This quiz is for all the alcoholics among us. How many more years of drinking do you have left before your liver decides it’s had enough?

Let’s find out.

This quiz is for all the alcoholics among us. How many more years of drinking do you have left before your liver decides it’s had enough?

Let’s find out.

Is it impossible for you to take a bad picture? Take this quiz and find out.

|

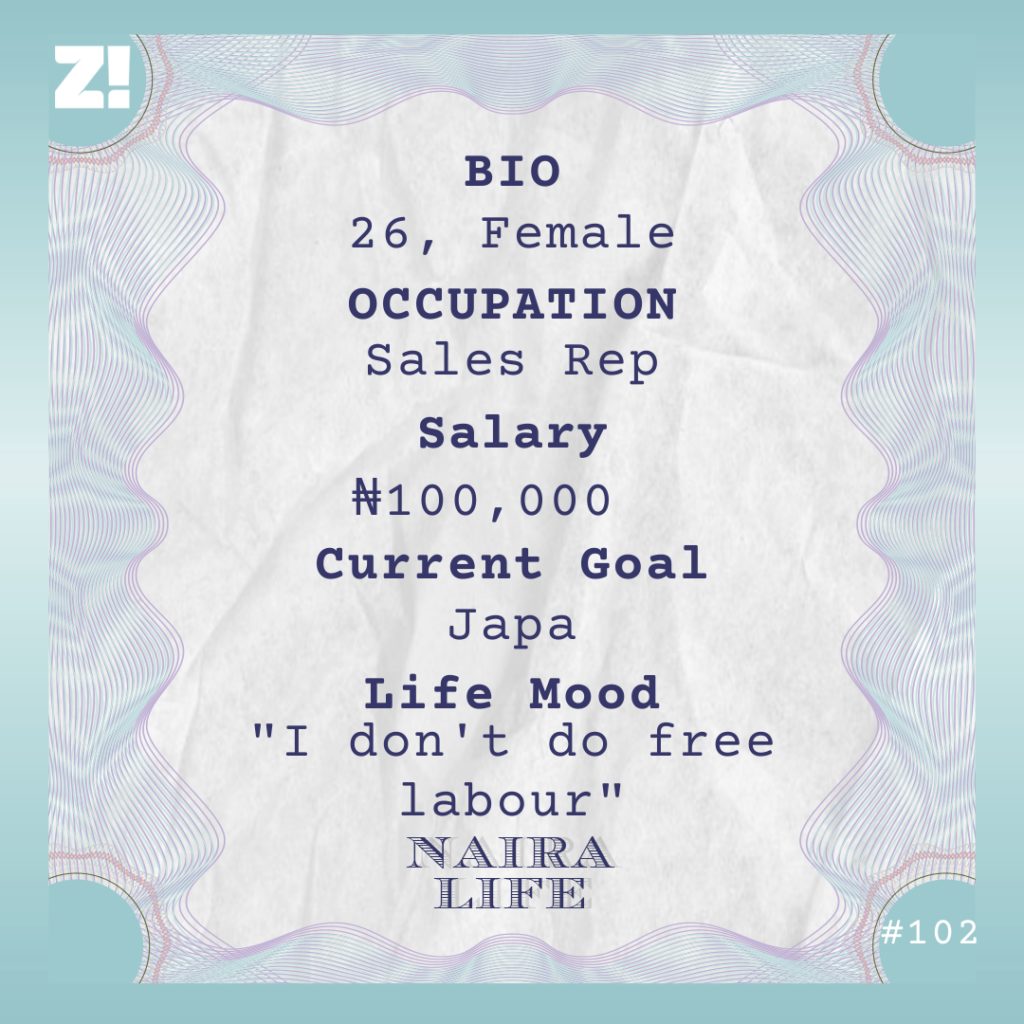

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

The subject of this NairaLife is a medical sales rep who works at a job where everything can go wrong and derail the trajectory of her life. But you see how to make money and build wealth? She kinda has it on lock.

When I was eight years old, I decided that I didn’t want to share a sponge and soap with my siblings anymore. So I saved up to buy my own from my ₦50 allowance. I don’t remember how much it cost but I saved for a week before I could afford it.

I grew up in a three-bedroom apartment with my parents, five siblings, and three aunts. I remember thinking that we were rich until I transferred schools and went from paying ₦6,000 to ₦24,000. My parents made it work, but it was clear I was one of the poorest students in that school. Most of my classmates had drivers.

My parents actually got me a driver to bridge the gap, but it was still there. There was a day someone’s money went missing in class and my classmates assumed I took it because I’d bought something I didn’t always buy earlier that day. Rich people are mean!

I always saved a lot from whatever I got. At 16, I wanted a bank account, but I didn’t want a kiddies account because I needed my parents for it. I increased my age by two years and got a cybercafe to issue me an employee ID with a false date of birth. I had ₦12k when the account was ready and put everything in it.

Not long after, my sister, who just had a baby, needed to return to her job, so she asked me to babysit him while she was at work. I did that for two months and she paid me ₦15K for it. I know she’s my sister, but I don’t do free labour.

The ₦15K also went into my account. Then right before I went to uni in 2010, I took this INEC job to register people who wanted a Permanent Voters’ Card.

I covered for a relative who had to go back to school to get her documents. I thought I could do it, and the lady in charge agreed. They paid ₦15k per week and I did it for three weeks. But I made more than ₦45k.

Tips from people. Also there was a time we had to stop printing registration slips because we ran out of ink. Someone volunteered to pay for the ink, which sold for ₦20K. Before we got back to the office, they’d supplied us with a fresh batch of ink. We didn’t return the money.

At the end of the job, I made about ₦60k in total. Again, everything went into my account.

I got into university in 2011 with ₦111k in my bank account. I could pay my school fees if I wanted to, but why would I do that?

The only thing on my mind was how to manage my money. I wasn’t on an allowance — my parents sent money when I called. But everything couldn’t be more than ₦7k per month. Thankfully, the cost of living in the town wasn’t high. I cut back on a lot of things. I mean, I stopped eating fish and meat except on Sundays.

It felt like a waste of money. I even brought my roommate into that life.

In my second year, I started going for ushering jobs on weekends. The standard price was ₦5k per job. Sometimes, I covered for people who got a job but couldn’t do it, and we would split the money.

The highest I made from a job was ₦25k.

In my third year, I opened my first fixed deposit account with ₦100k and the bank assigned an account manager to me. In my final year, I increased it to ₦150k.

Yes, pretty much. In my final year, I did a brand projector job — it’s like ushering, but the pay was better. You know those girls you see at the mall trying to get you to sample a product? That kind of job. I got ₦40k every month, and I did it for two months. It wasn’t hard; I only had to work four hours a day.

About ₦300k. I had no plans for it. It was just sitting there.

Yes, in 2015. My dad gave me the ₦20k I took to camp, but I didn’t spend a lot there. It wasn’t until after camp ended that I blew the money and what the federal government paid us on fast food. But I didn’t have a choice. I was staying with a friend of my sister and wasn’t cooking. I think I spent about ₦37k in three weeks on food. I was so sad.

I was going to redeploy until I heard that the state government paid corps members ₦18k, which I never got. I wasn’t working either, so I didn’t make a lot. The constant money was the ₦19,800 allawee, which I wasn’t spending. I was living on the money I had saved up before service year.

One day, my sister called me and asked if I was interested in a piece of land going for ₦300k. It was a good deal, and I could pay in installments. I had ₦150k left in my savings, and I sent it to her.

It didn’t take long before I finished paying. I made sure I paid before I finished service. I’m not even sure how it happened. Sha, at the end of NYSC, I returned home with ₦49k and a piece of land.

I stayed home for the following six months because I couldn’t get a job. During that time, I helped my sister sell a few properties and made ₦300k in commission, which I put in my fixed deposit account. I finally got a job as a medical sales rep at a pharmaceutical company in June 2017.My starting salary was ₦62k. I also got an additional ₦34k as “float” — my running expenses. I’ve been at this job since 2017.

By the way, I raised ₦700k and bought another land during my first year on the job. The ₦300k commission I made from land sales, an additional ₦200k I saved from my salary, and some money I borrowed from a friend paid for it.

It hasn’t, really. My salary was increased to ₦100k after my first year and I got a car from them, and that was the last time I got a promotion or a raise. Yet the job got significantly harder. 2018 was a tough year for me.

Monthly targets. I had to sell ₦5.5M worth of drugs every month. But I was averaging between ₦2 – ₦3m. So I was giving them my salary to keep the job. It made me feel better.

I was also entitled to 2% commission of whatever I sold every 3 months. But I didn’t get that — they used that to offset whatever I owed them. I was pretty much rolling in debt. I was always borrowing money from my sister to pay into the company’s account every week, because my clients didn’t always pay on time.

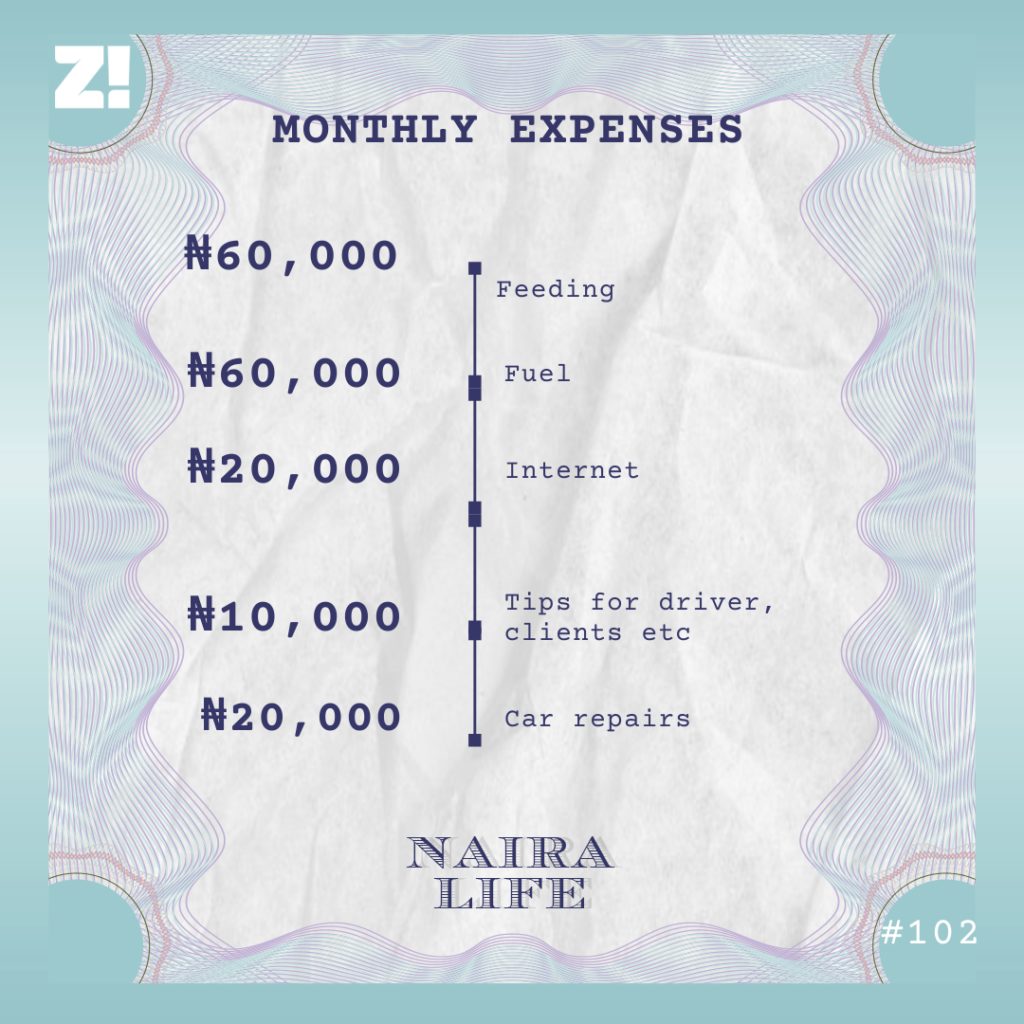

I was living with my parents and had a car, and these made things easier. The ₦34k I got monthly as my running expenses was all I was living on. I was at a really low point in 2018. I had no liquid cash, and whatever I had was the company’s money.

It wasn’t until the end of 2018 I started to hack this sales thing.

Price markup. We’re allowed to set the price of products we supply to the clients. Sales people add whatever they think is fair to the units of products they get from the company. However, it’s an open market, and there are competitors within and outside the company. So, nobody can increase the markup by a lot.

By 2019, I had more clients, and they were paying. That meant I stopped giving the company my salary. I was doing between ₦4m and ₦4.5m. In fact, I think I did ₦5m in a month.

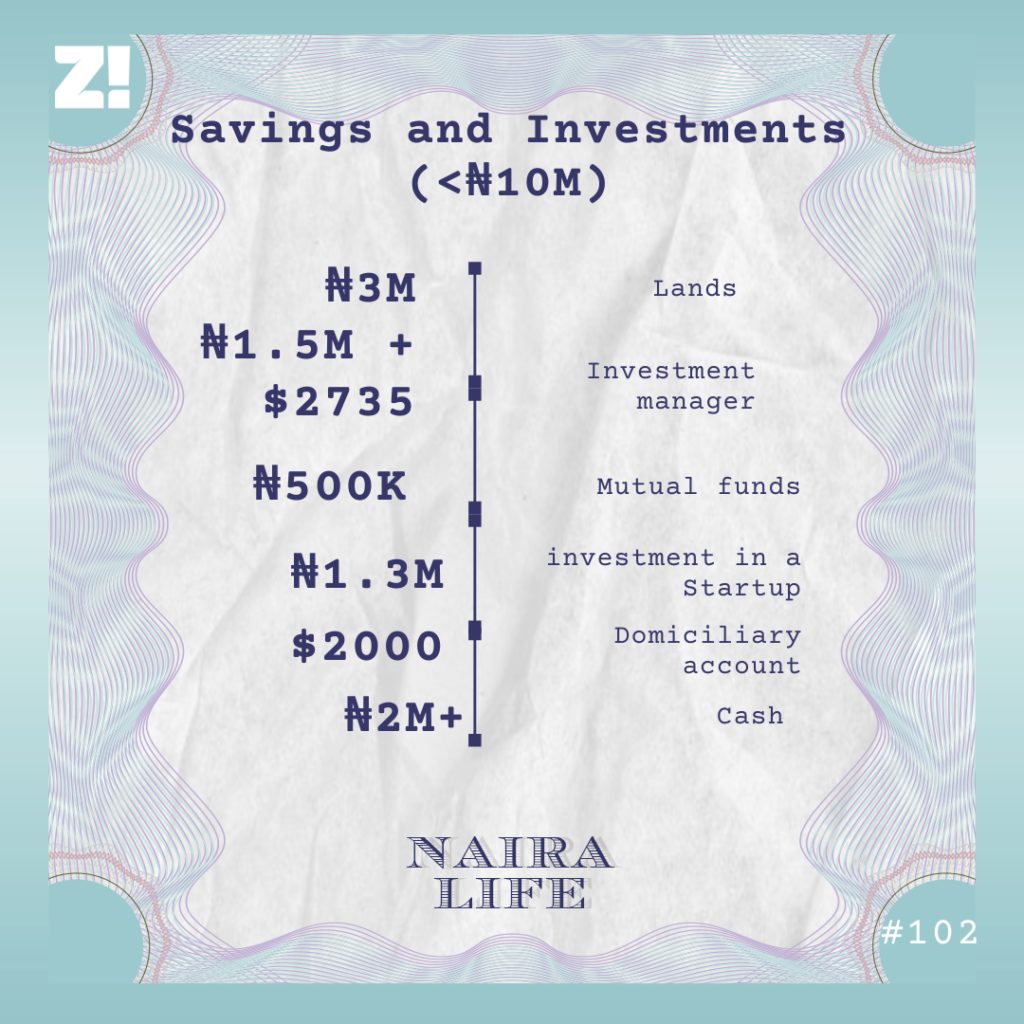

I was getting about ₦215k in commissions every three months. But I was also making more money from the markup. The company knows about this — it’s why they pay as low as they do. At the beginning of 2020, I had ₦1.5m in my account. With the lands and other investments, my net worth was about ₦4.5m. Then I set a ₦10m target.

The pandemic was the major highlight, and it actually worked out well for me. During lockdown, the demand for drugs and other pharmaceutical products increased. Clients were calling me to deliver products to them and paying immediately. Also, the products were scarce, so they had to buy at whatever price I gave them.

I should mention this: my company had stopped distribution, but some of us still had some stock with us. This is what I did: I took ₦500k out of my money and brought the products I didn’t have from some of my colleagues. Now, I wasn’t selling them for the company but for myself.

Because people wanted to buy and hoard the products, clients who usually ordered for 100 units upped their orders to 1000 units. Now, adding ₦500 or ₦1000 to the markup price of each unit made all the difference.

This happened for two months, and at the end of it, I made close to ₦2 million. It was really good business.

When you work as a salesperson in pharmaceuticals, you can’t work with your salary. Thinking about how much they pay me is actually depressing. I don’t even have an alert for my salary account, I just know they pay something there at the end of the month.

It’s very easy to run into debt. I have a colleague who had a deficit of ₦5m and couldn’t account for it. He had to pay them back out of his pocket. Another colleague was remanded in prison for losing ₦40m. It’s pretty dicey. Everyday is a struggle to ensure that I have their money and can track where their products are and which client is owing me money.

It’s close to 0. I took the job because I was home for 6 months. The only exciting thing about the job is how I’ve been able to save and invest what I’ve earned in the last two years.

My salary is ₦100,000. On average, I make ₦300k extra from commissions and markup.

Remember I said I had a target of ₦10M at the beginning of 2020? I hit that in October.

See, I like money. And I like having a lot of it. Also, I don’t spend more than I earn. One interesting thing I always do if I want to buy something for myself is that I take money out of my savings and use it for something that will fetch me the money I need. Let’s say I’d like to own a new phone, and it costs ₦500k. I’ll take ₦2M out of my savings and invest in something.

And although, I may get the amount I need the first time, I’ll hold off on it for a while and reinvest everything two or three additional times. Now, I can take out the ₦500k I need and put the rest back in my savings.

My investment manager handles that for the most part. But I do some myself too. For example, every time I see an investment opportunity on Piggyvest, I go in.

I’m not sure at the moment. But I’ll be out of this country. I’m actually leaving this year . This job is too risky. It’s always one thing or the other. I’m always on the road and I carry a lot of cash around, and that’s very dangerous. I could also run into debt and go to prison. I’m going back to school for my master’s. Ask me what made me decide to leave.

One day, I went to a client’s place to collect the money he owed me. This man made me wait for him for hours, and when he eventually decided to see me, he asked his security guys to throw me out. It wasn’t the first time a client embarrassed me, but that one hit deeply. I got to my car and broke down in tears, thinking about everything I’ve faced on the job. There is no chance that they will promote me or increase my salary. So, I’m not even growing in my career. Like how many more years can I actually give them? I made up my mind to go back to school that afternoon.

£22,800 for a start. That’s more than ₦10,000,000, which I’m paying myself. I don’t even have it all yet, but I’ll get it. So, all my savings is going into this. I’m starting afresh. It’s a huge risk, but it is what it is. I’m going to restart there like I did in uni here — spend the minimum, save and invest.

I wish I’d worked harder this past three years. I would definitely have made more money. I didn’t realise it until I started going out with men who had money — that was when I understood how to make money.

I don’t think there’s anything I want that I can’t — oh wait, maybe a vacation. I’ve never been out of the country. I was supposed to do that in 2020, but Covid happened. I have two tickets I didn’t use.

I gave my room a new look. Bought a new bed and frame, and installed a wine bar. And plants. I’m a plant mum now. I parted with ₦215k but it was totally worth it.

8. I can afford most of the things I want, and I’m in a better place than I was 2 years ago. But I still feel like I didn’t make enough.

Editor’s note: This conversation was had in November 2020. I checked in on the subject over the weekend and she confirmed that she will be leaving the country later this month.

Everyone likes to think that they have a beautiful heart and everything that comes with it, but this isn’t always true. This quiz will reveal what you truly are like on the inside.

Let’s begin:

Dreams are so stressful, man. Some of them are cute and whatnot, but generally, they’re some of the worst triggers ever. And these are some of the reasons why:

This just makes them seem like a waste of time. The only time I get to rest is when I sleep and I’d rather if I don’t need to process anything in my sleep. Or painstakingly mull over the details of some dream after I wake up. What’s the point of having these dreams if you can’t remember them?

So, you’re there having a vivid dream when something wakes you up. But it’s such an interesting dream that you go back to sleep, hoping to continue where you stopped. But these vicious things don’t have a pause/play function, and most of the time, that dream is lost forever. So, what’s the bloody point?

I don’t have much to say here. The only advice I have is that when you’re peeing in a dream. Wake up immediately. Get out of that mind trap because chances are that you’re seconds away from messing up in real life.

Some of these stupid things make you believe that the silliest things can happen in real life. Like make you believe that you and someone belong together. If this is you, don’t act on that dream. The person you dreamt about definitely didn’t dream about you.

Have you woken up from a nightmare and can’t shake the scary details off your mind? The paranoia that tends to follow is definitely not fun. You will be on an overdrive making sure that whatever fate that befell you in the dream doesn’t happen out here. Isn’t that torture?

Forex trading is becoming hugely popular in the country. While it comes with its scores of risk, it also promises huge returns. Nigerians either trade themselves or give a capital to “traders” or “investment companies” to trade on their behalf and get a return on investment. Both can go wrong, so we asked 6 people to talk about their experiences.

I served in a financial investment firm during NYSC, and I was taught various trading strategies and trained to trade forex. I was retained after my service, and the company gave me my own account with an initial balance of $1000. Now, I started trading with real money.

For 7 months, I hardly made a significant loss. On a good week, I was making between $1k -$3k in profit. Within three months, they increased my trading balance to $18k. But the working conditions got too hard for me, and I resigned from the job. I opened my own account and started trading with a capital of $500. My run continued, and in less than 6 months, I grew my capital to $6k.

There’s this thing called flash crash in forex trading — it happens when the market suddenly becomes volatile, and you can make thousands of pips in profit or loss within seconds or minutes. That happened with some AUD pairs I was trading and changed everything for me. The flashcard went in the opposite direction. Unfortunately. I wasn’t tracking my trades because I was on the profit side the last time I checked, and I had a projected point I was expecting the market to reach before I left the trade. I didn’t use the stop loss feature either — I didn’t think I needed it. When I returned to it, my capital and profit had been wiped out, and I had only $1.40 left. I lost everything I made over 6 months in less than 30 minutes.

I paid someone ₦15k to teach me forex trading when I was in university in 2010. After trading with a demo account, I figured out that it required more effort than I could give it at the time, so I let it go. In 2018, a guy I met at work training made close to $11k in 30 minutes. Nonfarm payroll had come out that day, and the market swings dramatically depending on if the number is positive (higher than projections) or negative (lower than projections) The guy traded using the data and made more than my annual salary in less than an hour.

I flipped. I knew I had to get back in. However, he wasn’t taking outside funds that were less than ₦10M. I convinced him to share his trading tools with me and joined his trading community. I practised with a demo account for more than a month before I went to the market. It still ended in premium thousand dollar tears.

The plan was to use $100 for each trading opportunity, so I had only 20 shots at getting it right. I projected a minimum return of $300 in 4 trades. If I got this result, I would have an ROI of $1200 minus $600 depending on my stop loss.

Of course, it didn’t happen. I lost half my capital in little time. But I wasn’t ready to stop. I changed my strategies and continued trading. then I lost the other half. I had only $100 left when I left the market. In hindsight, I could have been less emotional and more patient. But we move.

Forex trading was the rave in my school in 2019, and I decided to join the fun. All my friends were practically doing it, so what could go wrong? I gathered my savings, including the money I was keeping to buy a laptop, and my house rent, and invested with someone — everything totalled 250k.

I was supposed to get my capital and 20% returns on investment at the end of each month. I got the first returns without a problem. After that, it started to go wrong. Apparently, the person I invested with was also investing with someone else. It was some sort of pyramid scheme. The person at the top of the pyramid tried to abscond and people caught a whiff of it. They had him arrested, but that was the last I heard of him. I never got my money back.

I gave it another try in October 2020. I was in a weekly contribution program with a few friends, and we decided to invest the ₦150k we had saved. When the first investment cycle ran its course, we reinvested the capital and ROI. Last month, the guy who had our money informed us that they won’t be paying people until March. There is a chance that we won’t get our money back. It didn’t even hit me the way the first experience did. I’ve accepted that this forex thing is not for me. Fool me once, shame on you. Fool me twice, shame on me. There will never be a fool me thrice.

Last year, a classmate told me about another classmate who had invested in forex trading and was making good returns every month. I called her and she confirmed that it was true. I thought about giving it a try too. The profit margin didn’t seem unreasonable — ROI was 20% at the end of the month rather than the 50-100% everyone else was throwing around. Besides, it seemed like the guy knew what he was doing — he threw words like risk and asset management around. He even sent me a signed ‘Memorandum of Understanding’, stating the capital and expected returns. I invested ₦100k for a start, and I got it back with the promised ROI at the end of the month. A few weeks later, I increased my capital to ₦250k and let it roll over in the following months. I wanted to take my money out in December because I’d started seeing some disturbing signs. But I thought I should chill for an additional month. A week before payout, he informed me that he would be paying only the interest on capital for three months because he’d locked the capital somewhere. My money had grown to over ₦500k, and till today I haven’t gotten it back.

My story started in 2018. A friend whose church member worked at an investment company told me about the opportunity. I did my research and went to the company, and everything checked out. The company’s boss is a lawyer and a former judge, so I felt I could trust them.

I told a few friends about it, and together we raised ₦7M and invested with the company to trade for us. We were supposed to get our capital and 50% ROI after four months.

The payment was due in March 2019, but nothing came. At first, they claimed they were having issues with money transfer. Then I noticed that the owner of this company had turned off his phones and deleted his social media accounts. It didn’t make sense because he’d just completed a state of the art building. I reached out to the company’s lawyer and found out that the man was the only person linked to the company’s account, so nobody but he could authorise payment. This man is still in the wind — he left his wife, children, mother and ran away. Last month, I heard that he owes his investors about ₦7billion.

I first heard about Forex trading during a SAED class at NYSC camp, but I didn’t put a lot of thought into it. Later, my mum told me about it — she had a colleague who was into it. Well, it wasn’t illegal, and the source was solid. So, I put ₦100k into it and got ₦36k in returns at the end of each month.

After a few months, I told some friends about it and brought them on board. Sometime in 2018, the trader warned us that the market was volatile and that he would have to stop the monthly payouts for a few months. But he offered us a chance to take out our money if we wanted to. I don’t know if it was greed or blind faith, but nobody did. And that was the last time we got a payout.

The timeline he gave passed, and he kept posting us. People tried to track him down, but nobody found him. I wouldn’t have been bothered so much if I hadn’t brought people to invest. Their investment ran into millions of naira. I had gotten more than my initial capital, but my friends had over ₦5M in it and never got a dime back.

If you pay attention to Nigerian artists and their projects, this quiz will be a breeze.

No one likes to be stuck in traffic, but depending on where you live, those things can be unavoidable. Now, we know you don’t pay much attention to how much time you must have spent in traffic. But we thought that would be good information to have, so we created this quiz.

Let’s start.

[donation]

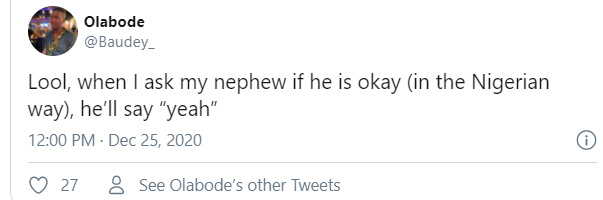

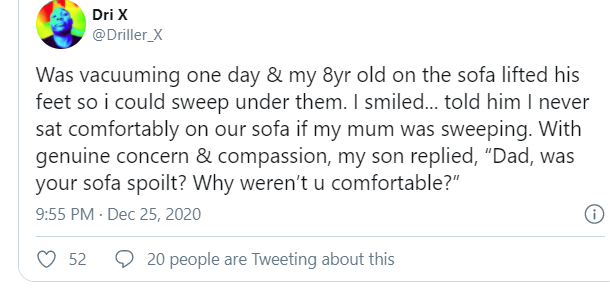

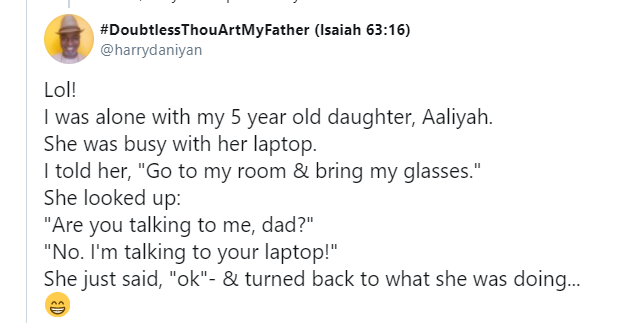

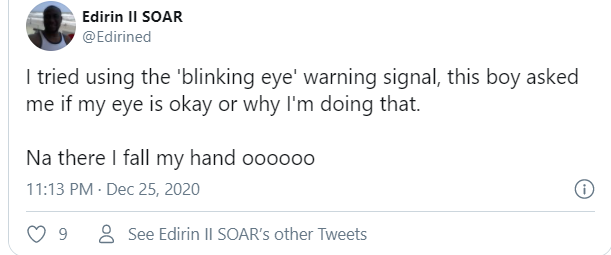

Sarcasm is a language and Nigerian parents speak it fluently. Or at least they used to. Growing up, one of the first things we learned was how to detect the sarcasm in our parents’ words or actions. Every time they gave that look and said “Put it on my head.” we instinctively knew what they really meant. It seems the new generation of Nigeria kids couldn’t be bothered about all of this. God bless their innocent hearts.

This thread I found on Twitter proves this, and it’s one of the most hilarious things I found last week.

Recommended quiz: Only People Who Speak Fluent ‘Nigerian Parent’ Can Get 10/13

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

In case you missed it: Fu’ad wrote and published his last Naira Life story last week. My name is Toheeb, and I’ll be taking over from him.

Also, I had an interesting conversation with him where he talked about the origin of Naira Life and his experiences writing the first 100 episodes. You can read it here. It will give you an idea of what we’ve been trying to do with this series.

Anyway, this is cheers to change and new beginnings.

Now let’s get this party started.

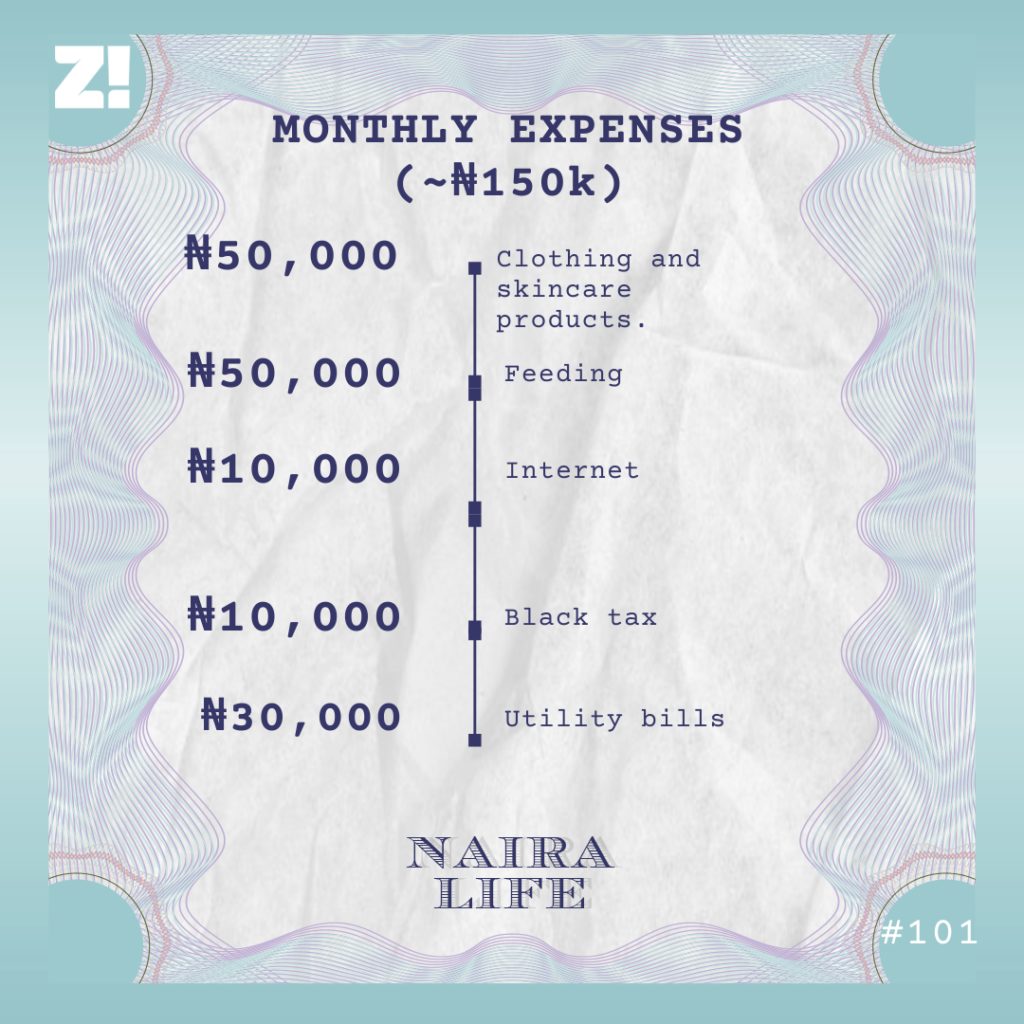

Talent and promotion are two different beasts in the music business. The subject of this week’s story, an up-and-coming artist knows this better than most people. So, how does he earn money in an industry where nothing is guaranteed, and what does his #NairaLife look like?

I grew up in a house crawling with kids in Benue State, and money was the prize for good behaviour. Every time I got good grades, my dad rewarded me with money. Also, If I was on the good side of any of my father’s wives and they thought I behaved well, they tipped me.

Four wives. My mum was the first and had seven kids for him. I’m the sixth. My parents got divorced when I was four and my dad got custody of the kids. My mum checked in on us when she could, but she was always on the road because of her business.

When you live in a home filled with children, you learn how to compete for resources. You have to be strong. Living that reality — even though it wasn’t always ideal — showed me where hustle ranked in the grand scheme of things.

When I was about to get into secondary school in 2005, my dad wasn’t ready to take care of the fees. So at 10 years old, I started going into the bush to fetch firewood and sell to people. I raised the fees and enrolled myself in school.

I sold a bundle for ₦30 or ₦50, depending on who the buyer was. On a very good day, I got up to ₦100 on a bundle.

₦150 per term.

I don’t hold it against my dad actually. He had a lot of responsibilities. For four years, I stuck with the firewood thing, and my mum and older siblings chipped in when they could.

I left the village. I had a sister who lived in Abuja, and she thought it was best if I came to live with her. In 2009 and at 13, I moved to Abuja. Coming out of the village was a dream, but it was also a lot. I had to adjust to having smart people around me all the time — no shade to my classmates in the village. When I got the hang of the city and my new school, I realised that I had been handed a lifeline. My sister took care of my education and pretty much everything else, and my mum also contributed. Not much happened in the remaining years I spent at secondary school.

Yes. In 2012, I was admitted to study at a university in the south-west. My mum had passed away at this point. She died when I was in SS3.

It’s fine. My sister continued paying my tuition. Every now and then, she sent me an allowance. ₦10,000 this month, ₦15,000 the next month. On my part, I went to uni with a mindset that I was becoming my own person. I started looking for things I could do to make extra money.

Modelling. I had the physical appearance for it. I started going for auditions in my first year.

On average, I got ₦5,000 per gig. This was in 100 level and didn’t have a lot to worry about, so I was living fine.

₦50,000 from a fashion show I went to in 2015. However, only ₦30,000 came to me. The guy who helped me secure the job got ₦20,000.

Anyway, when the money from modelling became more frequent, I decided that it was time to turn to something I had always wanted to do.

Music.

I’d always known I could sing. But I wasn’t sure that I wanted to do it professionally. I just wanted to put something out. I did that in my second year at uni when I recorded and released my first song.

I spent ₦5,000 on the studio session. The cover art took ₦3,000. I didn’t know as much as I do now about music promotion, so I didn’t do a lot of that. I paid ₦1,500 to host it on a blog in school. One of my lecturers heard the song and liked it so much that he offered to pay for the video. It cost ₦30,000.

I was like, “Omo, I go run this thing.” I got a manager and started doing it professionally.

Not from streaming, no. But I was invited to perform at dinner parties and other events in school because of that song. I don’t remember how much I made from each performance or how many of those things I went to, but it was between ₦3,000 and ₦5,000.

The best thing about that time was the platform. Brands used to organise events, and although they brought their artists with them, they also needed local acts, preferably student artists. I was one of those chosen for this, and it brought in extra cash.

I leveraged the relationships I had with people to build a structure around my brand. People offered to manage me. Someone volunteered to be my road manager when I went on shows. Producers wanted to produce songs for free. I put out two more songs before I left uni. For NYSC, I was posted to a state in the north, but I relocated to the south-west. Before NYSC ended, I got another manager, and we agreed he would take 30% of whatever I made. In 2018, he got me my first major gig post-uni.

Performing at a lounge in Port Harcourt. I worked on wednesday and saturday nights and got ₦60,000 per month. I also got tips. On nights when their guests felt generous and thought I was doing a good job, they came on-stage to spray me money.

I started getting invited to a couple of other shows. ₦50k here. ₦60k there. While I was doing all this, I put out another song. It was the first time I pushed a song with a plan. I got it to play on the radio and made a video. The video alone took about ₦150,000.

I also clocked something that year.

It’s almost impossible to convince people to pay money or even give an artist on the come up a chance. The mechanics of demand and supply can be harsh. There was this time I was supposed to perform at a show. My name was on the performance list but nobody called me to perform. When I tried to make an issue of it, they told me that they only brought out artists people wanted to see. That opened my eyes.

It was pretty dampening. But everyone has their story and we can’t all make it overnight. I just took it as one of those things that comes with the struggle and kept pushing. I still am pushing.

My manager was a little buoyant, and he believed so much in my craft. We didn’t have a written agreement, but he was willing to put in resources to get me out there. It was a bit of everything coming together to make it work. Also, I discovered songwriting and how it’s a hidden gold mine.

It happened like this: I went to a studio in 2019 to record a song. A popular artist was there, vibed with the song and asked that I give him the song for a fee. He paid me ₦150,000 for it. I wrote one or two more songs for him and he introduced me to a few more people, and it picked up from there. I charge between ₦100,000 and ₦300,000 to write songs for people now.

Before then, I didn’t think the Nigerian music industry embraced the idea of songwriters.

2019 was also the year I met 2face and his team.

You know, I’ve always been a die-hard 2face fan. He’s from my village, and we idolise him there. I’d been participating in his competitions and tagging him on my posts, hoping to meet him one day. That year, he organised another competition because he was looking for three young talents for a project he was working on. I reluctantly entered and I was picked. That was it.

I got more attention from the mainstream. A couple of record labels reached out. But the thing about signing a record label contract is that you have to be very aware. Even when I decided to go with a label, there was a lot of back and forth reviewing the clauses. It took about four months before I penned down the deal. I signed with them in November 2019.

I can’t talk about the details, but they were going to give me freedom to express myself and back me financially. Talent is like 60%, money is 40%. The contract was supposed to be a relief. It was me trusting them to make me grow in ways I couldn’t do as an independent artist.

There’s been ups and down. A couple of things have happened in the past months, so it’s currently on hold. That’s the simplest way I can put it.

This music business get as e be. No matter how big you are, you can’t tell how busy you will be in a week or a month. 2020 was chaos. I literally didn’t have any public performance. I made the bulk of my income from songwriting.

I make about ₦200,000 – ₦300,000 every month. But it’s not set in stone. I’ve made ₦100,000 in a month. I’ve made ₦500,000 in another month. It depends on how the market moves.

This definitely goes up on the month I have to pay rent. Rent is #520k

I used to be about that life, but I’ve found that it’s better to invest. I put ₦400,000 in an agriculture business recently. It isn’t a lot, but it looks promising. I have other running investments too.

I don’t know. They’re everywhere. I’m not good at tracking them.

Bringing my investments together. At the moment, they are all over the place. I’m struggling with getting a grip and knowing where my money is and what it is currently doing.

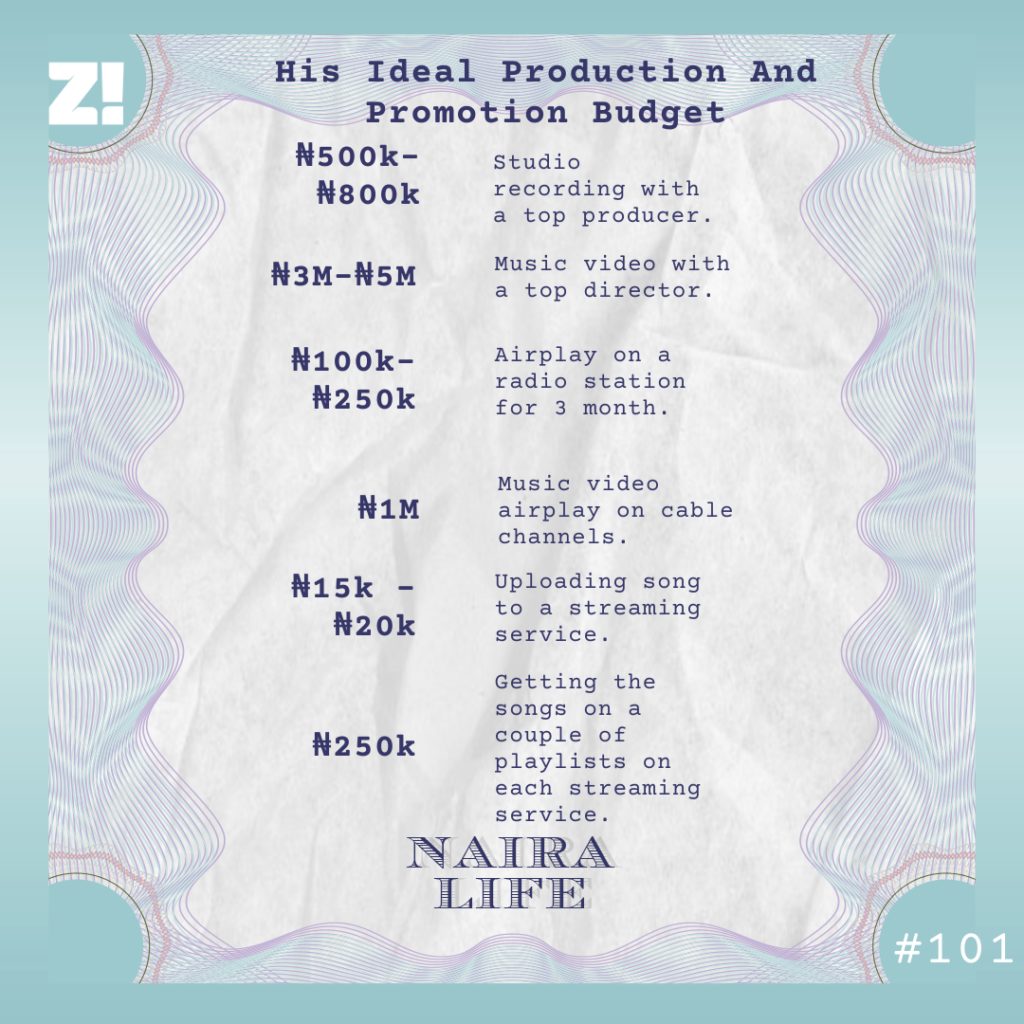

Omo, I can’t afford the kind of promotion I want for my music. On average, promotion costs on one song can run into ₦10,000,000.

Also, if you want social media influencers to talk about your song and sometimes get you on the trend tables, you have to distribute reasonable sums to them.

Record labels budget between ₦10,000,000 and ₦15,000,000 on a single. Some go as high as ₦20,000,000 if they want to disturb everywhere.

A lot of work goes into making a song. Some of us aren’t as big as we probably deserve though we have songs that can compete with the best. But promotion is a different beast. It’s sad, but it is what it is.

And this is where record labels come in. They have money and they are risk takers. But in some cases, they also have the power to rip you off when you blow. The industry is a lot. Talent isn’t enough — that’s for sure.

I spent ₦300,000 on a couple of production equipment. It’s not always easy to go to the studio to record, and not all producers get the picture of what you’re trying to do. It helps if you can do some of these things yourself. They weren’t cheap but were totally worth it.

Lmao. I’ve not even gotten a small break.

2. Not that I’m not content, but I always feel like there’s something more out there for me. I’m hoping my investments in agribusiness pick up the way I want. When that happens, I can move up to 5.