Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When was the first time you made money?

I worked as a childminder — an assistant class teacher — at a nursery school when I was 16. The school paid me ₦7k/month to look after the children and help with their school work. This was 2012, and I’d just graduated from secondary school. I took the job so I could reduce the time I spent at home.

Why’s that?

My parents often fought about money. Our financial situation wasn’t even terrible — my mum was a teacher and my dad was a lecturer — they just hardly agreed on what to do with money.

For instance, my dad would talk about saving money to pay school fees and house rent, but my mum didn’t think that should stop us from going out to eateries and parties on Saturdays. Then I started hearing my mum say my dad was hiding money so he wouldn’t have to spend it on what he called “unnecessary things.”

It was always one thing at home, and after secondary school, I had to get out and try to forge my own path.

Did your first job help you do that?

The job helped me earn a living and build a sense of responsibility. My parents still provided for me, but I had something to call my own. I even gave my siblings money sometimes. I also saved, but I usually spent it on food. I wasn’t keeping track of my expenses either.

When I got admitted into the university in 2014, I quit teaching and moved to the south for uni, which was a long way from home. My parents usually sent me ₦15k as my total allowance for a whole semester.

How did you survive on that?

I had an aunt who I called for financial assistance when I got broke, which was often.

In 300 level, I decided to start a business. I think ASUU had declared another strike, and I needed to start something that’d bring me money. That’s how I started selling ankara fabrics in 2017.

How did the business work?

I used about ₦5k to start. I’d buy two yards of ankara at ₦1k and sell for ₦1500 or ₦1800. My primary customers were my friends and classmates, but I also gave some of the fabric to someone who sold provisions in school to help me sell. That turned out to be a good idea because I soon expanded to buying six yards. She’d sell at a markup and remit the remaining money to me. I made between ₦3k – ₦4k in profits weekly.

Not bad

I also started a palm oil storage business that year; I heard it was lucrative. A village close to my school had several oil mills, so I used the profit I made from selling ankara to buy six gallons of palm oil at ₦4k each.

The trick was to buy in January when palm oil was cheap and store it till September when it becomes expensive. By September, I sold each gallon at ₦16k.

There was already a market for it so it was quite straightforward. I just took the oil to a depot that Hausa traders frequented. The traders brought in yam and potatoes to sell and they bought palm oil to take back to the north.

I did both businesses till I graduated from uni in 2019.

Would you say you made good money?

I was comfortable. Just before final year, I moved to an off-campus accommodation and paid the ₦84k annual rent myself. I was essentially taking care of myself; I didn’t disturb anyone for money and no one disturbed me.

That’s the dream, TBH

After graduation, I stayed back in the south. The COVID lockdown met me there the following year. I couldn’t sell ankara because of the restricted movement, so I decided on a new business idea: sex toys.

How?

I discovered a need. Before the lockdown, I heard stories from my mum about one family or the other having sex-related issues. You’d hear one aunty had never had an orgasm and was sexually dissatisfied in her marriage. Anytime I went home, my mum and her friends would swap stories like that.

When lockdown came, it was like sex was all people could talk about online and offline. So, I decided that pleasure was a need. My plan was to sell vibrators to married women so they’d at least get some satisfaction.

Married women?

Yes. Women were the ones suffering according to the stories I heard. Also, I felt married women were a market audience people hadn’t gotten into like that. Till now, the market still isn’t saturated.

How did you start the business?

I started by dropshipping for a sex toy company. I paid ₦10k to register as a reseller, which gave me access to their website for pictures and videos of their products. From there, I marketed the pictures on WhatsApp and put my own price. If someone signified interest, I’d buy the toy from the company at a discounted reseller’s price and keep the profit. The company was in charge of delivering the product to the customer. For instance, they could give me a vibrator at a reseller’s price of ₦12k and I’d sell for ₦20k – ₦22k.

I only sold one item for the company in the whole of 2020 sha. A wand vibrator that brought me a ₦5k profit.

Was it difficult to get customers?

The problem was the company. They hardly gave resellers good products. Customers would reach out to me for products but I couldn’t deliver. The company could just decide to refuse to sell, saying they’d finished selling that particular product to resellers and wanted to sell the remaining themselves. It was like they only left the worst products for resellers, and that wasn’t helping me.

Yikes. What did you do?

I stopped dropshipping for them in 2021 and decided to buy and market my own toys. In March, a friend gifted me $100 (about ₦50k) and I used it to buy my first set of toys — 13 pieces of vibrators, dildos and BDSM kits.

My plan was to run ads on Instagram so I wouldn’t depend on WhatsApp. I didn’t do that till around October because I changed cities and needed a few months to settle in.

Why did you change cities?

I was tired of where I was and wanted a change of environment. Plus, a friend offered to let me stay in one of their self-contained apartments for free, so it was a win-win.

Fast forward to October, I started reaching out to bloggers and Instagram influencers for ads. I paid ₦5k to one influencer, and ₦3k to another. That week, I made ₦150k in sales. Profit alone was about ₦100k.

That’s impressive

It was as if the whole city knew about me from those posts. That’s how my business kicked off. My main mode of marketing is still influencers, and I run ads continuously every month. In the early days, I spent about ₦15k monthly on the ads and made almost ten times that figure in sales.

I’m curious. Did you experience any challenges starting out?

Not really. My family knows I sell sex toys and everyone minds their business. I’ve even sold toys to my relatives. I hardly have issues with customers too. People love their sex toys, maybe even too much. They treat them like important items.

If I were to name a challenge, it’d be that people tend to abuse sex toys. I started with the intention of selling the toys to married people, but it’s mostly young people who buy them. They’d buy up to four or five toys at once and come back again the next month.

One time, I visited a friend and saw that she had eight vibrators. People buy several types to experiment with and toss them after a while. I mean, it’s good for business but it’s bad for them. Excessive usage like that can’t be healthy.

Oh, I didn’t mention I also started a decorative flower business in 2021.

Tell me more about that

I’m always on the lookout for business opportunities, and I stumbled on bonsai flowers. They’re used to decorate TV consoles and are imported from China. I made findings and started off buying small quantities from a supplier — like 20 at a time — and reselling.

At the time, each flower was ₦1k, and I sold to wholesalers at ₦1800 – ₦2000. I also created an Instagram page for the business. For retail customers, I could sell the flowers at any amount. I once sold four pieces at ₦5k each.

I got my big break in 2022 when my sugar daddy gave me ₦2.6m to invest in both my sex toy and flower businesses.

Woah. This is the first time you’re mentioning him

I met him through a friend during lockdown. He was the “friend” who allowed me to live in a free apartment. But I didn’t want to rely on anyone and wasn’t asking him for money. Living for free was enough for me. I just wanted to do my business and make money.

How he even gave me the ₦2.6m was funny. I’d given him some of the flowers, and he liked them. He asked if I could sell them on a larger scale, and I responded that I’d need at least 1000 pieces to start. Then he just announced that he’d give me the money. I used that money to buy 3000 flower pieces and about 100 sex toys in October 2022. Funny enough, we parted ways soon after.

That investment must’ve changed your income flow

It did. The thing about having so many products as a business owner is that you become more confident in your marketing. I think I cleared off that first bulk batch of flowers in seven weeks.

This is how it worked: I imported the pieces straight from China and stored them in a warehouse. Since I was buying so much, the cost price for each piece was ₦600. Clearance at the port was the same cost for each item. So, I also paid ₦600 for each item. That meant it cost me ₦1200 to bring one flower pot to Nigeria.

After I cleared the products, I started running ads on Instagram with influencers. Also, I sold mostly to wholesalers — people who could buy at least 400 pieces. The flower business is quite profitable in Nigeria o. I didn’t expect the turnover. I didn’t know so many people were into interior decor like that. I made about ₦3.2m in profit from the flowers in 2023.

That same year, I was finally able to afford to move into my dream two-bedroom apartment. That costs me ₦600k/year in rent.

Nice. So you run both businesses concurrently?

The flowers are like a side hustle. I imported only three times in 2023. It’s capital-intensive and clearance costs can be all over the place. I’ve not even imported anything this year. Right now, I work with a supplier in Lagos whenever someone reaches out wanting to buy them. So I just add a small profit on top and she sends it to them. It’s not regular and I don’t actively market so I can’t say I make a particular amount from it each month. My sex toy business brings in enough money for me.

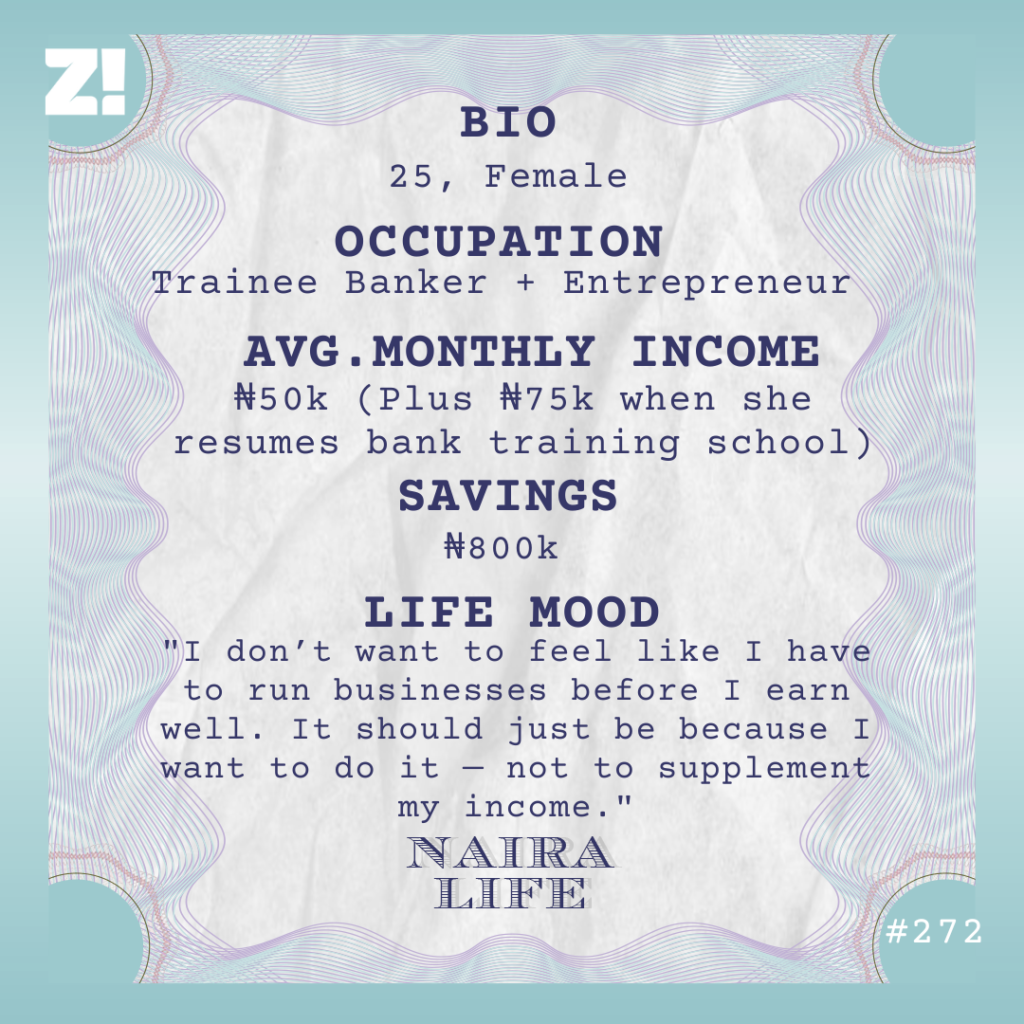

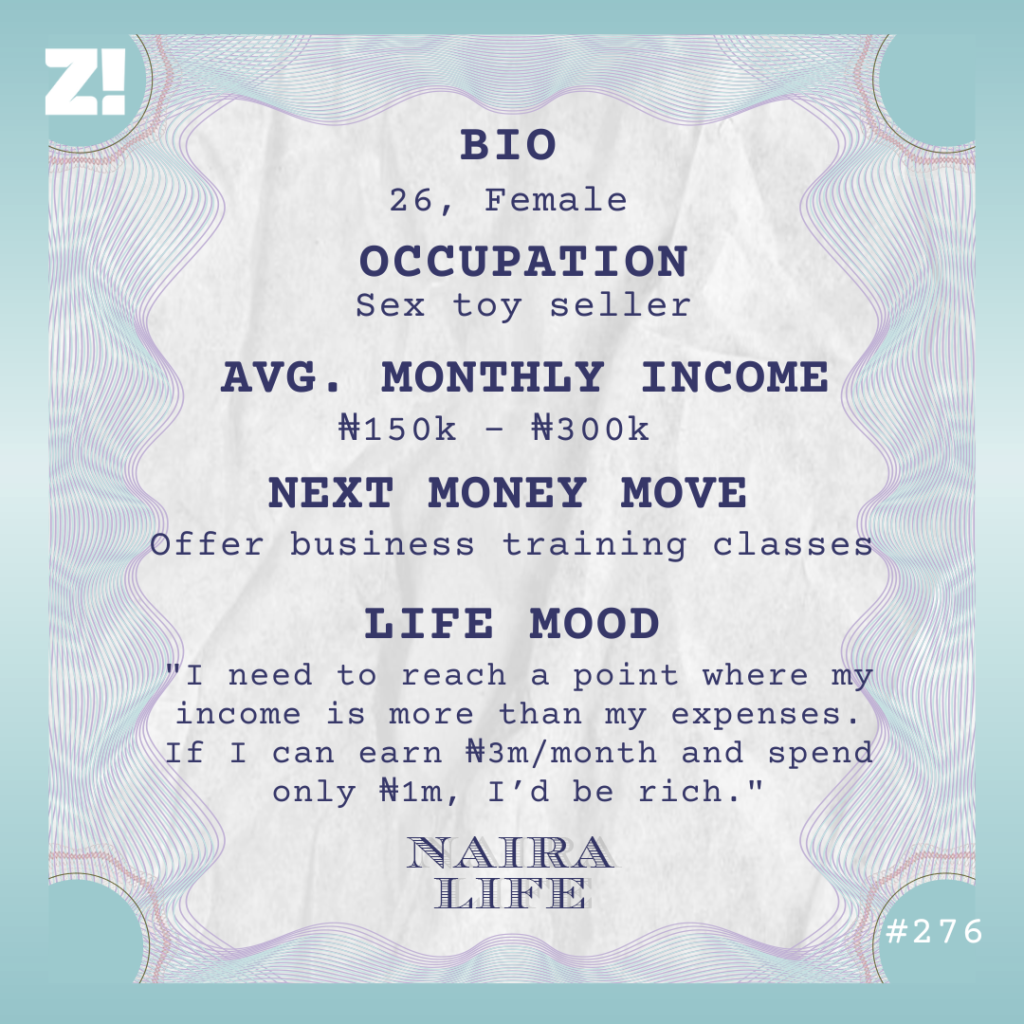

How much do you make on average from the toys?

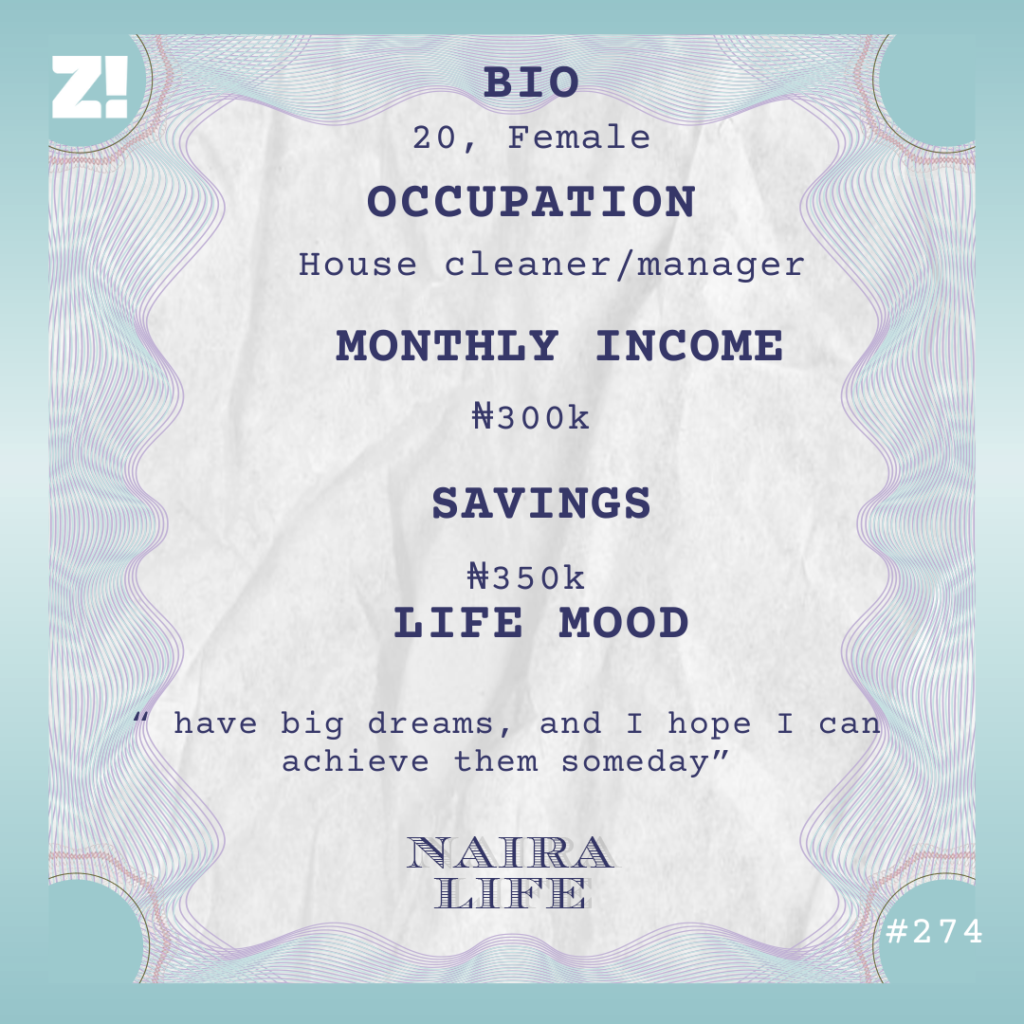

I comfortably make between ₦150k – ₦300k in profits monthly. ₦150k in a really bad month.

I’m currently in a good place with my finances. There’s a satisfaction that comes from knowing I can pay for most of the things I want. I can walk into an eatery and order food without first asking for the price. I can hang out with friends and travel — at least within Nigeria. But I’m okay.

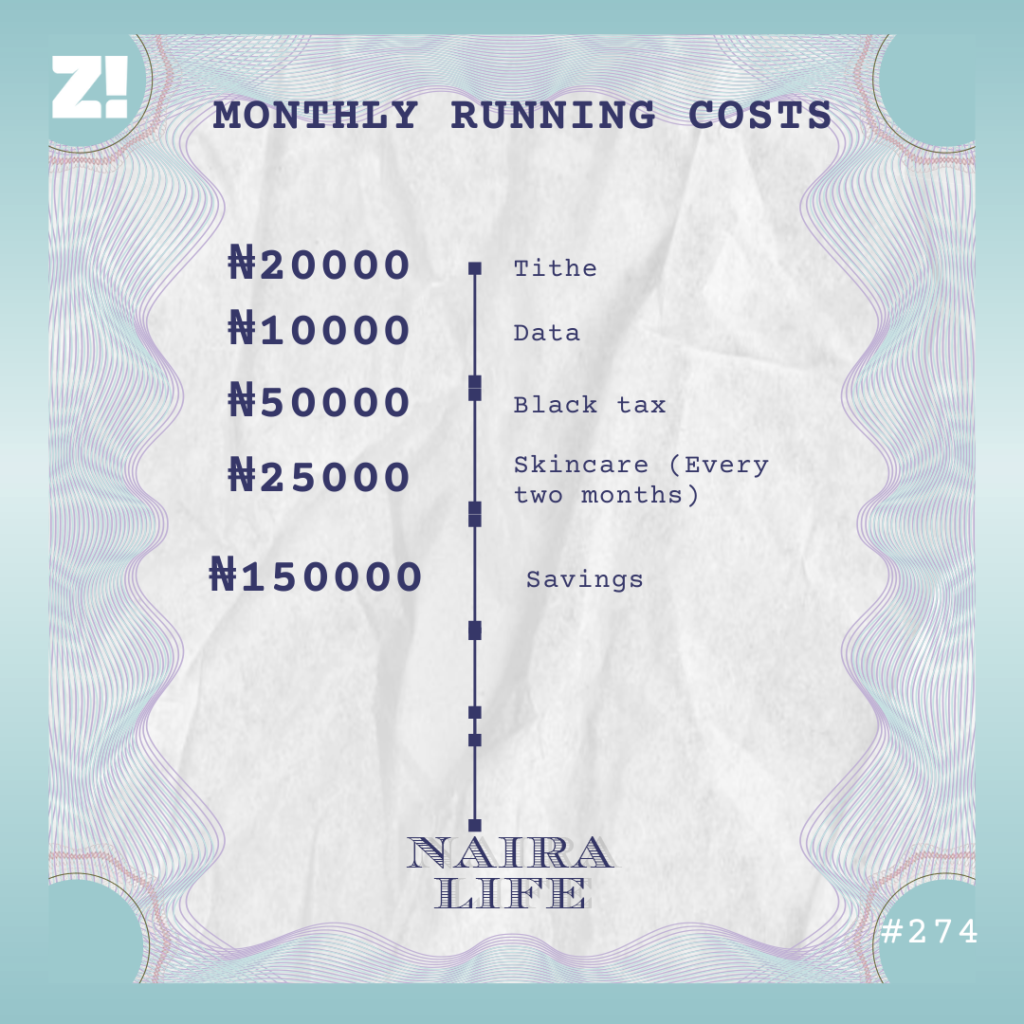

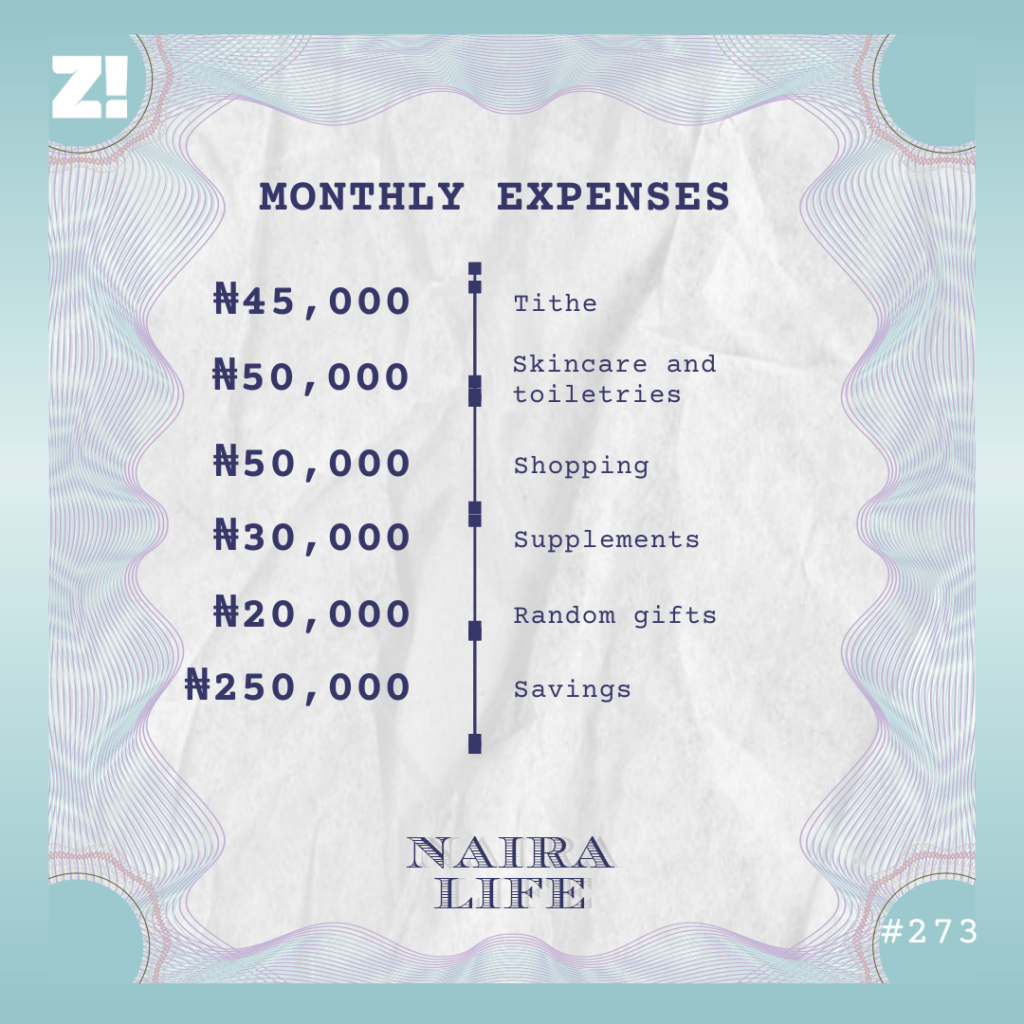

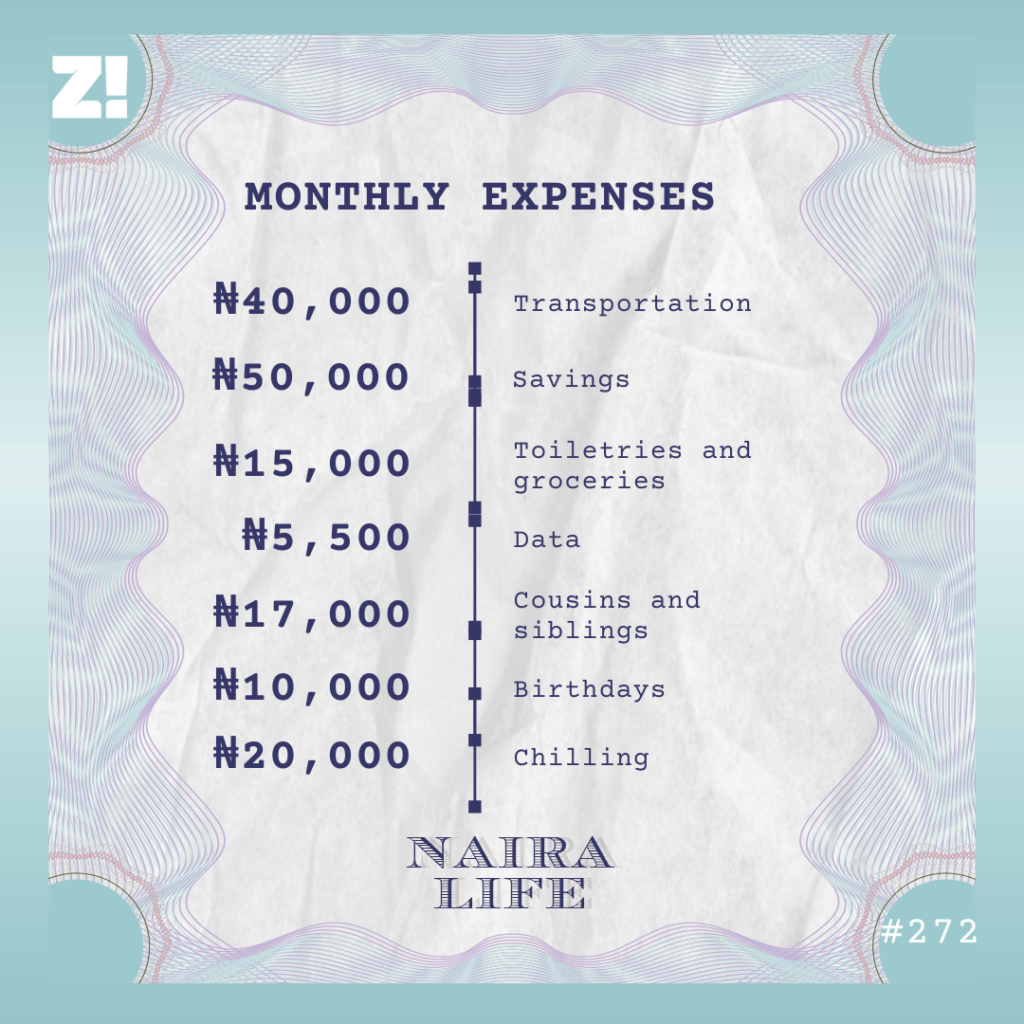

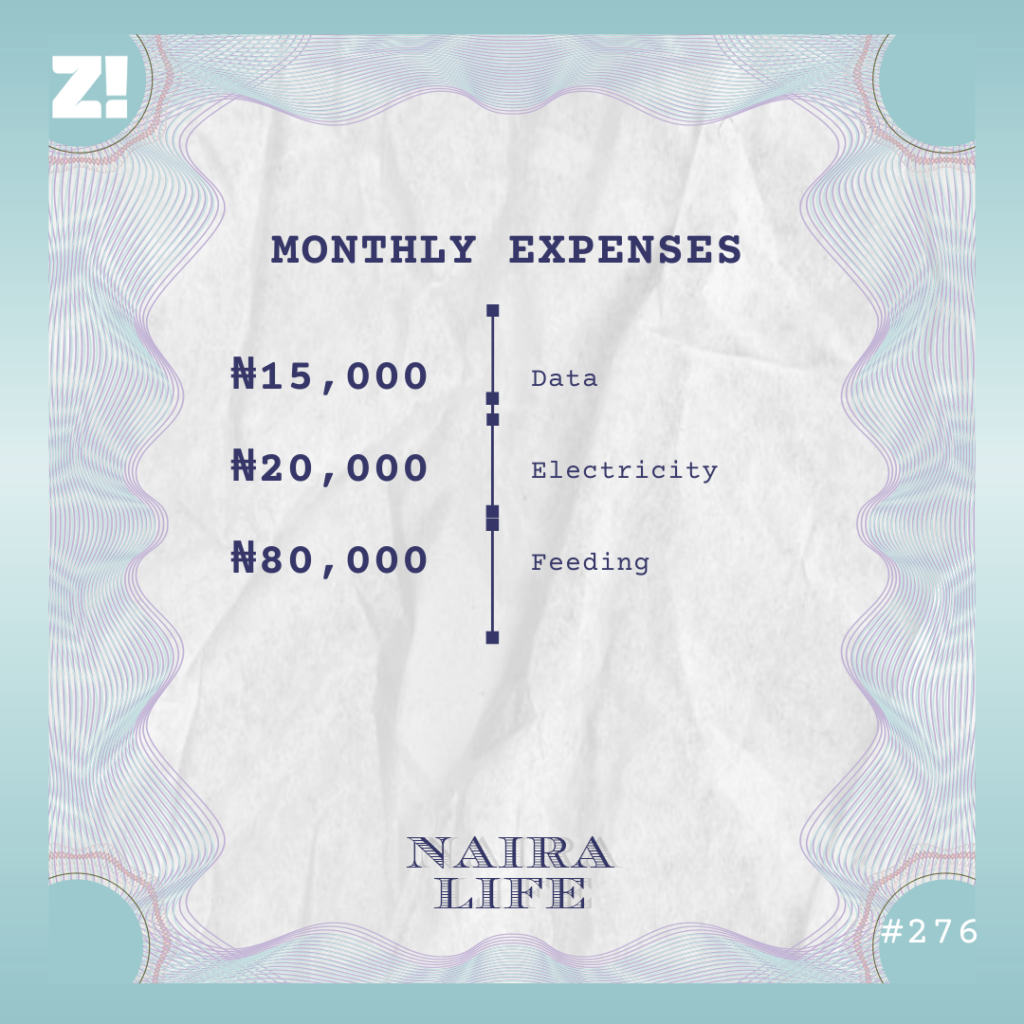

Can you break down what these expenses look like in a good month?

I’m always home, so I hardly spend on transportation. But I often host get-togethers to spend time with friends, and that increases my feeding expenses. That’s usually like an extra ₦80k. It’s not every month though.

Also, I don’t save. I’m always buying one product or the other for my business so I always need liquid cash.

What about black tax?

I rarely send money home unless it’s absolutely necessary. Maybe ₦5k here or ₦10k there. The most I’ve ever spent on black tax was ₦100k a few years ago when I paid my parent’s rent. I’ve realised that black tax isn’t always from a place of need, it’s usually from entitlement and greed.

I sent money home regularly when I first started making money, but I shut that down when it became too much for me. I noticed everyone was still fine without my money, so they’ll continue to be fine.

What’s the hardest part of running a sex toy business?

People treat the toys like food. What I mean is, someone would place an order right now and expect it to be delivered immediately. Some are ready to pay double the delivery fee just to get it immediately. I think it’s the state of mind people are in when they order an item. I constantly have to manage expectations.

Is it weird that that’s the only “difficult” side to the business?

Uhm —

It’s just a relatively easy business. I don’t even look for customers anymore. Sometimes, I spend only ₦3k in a month for influencer marketing and I still make sales. My customer base is mostly repeat purchases and referrals.

How would you describe your relationship with money?

I believe money is a spirit. If I don’t plan how I want to spend money before it enters, I may end up spending it on emergencies or impulse purchases. So, I try to plan and track my expenses to avoid that.

Also, I’m earning well, even though it sometimes feels like I’m not with how the economy moves these days. I need to reach a point where my income is more than my expenses. Maybe then, things will begin to make sense.

How much do you think you should be earning for that to happen?

At least ₦3m/month. I say this because, even though I don’t have that many expenses, I spend a lot on my business. I have to restock regularly and my money is tied down until I sell them. The thing with business is, you’re always buying. It’s sometimes difficult to separate business money and personal money. So, if I’m earning ₦3m and spending like ₦1m, I’d be rich.

Have you considered what you’d need to get to that figure?

I started offering business training classes this year. In fact, my first class is a few months away. I’m charging people ₦50k to teach them about the palm oil storage business, and I’ve gotten seven students so far. I should start running ads to get more students soon. I also plan to hold mini-importation and business foundation classes. Let me teach what I know how to do best, right?

Get it! Is there anything you’d like to be better at financially?

Knowing how to grow my money through investments, but I’ll still need money for that. I bought two plots of land for ₦1.3m in 2023 and they’re worth about ₦2.4m now. The land is close to a university and I know I can make good money if I build on it. It’s that or I turn it into a farm. But these are plans for the future.

Is there anything you want but can’t afford right now?

A phone so I can have a separate business phone. It’s very difficult using one phone for both business and personal life because of the tons of messages and calls I get. I’m considering an iPhone 12, but that’s like ₦530k.

How would you rate your financial happiness on a scale of 1-10?

8. Maybe by the time I start the training classes and make small additional money, it’d be a 10. Ask me again in October.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]