Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

Watching my classmates in primary school buy biscuits and snacks at lunchtime, and feeling left out because I couldn’t do the same. My parents always gave me home-cooked meals to take to school. Whenever I asked why I couldn’t buy biscuits in school, they’d go, “Oh, there’s no money”, or “Money has finished.”

What was the financial situation at home like growing up?

It was crazy. My parents were civil servants and worked with the local government. I have four older siblings, who were in secondary school and university. That meant that the already insufficient money mostly went to their education.

For context, my parents’ combined salaries were just about ₦30k/month. This was around 2013/2014, so it wasn’t that far back. We could barely afford the necessities. The most my dad could do was pay your school fees, while each child figured out the rest themselves.

Tough. Do you remember the first time you did something to earn money?

Yes. I was 14, and my dad gave me ₦70k for the WAEC registration fee to pay at the bank. He gave me the money on a Friday, so I left the money in my room, intending to take it to the bank on Monday. Monday came, and half of the money had disappeared.

When I told my dad, he said, “I gave you the money, so go and look for it.” But the money was gone. The only thing I could do was find a way to work and make it back.

Wait first. How did the money disappear?

A cousin was staying with us, and he was the only other person with access to my room. We asked him, but he denied it. My dad believed I had spent the money, so he told me to go find it myself.

I had to work as a labourer on a construction site for 10 days — earning between ₦3k and ₦5k daily — to make that money back and register for WAEC. The work was so stressful, and I’m not sure how I survived it.

The next opportunity to make money came during the waiting period between JAMB and university admission. I should’ve resumed uni in 2021/2022, but several strike-related delays pushed my resumption to 2023. While I waited, I tried my hand at several things.

Tell me about them

First, I taught for two terms in a primary school that paid me ₦7k/month. Next, I worked with an agency that placed me at a hotel. My salary was ₦20k/month, but the agency I came through took half of that for the first three months. Thankfully, I often made close to my salary in tips, so I didn’t really feel the difference. I worked there for 8 months.

After I left, I took up learning digital marketing and social media management. I found a couple of free courses online and just decided to give them a try. Three months into learning, I got my first client. The person paid me ₦10k plus a ₦2k monthly data stipend to manage their Facebook business page. I did that for about four months and left in August 2022. I resumed uni in January 2023.

Did you try to find other clients when you got into uni?

I didn’t. I realised digital marketing wasn’t my thing. I didn’t enjoy doing it, so I didn’t push for more work. Instead, I started learning how to code.

I actually started in November 2022 at a training centre. Tuition was about ₦350k, which I didn’t have. So, I came to an agreement with them instead: I’d work for them as a digital marketing tutor in exchange for my coding classes.

They agreed, and I sort of “speed learned” frontend and backend development in two months before I resumed school. I also watched a lot of YouTube tutorials. I learned really fast and actually enjoyed what I was doing.

I got to school, and everything changed.

How so?

Life happened. My dad had retired, and my brother was paying my school fees. There wasn’t enough money to go around, so I struggled to survive. I lived in a church because I couldn’t afford accommodation. I didn’t starve during that period because I’d help a church member out in her cyber cafe, and she’d buy me food.

Since I lived in a church, there was often no light and no internet. My phone, which I’d been holding together with rubber bands, also spoiled during that period. It was a lot. I didn’t even remember coding.

Thankfully, I found a ray of hope. I randomly helped a faculty officer fix a notification issue on her phone, and she said, “I’ll give you a job.” Right there, she connected me with her friend looking for a computer teacher for her kids. That job paid me ₦15k/month and was my primary source of income for most of 2023. The pay increased to ₦25k towards the end of the year.

Was that good money at the time?

Not really. It was better than nothing, but transportation costs often took up more than 50% of my pay. To be honest, I began considering learning Yahoo (internet fraud) at some point. I actually took steps to learn it during a three-week school break.

I contacted someone who was into it, and he told me to come to his house for lessons. Interestingly, the guy didn’t teach me anything. He left me at his house for three weeks and travelled. He wasn’t even taking my calls.

While I was there, I thought, “I already know how to code. Isn’t it better for me to go back to that?” So, I started looking for opportunities. Within a week, I saw one on Facebook, applied, and got hired to write backend code. The ₦20k pay was terrible, but I took it.

The money funded my trip back to school, and it gave me a renewed conviction: If coding could give me ₦20k, it could give me more.

Love the energy

The same client called me a few weeks later to ask how much it’d cost to build a landing page. I didn’t know how much to charge, so I just said ₦70k. After some negotiations, we settled on ₦60k, and he sent the money immediately.

I remember seeing the credit alert in class. I was so shocked. I couldn’t even hear anything the lecturer said. In fact, I stood up and left the class.

Skrimm

After I completed the gig, the client put me on a ₦10k/month retainer for site maintenance. This happened between September and November 2023. That money helped me sort out my accommodation issues. I rented a one-room apartment and stopped sleeping in church.

That same November, I got a content writing role for a new web3 platform. The payment arrangement was quite funny. Initially, they agreed to a $150 monthly base pay (about ₦105k at the time) plus $5 per interaction on each writer’s articles. They only kept to that in the first month.

In December, they reduced base pay to $75 and the extra incentive for interactions to $2. By January 2024, they removed the base pay entirely and cut down incentives to $1, meaning writers had to hustle for interactions to make money. I eventually left in February — I preferred coding to writing anyway.

Still, I can’t forget how I felt when I got that first payment from them. I think it was about ₦150k. Crazy thoughts immediately filled my head. I started considering upgrading my phone. Ultimately, sanity prevailed. I settled all my outstanding school bills before doing anything else.

Thank goodness. What did you do after leaving the writing job?

I randomly met someone at a workspace, and we talked about some work he was doing. I left that conversation with a job as a full-stack developer for a startup. My salary was ₦70k/month.

At this point, I was juggling multiple things. I was still tutoring at the training centre occasionally, plus the computer lesson gig, which I fully stopped in February. In March, I took on an additional frontend engineering role at my workspace. I still work there today, but I don’t get paid. It’s essentially a startup, and they can’t afford to pay.

I took the job in exchange for free access to the workspace and the co-founders. I’m particular about that connection to the co-founders. They’re doing big things in tech, and I wanted to be in that network. Interestingly, my proximity to them has given me a few opportunities to make money, so that’s great.

What kind of opportunities?

I took on another role with an international company in April 2024. I started as an open source contributor and eventually moved to a contract position in developer relations in November. As a contributor, I averaged between $600 and $ 1,000 per month (around ₦1m to ₦1.5m). When they changed it to a contract position, my income increased to an average of ₦2.5m – ₦3m per month.

This was my primary source of income at this point. I’d left the ₦70k startup role when they folded in August. I still worked at the workspace, but this was the only job paying me.

I’m sure it helped that the pay wasn’t bad at all

Oh, it wasn’t. It was good money. I even stopped attending classes because I focused on making money.

I was relieved from the contract role in January 2025. While I could have continued working as an open source contributor, I decided to leave for two reasons. One, I was starting my fourth year and my grades were crying. I was barely hanging on. So, I decided to take a break from work to improve my grades.

Secondly, I wanted to learn AI engineering.

Any reason why?

I want to be at the forefront of things. There are millions of full-stack engineers in the world, and with the way Artificial Intelligence is going, I’d have more career prospects with AI engineering. Also, it seemed fun, like something I could work on for hours and get satisfaction from my job.

So, between January and September 2025, I was an unemployed student, living on my savings and studying AI engineering.

What did these savings look like?

My living expenses didn’t really change when my income grew to millions, so I was just saving. By that January, I had about ₦20m saved up.

Besides surviving on my savings, I made a couple of big expenses during that nine-month period. I spent ₦700k on moving to a new apartment (rent and agent’s fee), supported my brother’s relocation to the UK with almost ₦10m, and contributed around ₦2m – ₦3m to renovating my dad’s house.

I also spent money on a few other things, like new furniture and appliances for my new apartment, a phone, and an international trip in September. I made the trip to attend a three-day gathering of company CEOs, Blockchain founders, VC investors and the like. At 19, I was the youngest person there, but I interacted with multiple people. I was just networking everywhere.

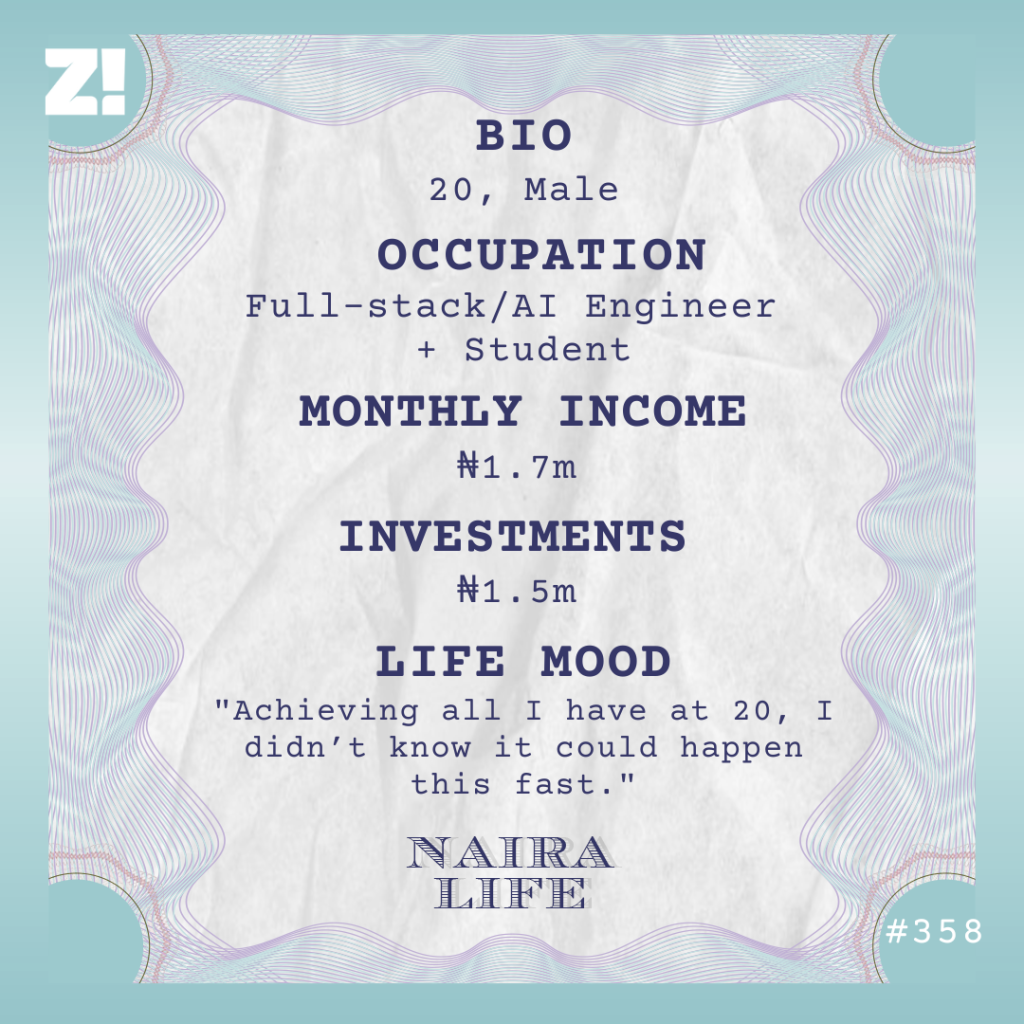

On the last day, a company approached me and offered me a role as a full-stack/AI engineer for $250/month (about ₦362k). In December, I got a slight pay increase to $400 (around ₦580k). I also got another $800/month backend engineer job in December. So, I currently work two jobs, bringing my total income to about ₦1.7m/month.

₦1.7m is impressive, but do you ever feel like you took a pay cut to transition?

Oh, definitely. It feels really weird coming from previous roles where I was paid more to do much less. But I had run out of my financial runway, and I needed to get another income source fast.

That said, I do feel like I’m slowly entering my desired field. I work with an impressively cracked team, and my career prospects look promising.

Love it for you. How has your income growth over the years impacted how you see money?

Money is a tool to make life better. My income growth has changed the level of comfort I can afford. Coming from someone who used to sleep in a church to being someone who can save enough to afford an international trip. I know money comes and goes, but when you have it, it can literally change your life, as well as everyone around you.

I’m not going to lie, it has been crazy, though. Achieving all I have at 20, I didn’t know it could happen this fast. My financial situation has now allowed my mindset to grow far beyond most people in my age group.

For instance, my classmates are mostly thinking about NYSC, what will come next after uni, and what to do with their certificates. My mind is on a different plane. I’m thinking about the next big move for my career. I recently interviewed with one of the biggest AI companies in the world. The only reason I didn’t get the role was that I don’t live in San Francisco.

Sometimes, my growth feels intimidating. Other times, I have the tendency to think, “I’ve come so far. I’m not your mate.” But I deliberately try to remain humble. I haven’t come this far by my strength alone. Most of the moves I’ve recorded came unexpectedly. I just happened to be in the right situations where favour found me.

How would you describe your spending habits and relationship with money?

I live below my means as much as possible. I try to rationalise my purchases by assessing if it’ll be an essential part of my life and if I really need it.

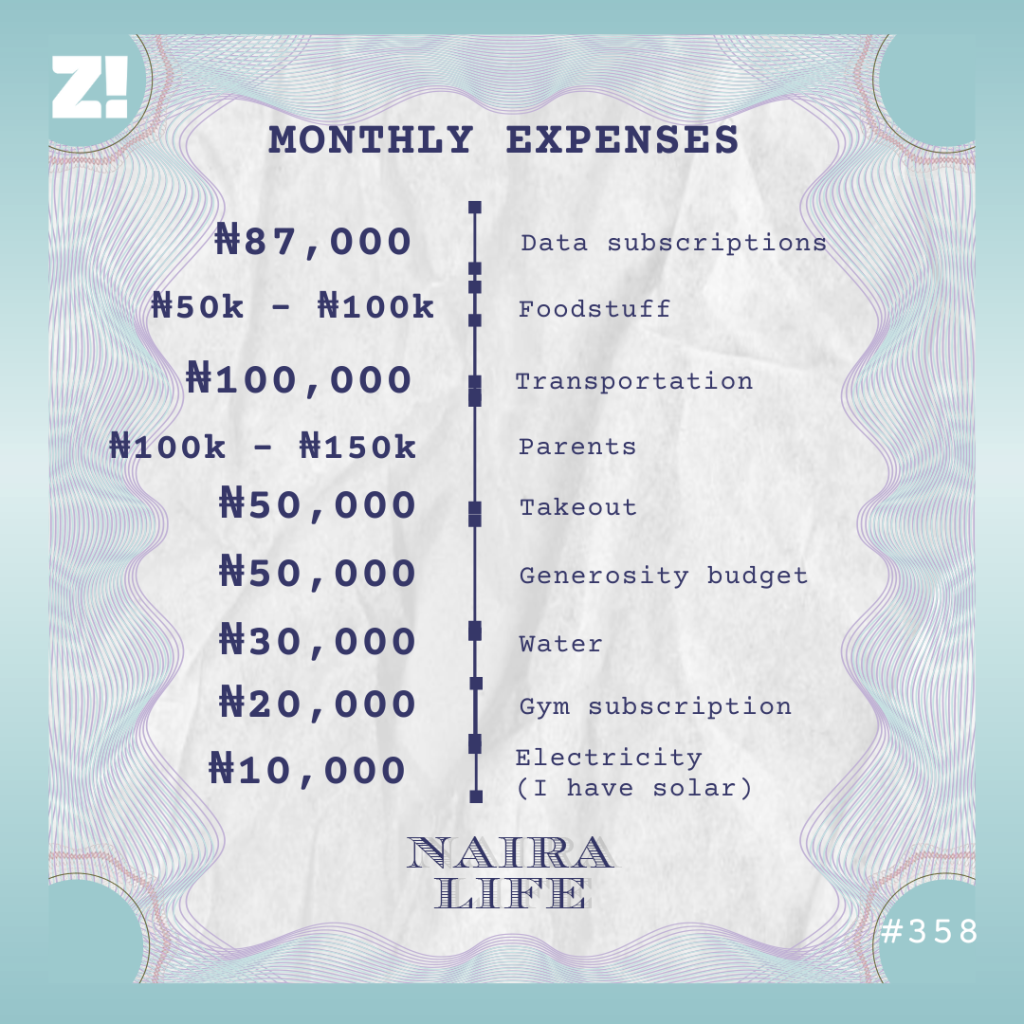

I also spend money to improve my life. For instance, commuting from my campus to town by commercial transport costs approximately ₦5k. But I’ve been profiled and harassed by police officers a few times, so I prefer to spend ₦35k – ₦40k on private cabs just to avoid that.

When I’m not spending on essentials, I’m mostly saving and investing my money. I have a 20% – 20% approach to both savings and investments every month, but the latter is mostly money I can forget. If I look at my monthly expenses and don’t have much left, I forego investments.

What does your portfolio look like now?

I have about ₦1.5m in Nigerian and US stocks. I’m just trying to rebuild my savings after exhausting them in 2025, so there’s not much happening there right now. My major focus this year is to build my savings to around ₦40m – ₦50m. It might not happen this year, but I plan to at least be on track for that figure.

Let’s break down your typical monthly expenses

Is there an ideal amount you think you should be earning monthly?

I want to earn at least $10k/month. That’s another major goal for this year.

What do the next few years look like for you?

Graduating from uni and possibly relocating out of Nigeria. That’ll bring me closer to my goal of working with major AI companies. I also want to travel more.

Is there anything you want right now but can’t afford?

A 2022 Honda Accord. It’d cost me about ₦45m.

How would you rate your financial happiness on a scale of 1-10?

6. I’m good right now, but I want more. There’s always room for improvement.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.