Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

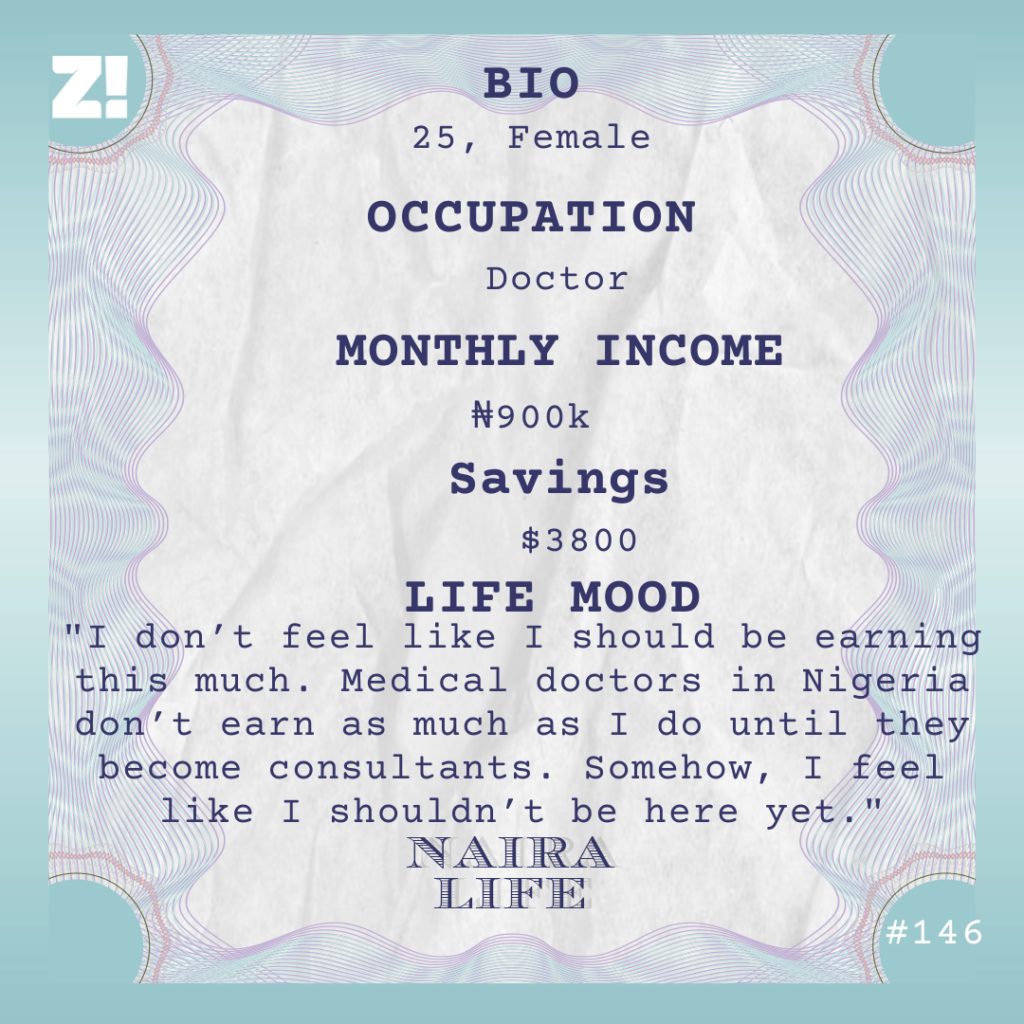

Between 2020 and 2021, the 25-year-old doctor in this story increased her salary by at least 5x and now earns ₦900k. But the thing is, she’d feel more comfortable with half of her current income.

What’s your oldest memory of money?

When I was six, my father would send me to our neighbours’ during Sallah with pieces of meat to share with them. I loved this errand because the neighbours would dash me money. I’d divide the money into two parts and give each to my parents to save for me. The day I asked them for it, they said it wasn’t available.

Haha. We’ve all been there.

Actually, my dad was saving the money for me. When I was in JSS 3, he told me he had opened a bank account with all the money deposited there. He eventually gave me access to the account when I finished secondary school in 2012, and there was a little over ₦50k in it. I suspect that he topped the money up from his pockets too.

That’s thoughtful. What did your parents do for money?

They were both civil servants. My dad worked in a science research agency owned by the Federal Government and my mum worked in the state judiciary. I never lacked anything while growing up. My siblings were much older than me and were out of school, so most of my parents’ financial resources were spent on me.

Up until 2014, I thought there was an endless supply of money my parents dipped into at will, and this shaped my relationship with money for the longest time.

What happened in 2014?

For context, I should start from 2013 when I got into a university in North Africa. My tuition was $5k, accommodation was $2400/year, and my allowance was $300/month. Everything was fully paid for at once, and I also got my allowance for the entire year in advance.

For a 16-year-old girl who had just left home for the first time, it was more than sufficient. It also meant that I could splurge on random things. At the end of my first year, I had nothing saved up.

Right when I was returning to school in 2014 for my second year, my dad got diagnosed with a terminal illness. Things got really bad after that.

How?

Both my parents had retired and had a plan to live on their pension and a couple of investments they put money in over the years. The diagnosis changed everything. Most of the money went into surgery, chemotherapy and other treatment options — and they weren’t cheap. Before long, we were selling our properties to raise money for treatment.

As a result, it was difficult to find my school fees or pay in one installmenT. My allowance was also reduced to $200, and I got only four months worth in advance. The balance came when we sold some other properties.

Then reality set in, and I went through a series of lifestyle changes. I stopped eating out, went for the cheapest transport options and gave a lot of thought to other expenses, especially if they were out of my budget. Thankfully, I had a community of Nigerian friends with whom I was close. We would contribute a portion of allowances and use it to buy food that could last us through the month.

My dad got better when I was in my fourth year and they put me back on my original allowance. Like that, I went back to my old habits. I moved into a cheaper apartment where I paid $1800 a month only because I wanted to have more money to spend.

I’d argue that I was a little more disciplined with money than I was in my first year if I wasn’t getting broke before the end of each month and touching the following month’s allowance before I should.

A familiar struggle. When did you graduate from university?

2018. I returned home with no savings. I wasn’t worried about this though. The plan was to write my Medical and Dental Council of Nigeria (MDCN) exam and start my house job immediately after I got back. The thing was, my dad got very sick again, and it was hard to raise the ₦180k I needed for the exam. Fortunately, I made the payment deadline and passed the exam. I was inducted into the profession in January 2019. I also got a house job position in a federal hospital in the same month.

Lit. How much did this pay?

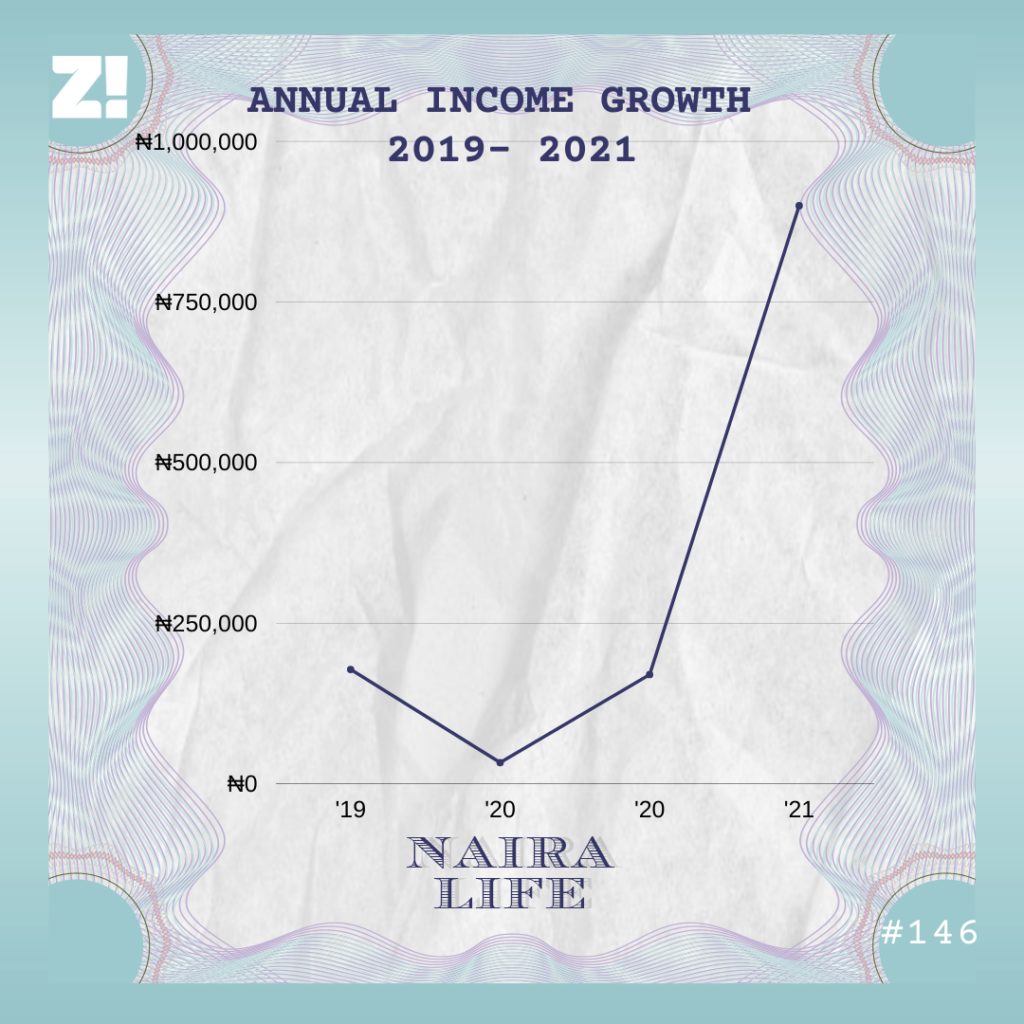

₦178k. They didn’t pay me anything in the first five months. It had something to do with the payment platform the government was using at the time.

Tough. How did you survive those months?

My dad sent me ₦80k every month, and that was what I lived on. Unfortunately, he passed away in March. The allowance stopped and by April, I had run out of money.

What other options did you have?

Nothing. My mum had only her pension, and I felt it would be selfish to ask her or any of my siblings for money. We were all grieving.

As a last resort, I took a quick loan from a loan company. ₦20k. The interest rate was high, but I had no other choice. I also asked a few friends to loan me money. It was easy to convince them because it was the first time I asked. I got about ₦90k from all of these sources.

I managed to stretch the money through April and May. Thankfully, I finally got paid at the end of May.

How much?

It was close to ₦900k, which was exciting. I was down to ₦100k within a week though.

Ah, how?

I don’t remember most of what I did with the money, but these were the major expenses: I paid off my debt, sent some money to my mum, fixed the multiple issues my car had and bought a new phone. The phone alone cost ₦300k.

I was back to thinking about how to survive until the end of the month. To be honest, this is how the rest of my house job went: I’d get my salary, send ₦70k to my mum and maybe ₦30k extra a month to some people in the family. The bulk of what remained went to feeding. I wasn’t saving either.

The most jarring thing about that period was realising the role money played in relationships.

Tell me more about this.

Some of my close friends cut ties with me. At first, I thought they were giving me space to grieve the death of my dad. But as the months passed, I realised that it was permanent. I don’t want to assume, but I felt like it was because I didn’t have much to offer financially anymore. My friends always knew when I had money because I splurged on them. My priorities shifted after my dad died, and I couldn’t do that anymore. I guess they couldn’t call or visit anymore either.

That’s rough.

If I learned anything from this, it would be that relationships are “give and take”. You become irrelevant when you don’t have anything to give anymore. It was a painful process coming into this realisation.

Moving on, I finished my house job in January 2020. I went for my NYSC three months later. Ten days into the orientation course at the camp, we were asked to vacate the camp and go home.

COVID?

Yes. I was home for about five months and living on the ₦33k allowance the government paid. In August 2020, I reported to my PPA — a health facility in a federal government ministry. At the end of the month, I saw a credit alert of ₦170k from the ministry. That was my monthly stipend.

Sweet.

Unfortunately, I really splurged this time. Up until today, I have no idea what I spent the money on. I had about ₦50k in my account when I resumed work in September. I wasn’t worried because I was expecting another payment at the end of the month. That didn’t happen. I didn’t get paid for two months after that.

Why, what happened?

They skip monthly payments and pay bulk amounts in arrears. I had a boyfriend now, and he supported me for the two months I didn’t get paid. The next payment came in November. ₦340k.

I took ₦210k out of it and bought another phone.

Whew.

My old phone’s screen was bad, so I convinced myself that I needed a new phone.

Fair enough.

I didn’t get paid for three months after that, and I had to rely on my boyfriend — who was now my fiance — to slug it out. I finished NYSC in February 2021. The payment arrears came at the end of March. That was ₦510k.

I got married in April and used all of the money for the wedding. At the end of the day, I still had nothing left.

I’m curious, how much did you spend on your wedding?

About ₦1.3m, and it went into the purchase of furniture for our home and paying the food vendor that catered our wedding dinner. The extra ₦800k I used for this came from the money I got off the sale of some of my late dad’s shares at a company.

I’m not sure how much my husband spent, but the boxes of things he bought for me per tradition was ₦1.5m. Our families took care of the rest.

Gotcha. I suppose a couple of things changed after you got married.

Not much changed in the first few months. For starters, I was unemployed, so it was only him making sure our finances were in order. Also, he gave me ₦50k at the end of the month, which I usually sent to my mum. If I needed anything else, he made it happen.

That’s sweet.

As nice as it was that he took care of things, not earning my own money was frustrating. I couldn’t rely on him forever.

I guess you were looking for a job then?

Yes, I was applying to various jobs at hospitals. For three months, I didn’t get a single callback. I started getting invited to interviews in July, but they led nowhere. In the same month, I decided to try a public health organisation I thought was way out of my league. Surprise, surprise, they called me for an interview.

By August, I had done three different interviews with them. Then they called me to come and get my appointment letter and start work. I’m not going to lie, I couldn’t believe it.

Why not?

Well, the job pays ₦900k a month. My last salary before this was ₦170k. The thing I was most excited about when I started the job in August was how my relationship with money was going to change.

How has your relationship with money changed?

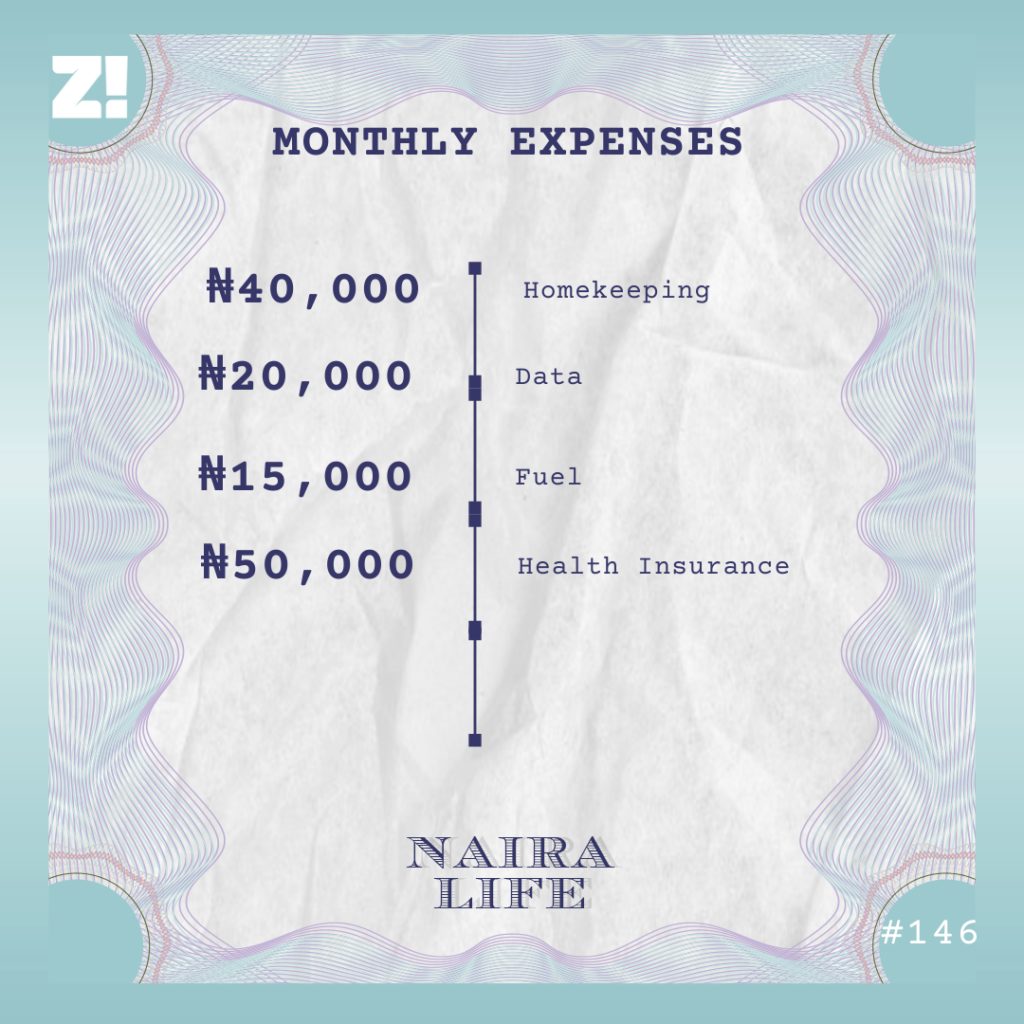

They pay in dollars into my domiciliary account. I feel lazy to go to the bank and go through the process of converting it into naira, so the bulk of the money remains in my account. Between the time I started the job and now, I’ve limited withdrawals to once a month, and I don’t take more than ₦300k out. ₦120k goes to my mum. The rest of the money goes to whatever I need to do that month.

Could you attempt a breakdown of what your monthly expenses look like?

Got it. What plans do you have for the money in your account?

I have $3800 in savings just sitting in my account. I have no idea how to move forward with investments and all that. I feel like having the money saved up in dollars and not naira is enough security.

Also, I might have a low-risk appetite.

Where do you think this came from?

It’s definitely from my experiences in the past few years. At my lowest point, I had to beg people for money. I don’t want to be back in a similar situation because I made a bad investment. I know where to look if I need money for an emergency and tying my money up in investments puts that sense of security at risk.

What other things have changed in your perspective about money in the last few years?

I think there’s nothing more important than having various forms of insurance when you can afford it — health and life insurance at the top of it. My dad’s wealth took a hit when he got ill, and good insurance coverage could have prevented that. I know I might be earning well now, but it’s not going to cover the cost of a terminal illness.

So I think everyone should use their money to buy all the safety nets they can afford. Money without insurance amounts to nothing when things go south.

Word. I’m wondering, how much do you think you should be earning now?

₦400k.

I don’t understand.

I don’t feel like I should be earning this much. Medical doctors in Nigeria don’t earn as I do much until they become consultants. I have only three years of experience and earn as much as some people who have been working for the past 12 years. Somehow, I feel like I shouldn’t be here yet. There’s definitely some impostor syndrome there.

You are here though. So how do you deal with it?

I just work as hard as I can. It’s like if I’m earning this much, I have to prove to myself that I’m worth it. I do more at work than I’m supposed to. This doesn’t totally eliminate this feeling. There are millions of people who work harder and still don’t earn quite as much.

Hmm. What do you imagine your next level of income will look like?

I work in the development sector and from the income trajectory of people in this space, I feel like I’d be earning 100% more than I currently do in my next job.

What would get you that job?

I’m planning to go for my master’s degree in September 2022, and I’ve started applying to schools. If everything goes well, I might get a scholarship as well. With my new qualifications and experience in public health, I’ll have a better chance of getting a job at organisations that can pay me that much.

Sounds like a plan. How much do you think your money management strategy will change as you earn more?

I don’t know. I have a feeling I’ll continue seeing saving money as a safety net in the near future. Maybe this will change when I start earning a lot more. But for now, I’m just happy to have something to fall back on.

I get that. What do you want right now but can’t afford?

There’s this cool 2018 Camry I like so much. It cost ₦9m the last time I checked. Even if I could afford it, I don’t think I would buy it. I’ve realised that it’s okay to want something without getting it.

What’s your biggest financial regret?

Not saving earlier. I wouldn’t have gone through the things I went through when my dad died if I had built a buffer of sorts. I regret not saving when I could and splurging on things that had no serious value.

What about the last thing you spent money on that made you happy?

A new compressor. I live in the north, and it’s hot this time of the year. The weather is about 40°C where I live. Earlier this month, the AC unit in my car spoiled, and I had to buy a new compressor to fix it. I spent ₦100k on a new compressor and other repairs. I go out a lot because of work, so it has definitely improved the quality of my life.

On a scale of 1-10, how would you rate your financial happiness?

6. I’ve saved a bit of money in the past few months, but I don’t think I’m doing the best I can do for myself with the resources I have. I’m always like, “Okay, how do I move forward now?” I don’t have that answer yet.