Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

The 27-year-old in this #NairaLife started a shoe business in 2012 and slowly built it over the years, thanks to social media advertising and returning. However, a few financial decisions set him back. Now, he’s playing catch up.

What’s your oldest memory of money?

2006. When I was 12, I started stealing money out of my mum’s room. We always had cash at home because she ran a micro-lending business alongside her civil service job. She took loans from a cooperative she belonged to and gave the money out to small business owners where we lived at a higher interest rate.

I took anything between ₦1k and ₦3k, and it was a lot more compared to my allowance. I’m not proud of what I did, but it did show me one thing: the more money you have, the more you can do for yourself. I was buying stuff for people in school, so I became popular really fast.

Hmm. What were things like growing up though?.

We were comfortable. Both my parents worked and earned money. My dad was an officer in the navy and my mum worked for the government. My mum managed most of our family’s finances. At the end of each month, my dad brought his salary home in cash and gave it to my mum to take out what she needed for the house. Whatever remained after the bills had been sorted was returned to my dad.

My dad died in 2006, but nothing much changed. By 2008, the navy had paid us his benefits. It came in three tranches, and I know the first payment was ₦1.1m. Not sure what the other two were, but it must have been a lot too because my mum finished building our house.

Sweet.

I was still stealing from my mum occasionally, and she had had enough. When I finished secondary school in 2010, she sent me to live with our pastor.

Ah, how did that go?

Not bad. The pastor travelled a lot for church activities. His wife lived in a neighbouring city, and his children had also moved out of the house. Every time he went away, he gave me between ₦500 and ₦1k to hold. I also made money from running errands for him. I think this was the time I fully stopped stealing money.

How long did you live with him?

About a year. During this time, I was writing entrance exams into universities.

I started getting allowances from home when I got into uni. At first, my mum sent me ₦8k every month and my uncle chipped in at times too. However, I had gotten used to getting money every week, and it was hard to manage my ₦8k until the end of the month. I always ran through it in one or two weeks.

How did you navigate that?

A childhood friend got into the university in the same year, so we decided to live together and combine our resources. We lived on his allowance — which was about ₦15k — for the first two weeks of the month and lived on mine for the remainder of the month.

We were living well and had money at every point we needed it. Then towards the end of 2012, my friend started a business.

Hmm. What was that?

Online sales of shoes. Here’s how it happened: someone linked him up with some retailers in Lagos. These guys sent pictures of pairs of shoes in their stock to him, and he was supposed to find buyers for them. For every sale, he was allowed to add his own profit to the original price as compensation.

My friend used his BlackBerry Messenger contacts to find buyers and lived on the profit he made from these sales, which ran into ₦50k and ₦100k per month. Within a few months, he had gotten a hang of it, and he brought me into the fold too.

How?

He showed me how it worked and introduced me to his contacts in Lagos.

I also got the bulk of my buyers from BBM when I started. There were a couple of people we called PR guys. They had a large contact base and charged people to advertise on their BBM channels and statuses. I had one of these people and paid him ₦5k for every ad he ran for me.

I didn’t always need to find buyers. Sometimes, people reached out to me with pictures of the pair of shoes they wanted, and I helped them find it in the market, make a deal with the retailer, deliver it and keep the profit.

Sounds interesting. How much were you making on these deals?

At least ₦10k on every pair of shoes, and I sold between 10 and 20 pairs every week. It helped that the students in my school loved spending money on how they looked. On a good week, I made about ₦100k.

Balling.

When the session break ended, I returned to school. I’d worked out a deal with my contacts in Lagos to ship the items I found buyers for to me. Sometimes, I travelled to Lagos too and kept it moving.

However, in the middle of 2013, the volume of sales decreased.

Why?

Finding new customers on BBM became more difficult. Usually, if I paid for an ad with the PR guys, up to 20 new prospective buyers would hit me up. But now, I barely got 10 new contacts on every ad. Thankfully, there were returning customers. So while income dropped, it didn’t go down to zero. On an average week, I managed to sell about five pairs of shoes.

Ah, I see. Were you still getting an allowance from home?

No, I had become totally independent. Besides, things had become a little tough at home — my mum stopped her micro-lending business when we moved into our own home. My older sister and I were in the university, and she had to figure it out on her civil service salary. To make things easier, I asked her to stop sending me an allowance.

In 2015, the business picked up again. This was actually where it peaked.

What made the difference?

I started paying for Facebook ads, and it changed everything. The best part was that it wasn’t expensive. I could spend ₦5k on ads and get tens of orders. Now, I could sell up to 100 pairs of shoes in a very good month and make at least ₦10k in profit on each one. That was a lot of money.

Agreed. What did that do to your standard of living?

Oh, I was a big boy in school. I lived in a furnished apartment and used the latest gadgets. There was almost nothing I wanted that I couldn’t afford. I started going to clubs almost every week. The way I saw it, I was working hard for the money and deserved to have fun.

Fair enough. Were you saving some of it though?

Just enough to run the business.

I should add that it was now a struggle to run the business and keep up with school work, so school suffered. I didn’t mind though. At that point, my friend had dropped out of school. He got tired of the strikes, but I hung in there.

Omo. When did you graduate from uni?

2018. When I returned to Lagos and reunited with my friend, I realised that he was miles ahead of me, and it wasn’t even because he had been making more sales — he was just better at saving money and reinvesting back into the business.

What made you think so?

When he dropped out of school, he had enough money to get an apartment and live as large as I did, but he didn’t do that. He moved in with his grandmother and started saving for his own store, which he got in 2018. I think he spent about ₦3m on it. Then he moved into wholesales and started importing his own stock into the country.

When I finished university, I joined him at his store even though I didn’t have any stock of my own. I was pretty much still a reseller, but he had no problem with me using his store as a base. Unfortunately, this wasn’t moving as fast as it did in 2017. Facebook and Instagram had become big hits in the online sales business, and almost everyone was selling the same thing on them. The competition was high, which meant that I couldn’t add a high markup on the products. For every shoe I wanted to sell for ₦30k, others had no problem selling it for ₦15k or ₦20k.

How did that affect your earnings?

First, my customer base was mostly people I got off referrals and old customers. For the better part of 2018, I made less than ₦100k/month in profit. Unfortunately, my bills had increased.

What bills?

My younger sister got into university in 2015, and I started paying her tuition. She was still in school in 2018, and I was responsible for sending her an allowance and anything else she needed in school. It was a little challenging figuring that out.

Fast forward to 2019, I finally realised if I’d done better with money earlier, I would have had a better chance of competing in the market. I thought it was time to fix that.

What were the steps you took after that?

In January 2019, I joined a contribution scheme with 14 other people. Everyone dropped ₦100k per month and someone in the group took ₦1.5m home every month. I was the first person that got the money.

I put it in my business and imported my first stock into the country. However, a lot of people knew me as a reseller, so it took some time to become popular in the market and have other resellers approach me for deals.

My returning customers came through before this happened, and that’s how I survived. I was still selling online, but what I made from it was only enough to pay the ₦100k I needed for my monthly contributions.

When resellers finally started approaching me, my monthly earnings increased. I started my own personal savings and put whatever I could aside.

Yay.

The contribution thing ended in May 2020 and covid had hit. Things came to a standstill again — everybody was fighting for their lives, so nobody was thinking about buying clothes or shoes.

Tough times. I imagine you didn’t make a lot of sales then. How did you survive?

My friend and I were staying with his brother, so I didn’t have to spend a lot of money. I mean, I touched my savings to send some money home, but that was it — I sent my mum ₦50k at the beginning of the lockdown. Subsequently, I settled some of the little bills. For the most part, though, my friend’s brother took care of us while we were with him.

When did things start to open up again?

In the last few months of 2020. By this time, I had about ₦1.5m in personal savings, and I used it to buy more stock. Not sure how much I made every month, but it was enough to hire a staff whom I paid ₦25k per month and save ₦100k every month.

In January 2021, I raised ₦2m from the sale of my stock, my profit and my savings. I used the money to order new stock. They arrived in the third week of January, and I thought the year was off to a good start. Two weeks later, something happened.

What happened?

My friend called me and said he wasn’t interested in our friendship anymore, and I could no longer sell from his store.

Wow. Did he say why?

No. Our parents intervened, and he stood his ground. He told them that I didn’t do anything, but he was just done with our friendship.

Omo.

All of my stock — which I bought with my entire savings — was still in his store, and I decided to leave it there. I haven’t seen him since that time, and I don’t know what eventually happened to my goods. I just decided to move on from it all.

That’s interesting. But what did moving on look like?

It meant I had to return to being a reseller and focus on online sales. The only problem was that the competition was tougher than ever. If I was spending ₦20k on Facebook or Instagram ads, someone else spending ₦100k on it.

My earnings dropped too. My highest earning month so far this year was in July when I made ₦200k. That was also the month I decided to invest in new skills.

What did you decide on?

Data science. I registered for a beginner course and paid ₦50k for it. But I was now so broke that I couldn’t even afford to go to class on some days.

For the first time in forever, I had no choice but to live off my family. My younger sister, whom I saw through university, lived with me — I rented an apartment after the lockdown in 2020. Sometimes, she would leave ₦1k on the table when she left for work. My mum occasionally sent me money to buy data. It was tough.

I’m sorry.

I finished my data science course in August. The plan was to enrol for the intermediate course in September, but it was a rough month, and I didn’t make a single sale.

Then October came with a lifeline.

Tell me more.

The iPhone 13 release. I helped a retailer ship 10 phones into the country and got ₦300k for it. Let me break it down: the 128 Gb iPhone 13 Pro Max sells for $1099; plus shipping to Nigeria, it cost ₦750k. However, I told the retailer I could bring the phones in at ₦780k, and he agreed. He gave me ₦7.8m, I removed my profit and sent the cost price to a friend in the US who bought the phones and helped me ship them to Nigeria. Like that, I made ₦300k.

Must have been a relief.

Oh, it was. I paid ₦50k for my intermediate data science course and bought a new laptop to study with, which cost ₦180k.

What are things looking like now?

I have ₦100k in my savings right now, and the plan is to build up from it.

How?

I’m hoping I can bring in another set of 10 phones this month. If I get ₦300k from that, that will bring my total savings to ₦400k. I intend to invest half of it into crypto and buy shares at a telecommunication company with the other half.

Then after I finish my data science course, I’m going to look for a full-time job. Once I know how much I’ll be earning monthly, I can start the second phase of my plan and build from there.

Rooting for you. What has all of this done to your perspective of money?

I think that money is transient. If you have it and you don’t do the best with it, you lose it. I have made some money, and I have lost it all. I’m trying to build it back now, but it didn’t have to be this way.

What’s your biggest financial regret?

I’d say not saving earlier, but I think that’s obvious. The biggest mistake I made recently was becoming too comfortable with selling from my friend’s store. Now that I think about it, I should have used the money I spent on the last order on setting up my own store. Things might have gone differently if I did.

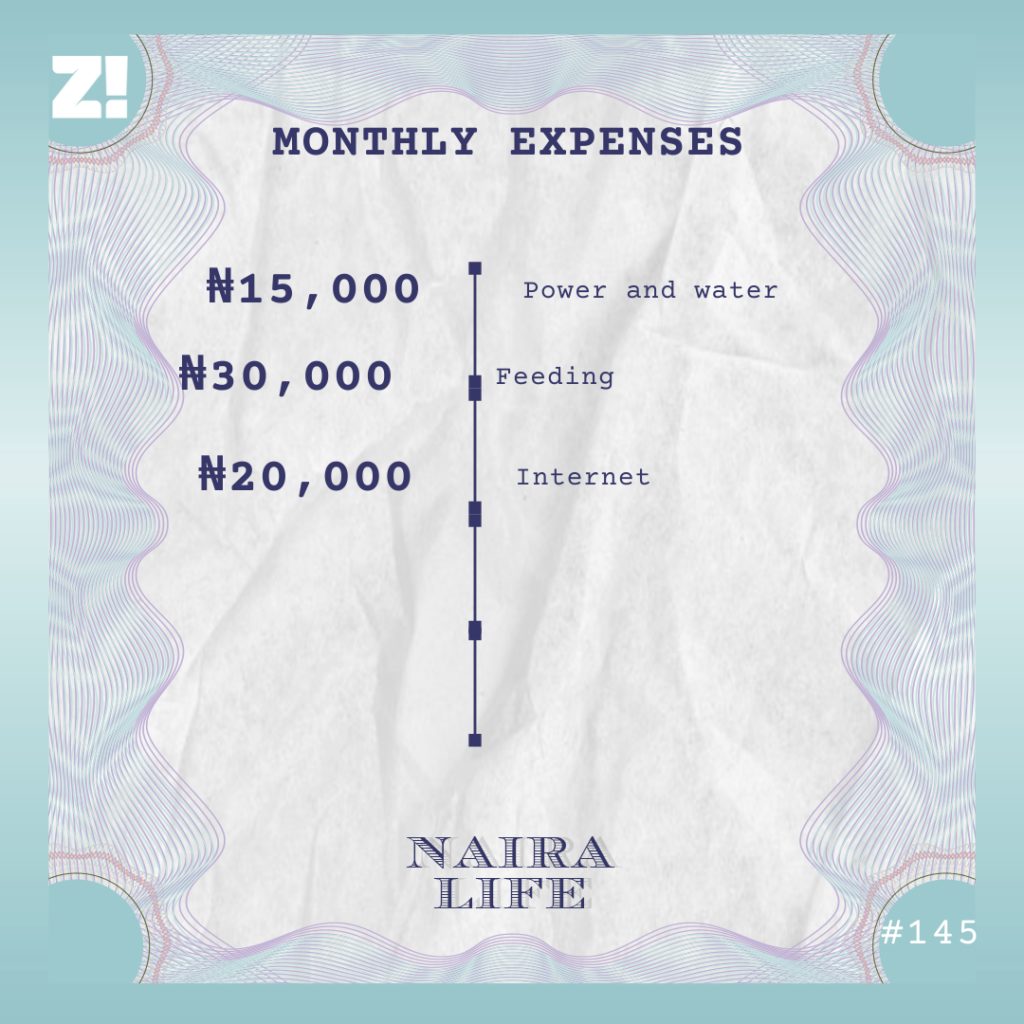

I hear you. What do your monthly running costs look like these days?

It depends on how much I make in a month. It looks something like this on a decent month.

I’m also curious about what you want but can’t afford?

Ah, I got an admission offer to study data analytics in a private university in Europe, and tuition is €15k/year. I’ve talked to my mum and she can raise ₦2.5m for me. That’s not enough. And even if I manage to raise enough money for the first year’s tuition, I still have to figure out where to get €30k for the remaining two years, and this doesn’t include accommodation and other expenses. I’d like it if I can go — it’s a fresh start — but I can’t afford it at the moment.

Oof. What was the last thing you spent money on that made you happy?

My laptop. A few months ago, I couldn’t practice everything I’m learning in data sciences. Now, I can. It feels so good.

This sounds like a good place to talk about your financial happiness.

I agree. Two months ago, it was 0. At the moment, it’s 5. That said, I know I’ve been in a better financial situation and didn’t use it properly, so most of it is on me. If I knew everything I know now, I would have made different choices. But it doesn’t matter anymore. I’m moving on.