Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

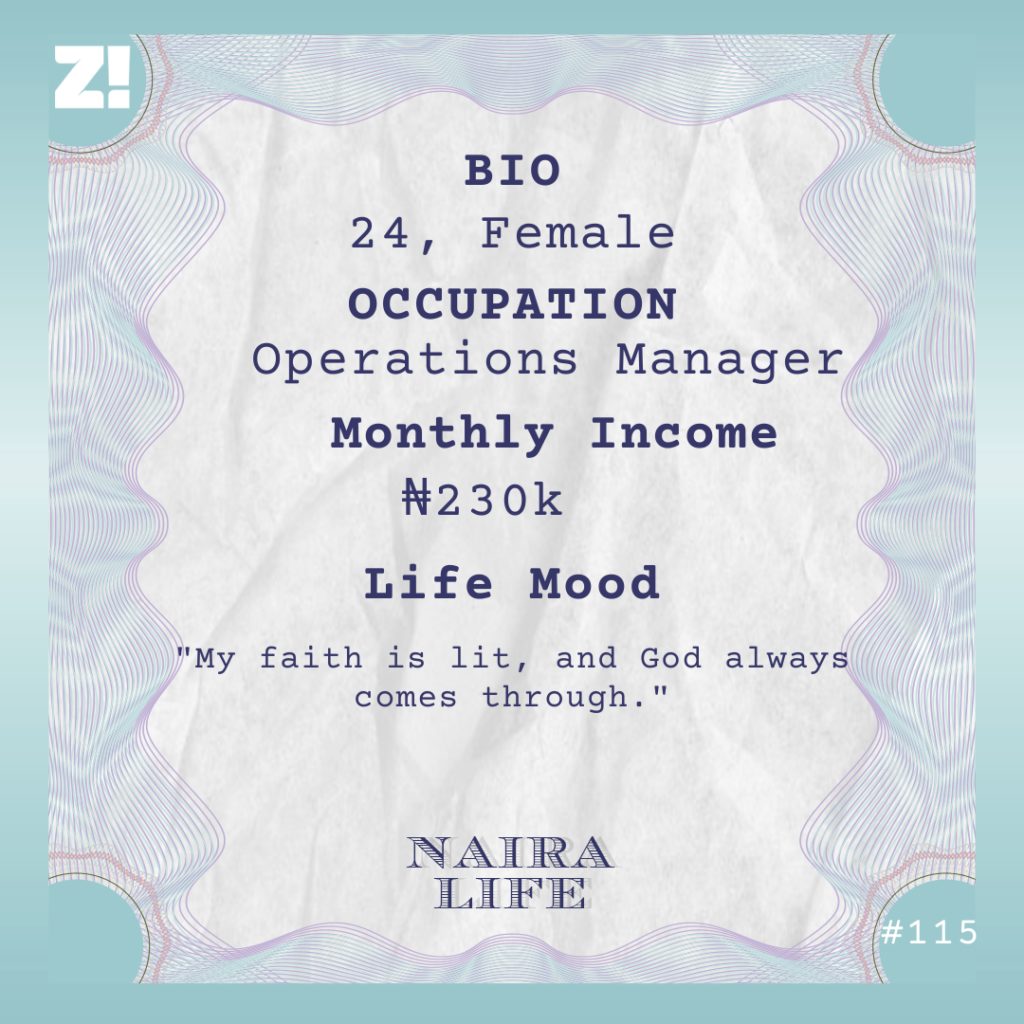

At the beginning of the year, the 24-year-old subject in this story was working at a job she hated and barely making ends meet, and then things changed because of a tweet she responded to. Through her highs and lows, one thing remains unchanged: her faith in God.

What’s your oldest memory of money?

That’d be taking money out of my mum’s purse to buy choco milo. This was 2002 or 2003, and I was six or seven years old at the time.

I –

By JSS 1, I was stealing between ₦100 and ₦300 to buy fruits and ice cream. I was caught once, but I didn’t stop. I was caught again in JSS 3, and this time, my dad flogged the budding Anini out of me. Since that time, I’ve not taken anyone’s money.

Omo. Moving on from that. What was it like growing up?

It was good at first. My dad sold trucks and other heavy-duty vehicles, and his business was good. We got everything we wanted, and my siblings and I went to good schools. I was in JSS1 when things first changed.

What happened?

My dad was a womaniser, and a lot of his money went into that. There was a time he bought a house for his girlfriend and built another one for her family. It wouldn’t have been a problem, but he lost a deal he was hoping to get, then, he was scammed and lost a lot of money.

Omo.

It took him about three years to bounce back, and when he did, what did he do next? He returned to his old ways. A few years later, he lost all of his money again. He tried to float another business but it failed. Like that, we were broke again.

Ugh. Where was your mum in all of this?

I don’t think my dad was giving her money even though he was generous to other people. My mum worked hard to keep up appearances and maintain the status people thought we had. She had a restaurant, and that was where she spent most of her time. She wanted to own two to three outlets. The stress got to her, and she died in 2015.

I’m so sorry.

Thank you. Her death hit my dad so hard that he took a year away from working. I was in my second year at university at this time. Before all of this happened, I was getting ₦15k-₦20k as my allowance. After everything, it reduced to ₦2k per month.

What did that mean for you?

I realised that I had to fend for myself. One of my friends worked as an usher for an event planner. One day, I asked if I could follow her to an event she was working at, and she agreed. She put in a word for me with her boss and said I could assist in serving food. My pay was going to be ₦2k. But I quickly spoke up and said I could be an usher too, even though I had no experience. She agreed to give me a try. At the end of the event, she paid me ₦4500. I gave my friend ₦500 and kept ₦4k.

Was that the only time you worked for her?

Nope. She called me two weeks after for another event and paid me ₦5k. It became a weekly thing. Every weekend, I had an event to work at. So I was getting paid about ₦20k every month.

Were you still getting an allowance from home?

Yup. The ₦2k came without fail. It was a good thing that I got the job because I was able to maintain the life I lived before things became difficult at home. I held the ushering gig for 2-3 years, I also did other things for money.

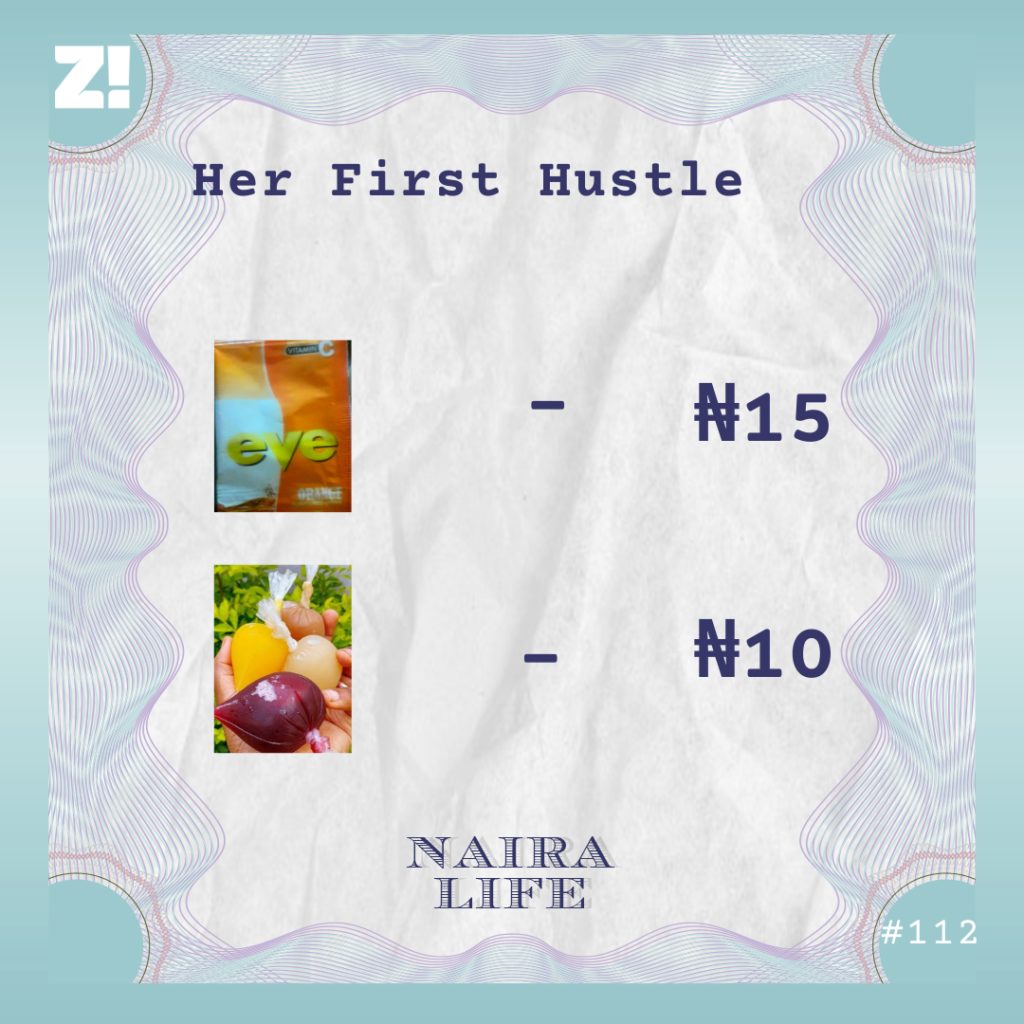

What else did you do?

Sometime in my third year, I heard that recharge cards were moving. I put ₦25k into it and started selling recharge cards. I did that for only 2-3 months, but I had made my capital back and an extra ₦30k in profit.

In my final year, I sold toast bread. It became as though I did blood money.

I’m listening.

This is how it started: one morning, I made toast bread and shared it with my roommates. Then they went, “Babe, you need to start selling this thing.” The next day, I bought two loaves of bread and six eggs. The cost of everything was ₦1800. The students next door bought everything, and I made ₦3500 that morning alone. In the evening, I decided to take it a step further — I bought a crate of eggs and loaves of bread. The students who had bought some earlier in the day spread the word that someone was making toast bread in the hostel. I got 55 orders and sold out that evening. Slowly, it became a thing. I increased the price to 150, and in a day I’d get up to 150 orders.

How much were you making from this?

₦8k-₦10k in profit per day.

Mad oh.

I should add that I stopped doing this every day. I couldn’t keep up with the stress, so I was open three days a week. I was going for the ushering gigs too. The steady means of income meant taking care of my tuition and other expenses and having enough left to save. I saved ₦100k every month from what I made from both sources.

What were your finances looking like when you left uni?

I left uni a rich woman but ended up broke three months later.

What happened?

I had between ₦650k and ₦700k when I graduated from university. But I went home and found out that my dad had sold our house to offset debt and had moved somewhere else. I didn’t like the state of the house he was living in and also didn’t want my sisters to come home from boarding school to that. I gave him ₦300k to renovate the new place.

I’m not sure how I spent the rest. I was reckless with money at the time, spending frivolously on food and hotels. I knew I was in trouble when I had run my chest down to ₦90k and I didn’t have an apartment.

Omo.

I found a job as an attendant in a store, and the pay was ₦60k per month. Also, I found two roommates and we gathered our resources together and rented an apartment at ₦300k per year.

What was it like going from ₦700k in savings to almost nothing?

I don’t think about money that way. True, I was reckless but I always knew I would bounce back. Once I realised my account was getting low, I was already praying to God to come through and started thinking about how to save the situation.

I see. How long did you spend at the store?

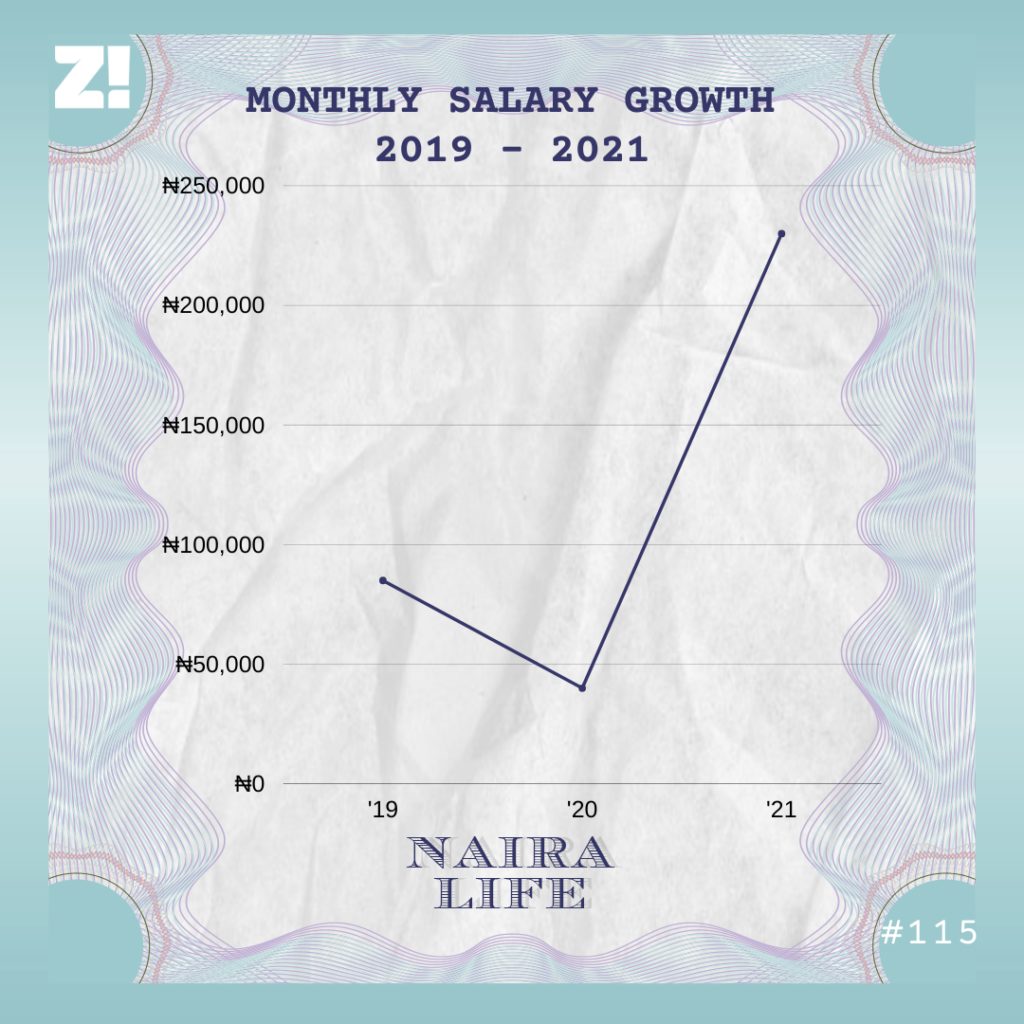

I was there between February and June 2019. I had to go for NYSC, but I had saved up ₦70k. A week after I left camp, I found another job as a front desk officer, and they offered me ₦85k. The federal government was also going to pay me ₦19,800. For the first time in a while, it looked like things were looking up again, but…

But?

But I quit eight months into the job. The owner of the place was moving mad. Eight people left the company on the same day.

Ah!

I didn’t think this through, but I moved out and spent most of my savings — about ₦300k — on another apartment. I thought I would get another job as soon as possible. But Covid said hello.

How long were you unemployed?

Six months. My allawee stopped coming in June when I finished NYSC. I had no support system or safety net, but God was with me, and I kept my faith in Him. Someone gave me ₦20k on Twitter in July and a friend gifted me ₦10k in August. I don’t know what I would have done with all of this. I lived on the money while being super prayerful.

I eventually settled for a job in September 2020. It was a personal assistant job a friend referred me for, and my salary was ₦40k.

That’s almost half your previous salary.

Omo. It was better than nothing. But I realised how tiring the job was very quickly. I was just powering through each day, praying and hoping for a better job. I quit officially in January 2021 but worked till February. I wasn’t paid for either month.

Was a job waiting for you when you quit?

There was no job, but God finally answered my prayers. It was like He was telling me, “You must have learned your lesson. Now let me say hello.”

That sounds interesting. What happened?

A few days after I finally cut ties with my previous boss, someone tweeted on Twitter: “Say what you want, you don’t know who is watching.” I quoted the tweet with “God should answer my heart desires.”

A while after, someone entered my DMs and asked what my heart desire was. I told her that it was a good job. I didn’t know this at the time, but she posted our conversation on her IG story. Later that day, she hit me up again to tell me that someone was asking for my CV. She asked me to send them a DM, and I did.

I went for a test the following day and was invited to interview after that. Two days later, I got an offer letter.

Ghen Ghen.

I was hired as an operations manager. My new salary? ₦230k.

That’s a significant raise, all things considered.

It is. And there are other great perks too. It was so unreal. It happened at the perfect time too. My rent had almost expired, and I didn’t have anything saved up. I didn’t care about a lot of things — I just didn’t want to be homeless.

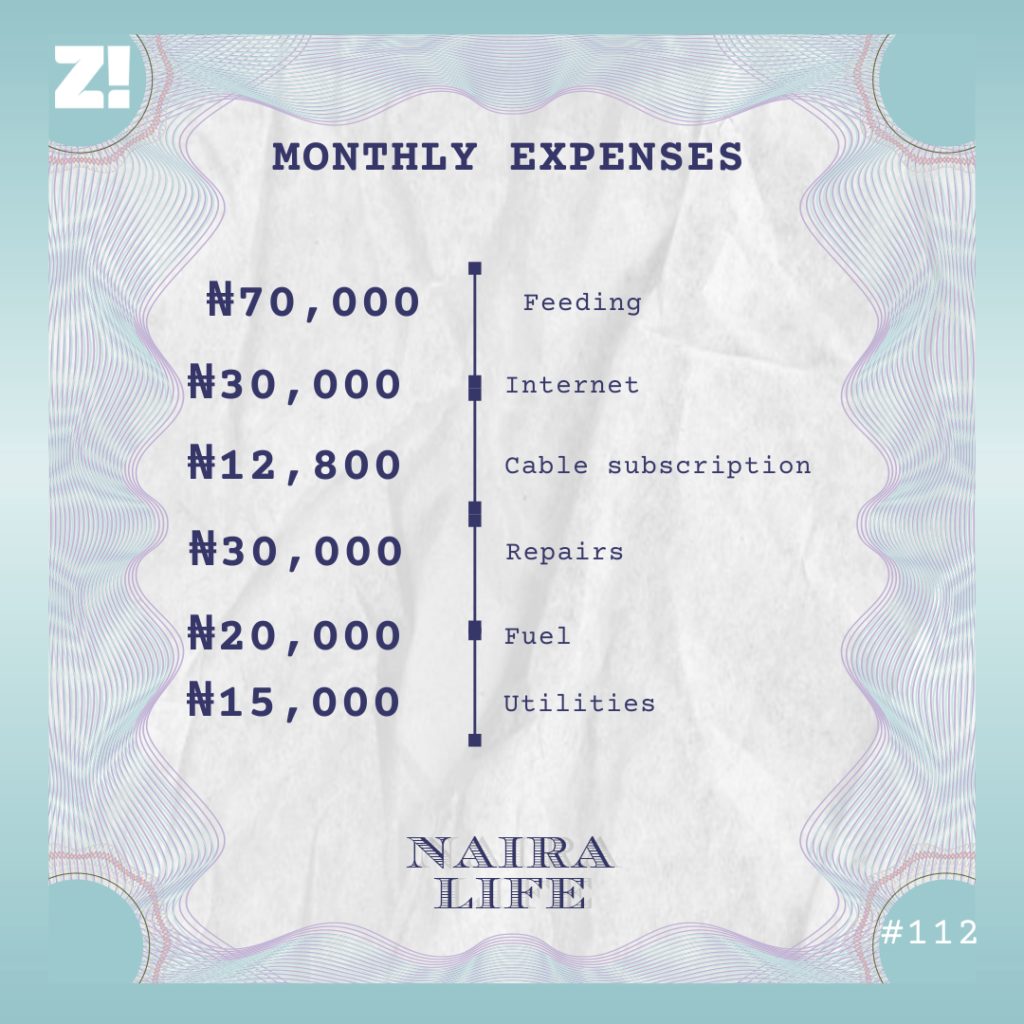

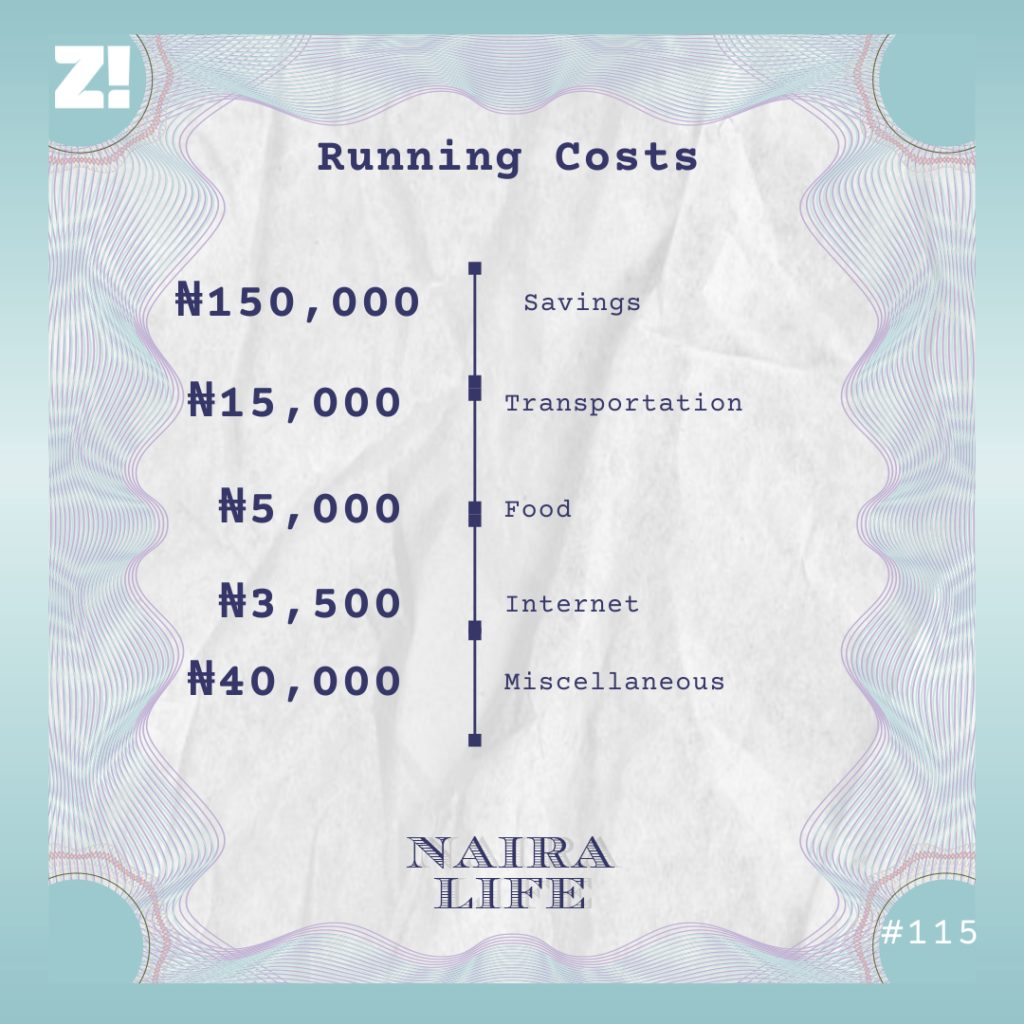

Talk about a close shave. You’re earning ₦230k every month now, what do your running costs look like?

I don’t spend a lot of money on food because the office takes care of my meals. About the miscellaneous: I send ₦10k each to my sisters. Also, I have an account I opened for my boyfriend, and I put ₦20k in it every month.

Aww. What do you think you could be better at financially?

I could do a lot better with how I manage my finances. There’s only so much I could do if I continue spending money — which isn’t even a lot — and hoping something else will come up. My faith is lit and God always comes through, but I should really be more responsible. I’m working towards that. I have to build my savings up first before considering other options.

What’s something you want right now but can’t afford?

A car. But it will have to wait because I’d be moving out of my apartment soon, and I also want to save enough to travel somewhere for a vacation this year.

Interesting. Anything you bought recently that improved the quality of your life?

I’ve always been big on health and wellness, but I couldn’t afford the vitamins and other essentials I wanted to buy. Recently, I bought WellWoman and some other vitamins for ₦33k. You should have seen the smile on my face when I left the pharmacy.

Have you thought about where you’d like to see yourself in five years?

If I’m still at this company, I hope to have made it to a managerial position. Also, I should have started and finished my MBA, and hopefully, be in a position where I can spend more on myself. And if I don’t have everything by that time, I’m happy the way I am. I just need to put my head in my job and keep my faith alive.

I’m curious, what do you think could have happened if your dad was still making enough money and your mum was still here?

I definitely would have had it easier. I probably wouldn’t be in this country, and I would have finished my MBA. Oh God, I would have almost finished seeing the world.

Man. I wonder what your relationship with your dad is like these days?

On some days, I’m angry at him for his mistakes. But I also love him so much I can’t stay mad at him for long. Besides, he’s trying his best to make us happy. It is what it is.

On a scale of 1-10, how would you rate your financial happiness?

I’m at a 7 now. I’m not crazy about building excessive wealth. I’m okay as long as I can afford the basics, and I’m in a better position to do that now. The only thing I want right now is to travel as much as I want to. There were many opportunities to do that when I was younger, but my father didn’t make it happen. Now, I can’t afford the places I would like to visit. This number will definitely shoot up once I can.