Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

What’s your oldest memory of money?

In 2000, when I was in Primary Three, my dad came home with two bundles of ₦50 notes. We counted it together and everything was ₦10k. I had never seen that much money. I was so excited I couldn’t stop talking about it to my friends the following day at school.

Flex. What was it like growing up though?

My dad used to work in a bank, but he resigned when I was about five years old to set up a consulting practice. This period was tough for the family though we kids didn’t really understand that there were money issues. My mum was a full-time housewife who did some petty trading on the side. On a few occasions, when my dad didn’t have money to go to work, my brothers and I were asked to break open our piggy banks and give him whatever we had saved so he could go to work.

Things weren’t rosy, but we never got to the point where we didn’t have food to eat. However, it was difficult to pay school fees.

Tell me about that.

One of my brothers was on a scholarship, but it was still difficult for my parents to raise school fees money for me and my other sibling. For the most part of my junior secondary school, I was always sent out of school. I didn’t realise how hard and embarrassing it must have been for my parents until a few weeks ago. I was at my daughter’s school and saw some students being sent back home because they owed school fees. That broke my heart.

Back then, though, I didn’t care very much. Being sent out of school meant having the whole day to play. My dad’s business picked up between 2007 and 2008, and this stopped being a thing. For my senior secondary school, I was enrolled in a boarding school in 2006. My allowance was ₦1k per month.

Do you remember the first thing you did for money?

This was 2008. I came home for the holidays from boarding school one time and my dad asked me to work for him. I did for three days, and he paid me ₦5k. He said that I did a great job and saved him time, so he insisted on paying me.

Haha. What happened after?

University. I left home in 2010 to live with a family member while preparing for my university entrance examination, and my allowance at the time was ₦10k. When I got into university in the following year, it increased to ₦15k. From there, it got to 20k. At the time I was leaving university, I was getting ₦20k–₦30k at the beginning of the month and ₦10k in the middle of the month.

Because both my parents were running businesses when I was growing up, I grew up with an entrepreneurial spirit. I hadn’t seen my parents work for anybody, so I was determined not to do that either. I decided to start a small business in my second year in university.

How did you get started?

My savings. I had been saving ₦10k from my monthly allowance. My capital was ₦20k when I started off selling hair attachments. Then I did other things at different points — I ran a printing outlet for a while, then I sold sunglasses, frames and makeup.

I was making about ₦10k–₦15k extra every month from these businesses. I stopped everything at the end of my fourth year and concentrated on academics in my final year.

Interesting. What did your finances look like at the end of university?

I had about ₦200k in my account. It should have been more than that, but I had loaned my mum some money when I was in 500 level. She was running a poultry business at the time. I don’t remember if I ever got the money back.

Somehow, my dad caught a whiff of how much I had in my account and stopped sending me all the extra flex money he used to.

Men.

Hahaha. I was home for about a year before I went for NYSC. During this time, I helped my mum with her poultry; I raised some birds and sold them. I also started writing to document my experiences with agribusiness.

I was mobilised for NYSC in 2016. I wanted to work in a government agency, but they rejected me. My dad helped me find a job in another government agency. Just as I was about to start work there, I received a text from a private health management consulting company, inviting me to a test and an interview. I passed both and was offered a job as an intern. I had to go back to beg the people at the job my dad got for me to reject me.

Whoop. How much did this company offer to pay?

₦75k. I was also getting ₦19,800 from the federal government, so my total monthly income was close to ₦100k. I was saving ₦50k every month and making do with the rest. I limited myself to spending ₦1k per day.

At the end of my service year, the company asked me to stay and offered me an entry-level position as a full staff. I declined the offer.

Why was that?

A couple of factors. My family didn’t think it was the right career move for me at the time. My mind wasn’t made up either. I felt I needed to do something in agriculture because that was what I studied at uni.

Also, I was going to get married.

Oh.

My husband and I had been dating for five years and he had been working for almost two years when we decided to get married. We got married in March 2018.

You hadn’t found a new job when you got married, had you?

No. But I had some of my savings from my service year. Then I went into my agribusinesses.

I started a fish pond in March 2018. I put in ₦300k and made about ₦150k in profit when I sold them six months later. In between this, I got a job that paid ₦50k per month. I quit after two months because my farm investment was beginning to suffer. Also, I was five months pregnant with my daughter.

The day after I quit my job, I drew an estimate for a snail farm and realised that I needed about ₦300k for it, which I didn’t have at the time. I tried to get investors, but they wanted up to 60% in ROI. From my experience, small scale agriculture doesn’t work that way. An outbreak, for example, could wipe out all your stock in one go.

After trying so hard to raise the money I needed without much progress, I put out a request on Twitter and raised about ₦200k. After that, a friend reached out to invest ₦100k in the business. Also, I borrowed ₦100k from another friend. The snail pen I built cost about ₦400k, and I bought stock worth ₦175k. But guess what happened?

What?

More than half of the snails died before they got to me.

Omo.

The driver who transported them was careless handling them. I had lost almost half of my investment before I started.

The snails were breeders and the plan was that when they mated and hatched new snails, I’d start selling them. It was a long term investment that wouldn’t turn in a decent profit until a year and six months. Then came June of 2019 with other plans. Heavy rain started and one night, a storm blew off the roof of the pen. I couldn’t keep snails without a roof — they were going to drown and die.

Ah.

There was no other choice. I had to sell off what remained at a massive loss. I think I sold them for about ₦50k. For six months the farm ran, I was spending about ₦3k per week on their feed and paying salaries. At the end of it all, I had lost over ₦800k.

I’m so sorry.

Moving on. I returned to fish farming and invested ₦50k in it. I bought 4000 fingerlings, but they were a bad stock and almost all of them died. Only about 300 survived. I let them grow for a few months before I sold them — that brought ₦15k – ₦18k.

Now, I told my friend who invested in the snail business what had happened, and we agreed that I’d return his capital. I paid him back the ₦100k he put into the business.

Brutal.

This was the end of 2019 I had run out of my savings. Things were beginning to get tight. My daughter had arrived in December of the previous year. We were living on what my husband made from his job and boy, was it tough. Let me paint a picture of what that looked like: we had to substitute almost everything for baby food. Every time we wanted to do something for ourselves, baby food or diaper expenses would spring up. Neither of us bought any personal items in 2019. Every resource went into taking care of our daughter.

It dawned on us that we couldn’t possibly raise a family on one source of income. I realised that I may have made a mistake turning down the job I got after NYSC. I didn’t enjoy agribusiness the way I thought I would.

Man. What were the next steps?

My husband started a side business. I started looking for a job too, although my mum fought me on this one. She was a stay at home mum and she believes every woman who has a family should be at home, raising the kids instead of chasing a career. In her words, “Your children will thank you for it”.

Anyway, I started applying for jobs again in 2019. I even sent an application to the people I turned down in 2017. I passed their interview, and they put me on a waitlist. I haven’t heard from them since that time.

While looking for a job, I was surviving and paying for basic things like data from what I made from booking flights for members of my family. Also, I started freelance writing in October 2018. My friend, who invested in the snail business, reached out and asked if I was interested in writing for him. He outsourced some writing gigs to me. This brought in between ₦5k and ₦20k per gig.

I finally got a job at my dad’s company in November 2019. At first, he was skeptical about hiring me, but he came around and offered me a job and an annual salary of ₦480k. He also topped up my salary with an extra ₦10k every month.

Aw.

I worked there for less than a year. I quit in September 2020 when I got a better paying job.

Lit. How much?

₦150k. My dad was upset that I was leaving though. He offered to increase my salary. But I had to leave — the new job was a role in management consulting in agriculture, and that was kind of my dream job.

I resumed work in September.

Yay.

A month later, I found out that I was pregnant.

Man. Was that a problem?

It wasn’t to me. But it was a new job, and the Nigerian workplace culture is not the best for women because of things like this. I didn’t want it to become a problem, so I worked as hard as I could. I avoided taking sick leaves. The two times I had to go to the hospital on a workday, I showed up at the office first.

I was supposed to get confirmed in March — six months after I started working there — but my appointment wasn’t confirmed.

Everything happened so fast. I got notified that my appointment wouldn’t be confirmed on Friday. By Sunday, the owner of the company was calling me, asking me to resign. I was so upset. Like even if my appointment wasn’t going to be confirmed yet, is a termination of appointment or asking for my resignation the next step?

I’m so sorry. That must have been tough.

I was heartbroken. That was one of the hardest things that has happened to me, and I cried for days. They did let me keep my health insurance for a few months; I guess that was to cushion the blow.

Now that I was out of a job again, I returned to freelancing for my friend. I did one very small gig in May and got paid ₦10k. That’s been it so far. I gave birth to my son in June.

Congratulations!

Thank you. Thankfully, the health insurance covered that, so we didn’t spend anything on hospital bills.

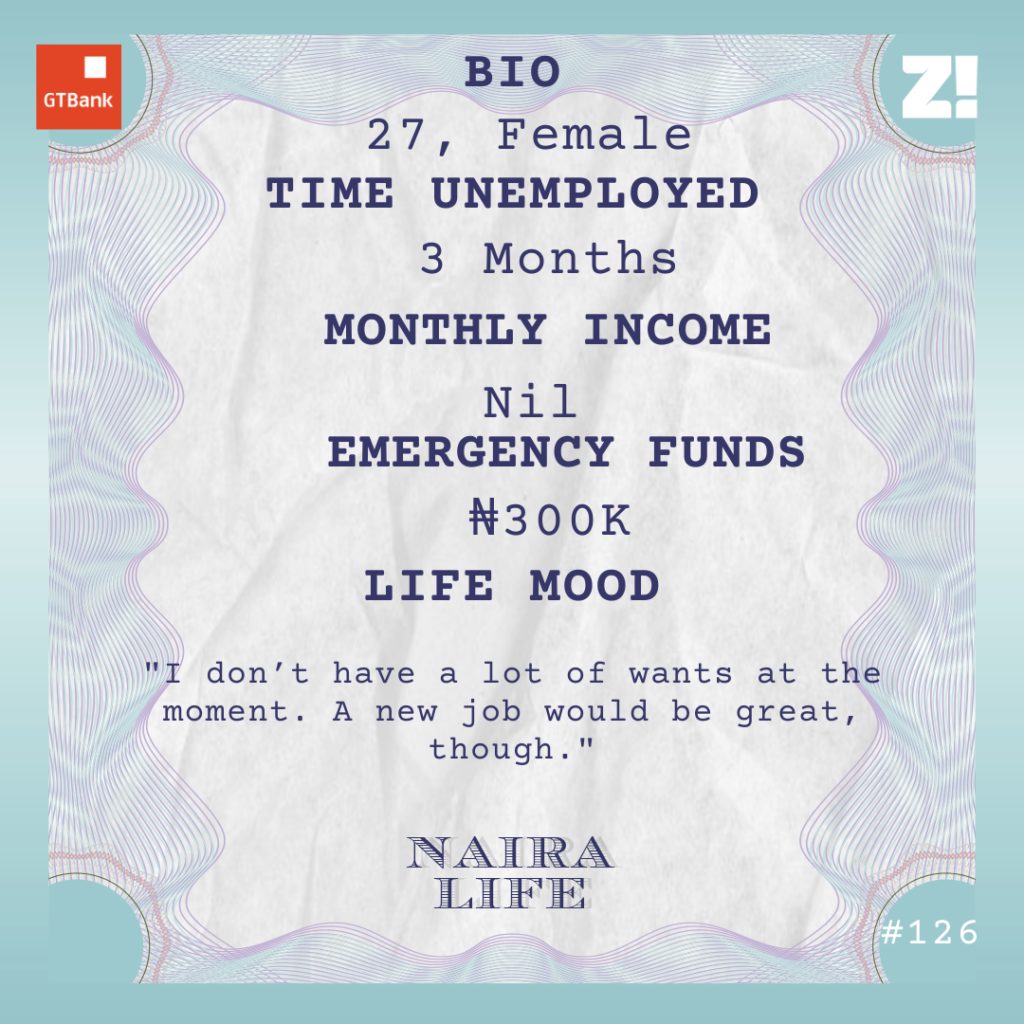

What about your emergency funds?

While I was at the last company I worked at, I was saving ₦50k per month. I still have the ₦300k I saved in the six months I spent there. Half of it is in a PiggyVest investment and the other half is in cash.

What do your monthly expenses look like now?

My cost of living is low. I pay ₦5k for my internet and ₦5k to the lady that helps me around the house. My husband covers the rest. We spend ₦40k on groceries per month and about ₦80k–₦20k a week for the other things and house utilities.

When I was still at my job, I contributed to this and my husband and I split the bills in half. But he’s taking care of everything for now.

I’m wondering, how much would be good money to you right now?

₦200k+. I’ve done a lot of things–data analysis, programme management and operations. Now I need to stick to one and build a career around it. I know if I get a new job now, I’ll probably have to start at an entry-level position though I’ve been working since 2017. I should be earning above ₦300k, but I’ll most likely have to settle for lower pay.

Do you have any financial regret?

Maybe not taking that job in 2017. The entry-level salary was ₦250k. Asides from that, I don’t regret any of the subsequent decisions I made. There were losses, but these things happen.

Do you have plans to return to running your farm?

I don’t think so. At least not any time soon. I’ve realised that I don’t like the uncertainty and the lack of structure that come with entrepreneurship. The farm is still running, but I don’t make anything from it at the moment. My mum handles the operations. I provide technical help where necessary. Maybe there’s a version of the future where I return to running it by myself.

What parts of your finances do you think you could be better at?

Investing. I have a low-risk appetite. I don’t want anything to happen to my money and I want good returns. That kind of combination is hard to find. If I could up my risk appetite and make bolder investment decisions, that would be nice.

What do you want now but can’t afford?

I don’t have a lot of wants. At the moment, there’s really nothing I want. A new job would be great, though, now that I’m done having kids. It’s time to build a career. That’s why I’m being very selective about the kind of jobs I apply to these days. If I don’t see myself doing something similar in 10 years, I won’t apply for it.

What was the last thing you bought that improved the quality of your life?

My laptop, but my dad bought it for me. It cost ₦180k. My last laptop was stolen, and subsequently, I had to use office computers. I had nothing to use for a while after I left that job in March, and it wasn’t a great experience.

How have your experiences shaped your perspective about money?

My family and friends call me frugal as I am almost always living below my means. Also, I place a heavy premium on saving and having emergency funds. My savings have come through for me during times I needed them the most. I’m grateful I learned the habit at a young age.

One more thing I have learnt over the years is not to put money first. A lot of my decisions are not driven by money but by my value for relationships. I don’t know if that’s a good or bad thing, but I think the greatest asset anyone can have is the people in their corner. I know that if I’m ever in a fix, I have people who will help me out.

I feel you. On a scale of 1-10, how would you rate your financial happiness?

5. I don’t have any pressing needs at the moment. However, at this point, I need to start earning again. If I could get a job that would pay me about ₦250k a month, this number will definitely jump to an 8.

I’m rooting so much for you.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld