Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

It was when my dad passed away in 2013, and money suddenly became a problem. My dad was the breadwinner and owned several businesses, from poultry to borehole drilling.

My mum had a small kerosene business, but she didn’t depend on the income because my dad supported us. That changed after he died. We went from living in our own house to starting from scratch. Our situation was worsened by the revelation that my dad had a secret family.

Another family? How did that come to light?

A wife and three kids showed up at his funeral. It turned out my dad’s relatives knew about the other family, and they insisted they had to share everything he had accordingly. Our house was one of those.

My mum had contributed to building that house, but it was technically my dad’s. So, his family sold the house and shared the money with everyone. My mum used her share to rent an apartment and focus on her business.

What kind of lifestyle changes came with the new financial situation?

I was in JSS 3 and had to switch to a public school to save money. It was a jarring change for me, especially as I was used to hanging out with “rich kids”. We also had to start managing everything.

We didn’t get any support from my dad’s relatives; in fact, they’d been waiting to see my mum’s downfall. They believed all she did was “eat” my dad’s money when he was alive, so it was a case of “shakara don end.”

My paternal grandma even told me a Yoruba proverb that roughly translates to, “No one will take care of an orphan. You’ll have to take care of yourself.”

That’s an interesting thing to say to a literal child

It was an interesting period. I started thinking a lot about money, and it may have influenced some of my experiences down the line.

For context: My mum switched from selling kerosene to a lotto and sports betting business. People weren’t buying kerosene because they were using gas cookers more. The lotto business did well, and she opened different outlets in different locations. For me, it meant I had to stay in one of the shops to help run the business.

The primary target audience for lotto is men, and since I was often alone at the shop, I was sexually assaulted a lot. I escaped three rape attempts. I couldn’t tell my mum because the customers were the ones technically feeding us, and if they left, we’d starve to death.

Also, my mum was very strict. If she came to shop and saw me standing outside, or maybe I went out to play or buy something, she’d beat the hell out of me. She always wanted me inside. She didn’t know it was the same “inside” that those men were coming to touch me. So, I couldn’t tell her, and I was also worried about losing what brought us money.

I’m sorry you went through that

Thank you. I don’t blame my mum, though. She was trying her best and didn’t know what was happening. I still haven’t told her sef.

My mum remarried in 2016, which relieved some of the financial pressure. My stepdad paid my fees and provided for us, even though he was a bit hard on me. I think it was his own form of discipline. I did all the chores at home, and whenever I didn’t do something well, he’d threaten not to pay for my WAEC.

I eventually gained admission into the university in 2018. In uni, I finally got the opportunity to make money for myself.

Tell me about it

In 100 level, my ₦2k/week pocket money was barely enough, and I often trekked to school. Meanwhile, my friend, who lived in the same lodge, got like ₦25k/week and bought things I couldn’t even dream of. Things like turkey. Moving with her often reminded me of what my life was like before my dad died.

However, instead of stressing about what could have been, I decided to make efforts towards improving my finances. The first thing I did was write assignments for fellow students, making ₦200 or ₦300 here and there.

Then, I discovered I could make money on WhatsApp. I managed an anonymous school TV and posted memes and funny school-related content. I had hundreds of people viewing my status, and students who ran businesses started paying me to run ads for them. I made ₦2k – ₦3k per advert, and it was really successful.

I still think a reason why it was so successful was that people thought a guy ran it. If they knew it was a lady, perverts would have filled my DMs.

You know what? I get it

In 200 level, I joined my school’s dance and drama troupe. That was when I realised I had a talent for chanting. Before long, people started paying me to chant for them. I’m talking birthday shoutouts or surprises.

Chanting became a major source of income for me. My fee ranged between ₦10k – ₦20k, and I consistently had clients. I even paid my tuition that year. I also had a boyfriend who supported me financially, so things were good. The guy almost ruined my life sha, but I’ll get to that.

Still in 200 level, I accidentally came across a business opportunity that changed my life forever. A friend told me about some plain T-shirts he wanted to buy from a vendor. The normal price was ₦2k, but the vendor was running a discount sale and selling them at ₦1200. My friend intended to seize the opportunity and buy many shirts.

Then I thought, “What if I also buy from this vendor and resell at ₦2k?” I didn’t have capital, but I could repost the pictures and only buy when I got orders. That’s what I did.

How did that go?

It went really well. I also posted the business on my WhatsApp TV, which brought in a lot of patronage and expanded my customer base beyond the school.

After a few months, someone connected me with a vendor who sold the same T-shirts at ₦850 each and a pack of 10 for ₦8k. This automatically increased my profit margin, and I decided to sell for ₦1500 instead of ₦2k. That way, people could also buy from me in bulk to resell. In fact, I decided bulk sales to retailers would be my primary business model.

So, I got the shirts, took pictures and created various styling content with them. I had just 10 pieces in store, but I also got pictures and videos from my supplier so people would believe I had plenty of stock. Then I organised my first sales to bulk buyers and ran ads online.

I made sales worth ₦500k from that campaign, with a profit of about ₦100k. It was such a big deal for me. I didn’t believe I could make so much money from those shirts. I cooked fried rice with turkey that day. I felt rich.

Love it for you!

I told myself I could definitely make more if I put in more effort. So, I kept at it. At this point, I had three income sources: the WhatsApp TV, chanting, and the shirts. I also occasionally wrote assignments for people. Things were really good.

In 300 level, I added dresses and bags to my business. I made my first ₦1m that year. To be fair, this included both sales and profit, but it was the first time I saw ₦1m in my account. I even hired someone to assist me.

Then the following year, I made some decisions that turned everything upside down.

Ah. What happened?

My mum had issues with her lotto business and wanted to start selling drinks. My stepdad had died a year earlier, and she didn’t have support anymore. She was literally calling me, crying that she was stressed and needed money for business.

She knew I had something going on since I was no longer collecting school fees at home. Anyway, that’s how I packed all my money, capital and profit, and gave it to my mum.

Wait. Like how much are we talking?

It was over ₦1m. I didn’t send everything at once, though. Drinks are usually sold in pallets, so she could say she wanted to buy a pallet today, and then say the same thing next week. Before I knew it, I’d given her all the money. About half of it was supposed to be a loan, but she didn’t pay it back, and I didn’t pursue it.

I should mention that I wasn’t particularly worried about not having capital. I told myself, “If I could do it before, I can do it again.”

Around this time, I moved to a different state for my six-month student industrial work experience (SIWES). Since I didn’t have money, I moved in with my boyfriend at the time, who lived in the same area.

Were you paid during SIWES?

Not at all. In fact, I didn’t actually do it. I told the person I was meant to work with that I had a business, so I couldn’t come regularly.

I didn’t have business capital and couldn’t import goods, but I still had my Instagram store and clients. So I found wholesalers near me, created content with their goods, and sold them as my own.

Some of the sellers noticed I was even selling more than they were, so they started creating content with their own goods and selling online too. I did a lot of moving around that period, looking for wholesalers willing to let me shoot content with their goods. It was very stressful.

On top of all that, I was having a really difficult time living with my boyfriend. The living situation made me regret giving my mum all my money. If I hadn’t done that, I’d have rented my own apartment. That guy nearly killed me.

You say?

Well, he didn’t literally try to take my life. I can’t go into everything, but he put me through a lot of emotional abuse. I suffered more in that relationship than when my dad died. He was still the one who ended the relationship.

Anyway, I returned to school after SIWES and faced my business squarely. I became strict with my finances, limiting support to my mum and saving every extra money I made. My goal was to rebuild my business back up to seven figures and save enough to move to Lagos after graduation. I even added a mini-importation class to my hustle, charging people to teach them to import products to sell in Nigeria.

My efforts paid off. I returned to school in 2023, and within months, I was recording sales of ₦2m – ₦3m. The only slight problem was that I didn’t have a clear sense of my actual profit. I also didn’t differentiate between my personal and business funds. Almost everything I made returned to the business. I just wanted to have enough when the time came to leave school.

When did you eventually graduate?

January 2024. By then, I’d saved over ₦3m and used 90% of the money to move to Lagos, rent a ₦1.5m/year apartment (plus an additional ₦750k in agent and commission fees), and furnish it.

This was another risky move because I used practically all my business money to relocate, but it paid off. Moving to Lagos put me in close proximity to many of my customers, and my business has grown significantly since then.

What’s your income like these days?

As a business, it’s really difficult to say this is what we’ll likely make in a month. Sometimes, we make ₦5m. Other months, we make ₦10m. Sometimes, we push all the ads in the world and still don’t make up to ₦1m in a month. I checked my business account recently and saw we made ₦75m in sales in 2025.

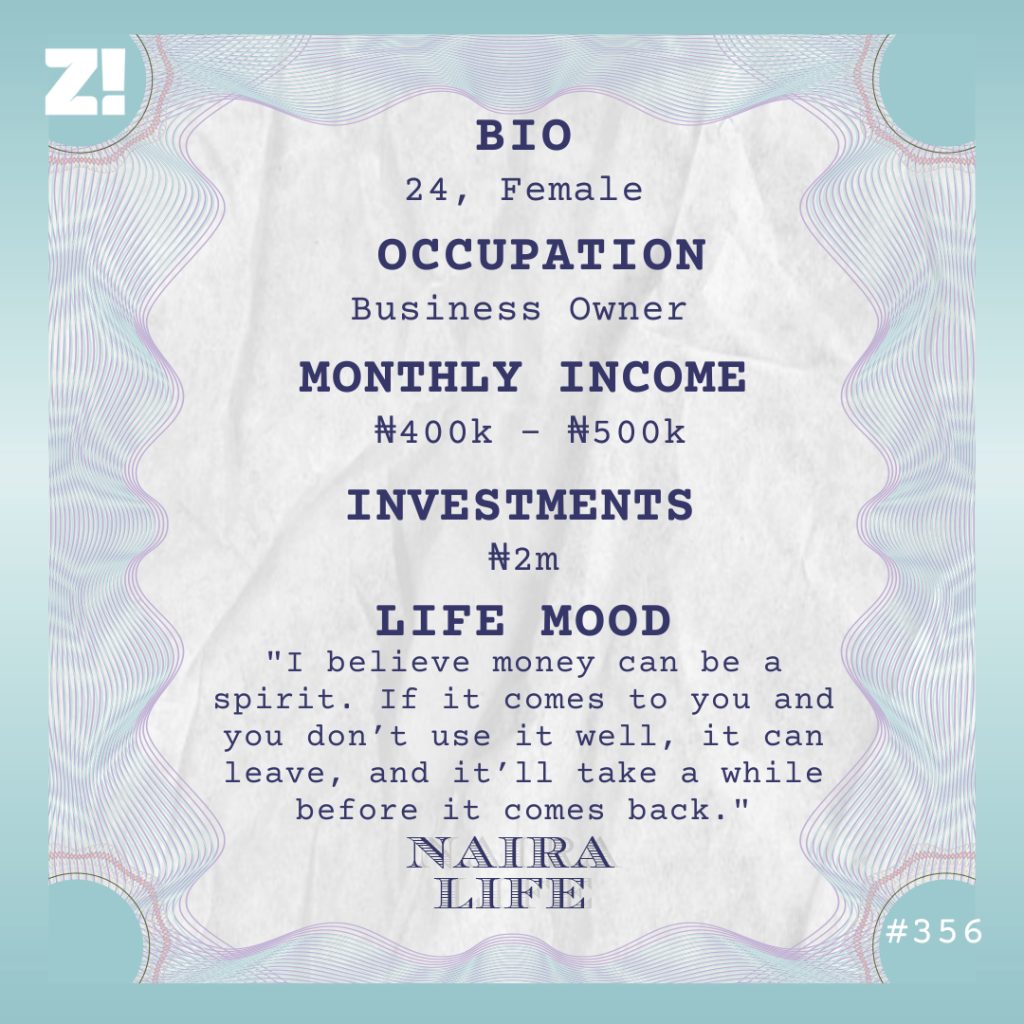

My income is usually 20% of whatever profit we make. Even that isn’t set in stone because I do what’s best for the business. If I were to give a range, I’d say I personally make around ₦400k – ₦500k monthly.

I also have three staff who I pay between ₦70k – ₦120k each monthly. I don’t have a physical store, though. I run my business from my apartment and completely deal with customers online.

What kind of life does your income afford you?

I can pay my rent comfortably. When I was in school, I admired people with nice wigs; now I can afford them. I can go on vacation and still maintain my beauty routine regularly. Going to the spa and getting my nails done are now part of my normal life — they used to be luxuries.

Energy. How has your income growth over the years impacted how you see money?

If you don’t have money, you’ll suffer. If I had money when I went for SIWES, I wouldn’t have suffered the way I did. Money gives you a choice. If you don’t have it, you’ll actually take shit.

Being a business owner is hard. There are days when it’s like nothing is working and I’m not meeting sales targets, but I have to keep showing up. I know what it’s like to have money, and I can’t return to those terrible days.

Out of curiosity, do you ever worry about the unpredictable nature of your income?

I don’t. Never. I’ve been through a lot already, and I keep getting back up. I mean, I’ve started afresh from zero twice, and I’m still standing. It means I can always get back on my feet, so I don’t plan to give up.

Also, I don’t intend to stick to just one thing. I’m currently looking into master’s scholarships and plan to return to school. If I get a scholarship today, I’m leaving the country the next day. I already have structures in place to ensure my business thrives without me.

I’ve also worked as a social media manager and customer service rep for my business. I can do many things. Even if my business stops bringing in money today, something else will. One thing I know for sure is that I’ll never give up.

Inject it. How would you describe your relationship with money?

I don’t spend anyhow, but I make sure to make good use of money. I believe money can be a spirit. If it comes to you and you don’t use it well, it can leave, and it’ll take a while before it comes back. So, I invest regularly, but I also take care of myself.

What investment instruments do you use?

I invest in mutual funds and stocks through a savings and investment app. I started in November 2025 and currently have about ₦2m in my portfolio. When I started, I just put money in there whenever I remembered. However, this year, I want to try investing ₦100k every week instead of leaving it in a savings account.

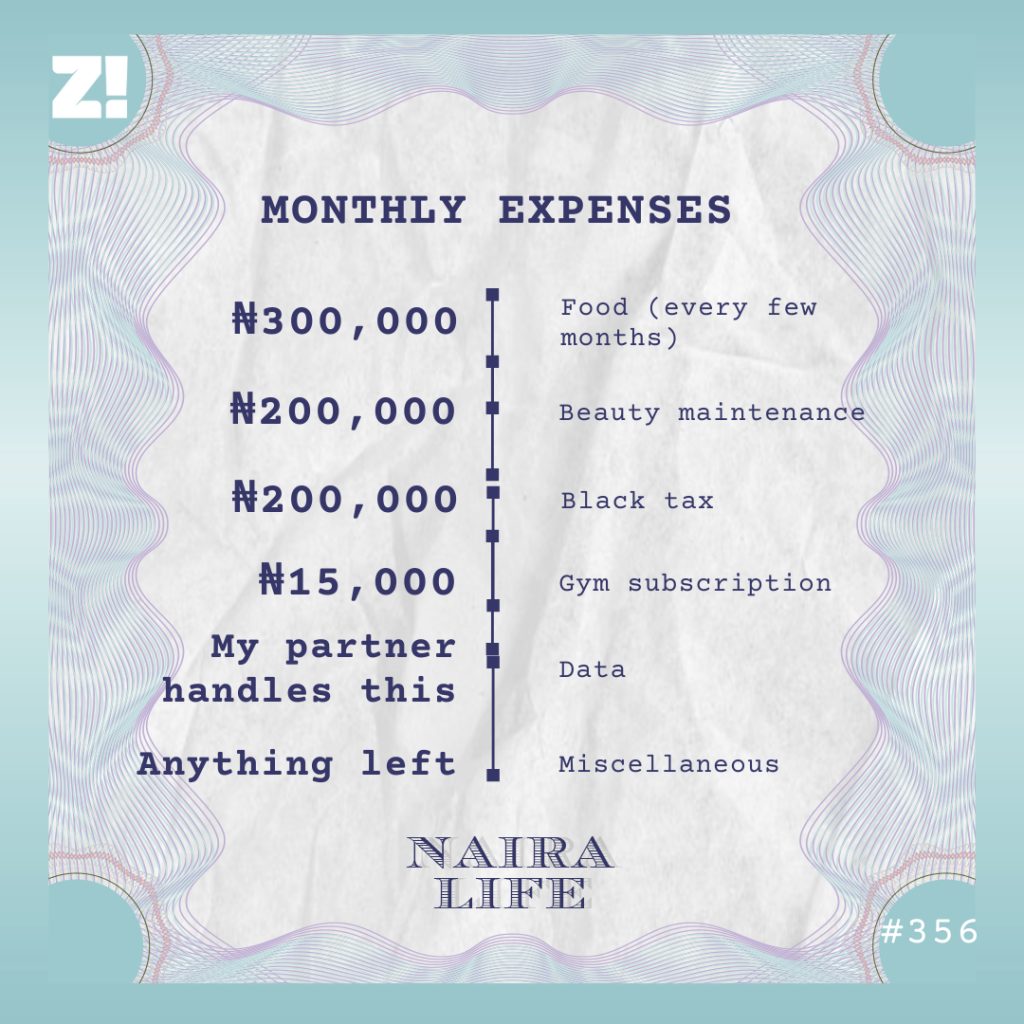

Let’s break down your typical monthly expenses

I honestly don’t have a lot of my expenses. Most of my income goes into taking care of myself. I also hardly cook or eat at home, so my food expenses aren’t a lot. I work from home, so I rarely spend on transportation.

Is there anything you want right now but can’t afford?

I’d like to travel for vacations outside Nigeria. The world is too big and beautiful to die in Nigeria.

How would you rate your financial happiness on a scale of 1-10?

4. I’m comfortable, but I know I can do better. I want more money. Imagine if I earned ₦20m/month. Everywhere go soft.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

Follow Zikoko Money on Instagram for relatable stories and actionable insights to help you make the most out of your money.