Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

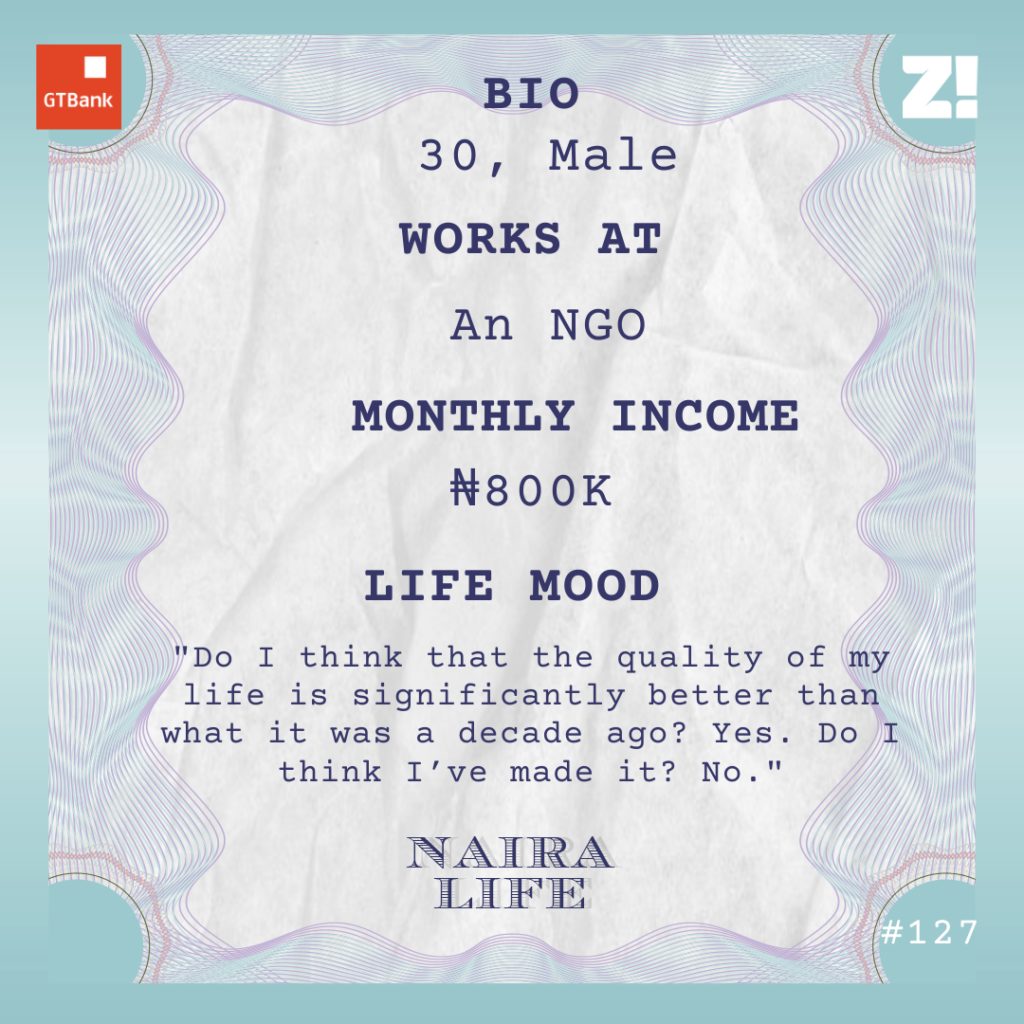

The 30-year-old in this story was born into a low-income family. The constant struggle was a lack of money. When he got his first 9 to 5 in 2014, his salary was ₦40k. In 2021, his monthly earnings stand at ₦800k. This is his #NairaLife.

Let’s go down the memory lane for a bit. What’s your oldest memory of money?

I’d say knowing money from a distance. My parents struggled to raise four kids and most of the problems were money-related. My dad was a businessman and my mum was a petty trader, who sold anything she thought she could sell. The default mood around the house was always ‘Where will the next meal come from?”

The first time I held money that felt like my own was in 1992. I was in nursery school and my parents gave me an allowance of 50 kobo. I don’t remember what that could buy at the time,but it wasn’t a lot of money.

When you think about your childhood, what comes to your mind?

Two things: being sent out of school and not hanging out with some of my mates because I didn’t have clothes to wear. I grew up in a large compound full of neighbours, so both were a struggle. Whenever I was sent home from school, because I hadn’t paid my school fees for the term, I would sneak into the house through a bush path at the back of our building because I was embarrassed to walk through the main road. I was mostly indoors when kids my age were out playing because there was no point going out to join them when I didn’t have clothes to wear.

I like to think that our neighbours were praying to God to bless my family first before blessing theirs. That’s how bad things were.

And you know what? Things got better for a while in 2002 – 2003. My dad started working with some oil and construction company and that came with a steady stream of income.

But something happened?

Yeah. I can’t say a lot about it because I was still young and it isn’t my story to tell. But I know my dad made some terrible financial decisions and some of his business plans went south. Along the line, some key business relationships broke down, so the oil and construction money stopped coming in. This phase hit deeply because we had gone from having nothing to eat to having a fridge stocked with food, then back to nothing. The promise of a new life was snatched from us before we could get used to it.

What did this do to you?

I wanted some level of control or anything that looked like it, and this drove me to looking for ways to earn money.

Do you remember the first thing you did that fetched you money?

Yes. I was good with computers, so I started working out of my dad’s office and helping people type letters and do basic graphic design. This was in 2003 when I was in JSS 3. I was making between ₦50 and ₦500 from this. Also, I used to go to a cyber cafe in my street to work for a stipend.

Phones were also beginning to be mainstream but the older folks didn’t know how to work it. I had become popular as the computer guy, and I leveraged it, helping people perform simple tasks on their phones even though I didn’t have one.

I stuck with all of this until I went to uni in 2008.

What was uni like?

My parents worried about paying tuition and that was it. I had to fend for myself for the most part. Some money came from my older siblings sometimes, but it was few and far between. I grew up loving fashion and had always wanted to do something with it. In uni, I met a tailor and we decided to work together. I was a striker — people who belong in this category don’t own shops. My job was to get the job and the materials the tailor needed. I was getting deals and bringing them to the guy and making between ₦500 and ₦1000 on a deal. This accumulated into lump sums when the business caught on.

What was the biggest money you made from a single job?

₦30k. I met this guy when I was in my second year of uni. He asked me for the price of a shirt and I told him ₦18k because I knew he could afford it. He brought it down to ₦15k and paid for two shirts. I went home with ₦30k when all I needed to make a shirt was ₦5k.

Omo.

My earnings saw me through uni. I don’t remember how many deals I got or how much I typically made in a month, but I was never hungry. I graduated from uni in 2012.

What came after?

I almost got a big break. One day, a hotelier I had made some clothes asked to see me.When I got to his office, he introduced me to a man who came from a state in the south south. Apparently, the man was rich and managed a large music band. He wanted me to handle the project of making new uniforms for his band members.

He put me on a plane — my first time in one — to meet the members of the band and take their measurement. I met the guys — about 100 of them and the initial deal was that I would make three shirts and trousers for each one of them. The total job was ₦2m. I got an advance fee of ₦800k on that trip.

Whoop!

I returned home with so much excitement. The only problem was that my go-to tailor had travelled and I thought I couldn’t wait for him. I decided to go for another guy I’d used for a small job a few months earlier, and I briefed him. He agreed to it and got a few more people to work on the project. But I put him in charge of the project and deposited the ₦800k advance I got. It was supposed to be spread among all of the guys who signed up on the project.

It was time for NYSC and I travelled to camp and was following up on the project.

When I got back and went to check on the status, I found out that this guy hadn’t done anything. He used all the money I gave him to fund his wedding and rent an apartment.

Wait, what?

For real. It was a bad situation. You know what this guy said to me? “You can’t do anything to me. The worst you can do is arrest me and I’ll get out eventually.”

Ah!

I was under pressure because my deadline had passed and I had nothing. The man who gave me the job had also started threatening me. During one of our conversations, he called out my NYSC state code and said he could make service year and life hell for me.

He wasn’t someone I could afford to totally piss off.

What did you do?

I used about ₦500k in my savings to try to salvage the situation. I contracted the job to another tailor and managed to deliver the first batch of clothes. But the man didn’t pay me the ₦1.2m balance because I was way past the deadline. Also, It wasn’t supposed to be a one-off job but after everything that happened, the man cut me off. He was like he had so many expectations and I let him down.

Damn. I’m sorry.

Thank you. I think my access to the man and the kind of jobs he would have brought to me would have changed the trajectory of my life. I was back at zero and the bulk of my savings had been wiped out. There was nothing I could do about it. After the deal crashed, I stayed away from fashion designing but I returned to it sometime during my service year because it was my primary source of income.

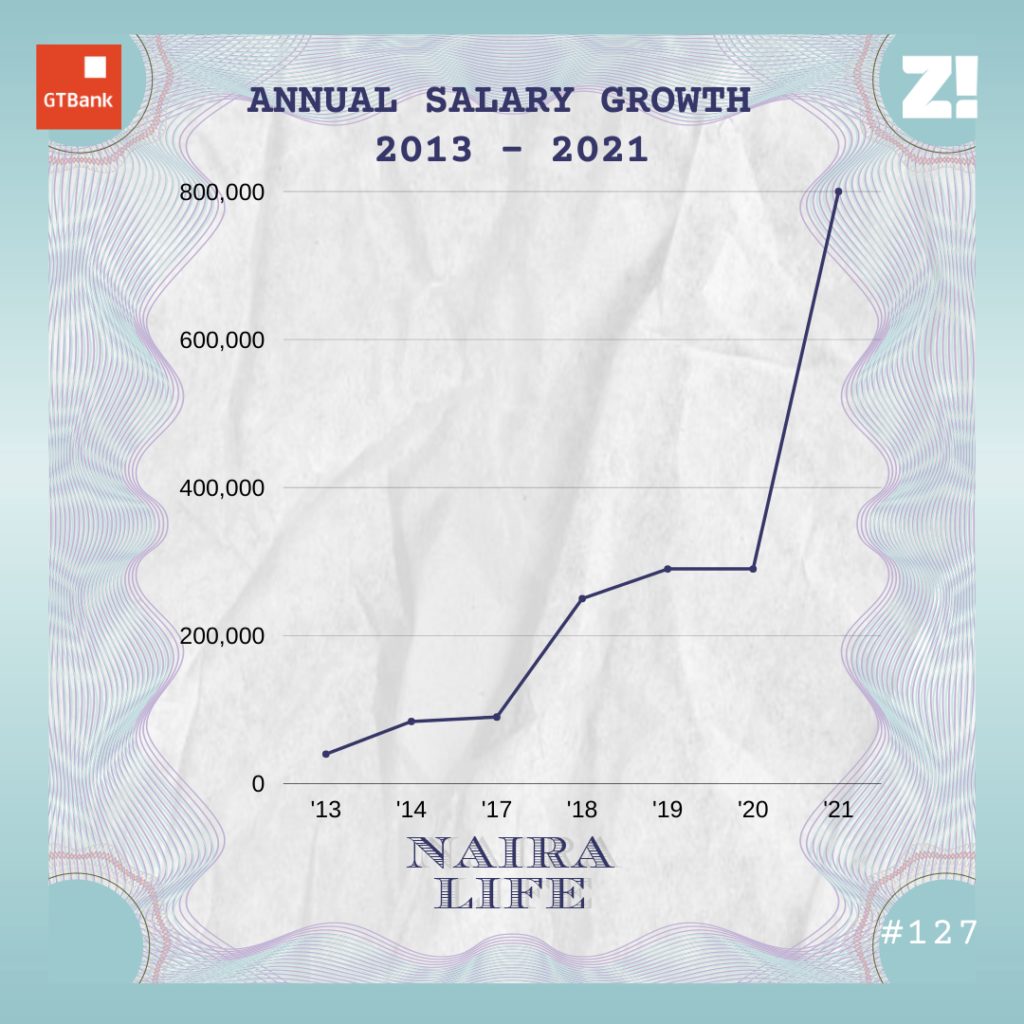

I finished NYSC in 2013 and started job hunting. After several interviews, I got a job offer. It was a personal assistant role to a managing partner of an oil and gas consulting company. The pay was ₦40k per month. Guess how long I spent on the job? Two months.

Why did you leave?

I had problems with my boss. At the peak of it, I was always looking forward to the end of the day, so I could leave the office. There was no point in staying there.

What happened after you left?

I didn’t get another job until 2014, but my side hustle kept me together. My next job was at a consulting firm and I was hired as a client relationship officer. My net salary was ₦47k when I started the job. After four months, I was promoted and my salary rose to ₦84k. However, I had taken a loan of ₦500k from work for some family needs and was repaying ₦41k per month. This put my monthly earnings to ₦43k until I finished paying off the loan.

How did this affect your finances?

I’m not sure it did. First, I was sharing an apartment with my sister and was making money on the side from fashion designing. Also, I consulted for some small marketing firms. I was running my day to day costs with my salary and saving whatever I made from the side gigs. I should add that I got another promotion and a salary increase. My salary was ₦90k when I left the company in 2017. By that time, I had about ₦1.5m in savings.

Why did you leave this job?

There was nothing to aspire to there anymore and I didn’t think I was going to get another raise. The ginger to leave really came when I got a marketing job at a sixth form college — a school that offers foundation and pre-university courses to Nigerians looking to study abroad. The salary was ₦250k. That was about 3x my salary at the time and I had to move to a new city for the job.

That’s a significant raise, but you had to move to a new city. What was that like?

Haha. It felt like I was being thrown into the wild but I took it in good faith. The money erased every doubt I had.

Haha.

I was at the job from 2017 and got a few raises there. My salary was ₦290k in 2020. Later in the year, a friend told me about a vacant position as the head of a department at an international NGO. I applied for the job, went through a couple of interview stages before I got an offer and it was a very good one for me.

I’m listening!

It’s a remote job. The offer was $1650 a month. That’s about ₦800k. I dropped my resignation letter at my previous job and resumed at my current job in February 2021.

You are currently earning almost 3x your old salary, what has this jump shaped spending habits?

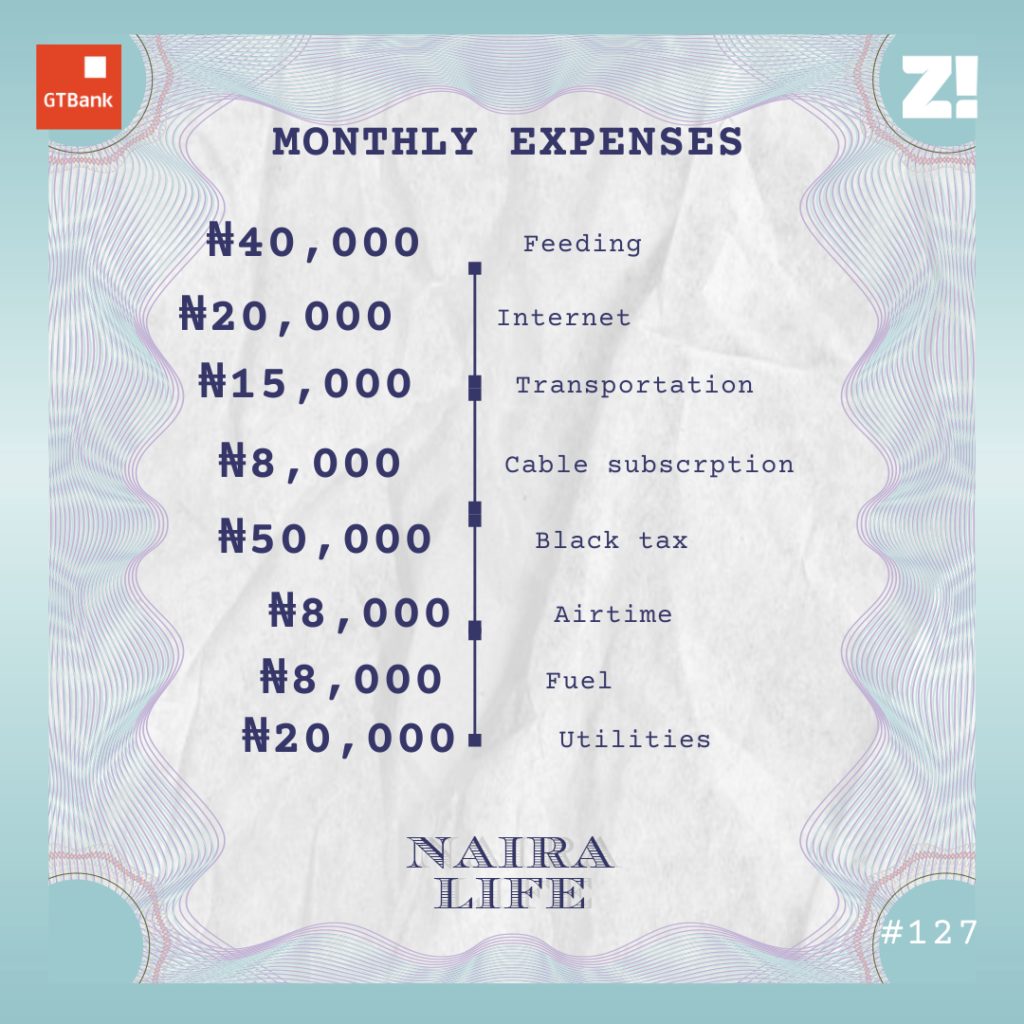

I’m still living on my old salary. My spending is still at a minimum and it doesn’t really reflect how much I earn. It helps that I don’t really go out except when I have plans with my girlfriend and other close friends. In addition, I don’t pay a lot in black tax, and that’s because my siblings and I pool our resources together. However, my savings habits have definitely changed. I was saving ₦100k on my old salary. Now, I’m saving ₦500k every month.

Lit. Lit. This feels like a good place to break down your monthly running expenses.

I pay ₦500k for my rent per year. I used to save a portion of my salary every month to make rent but I’ve not been doing that this year.

You’ve come a long way, how have your experiences shaped you?

My view of money is that it’s a reward for a service rendered. And financial success is what happens when opportunity meets proper preparation. People like me don’t get life on a platter of gold. We have to grab and make the most of every little opportunity we get.

Back to your savings, what does it look like at the moment?

I have about ₦5m from money I’ve saved over the years from salaries and whatever extra money I get. Saving money comes naturally to me, but I’ll admit that it got easier to save more as I earned more. Also, a savings app has been keeping me grounded.

Are investments your thing?

I invest in small businesses. Some of my friends have a couple of these, and I have a stake in their businesses. My investments there should be worth between ₦2m and ₦3m, and I’m sure they are going to grow. I’m not into or interested in crypto because I don’t know how it works yet.

In the near future, I’m looking at putting some money into setting up a food truck and hopefully grow it into a restaurant. I’m excited about that.

You’ve come a long way, but how much do you think you should be earning right now?

Hmm. I don’t think I’m grossly underpaid, but I imagine I’ll always want more. Anything from ₦1.2m to ₦1.5 is a good number for where I’m at right now.

Have you ever thought about what you need to unlock your next level of income?

The thing about working at an international NGO is that it opens to a lot of opportunities and contacts. If I can leverage this properly, I should be able to triple or quadruple my income in the next two to three years.

And in five years?

That’s more about my investments. I want to have a couple of food trucks and a restaurant by that time. I really love the whole culinary thing, so I’m geared towards it. This plan to own a food business is probably one of the reasons I went for my MBA.

I’m curious about this interest in the culinary business.

Haha. Let me paint a picture: I see a new recipe and I get excited. I’ve always loved to cook. I did go to a culinary school for a while and when I have the time, I teach cooking classes. Also, I watch food channels a lot. So yeah, it wouldn’t be the worst idea to go all in and make some money off it.

Back to the present, what’s something you bought recently that improved the quality of your life?

A Macbook. I got a good deal on it and it cost ₦400k. The synergy between my iPhone and the Macbook has been making my life a whole lot better. It’s out of this world.

Anything you spent money on recently that required proper planning?

I’m still thinking about it. I want to move to another apartment. Rent and furnishing will cost me about ₦2m. This definitely requires a lot of thinking and planning because it’s going to take a lot of money out of my savings.

Let’s talk about financial happiness, where is it on a scale of 1-10?

I’d say 6. Do I think that the quality of my life is significantly better than what it was a decade ago? Yes. Do I think I’ve made it? No. I want to build my wealth around my investments and get to a point where the dividends are enough to fund my lifestyle. This will take me to an 8. It’s almost impossible to hit a 9 or a 10 in my opinion, and that’s fine. But I want to look back in a couple of years, see the work I’ve put in and where I’m at and be happy about it.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld