I’m almost out of money and salary day is still some time away.

How have your experiences shaped your perspective about money?

As a kid, I didn’t have a reason to worry about money but now I think about it all the time. While money is not the most important thing in the world, it’s central to the quality of life you can afford. I like to see money in my account at all times because it’s security for me. I always want to know that I have something to fall back on if push comes to shove. It’s stressful, but it’s what it is.

I’m wondering if there’s anything you want right now but can’t afford?

I’d love to get a car. Public transportation in this country is killing me. But I imagine that I’d need about ₦3m to get me something that works, and I don’t have it right now.

What about something you bought recently that improved the quality of your life?

A pair of ear buds. I talk to more than 50 people on the phone every day, and I’m doing other things while I’m on the phone. The ear buds have made the experience better, and it cost only ₦28k. Great value for the money.

Love that for you. On a scale of 1-10, how would you rate your financial happiness?

2. There’s a lot of things I currently don’t like about my finances — my paltry savings and the fact that my salary is not enough to get me through the month sometimes. I don’t like that I don’t have an extra source of income even though I’m working on it. It’s stressful crunching numbers every time I need to buy something.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld