Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

When did you first realise the importance of money?

Around the time I was in secondary school. I attended a boarding school that allowed parents to put money into the bursary for their children. The money came in handy when we needed extra supplies like snacks or a haircut.

The arrangement made me realise the power of money. Some students went to the tuck shop often to buy snacks, while others rarely did because their parents couldn’t afford it.

What side did you fall under?

I had everything I needed in school. My family was financially comfortable. My dad, a medical doctor, ran his own small clinic, and my mum was a journalist.

They also founded an NGO on the side, and then they resigned to face its operations fully. I’m not sure how much leaving paid employment to run the NGO impacted our finances, or if it did at all. I just knew my needs were met. They still run the NGO today, and it’s solid.

Interesting. Tell me about the first thing you did to earn money

That was in uni. I studied in the US, and there were opportunities for students to work on campus. I started working in the IT department in my first year, helping students fix computer issues. I had a natural knack for computers, so it was work I enjoyed.

How much did it pay?

I can’t remember. 2005 was so long ago. All I know is that I used to get my pay via computer-generated pay cheques in my mailbox. Then I’d deposit the cheques into my bank account.

I did a handful of other jobs in uni, including tutoring at the academic support centre. My pay wasn’t my primary income, though. My parents covered most of my living expenses and school needs. My partial scholarship covered half the tuition, and my parents paid the rest.

In 2009, I graduated from my undergraduate programme and started a one-year internship at an NGO. My pay was between $10 and $15 per hour; I can’t remember the exact amount. My parents still supported me financially, but my income meant I could pay my phone bills, buy groceries, and entertain myself without any trouble.

What happened after the internship ended?

I applied for a master’s programme. During my programme, I worked with my school’s international study centre on campus. My pay was a little above $15/hour.

Unfortunately, I struggled academically and couldn’t complete the degree. I had to put my studies on hold after struggling to complete the programme for almost three years. I had family in the US, so I went to stay with my uncle for a bit to figure out what I wanted to do. I also returned to work at the NGO where I’d interned while I considered my next steps.

Around 2013/2014, I decided to try another master’s programme. I applied to a different university and got in.

Were things better the second time around?

Not really. I think my problem was similar to what many academically gifted students face. You finish your first degree top of your class, then you go to a different school and realise it’s not the same everywhere. There are different materials, different requirements and contexts.

I came from a smaller school, and was now trying to make it in bigger schools. The academics were more rigorous and demanded a lot of internal motivation. It was a learning curve for me, and I was just trying to keep up. Towards the end of the second master’s attempt, I took a break and returned to Nigeria for my NYSC in 2015; after the service year, I returned to the US to complete the programme.

Was there a specific reason you came for your NYSC at that point?

It was a case of, “My academics aren’t going smoothly right now. Let me use the opportunity to do something else.”

During my service year, I taught at a government school. The ₦19800/month stipend was practically impossible to survive on, so again, my family supported me. I also did some of my coursework and final assignments during NYSC, so when I returned to the US in 2017, it was just to graduate.

What happened next?

I returned to Nigeria. Permanently, this time.

I just stifled the urge to shout “ah”. Why did you return, though?

I realised I’d been running from home for too long. I thought coming back meant I’d failed. You know, the idea is usually to leave and not return. But when I returned for my NYSC, I realised it wasn’t the end of the world. I could start again in Nigeria and see how it goes.

Interesting. What was the plan after you returned?

I got a job with a recycling company. I worked in business development and earned about ₦70k/month. My salary wasn’t commensurate with my experience, but I wanted the experience. Also, I believed in the company’s mission, so I figured I could sacrifice some pay to do good work.

Unfortunately, even the small pay didn’t come regularly. Sometimes, they’d delay for months. Other times, the salary didn’t come at all. It wasn’t sustainable, so I left after a year and moved to a logistics company. My role there was also business development, and my new salary was double my old one. However, I only worked there for three months.

Why so short?

It was a step up in a way, but it didn’t feel like what I was supposed to do. I wasn’t sure what my passion was, but I knew it wasn’t in logistics. Also, I lived on the mainland, and the commute to work was long. I was spending all my salary on transport fare and all my time in traffic.

After leaving my job, I joined my parents’ NGO in 2018. I still work there today.

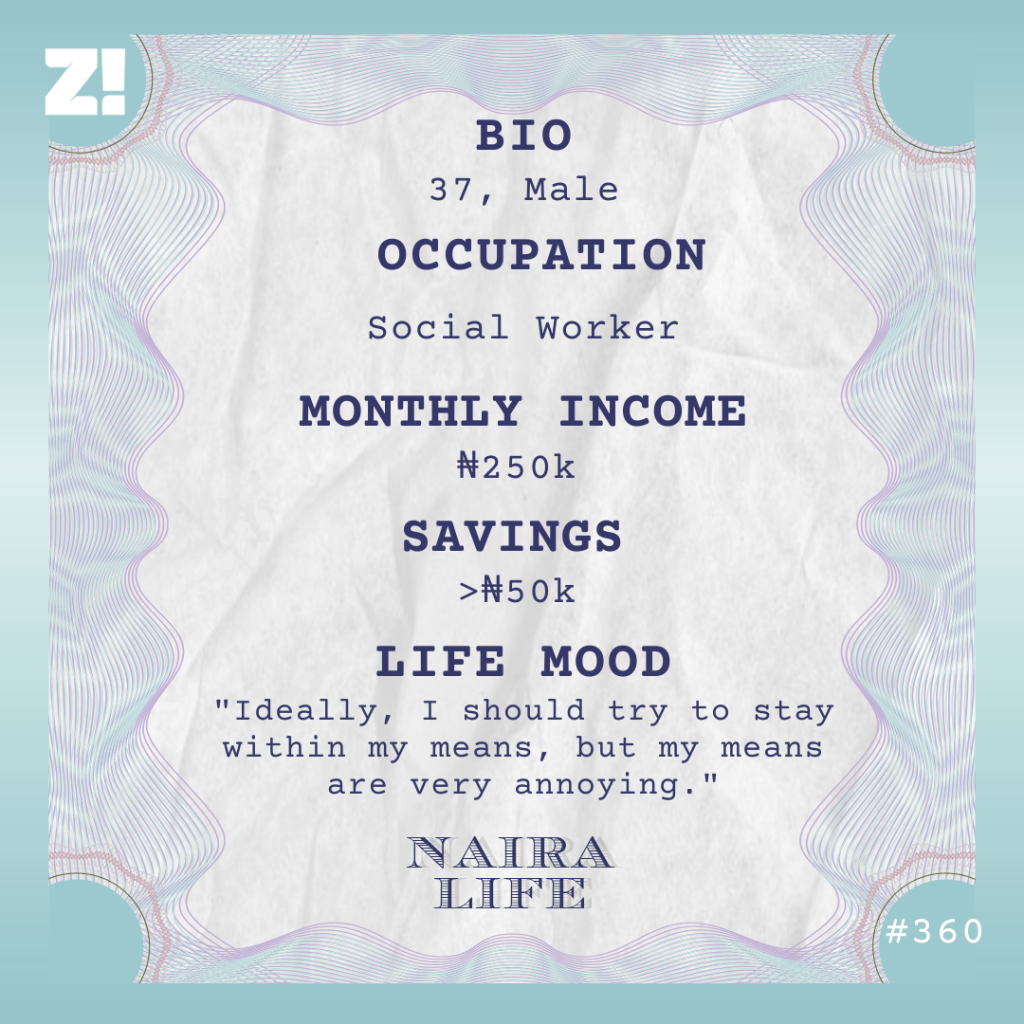

I’ve gone from media intern to media and documentation officer, and then became a programme officer in 2025. Currently, my salary is ₦250k/month.

That’s about 8 years. Would you say you’ve found your passion now?

I’ve always wanted to do work that contributes to community development, sustainability and impacts people’s lives, so I’d say my current line of work aligns with that.

I plan to build my own social enterprise soon. I intend to focus on youth entrepreneurship and development, and make it the next big thing in Lagos. In fact, I recently pitched it publicly for the first time, and I’m looking to begin operations by the end of the year.

That sounds exciting. Is the plan to juggle it with your current job?

Not exactly. I’m hoping to fully focus on it by 2027. There’s a chance the enterprise wouldn’t have grown enough to pay me a salary by then, but we’ll see when we get there. Besides, the work is about changing lives, not exactly about making a profit.

Right. How has your career trajectory and income over the years impacted how you think about money?

I’d say my actual income growth doesn’t match my qualifications at all. If I go based on the fact that I have two American degrees, I should be earning a lot more than I do.

On the other hand, I understand I’m earning this low because of the missed opportunities and challenges I had. Also, my earning power took a dip when I returned to Nigeria. There are times when I think about what would have been if I’d gone corporate from the start, rather than the NGO and sustainability route.

My first degree was in business, and I could’ve done an MBA and maybe got a doctorate in Business Administration. Instead, I switched to public administration for my first master’s attempt, then to urban affairs for my second. I would definitely be making more money if I’d stuck to the initial plan.

My parents sometimes say things like, “You’re not earning what you should be earning.” When they say that, I jokingly go, “Ehn why don’t you pay me what I should be earning?” I understand what they mean, and I think about it, but it is what it is.

Do you ever regret returning to Nigeria and taking this path?

There was more regret in the early years after I returned, but I’m now in a better place and attribute it to life’s journey. Things happened the way they did, and it’s just a matter of learning from the situation.

What kind of life does your income afford you?

It’s tough, really. I can’t do so much with inflation and the cost of living going up all the time. I can’t lie, my parents still support me from time to time. I live with them, and while I wish the only thing I got from them was my salary, I still have to call on them sometimes.

Every three or four months, an emergency comes up, and I need their help. It could be that my car fails, or there’s a hospital bill that the health insurance doesn’t cover. I try to make sure it doesn’t happen often, but sometimes I don’t have a choice.

I had even tried living on my own once. I moved out in 2022, but the cost of rent, combined with the stress of living with strangers and neighbours, was too much. There were also some issues with my landlord. I lasted only a year before moving back in with my parents.

Out of curiosity: Did you feel like you were losing a form of independence by moving back in?

Oh definitely. It was great to leave the cost and stress of living with strangers behind, but I’m definitely looking forward to moving out again. Unfortunately, I can’t do that if I want to keep to the timeline of my social enterprise kicking off next year. I can’t run it and move out at the same time at my current income level.

How would you describe your relationship with money?

I live slightly above my means. In terms of the basics, I can feed and fuel my car to go to work and church. However, my life can’t just be about going to work, coming home and going to church. So, trying to live a well-rounded life beyond those three places is what always takes my money.

I like to do other things, like explore and spend time with my friends. Those things cost money and make it impossible to stay within my means. I usually have to resort to borrowing and taking small loans to meet daily expenses. I mean, ideally, I should try to stay within my means, but my means are very annoying.

How often do you borrow money?

It happens every month. It just comes down to “Who do I want to owe?” Do I want to owe my friends and family, or do I want to owe loan companies? Both come with their benefits and disadvantages.

With family and friends, there’s more flexibility in repayment terms, but then everyone is in your business. They can see you doing some things and be like, “Didn’t I lend you money to do this thing? Why are you doing that?”

But borrowing money from a loan company comes with anonymity. No one is on my case to spend money a certain way or criticising my every move. The only thing is, when it’s time to repay them, there’s no forgiveness. You either pay them on time or they embarrass you.

So, which do you typically go for?

Right now, I lean more towards the loan companies. I have more freedom with them. The only headache is the constant mental note that I have to repay on time or risk them calling all my contacts.

I’m almost always repaying a debt every month. I’m sure I have a credit record by now. Right now, I’m owing about ₦150k. I repay a part of my debt every month, but like clockwork, I’m taking out another loan around the 15th because I’m in the red.

I know the loan companies are fleecing me with their interest rates and making money off my back, but what option do I have? I can’t consistently go home for help and lose the freedom to make my own choices.

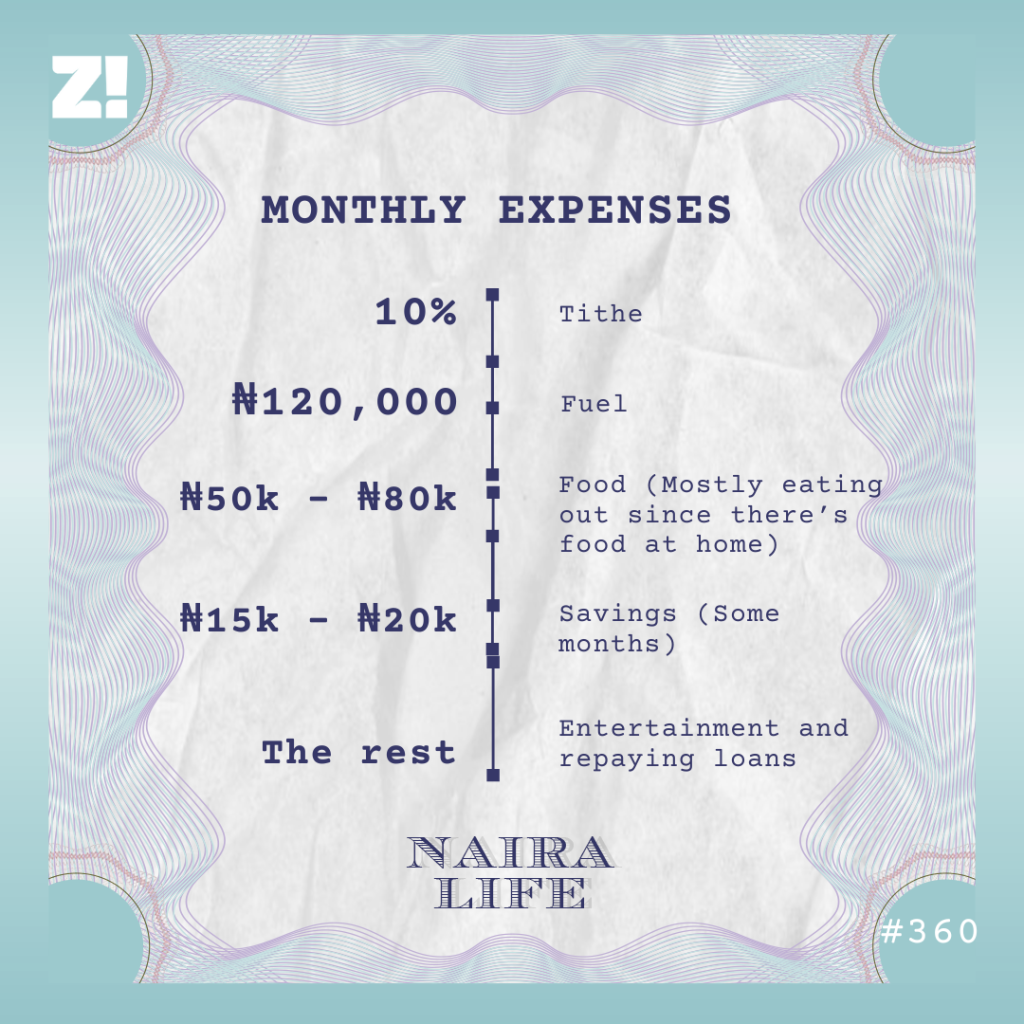

I guess that’s fair. Let’s break down your typical monthly expenses

Borrowing distorts the percentages because I work with what’s left after I pay off some debt. However, my big three expenses are car costs (fuel and maintenance), food and entertainment (eating out, watching movies and other stuff like that). If I were to break down the average cost, it would be:

You mentioned savings. What do they look like?

It’s really insignificant. I just put money in my savings app, and sometimes I buy stocks there too. Right now, I have just a little over ₦50k. I haven’t been consistent with my savings, but I’m trying to get better at it. I want to deliberately set aside a certain amount of money each month and build an emergency fund so I don’t have to go borrowing in the event of a big need.

Is there an ideal amount of money you think you should be earning right now?

I try not to think like that because then I’d calculate what I should be earning with my qualifications and feel sad. However, if we’re talking about a comfortable salary right now, I think it’s probably ₦400k or ₦450k/month. I’m sure I could reach that income level now, and it still wouldn’t be enough.

That’s so true. Is there anything you want right now but can’t afford?

Many things. It’d be nice to own a PlayStation 5 and a nicer car, but I have to deal with what I have.

What about the last thing you spent money on that made you happy?

The CAC registration of my social enterprise. That was in April 2025, and it cost me about ₦80k or ₦90k. It felt like the first step towards independence and finally taking life seriously.

I haven’t even told my parents about it yet. I want to have something set up before presenting my plan. I want them to see that I’ve already taken steps and figured things out without anyone’s input.

How would you rate your financial happiness on a scale of 1-10?

7. I recently started using an app to track my finances, and I think I’m beginning to get a better understanding of them. There’s still the problem of how to increase income inflows, but I think I have a better idea of what outflows look like.

I consider myself still at the beginning of my financial journey. I’m not earning to my full potential, and I don’t think I’ve made much progress in my career. That said, I feel like I’m taking a step in the right direction with my business, and we’ll see how that goes.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.