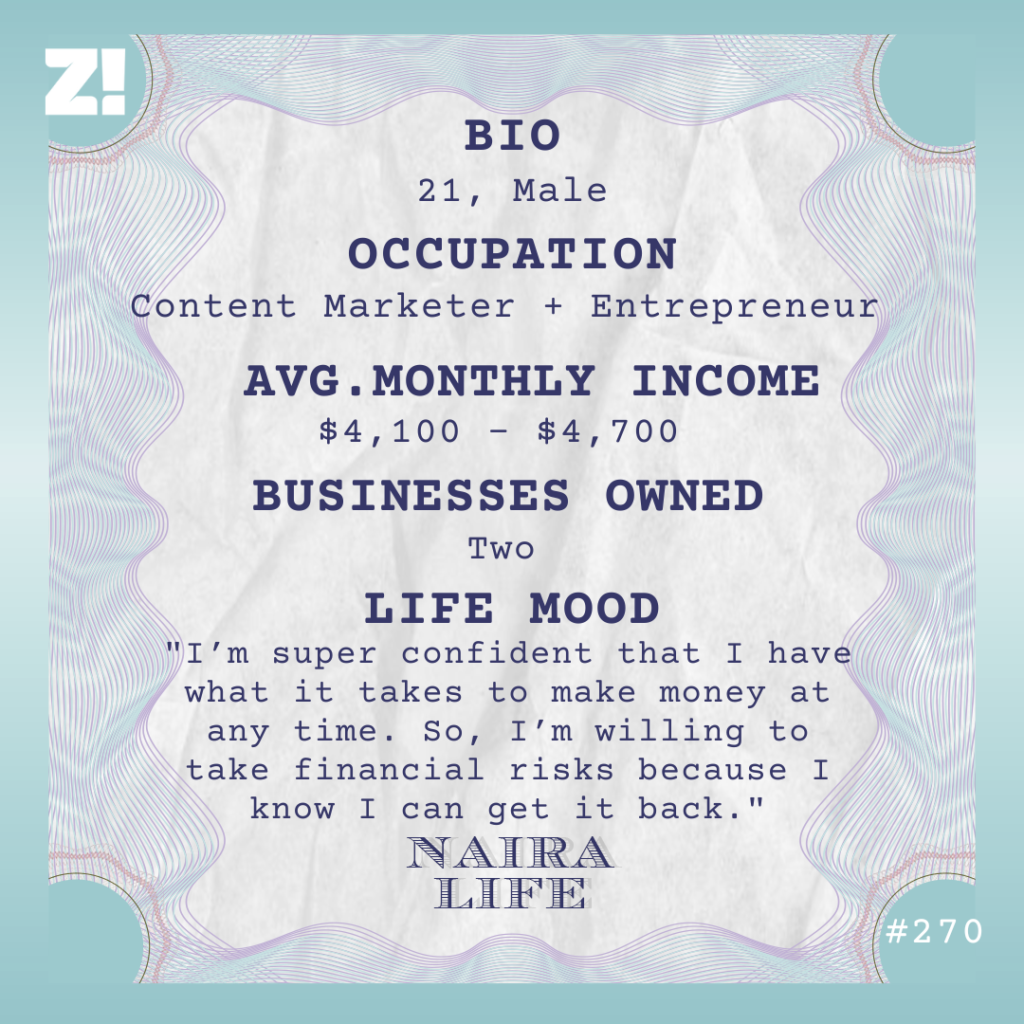

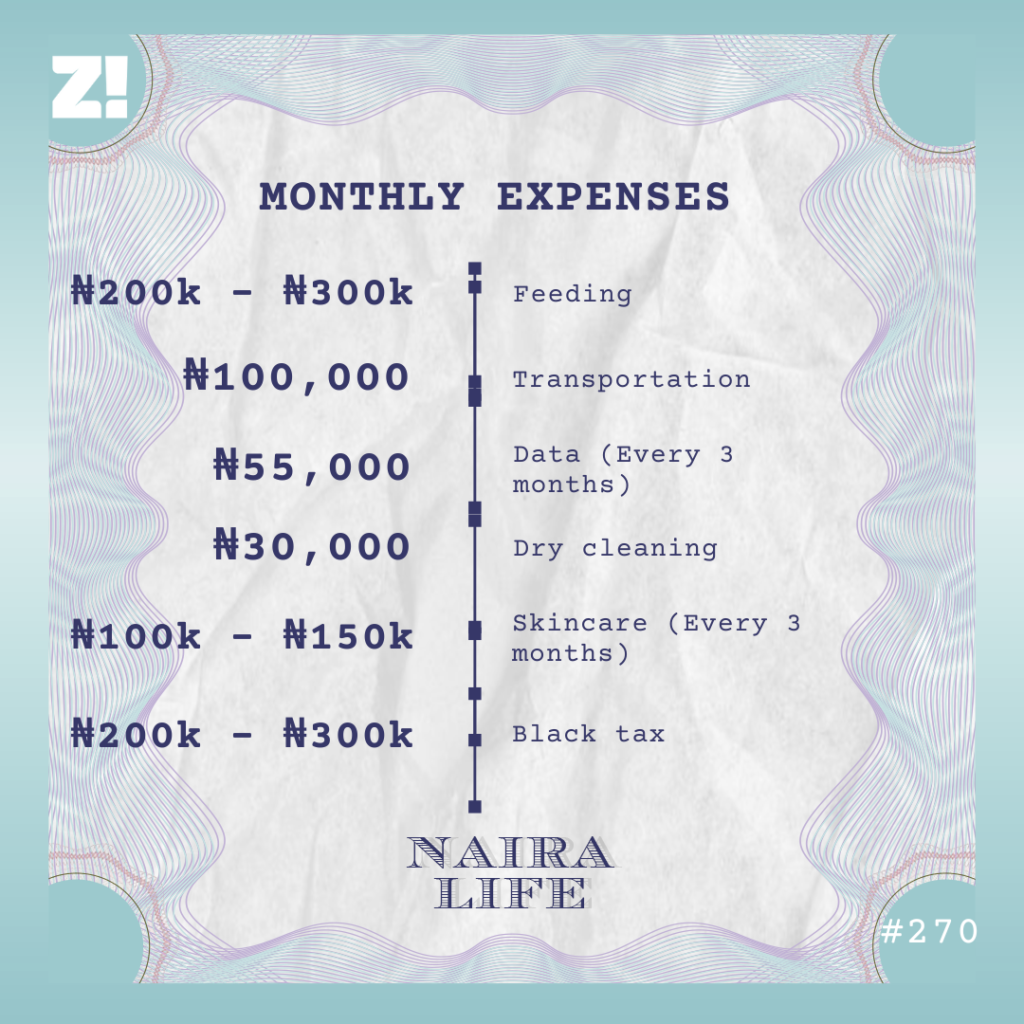

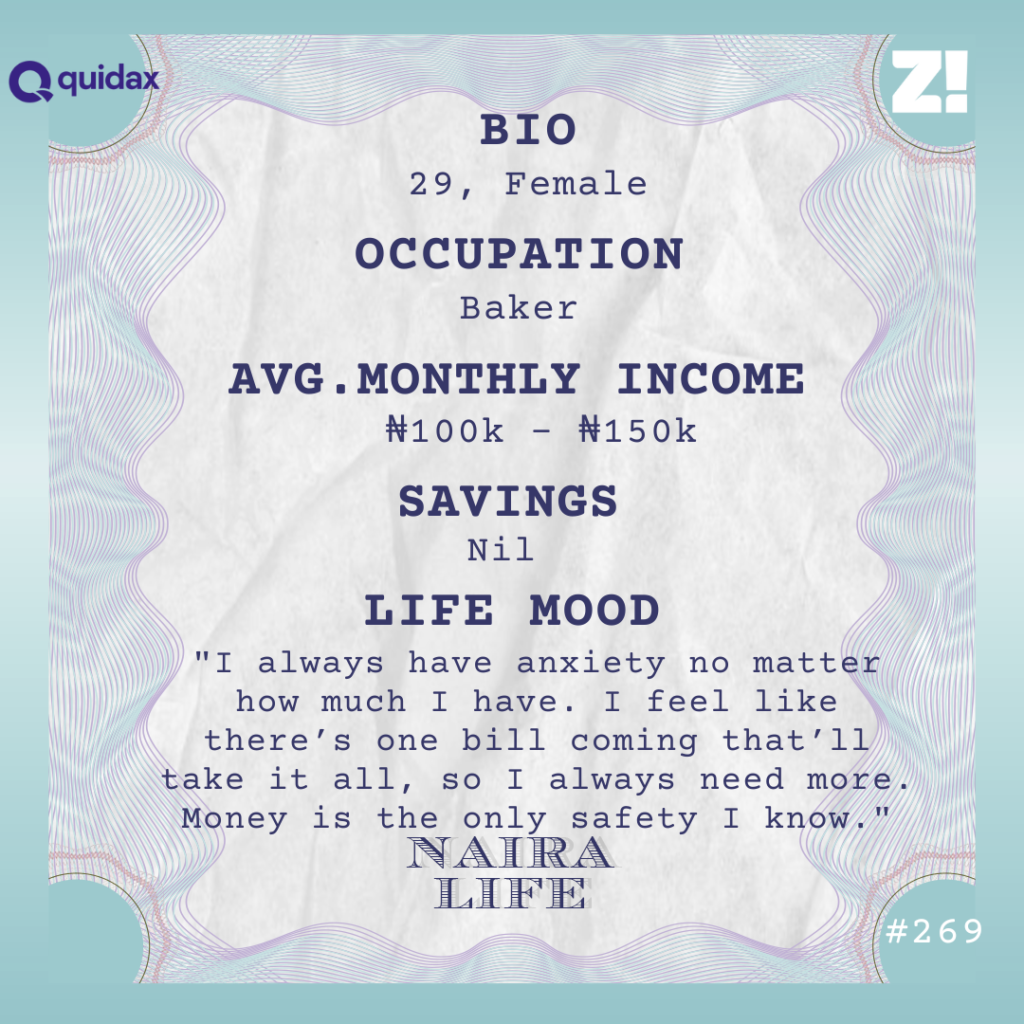

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I hawked okpa from morning till noon. When I got home, the money in my money bag was ₦100. All the okpa I sold that day should’ve been like ₦500. Maale — my mother — beat me that day, ehn. I was around 9 years old at that time. I already had small sense. I don’t know how I miscalculated the money.

Why did you hawk okpa, though?

Na hustle o. My father died when I was four years old and maale was the only one providing for me and my younger brother.

On that day, my school sent me home because I owed school fees, and I went to maale’s okpa stand to cry and complain. I don’t even know why I was crying. I didn’t like school like that. Maybe I had plans with my friends that day.

Maale vexed and packed okpa on a tray and put it on my head. She said I should also go and see what it’s like to make money. I sold everything at a nearby motor park, but those wicked people cheated me. After that, maale didn’t allow me to sell her okpa again.

I still helped with her other hustles, though. She also washed clothes for people and cooked sometimes. So, after school, I’d help her fetch water, rinse clothes and even go to the market.

What other things did you do to make money?

In JSS 3, I started pounding fufu with some other guys at a restaurant every morning before school. This was 2014. I’d start work around 7 a.m. and then rush off to school. Highest, one hour and I was done with the fufu. The restaurant owner used to pay me ₦200 every day I worked.

When I first started, I used to pound the fufu with my uniform so I could just rush to school. But I tried to talk to a girl I liked in school one day and she started squeezing her nose like I was smelling. I went to the back of the class and smelled my armpit. Omo, I was smelling like one-week-old fufu. Nobody taught me before I started wearing a singlet to pound the fufu before changing into my uniform.

Haha. What were you spending the money you made on?

Mostly school. Maale stopped giving me transport and food money because I was working, so I was providing for myself. I also bought food and clothes for my brother sometimes. Other times, maale would ask me to drop money for us to eat at night. The money was just going like that.

When I entered SS 1, I started helping the restaurant owner to transport drinks from their supplier twice a week. She had a big wheelbarrow I used to move the drinks, and she paid me ₦1k per week. That one only lasted for two months before I got into an accident and broke her drinks.

What happened?

The wheelbarrow and the load in it were too big for me; I was 14 years old. One aboki used to help the restaurant owner push the wheelbarrow, but they fought and he left. When I heard she was looking for someone else, I made mouth that I could do it.

But I lost control of the wheelbarrow while trying to avoid water on the road. Wahala. I didn’t even go back to the restaurant because she’d have asked me to pay. I think she later settled with maale.

What did you do next?

I started hanging around with the area boys at the motor park. I’d befriended one during my days at the restaurant and he sometimes dashed me ₦500. He used to help the transport buses load passengers, and I thought he was a big boy. Only big boys can be dashing people money like that.

I’d go to the park during the weekends and help to load passengers, too. You know all those boys who stand some distance from the bus to ask people walking around with bags where they’re going? That’s what I was doing. I was mostly helping my friend, so he used to share his money with me. Sometimes, I’d make like ₦2k daily.

When I finished secondary school in 2017, I started going to the park every day. Maale didn’t like it. She said I was becoming rough like the other boys. But if I didn’t act rough, the other boys would drag my passengers.

How much were you making this time?

Between ₦4k – ₦5k daily, depending on how hard I hustled for passengers. There were many boys in the park, so the drivers just dropped money after their bus filled up, and we’d all share it.

But that job no easy o. You have to stand for hours and shout up and down. You also have to fight a lot with everybody: The drivers when they don’t want to pay after loading, the other boys who try to drag your passengers, and even the passengers sef.

One time, one lady slapped me because I tried to drag her bag to the bus I was loading. It’s not her fault sha. Na condition make crayfish bend.

How long did you work at the park?

I worked there till 2019. By then, I was already thinking if that was what I wanted to use my life to do. My brother was already in the polytechnic. My head doesn’t carry book like that, so I didn’t want to go to school. But I couldn’t be loading passengers forever.

Thankfully, I knew a mechanic who trained people, so I went to him and he said I should bring ₦80k to learn for a year. He told me this in 2018, so I started saving money for it. By 2019, I had the money but it got stolen in the same week I wanted to pay the mechanic.

Damn. How did that happen?

It was my fault. I saved the money in a kolo, but I didn’t hide the kolo at home because I didn’t want maale to know I had money, so she wouldn’t ask me to borrow her. I hid the kolo in my friend’s room because I usually slept there sometimes. He must’ve found it because the kolo disappeared.

He denied it, but there was no one else who could’ve taken it. I couldn’t fight him because he moved with cultists and I didn’t want wahala.

Sorry about that. What did you do next?

I just stopped going to the park. My mind was out of there because I thought I’d soon learn mechanic work.

After staying home for two months, maale suggested I should learn a trade under someone instead. At least that way, I wouldn’t have to pay money to learn, and my oga would settle me after I finished learning.

So, in 2020, I moved to Lagos to serve my oga who sells imported furniture. Maale had discussed it with him, I think he’s a relative of one of her friends. I’ve been learning the trade since then.

What’s the arrangement like?

We arranged that I’d serve him as an apprentice for seven years and then he’d settle me with ₦5m and a shop, so I can start my own business.

It’s not in every case that your oga tells you how much he’ll settle you with, though. Some just settle you based on how you work. But I think that happens to people who become apprentices as small boys. I was already 19 years old, so I wasn’t a small boy.

I’ve done almost four years out of the seven. But honestly, I don’t know if I want to stay till the end.

Why not?

I’m not sure my oga will keep to our agreement. In the time I’ve been here, he’s settled only one person after the apprentice reported to his family in the village. The guy had served for almost 13 years, and my oga didn’t show any sign of releasing him. He eventually settled him with ₦3m. When he rents a shop, how much will remain?

I currently serve with four other apprentices, and two of them have been here longer than the initially agreed period. According to them, oga is blaming the economy as the reason why he hasn’t settled them.

It’s not just the economy; the man is stingy on his own. He doesn’t pay any of us a salary. Yes, that’s normal in this system, but he barely feeds us, too. We’re only sure of breakfast because we live in his house. The apprentices get home late at night because we have to close the warehouse, and by then, every other person has eaten dinner. Sometimes you see food, sometimes you don’t see anything.

But how do you survive without a salary?

The other apprentices and I usually “pad” the price of items in the shop to make a profit. For example, my oga can say we should sell a centre table for ₦500k, and we add ₦20k to it and share the gain among ourselves. Sometimes I can make ₦50k/month, depending on how well the market moves.

Oga doesn’t really care how much you sell the furniture as long as his money is complete. We don’t do that when he’s in the warehouse sha. But he’s been around a lot lately, and I’ve not really been making money. Now I struggle to get ₦20k in a month.

Do you know why your oga is around more now?

Market has been really bad since Tinubu became president, especially with how the dollar has been going up and down. Before, my oga regularly travelled to China and Turkey for goods, but in 2023, he only travelled twice. People don’t have money to buy imported furniture again. I think my oga even wants to branch into local furniture.

Another reason why I want to leave is I don’t even think I’m learning anything. My oga keeps details of how he imports the goods to himself. I somehow understand him sha. I heard that one of his former apprentices stole some of his China contacts and customers and went on to start his own business. But how come I’ve been here for four years and I only know how to check for high-quality pieces and price them?

Do you have any plans for if you eventually leave?

I’ll probably drive keke for some years to gather money. I know many keke drivers and some of them make up to ₦30k a day. When I’m ready, I can contact any of them to link me up with someone who wants to give out their keke on hire purchase. That’s when someone buys a keke and gives it to a driver to use. Then the driver pays the keke owner every week till they pay the full price (and interest) for the keke.

After I’ve saved enough money, I can think of starting a business — maybe a tyre business or electronics. I hear there’s money there. I just need something that’ll give me money. My brother doesn’t have a stable job even though he has graduated since. I usually send money home to him and maale, but it doesn’t even reach anywhere. I need to make money so maale will rest small.

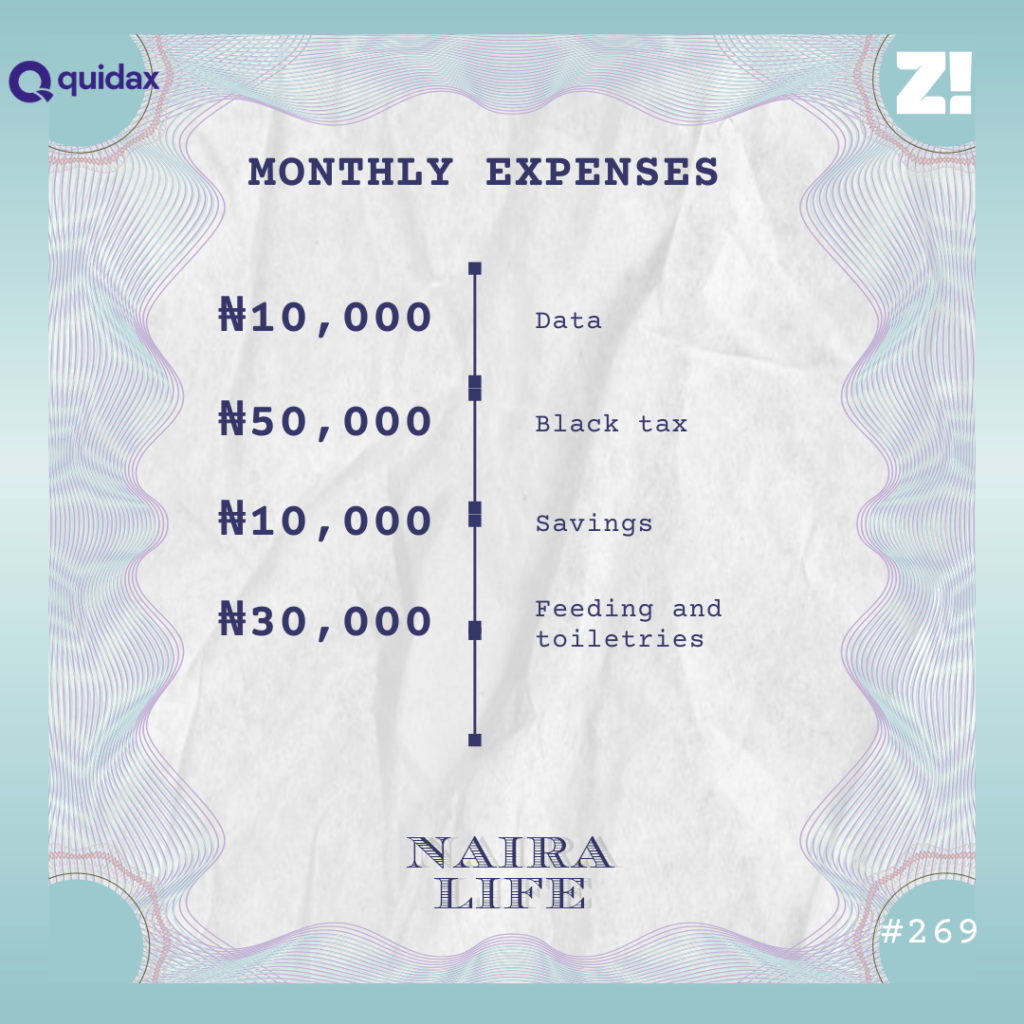

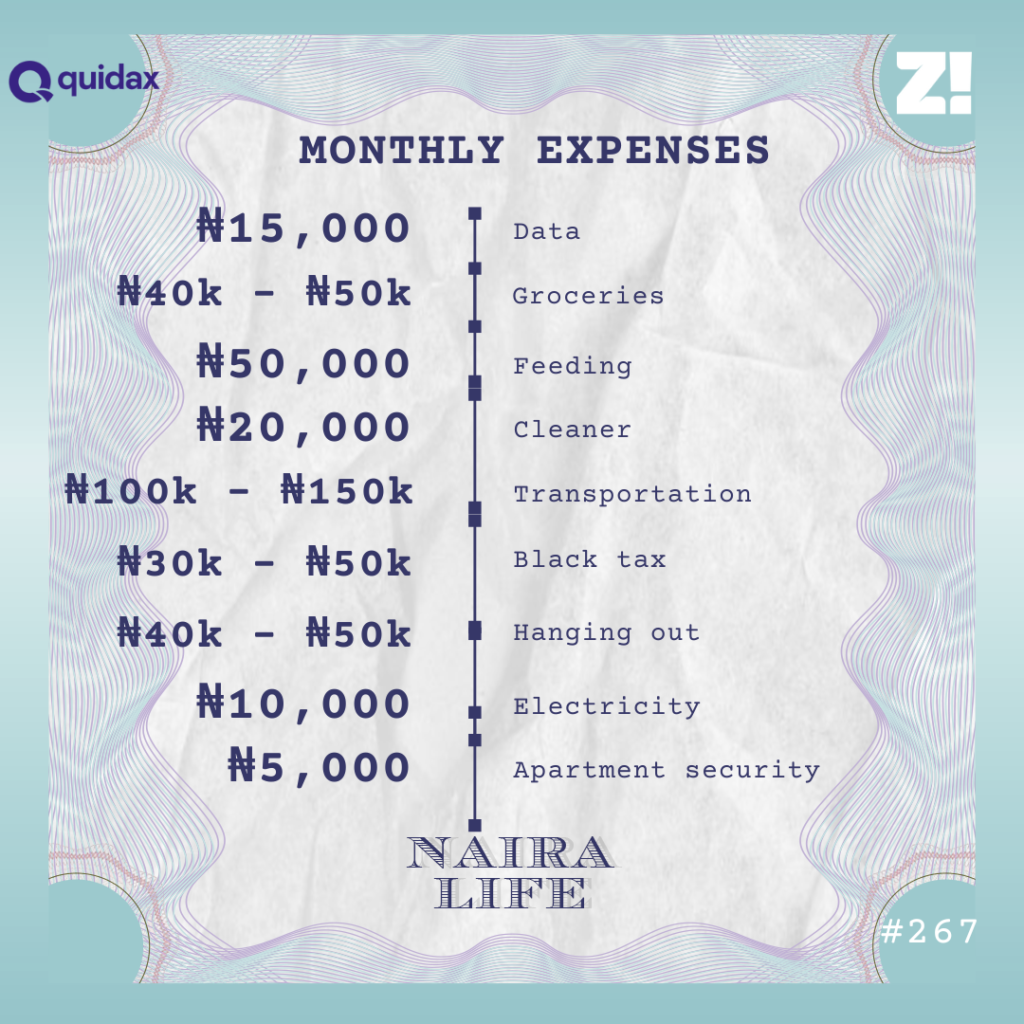

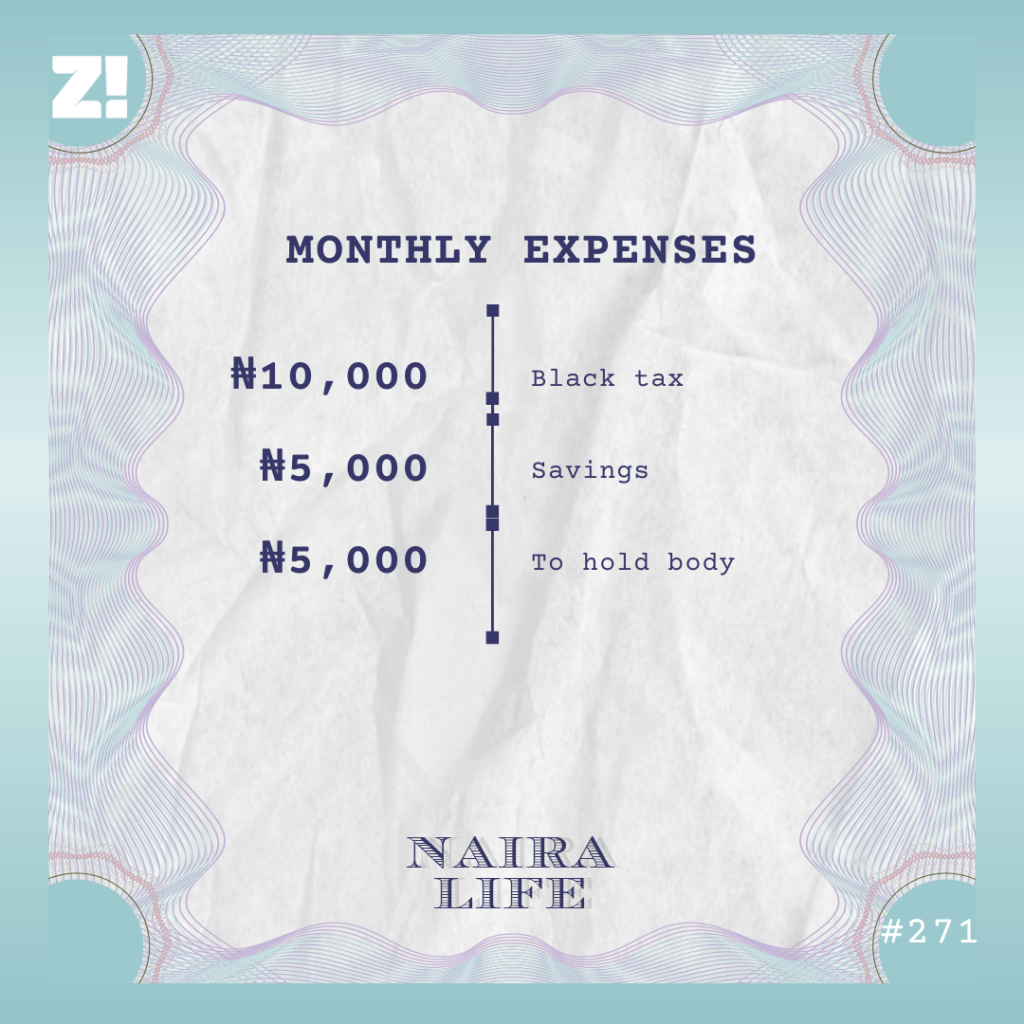

How do you break down your expenses in a typical month?

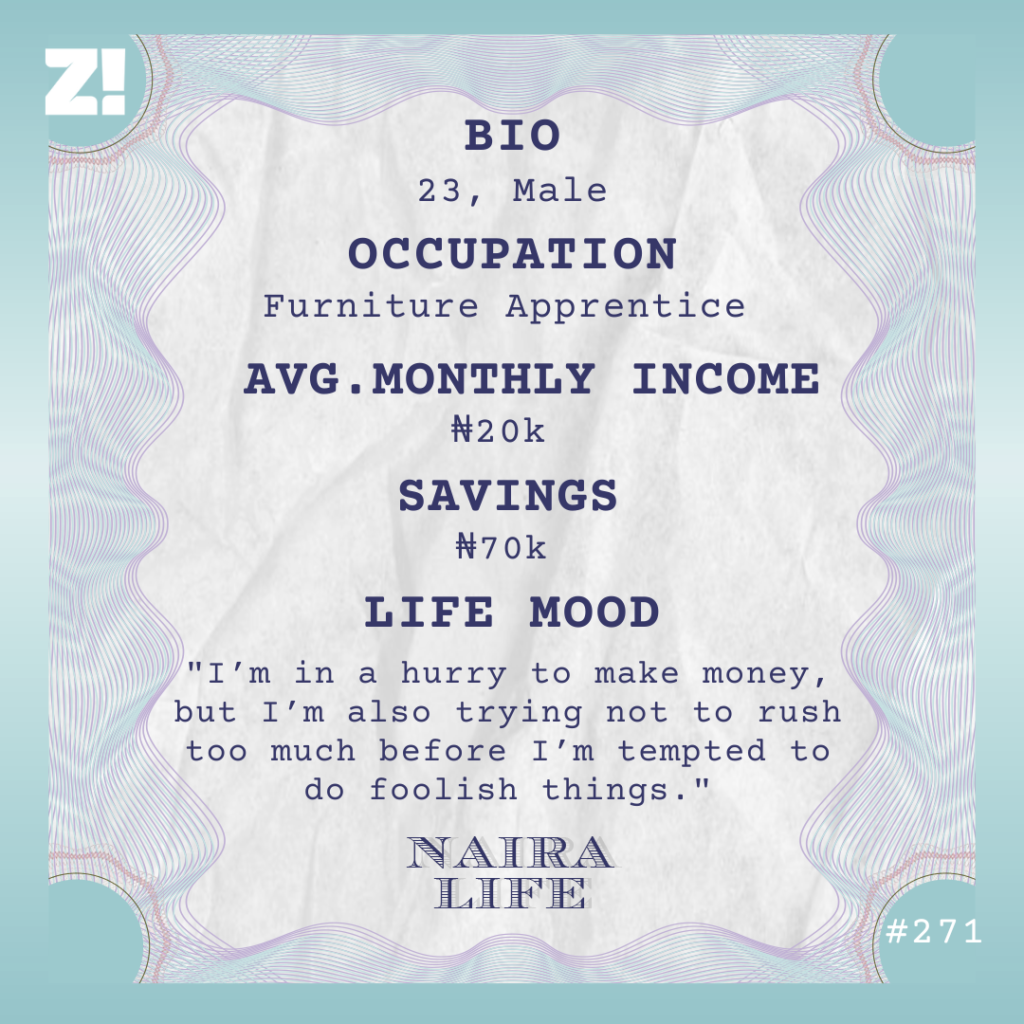

I try to save at least ₦5k monthly in case they call me for emergency at home. I have a bank account now, sha. I can’t save in kolo again. Right now, my savings is around ₦70k.

What’s a recent emergency need you had to settle?

One part of the roof of our house in the village collapsed around April. The roof wasn’t too okay before, but it finally scattered after one small rain. I had to send ₦50k home so they could patch it small.

How would you describe your relationship with money?

Ah. That one is still far. I need to make the money before we start to know each other. But with the plans I have, I feel like I’ll touch money soon.

I’m also trying not to compare myself to other young people who are making it. I’m in a hurry to make money, but I’m also trying not to rush too much before I’m tempted to do foolish things.

What’s something you wish you could be better at financially?

Taking risks. One of my friends recently bet ₦1k on a betting platform and won like ₦100k. I’m too afraid of losing my money to try that type of thing.

How would you rate your financial happiness on a scale of 1 – 10?

2. My journey is still far but I thank God for life.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]