Volume 116

Good morning, ☀️

My favourite thing about this week’s dispatch is the mix of individuals at different stages of their financial management journey. Here’s what I mean:

On #NairaLife, we have a 22-year-old who is keen on taking charge of her finances after years of living comfortably with the help of an older lover. Her destination, of course, is financial independence. To her credit, she’s made a few moves, but a few struggles stand in her way.

For #LoveCurrency, there’s Jola, who is measured and confident about her relationship with money. Her biggest task right now? Managing her partner’s finances. Couple goals?

And if you’re wondering what intentionality looks like, a 22-year-old entrepreneur explains how she grew her wealth by 29% in 2024 using naira and dollar investments.

Let’s jump in.

In this letter:

-

- #NairaLife: This Sugar Baby Is on a Mission to Making Better Financial Decisions

- Love Currency:The Lagos Freelancer Teaching Her Boyfriend Financial Discipline

- I’m 22, and This Is How I Grew My Money by 29% in 2024

- Where The Money At?!

#NairaLife: This Sugar Baby Is on a Mission to Making Better Financial Decisions

In 2019, this 22-year-old student was knee-deep in financial uncertainty. Six years later, she lacks nothing, courtesy of an older lover.

Now, she’s ready for another change, starting with her spending habits and taking an intentional go at financial independence.

Big Cabal Media’s newsletter,The Big Daily can make you sound like the smartest person in the room. We make the biggest news around the world less boring and easier to understand. Subscribe here and start serving “I’m always in the know” energy!

Love Currency: The Lagos Freelancer Teaching Her Boyfriend Financial Discipline

Jola* (25) and David* (25) have been together since 2023. While they’ve been open books with their finances, they’ve had to navigate friction due to their different spending habits.

For #LoveCurrency, Jola talks about their journey so far and why she now manages his money.

I’m 22, and This Is How I Grew My Money by 29% in 2024

In 2024, this entrepreneur experimented with naira and dollar investments and grew her net worth by 29% across three different investment instruments.

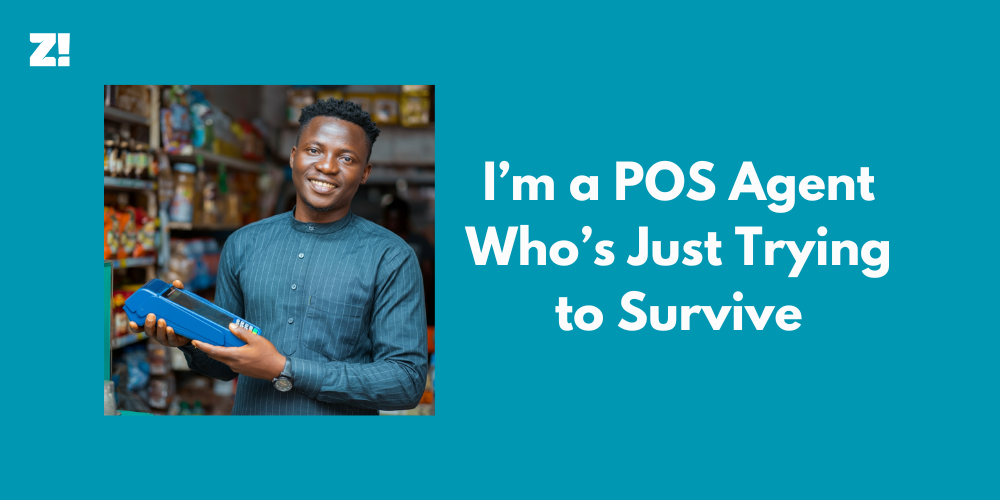

Where The Money At?!

We can’t say we’re about the money and not actually help you find the money.

So we’ve compiled a list of job opportunities for you. Make sure you share this with anyone who might need it because in this community, we look out for each other.

Again, don’t mention. We gatchu.

All good things must come to an end. But not this good thing. We’ll be back next week.

In the

meantime, keep reading Zikoko’s articles and be sure to share the love.

See you next week…

Yours cashly,

Toheeb,

Zikoko’s “OG” Mr. Money

Did someone awesome send this to you?

<