Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

When I was around 6 or 7 years old, my uncle came to visit and, as relatives do, gave me money when he was leaving. I remember that visit because he gave me ₦800. It felt like a lot of money.

Being sent out of class in primary school is another memory that stands out. It was exam day, but I hadn’t paid my fees, so the teacher sent me out. That was the first time I realised the importance of money.

What was money like at home?

It wasn’t bad. We just had moments when we had money and when we didn’t. I lost my dad when I was just a few months old, so I grew up with my mum and our extended family. While I mostly stayed with my mum, my siblings lived with relatives. My mum earned a living by running a couple of small retail businesses. I think she sold eggs and frozen foods at some point.

We didn’t have much, but we survived. We just had moments of financial struggle.

Do you remember the first time you did something to earn money?

Yes. Writing. I’ve been writing for fun since secondary school, but I realised I could make money from it in university.

When I was in year three, I met a guy who told me about how he monetised his writing. He got a lot of freelance jobs, and whenever he couldn’t meet deadlines, he’d pass off one or two gigs to me. I got at least one from him every day, and he paid me ₦2k per 500-word article. Most times, he paid me in bulk, around ₦10k – ₦15k at the end of the week. This was during the COVID period in 2020.

But the gigs became less consistent after the lockdown ended. He wasn’t getting as many anymore, and I figured, “Wait. This pay is actually shitty.” So, I stopped working with him and moved on to someone else. This was now during my SIWES period in 2021.

The new guy paid me ₦5 per word to write articles and YouTube scripts.

How often did you get gigs from him?

It was pretty irregular. I could work on 30 articles over a three to four-month period, then have a dry spell for as many months. Thankfully, the civil engineering company I worked at for my SIWES paid me ₦30k/month as a maintenance personnel — I studied engineering — so that income filled the gap writing left.

I continued working with the guy after my six-month SIWES. It wasn’t very easy to juggle it with school, though. There were a number of times when I couldn’t take many gigs because I was busy with school work, or we didn’t have light.

Sometimes, I’d hit him up when school was on holiday to say I was available, and we’d work for three months again. I think the longest stretch I worked with him was for six months, just after I graduated from the university in 2023.

What came next after uni?

A five-month stint doing content design for an NGO. It was essentially graphic design, but mostly content-based, like infographics and write-ups for social media banners. I’d learnt a bit of product design while in uni, so that came in handy for the job. They paid me $100/month, which was about ₦100k at the time.

The job eventually let me go because of NYSC. I tried to take time off for the three-week NYSC orientation camp, and they initially said it was fine. Later, they said something like, “We realised we don’t need this many people for the role. We have to let you go.”

Yikes. Sorry about that. What was NYSC like?

It was okay. I served at a federal government agency, and they paid me ₦40k/month. This was in addition to the ₦33k/month NYSC allawee.

The money wasn’t so bad, but it all went back to work. Transportation was my biggest expense: I served in Lagos and commuted from the mainland to the island every day. I wasn’t buying clothes, shoes, or anything like that. Fortunately, I was living with my elder sisters, so I was just taking their stuff.

I still had to pay rent, though. My sisters and I got an apartment together when I was serving, and I had to contribute ₦200k toward the rent. Also, I began contributing to other living expenses. My money always just had somewhere to go.

The occasional writing gigs from my plug helped during this period. Whenever I got payment for a gig, I’d immediately send half of the money to my savings app. That was how I was able to meet most of my expenses until I finished NYSC in 2024.

Let me guess what came next. Job applications?

Exactly. I applied to a bunch of graduate trainee roles across different companies. Thankfully, it didn’t take long before I got into one at a financial institution. My salary was ₦300k/month.

You would think that earning more than triple what I did during NYSC would make my life easier, right?

I mean, that’s the expectation

Well, it didn’t make it easier or better. I remember complaining to my sister about how I didn’t know where my money was going. Inflation increased the prices of everything, from food to transportation, and even fixing little things around the house.

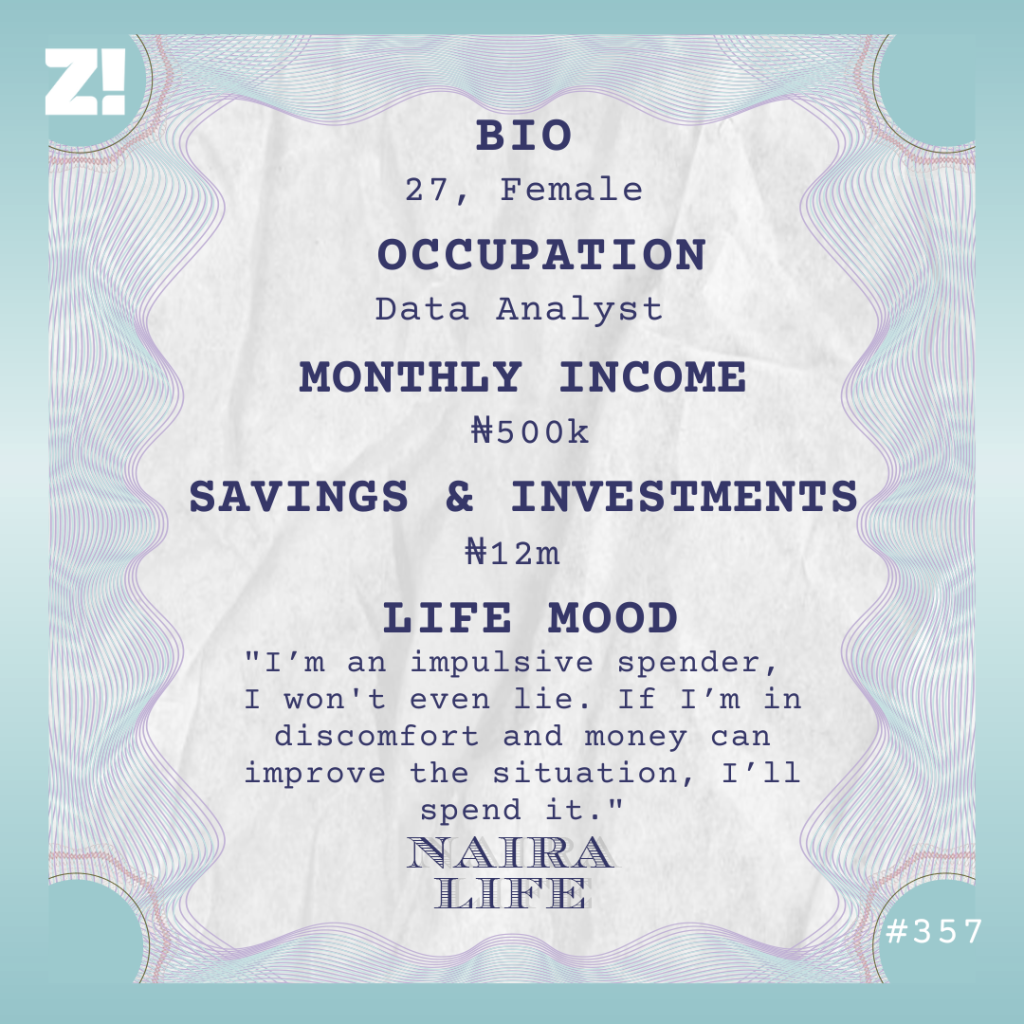

Also, I was working in corporate and had to dress the part. I had to buy clothes regularly, which also cost me money. It was a lot adjusting to the new expenses. I still work at the same place today. My role is still entry-level — I work as a data analyst — but my salary has increased to ₦500k/month, which is a bit better than ₦300k.

Wait. You’ve done several pivots. From engineering to writing and now data analysis. Was it an intentional move?

You forgot content design, haha. But yes, it was an intentional move. During NYSC, I started thinking about working in tech. I noticed that I was leaning more towards writing and wanted to do something engineering or science-related. Everyone was talking about data analysis, so I decided to give it a try.

I took a paid Coursera course and applied for one of the platform’s scholarships to get it for free. I completed the course and realised I liked it. So, many of the graduate trainee roles I applied for were in data analysis.

Many financial institutions are always looking for entry-level candidates to train in those roles, and, fortunately for me, I got a job at one. My job has really helped me learn quickly, and I look forward to becoming even better. The goal is to get better roles and make more money.

I rate it. Who doesn’t want more money?

Speaking of, my financial situation completely changed recently. I got a windfall inheritance worth ₦10 million.

Wait, that’s random. How did that happen?

It’s a long story, but the short version is that my late dad left behind some property. We sold one of them, and my siblings and I shared the proceeds. ₦10 million magically appeared in my bank account, and I was just staring at it, not knowing what to do with it.

I remember thinking how it was like those memes or vox pops where someone asks you, “What would you do if someone gave you ₦10 million?” There I was, facing that situation, and I was totally confused. I mean, I knew I was going to invest it, but it came down to, “What am I actually investing in?” “What trend should I follow?” I didn’t know a lot about investing — I still don’t — and I didn’t want to put my money somewhere and lose it.

While one part of me was thinking about investing the money, another part was thinking, “Shouldn’t I enjoy myself a bit?” You know how they say money shows someone’s true colours? That statement is so true. Sometimes, someone would be talking to me, and I’d be like, “I really don’t have to listen to this person. I have money.”

Screammmm. Have you decided what to do with the money yet?

Oh yes. I moved the money into different money instruments within a week. I spread it out because I didn’t want to wake up one day and hear that one CEO of one investment app carried all my money away.

I was also scared of leaving it in my account. What if someone stole my phone and took my money? I never worried about anyone stealing my phone when I had just ₦5k in my account, but the stakes were higher, and I couldn’t risk it.

Walk me through how you spread the ₦10 million across different instruments. What informed your choices?

As I said, I don’t know much about investments. All I knew was that I didn’t want to do anything risky. I learnt that Money Market Funds (MMFs) are low-risk investments, so I put 80% of the money (₦8 million) in them.

Then, I spread out 10% in different stocks. From my research, people had a considerably good experience with Nigerian stocks in 2025, but they’re still volatile, and I don’t know how 2026 will be. So, I just bought a few stocks here and there.

The remaining 10% went into tithe and getting a few things for myself, specifically a phone. I added ₦300k to my iPhone 12 Pro and upgraded it to an iPhone 15.

Do you have short-term plans for your investments, or is the plan to just leave them there for a while?

I don’t have any plans or immediate financial needs for now. So, I’ll just leave them to grow until I learn more about investments, then diversify.

I’m also looking for tips. It’s a big reason I’m sharing my story. I’m hoping finance experts and more experienced people will leave comments and tell me what they’d do if they got a ₦10 million windfall. Maybe I’ll get a better financial strategy than the 80% in MMFs and 10% in stocks I have now.

Let’s hope so. How would you describe your relationship with money?

I’m an impulsive spender, I won’t even lie. If I’m in discomfort and money can improve the situation, I’ll spend it.

I recently had to write an exam, and there was no light or water at home. I immediately paid for a hotel room and moved there so I could be in a good headspace to study. So, yeah, I can be impulsive like that.

At the same time, I can also be quite frugal. If I receive money and don’t need it, I don’t mind sending most of it to my savings. I just make sure to spend on reasonable necessities. I also really believe in spending on my loved ones. I can’t be stingy with them.

You mentioned savings. Do you have a specific approach to it?

I only became serious about saving when I started paying rent and other bills. I realised these expenses would always come, and if I didn’t put aside something for them, what I needed wouldn’t just appear out of thin air.

So, these days, I employ a 70-20-10 approach to my expenses: 70% for living expenses, 20% for savings, and 10% for outings. So, I save 20% of my income every month. It’s more than that most of the time. My savings are also divided into three: rent, an emergency fund, and travel (I sometimes eat this money, sha).

Is there a formula for dividing your savings among these three channels?

It’s honestly just vibes. I still live with my sisters, and my share of the rent is now ₦325k. If I feel like I’ve saved close to that amount, I put more money in my emergency fund. If I want to get a new gadget, I direct my savings there instead. Altogether, I have about ₦3m in my savings portfolio. If you add the ₦9m in investments, that’s ₦12m.

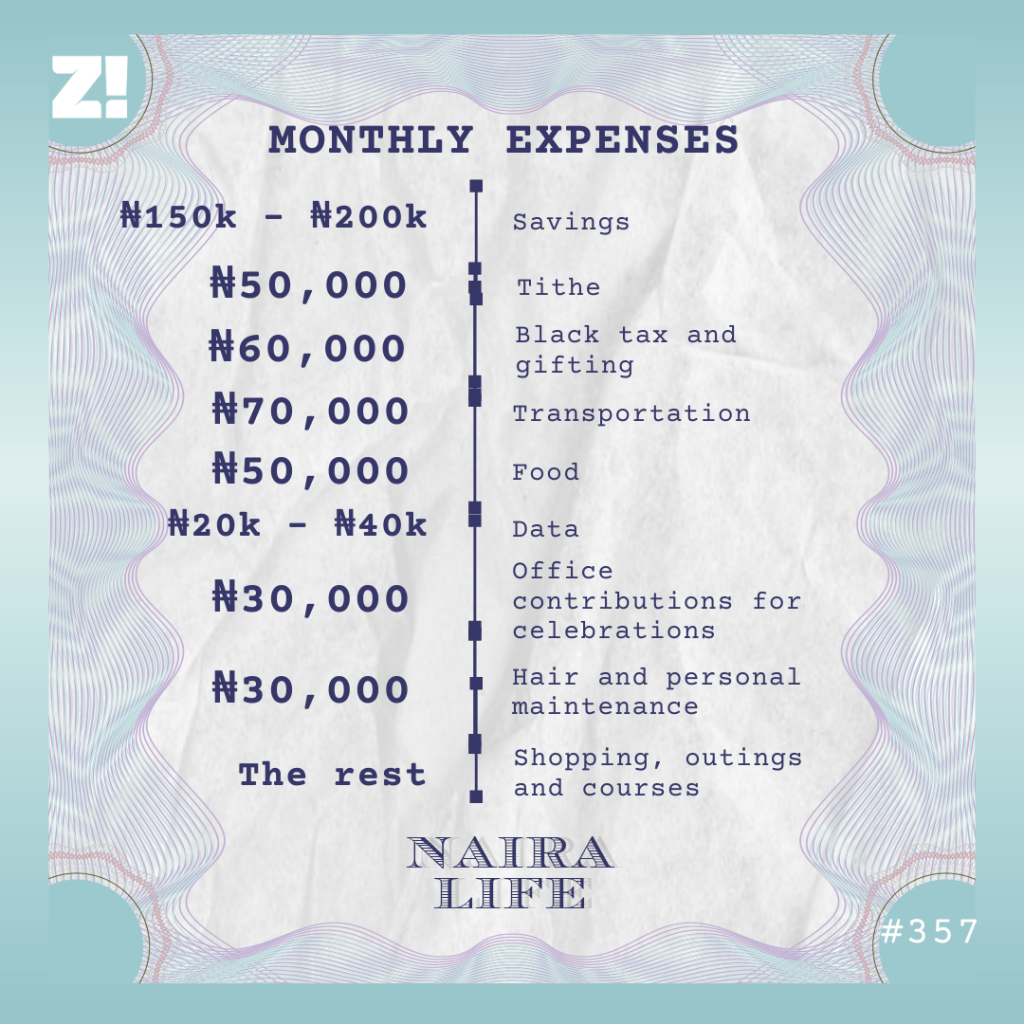

Let’s break down your typical monthly expenses

I’m constantly taking certification courses for my career and personal development, so a lot of money goes into that. The costs vary, though.

How has your income growth over the years impacted how you see money?

I’ve realised that money isn’t everything. It’s important and all that, but it used to be such a big deal to me. It no longer feels like that. What matters now to me is that I can afford the basics like food, shelter, clothing and some comfort. I would like to be able to afford more comfort in the future, too.

Is there an ideal amount of money you think you should be earning?

₦1 million/month wouldn’t be bad. I’m hoping to get there before the end of the year, and it’ll definitely involve getting a better-paying job.

Is there anything you want right now but can’t afford?

Japa. Maybe if I try really hard, I can afford it, but I’ll still need a lot of help. I figure I’ll need at least ₦20m.

How about the last thing you spent money on that made you happy?

Remember that hotel room I booked? It made me so happy not to have to suffer in silence. This was just last week, and it cost me ₦78,400. Money well spent, if you ask me.

How would you rate your financial happiness on a scale of 1-10?

7. I feel like I can do more and earn better. It might be a skill issue. I need to scale up, not just career-wise, but also with my finances, so I’ll know what to do with my money in order to make more.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.