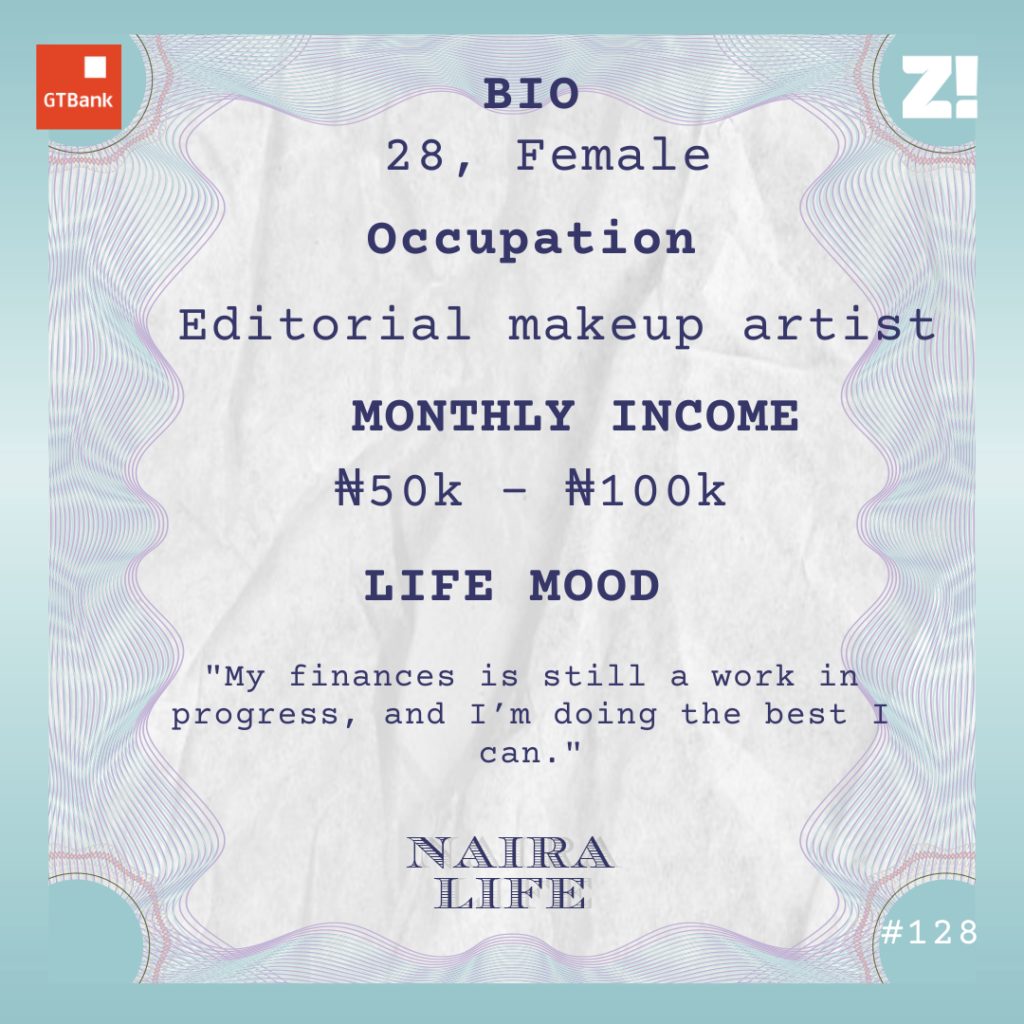

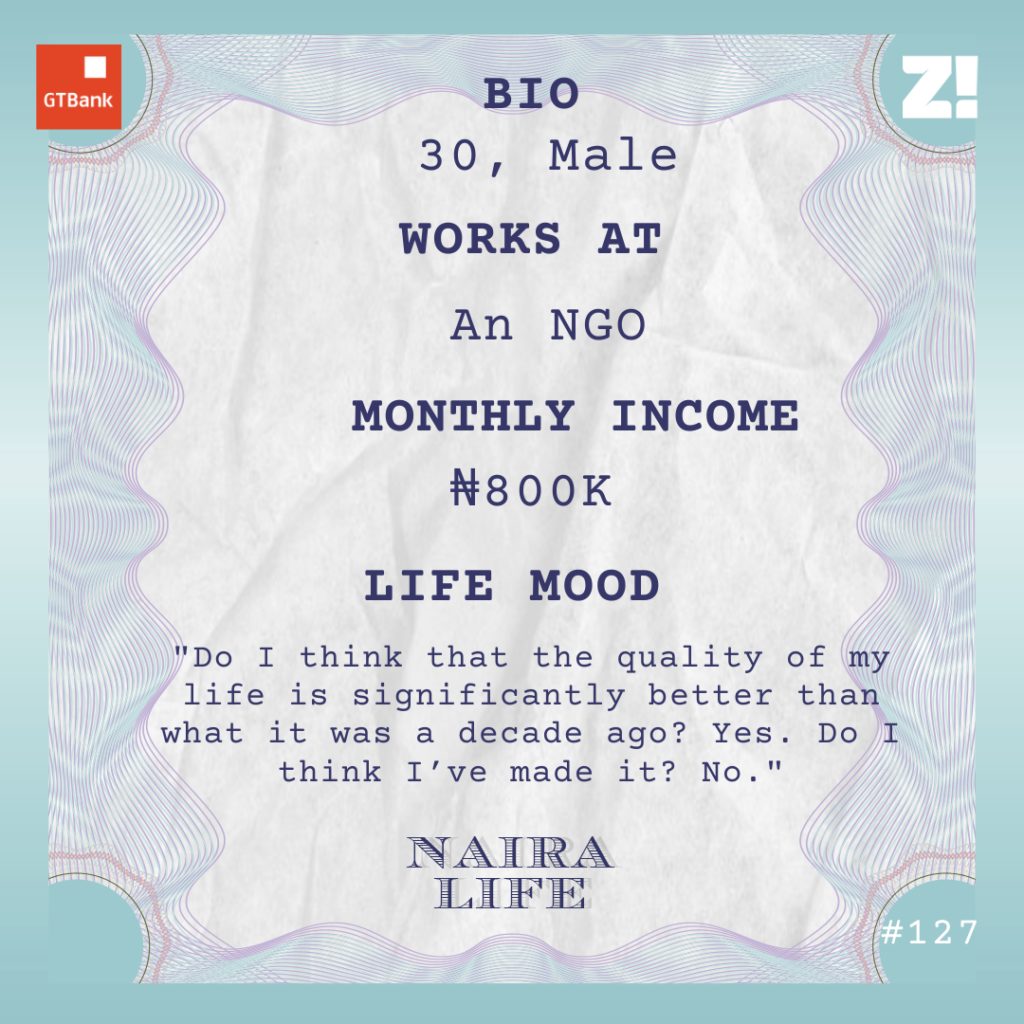

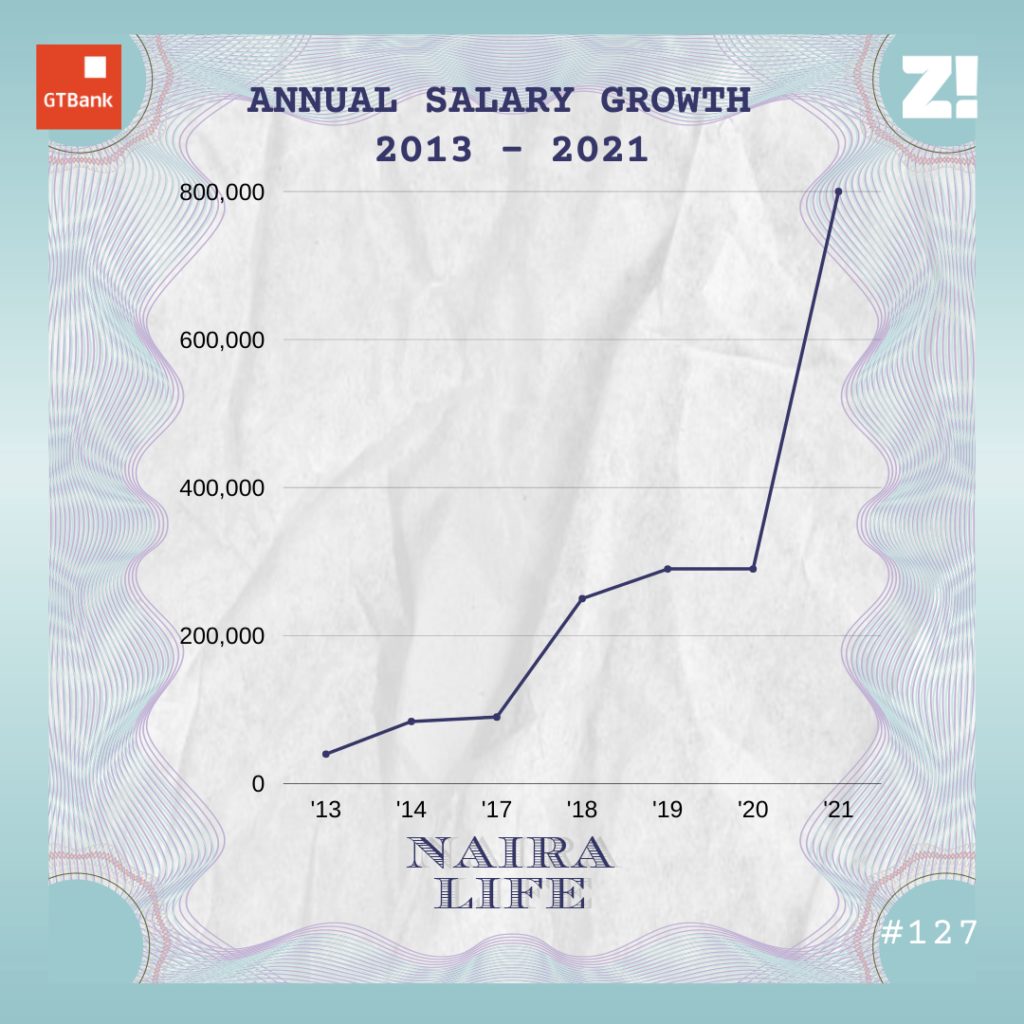

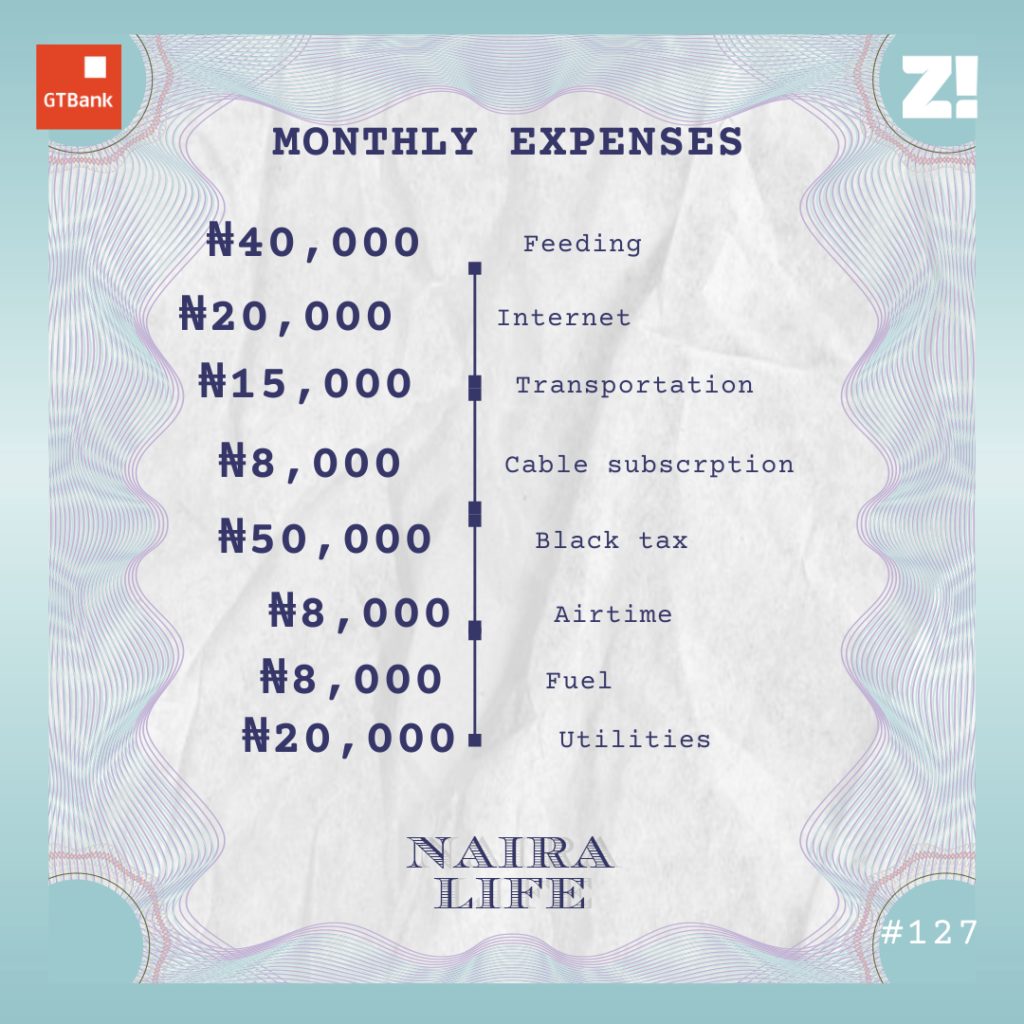

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

What’s your earliest memory of money?

I’m not sure I remember. I never thought about money while growing up because there wasn’t any need to. I was an ajebo who lived a very sheltered life. My parents were lawyers who were doing quite well, and we didn’t lack anything.

It wasn’t until I went to secondary school in 2000 that I began to understand what money and wealth meant.

How?

I went to a federal government secondary school and lived in the hostel. It was a melting pot of social classes. The quantity and the brand of the provisions everyone brought to school determined where they belonged. I never felt inadequate, so secondary school made me realised how privileged I was.

I graduated from secondary school and got into university to study law in 2007. At first, my dad sent me ₦10k every month, which was more than okay — you could make a pot of soup with ₦200 in 2007. After the first year, he got tired of the monthly deposits. So he changed the way he sent me money. He started sending me ₦100k in the first semester to cover my tuition fees, accommodation fees and monthly allowance. During the second semester, he sent ₦60k. Now, it was up to me to manage the money and make sure it lasted the three months I stayed in school for every semester. But even if it didn’t last, I could call him to ask for more money.

I won’t lie, my dad spoiled me. But my mum? Left to her, ₦5k was enough.

Haha. Do you remember the first thing you did that fetched you money?

Yes. I was in 300 level when I felt the need to hustle because I had friends who were working to make money. I got an ushering job for a wedding, and the pay was ₦2k. I was so excited. In my head, it was free money. Guess what happened at the event?

What?

I fainted.

My God!

I had low blood sugar. The lady who hired me was frantic and said things like, “If you knew you couldn’t do the job, why did you come here? Do you want to spoil my business?”

Luckily, a doctor was at the wedding and attended to me. After resting for a couple of minutes and drinking a bottle of soda, I was ready to continue. I did the job and got my ₦2k at the end of the event.

You earned your ₦2k.

You get. After that, I said to myself, “I did not come to this life to suffer,” I returned to my ajebo life and didn’t make another attempt to work for money until after university.

Tell me about that.

I was mobilised for NYSC in November 2013 and left the north central where I grew up for the south-south. My dad paid my house rent, which was ₦120k. After that, he gave me a stern warning. I don’t remember his exact words, but it was along the lines of: “I’m not going to give you one kobo, and I expect you to save ₦10k monthly.”

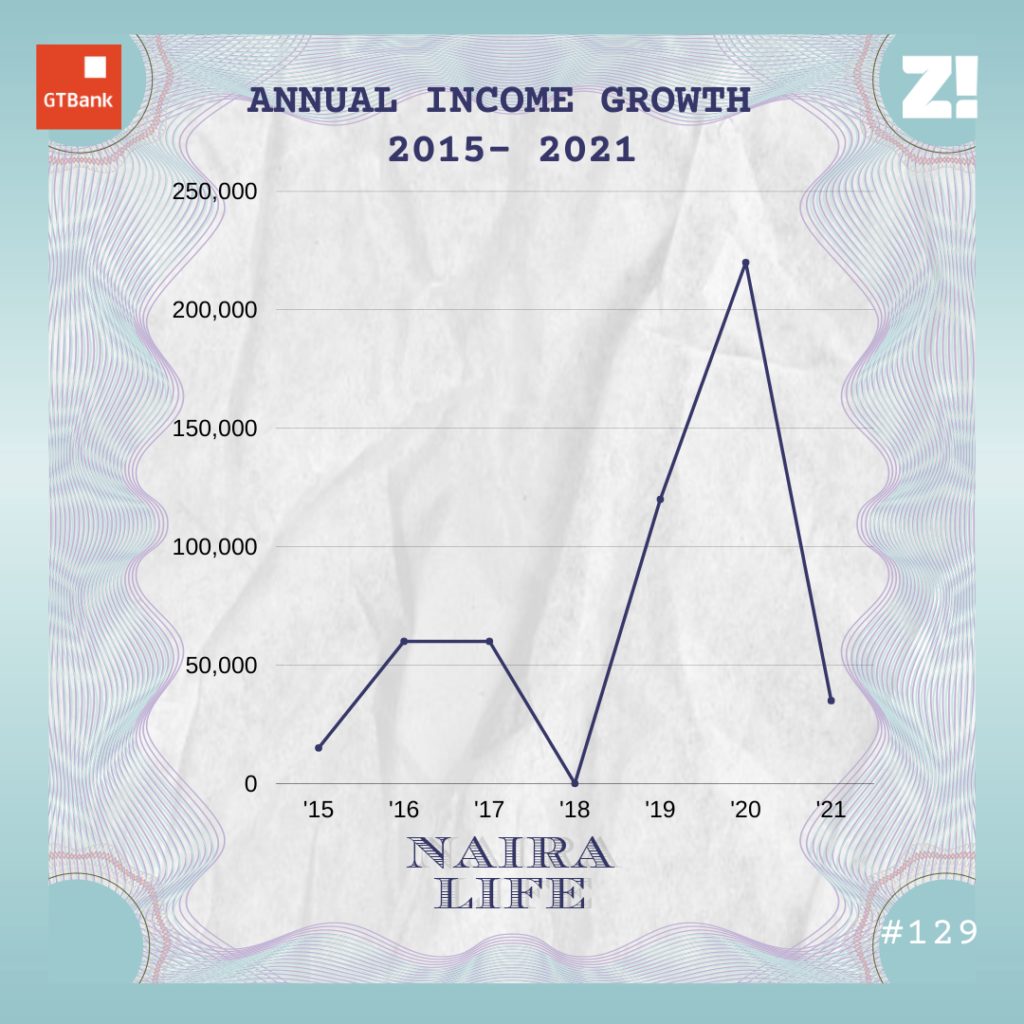

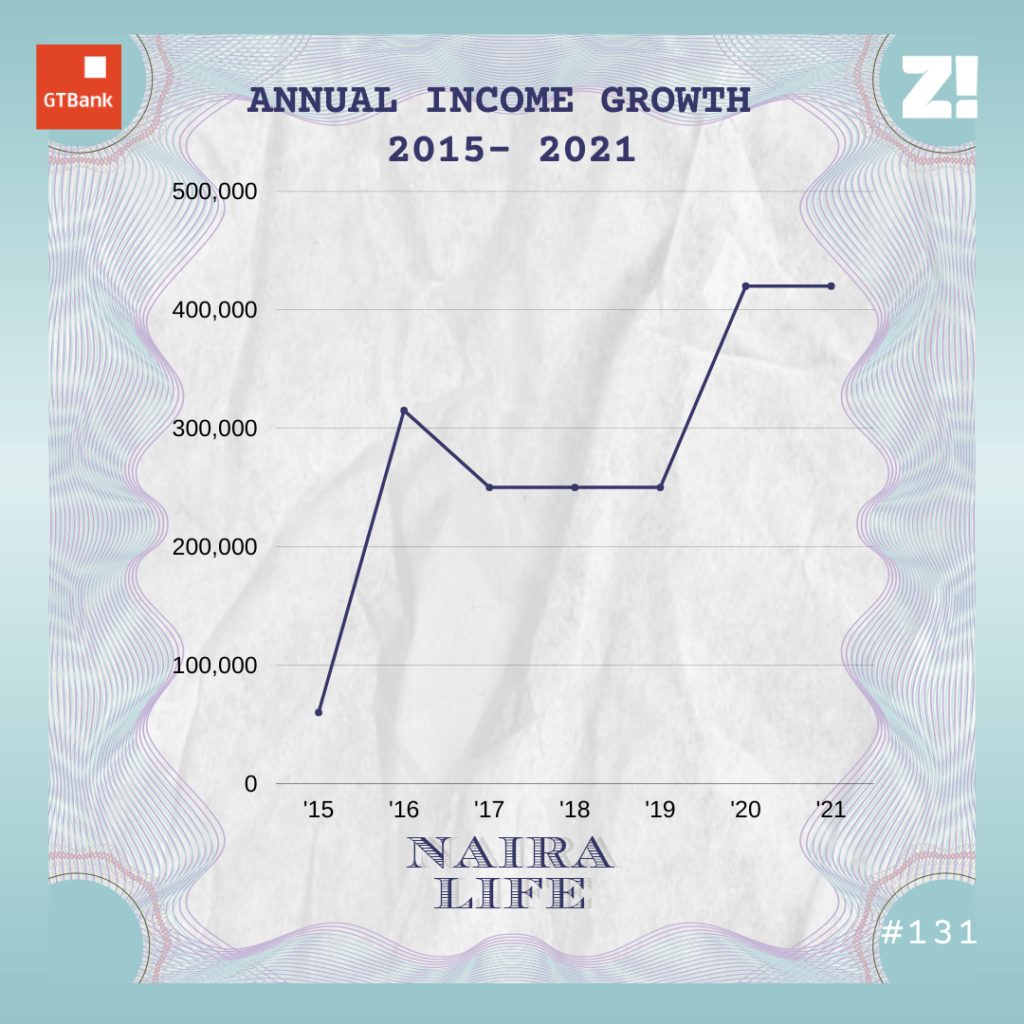

I had to survive on the ₦19800 the federal government paid and ₦10k I got from the law firm I worked at. I cut down on a lot of things or went for cheaper alternatives in my service year. Not like it was hard, but I wasn’t used to it.

I managed to have ₦40k in my account at the end of my service year. I felt on top of the world. But I was also like, “Freedom is overrated. I’m going back to my father’s house.”

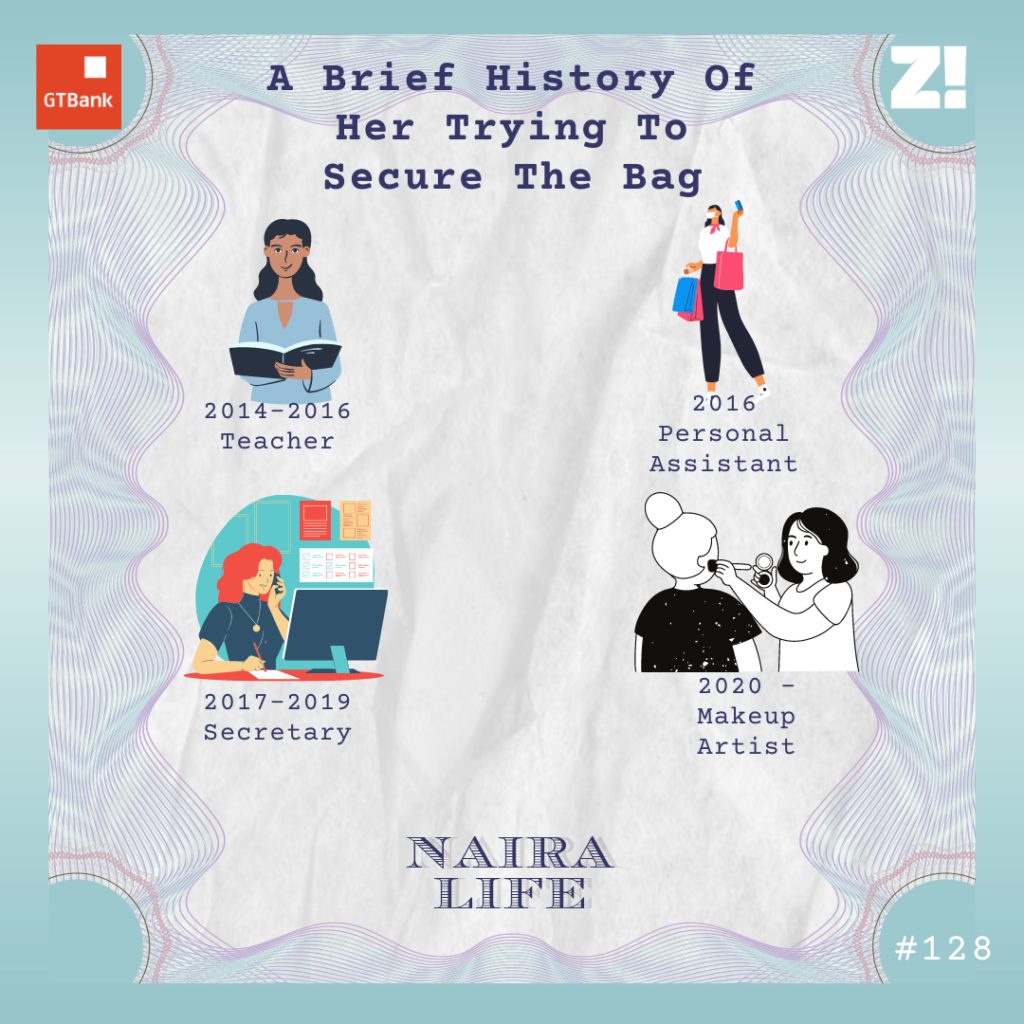

What did you do after NYSC?

I chilled at home for a bit because I didn’t want to work at my dad’s law practice. While I was at home, I started helping people incorporate their companies with the Corporate Affairs Commission, and I got a lot of these clients through my dad. I was getting about ₦15k and ₦50k from these businesses depending on the size of the company I helped register.

A year later, I got a job at a family friend’s law firm. The salary was ₦40k, but I was allowed to continue my CAC runs. My earnings on most months were between ₦60k and ₦80k. Six months after, one of my aunts reached out to me and told me that one of her former bosses, who had just started a new job at a high-ranking government office, was looking for a lawyer to be his executive assistant. I interviewed for the job, and I got it.

The office didn’t have a budget at the time and asked if I could work for free for a few months, but they would pay me a monthly allowance of ₦60k. I would have accepted the offer even if they didn’t offer to pay me anything because of the kind of people that worked there. Nothing much happened until December when I took a break to get married.

That came out of nowhere.

Haha. We were family friends and had known each other for years. Our parents sent the ball rolling, and we started dating officially in March 2015. A few months later, we got married and moved into one of his dad’s houses.

Ah, I see.

By the time I returned to work in January 2016, my workplace finally had a budget and could pay me an actual salary.

How much was it?

₦315k.

That’s a significant improvement from ₦60k.

It was. The good thing was that aside from the occasional shopping I did on ASOS, I had no major expenses, so I was saving most of my salary. In less than four months, I had more than ₦1m in the account.

However, I started to get restless.

Why?

The structure of the office where I worked meant that there was no job security. A change in government could mean I’d lose my job. I started looking for opportunities to change my workplace. One came in August 2016 when a senior colleague was appointed as the managing director of a government agency. He wanted me to come with him, and I agreed. My starting salary at the government agency was ₦382k gross. My net salary was ₦250k.

This was less than your earnings at your previous job.

Yes, I took a pay cut on paper. However, there was no health insurance or pension scheme at my previous job. Also, the agency where I now worked pay me a cut of my annual salary at the beginning of the year, and It was ₦900k at the time. I really liked that.

Fair enough.

I had job security locked down, so I thought it was time to focus on something I had always wanted.

What was that?

Investments. My dad always said that he regretted not investing more when he was younger and hoped his kids would do better. By the end of 2016, I started to give investments a go.

What was the first thing you invested in?

Two hectares of farmland in the outskirts of the city. The whole thing cost ₦3.2m, but I paid an advance payment of ₦1.7m. Subsequently, I paid ₦100k every month until I finished paying for it. I missed a couple of months, so it wasn’t until earlier this year that I completed the payment.

After buying the farmland, my sights turned to crypto. I heard about bitcoin for the first time in 2016 and thought I should get into it. One bitcoin was trading at $800 – $1000 at the time, and I bought one bitcoin. This cost me about ₦450k. A couple of months later, there was a bull run. When the price of bitcoin hit $3k, I sold half of it and held on to the rest.

At the height of the bull run, one bitcoin was trading for more than $20k. Then the bull run ended sometime in 2017, but I decided not to sell. The price of bitcoin started dropping but I still held on to it, hoping it would go back up. I panicked when it dropped to $10k, sold the remaining half, and got $5k from it.

What did you do with the money?

I put it in a mutual fund account. The total amount I had in the mutual funds was $10k. I had put in my 13th-month salary the previous year, the ₦900k lump sum payment I got at the beginning of the year and some of my savings into it.

Things were rough for a couple of months after that.

What happened?

I had a few health challenges. My health insurance package couldn’t cover the service I needed, so I upgraded my plan. My salary took a hit and was reduced to ₦210k.

I got pregnant in October 2017 and gave birth to my son in June 2018. Thankfully, we spent almost nothing on that because of my health insurance. My husband and I had also been saving ₦50k every month from the moment we found out that I was pregnant, so that took care of all the kid’s supplies and stuff.

I was on maternity leave for four months and returned to work towards the end of 2018. There was only one thing on my mind when I returned.

What was that?

Getting promoted. I was due for promotion after three years, and I was looking forward to it. That didn’t happen in 2019, but something else did. I realised that my marriage wasn’t going to work.

Uh-oh.

I started thinking about my options — to move into a new apartment or not. I couldn’t afford rent on my salary, so I decided to stay at the house. My ex-husband and I had an agreement that we were only cohabitating, and it worked. I contemplated taking a federal housing loan, but my dad advised me to buy land and start building my own house.

We found a plot of land for ₦6m. I liquidated some money from my mutual fund account, my dad loaned me ₦3m, and I paid for the land.

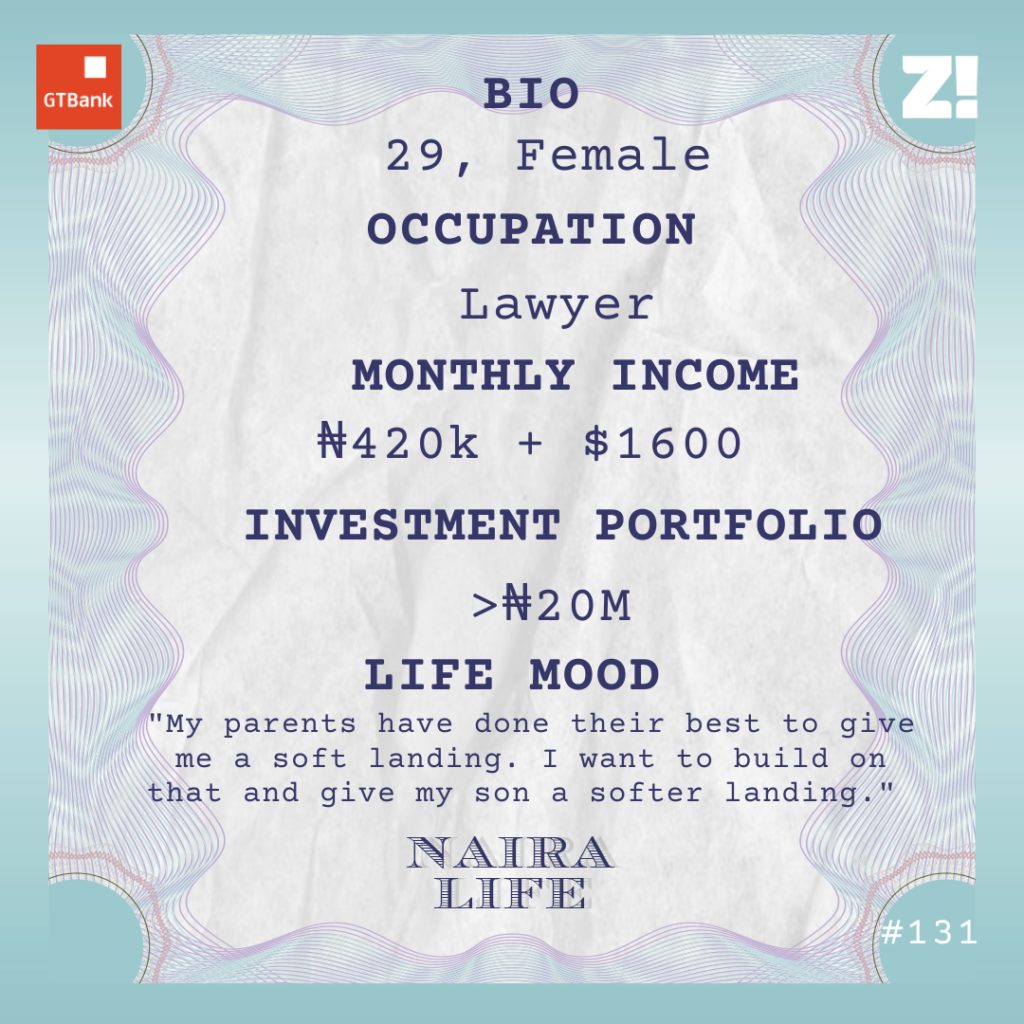

Here’s the thing: I bought the land because I was banking on my promotion. I planned all my finances around it. I was finally promoted in October 2020 after months of lobbying and politicking. My gross salary increased to ₦600k but my net was ₦420k. Now, I thought I could start building on the land I bought, but then the Lekki shooting happened. Like that, I couldn’t see myself raising my son in Nigeria anymore. I shelved the plan to build the house and started investing in relocating to Canada.

Two other interesting things happened in 2020: a colleague who knew I liked to invest money gave me an idea to build a student hostel in a neighbourhood close to a university. I got a plot of land for ₦500k, which was pretty cheap. By the end of 2020, I had spent an additional ₦1.7m on early foundation work for the building.

Also, I got a remote job with a law firm in the US.

Yay. How did that happen?

It became clear that I needed an extra job when they wouldn’t promote me at work. I told my friends that I needed help finding a new job. A friend who went to law school in New York recommended me to the law firm he was working for. Luckily, they were expanding at the time. I did the interview and was offered employment in September 2020. $15/hour. I did 66 hours in my first month.

Mad. What about the hostel you were building?

My mum came to me in January 2021 and told me that I wouldn’t finish building it on time at the pace I was working with. She offered to come in and take over the project. I agreed to it and both of us started injecting money into it. We finished building it in May 2021, and it ended up being a 16-room building. When I calculated how much money we spent on it, I realised that my mum had spent ₦7m and I had spent more than ₦4m. The budget was less than that, but inflation affected everything.

How did you raise the money you needed?

From different savings and investments sources. Remember I said my workplace pays me a lump sum at the beginning of each year? The money increased to ₦1.8m after my promotion. It went straight into my savings when I got it, and I didn’t use it until the project.

When I got my remote job in September 2020 and started earning in October, I was saving the money into my domiciliary account for my proof of funds. After I submitted my relocation application in March 2021, I took $3k out of the account and channelled it into the building project. Also, I added my remote job salaries for April and May.

I got some more money from another investment, although it was very risky. In 2020, I took a ₦750k loan from the bank. The dollar was trading at about ₦380, and I converted the money into dollars and invested it in a forex scheme. For six months, they paid me $300 — 15% of the $2k I put in it, and I saved each payout. I was supposed to get my capital back at the end of the 6-month cycle, but it didn’t happen. At the end of the cycle, I had $1800. Luckily, a dollar was trading at ₦400+ already, so I didn’t really make a loss. What I made from this also went into finishing the hostel.

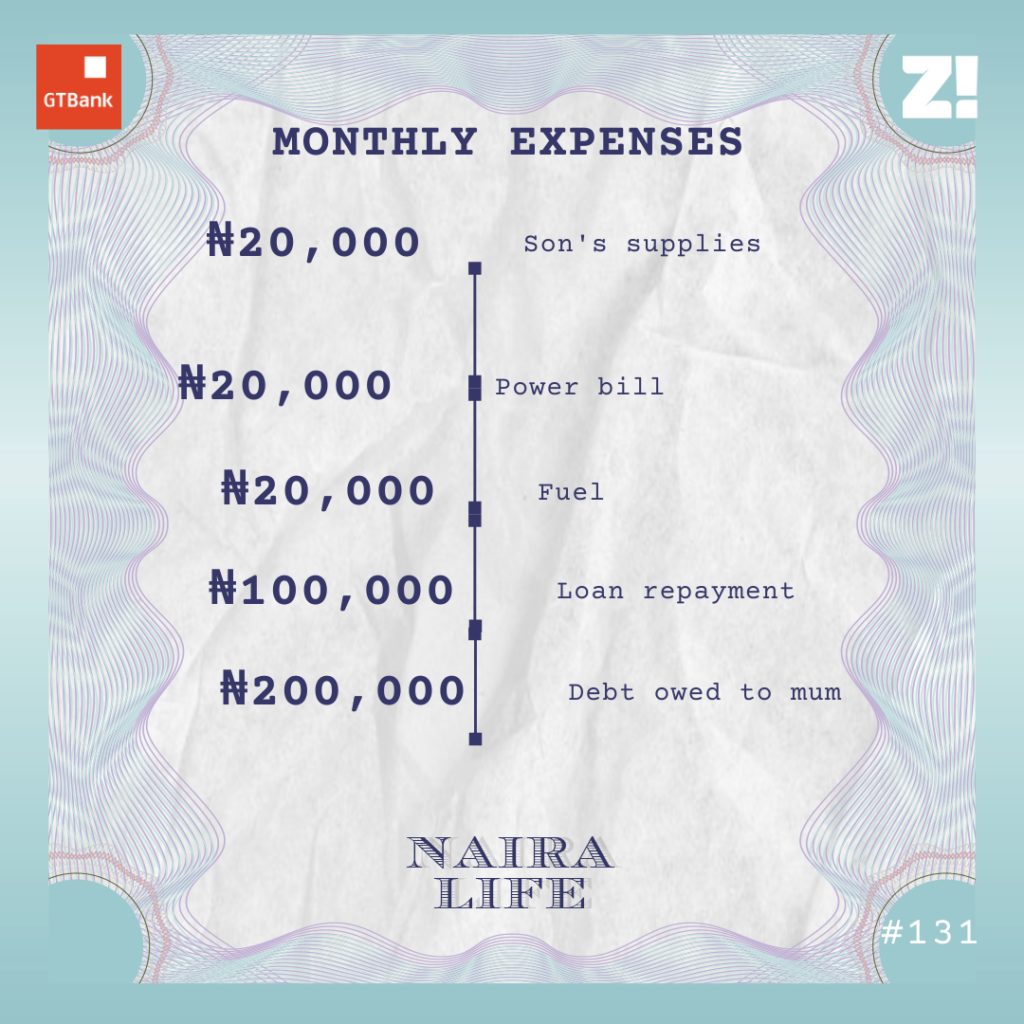

We finished the project in May, and I had to figure out how to pay my mum back the money she spent. We rented each room out for ₦150k, and we agreed that the money we make from rent will go to my mum for two years. Also, I’d be paying her ₦200k for 11 months.d I’ve started doing that already.

Interesting. What has happened between then and now?

The law firm I’m working for in the US increased my wages from $16 to $20 per hour. On average, I work 80 hours per month, so I earn about $1600 extra every month. However, I don’t touch the money — it goes straight into my proof of funds account. My dad loaned me ₦5m for that too. I have $11k in it right now, so I guess that’s covered.

I moved out of my ex-husband’s house in May. We had a fight, and I decided that I couldn’t live with him anymore. I called my parents and told them that I was coming back home, and that was it.

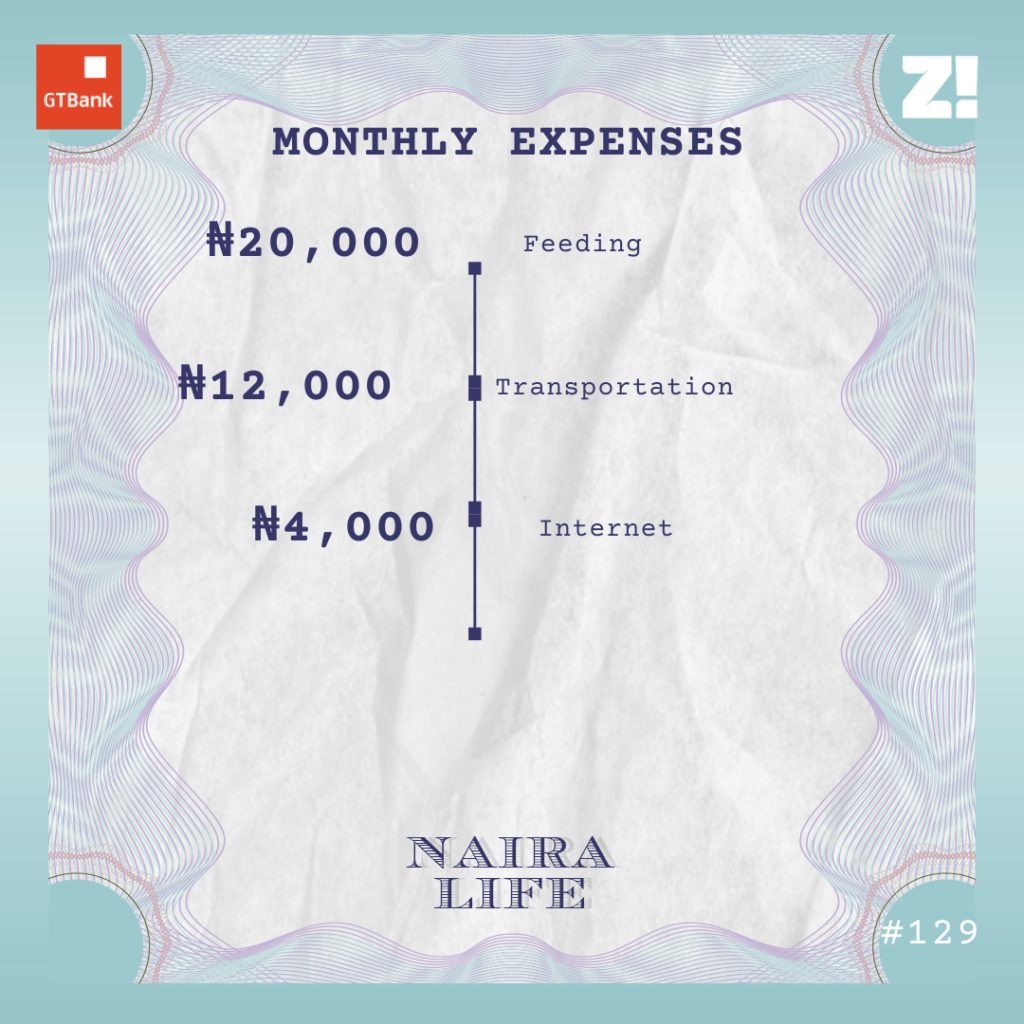

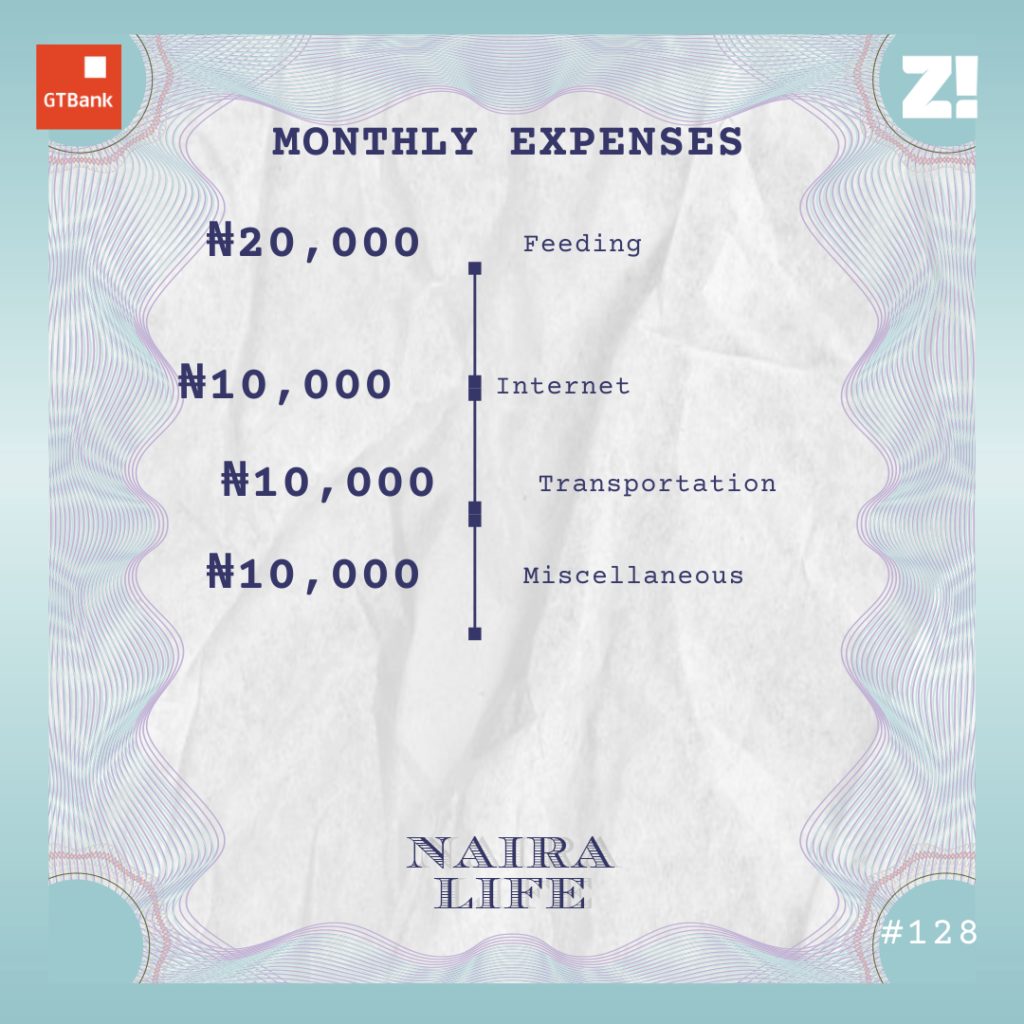

Speaking of, what does your monthly running cost currently look like?

I returned to investing in crypto earlier this year and took a ₦1m QuickCredit loan from GTB. I invested all of it in crypto and have been paying the bank ₦100k every month. I know the market is still as volatile as ever. During the height of the recent bull run, I had about $6k in my wallet, now it’s $4500. I don’t care what happens to it in the short term. I’ve been here before, so I’m going to hold my position.

Hoping it works out. So what are all your real estate investments worth now?

I haven’t valued the properties recently, so I only know about how much I put into them.

Two hectares farmland: ₦3.2m

One plot of land: ₦6.5m

16-room student hostel: ₦15m

How have all of your experiences with investment shaped your perspective about money?

It’s extremely important to have money, but it should be seen as a tool to shape your life and your legacy. Money should always have a goal. My parents have done and are still doing their best to give me a soft landing. I want to build on that and give my son a softer landing.

My goal is to build something for my son and ensure that he has things that will always bring him money. That’s the way I think about what I earn and what I invest in. I also think I punch above my weight a lot, but it’s going to be worth it in the end.

I get that. Is there something you want but can’t afford?

A house. I don’t have a problem living with my parents, but sometimes, I want to have my own space. I don’t want to rent a house in Nigeria before I leave for Canada. I have land I can start a building project on, but I can’t afford to start that right now. I’m doing too much already.

On a scale of 1-10, how would you rate your financial happiness?

6. I wish I didn’t have to put so much time into working and making money. Also, most of my investments haven’t brought me money yet. But I understand that they are long-term investments, so I’m not in a rush. When the returns start coming in, I can expect to move to an 8.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld