Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was money like growing up?

I don’t come from a rich family, but we had the basics. My dad’s printing press was the first in our local government, and my mum had a thriving business. We were fine.

Unfortunately, around the time I was in my first or second year of senior secondary school, my dad’s business suddenly began to fail. My mum’s business followed shortly after due to the financial pressure of supporting our family of seven.

Phew. I reckon that came with some lifestyle changes at home

It did. My siblings had to switch to public schools. I attended a boarding school, and I went from having provisions to share with friends to returning home to find out that we barely had enough food to eat.

The moment the severity of our situation clicked was when I needed to travel to write the post-UTME exam, and my dad couldn’t afford the transportation fare. That’s when I started telling myself I needed to hustle to support myself and relieve the burden on my parents.

So, when did you start hustling?

In 2008, the year I entered the university. I worked with a dry cleaner near my mum’s shop, assisting with laundry and dry cleaning. For the first two months, our arrangement was that he’d split whatever he made three ways, and I’d take one part.

For instance, if he earned ₦10k in a week, my pay was ₦3k. I earned around that range for a while until he thought I was making too much money. So, he recalculated the sharing formula into four parts, bringing my share down to 25%. I didn’t like that, but I couldn’t complain because we were friends. I worked with him for four more months.

I should mention that my parents only paid my first-year tuition. Subsequently, I sorted out my school needs, including tuition. To be fair, they tried their best and gave me ₦500 three times a week to support my transportation to school (I went to school from home). That was all they could afford.

To make money, I started taking small jobs during holidays and semester breaks. Unfortunately, my financial situation also led me to move with the wrong crowd.

How so?

I was open to befriending anyone who had money and wanted to hang out. One of the guys I moved with, the son of a former minister, was always spending money. We’d skip class to smoke and drink.

My academics suffered for this. It wasn’t entirely because of the friends I kept, though. There was no money to buy handouts, textbooks and other school supplies, so it was easy to decide to skip classes and exams. I’m not sure I wrote more than four exams in my first two years in uni. I was just racking up carryovers.

I became serious in the 300-level when a mental breakdown forced one of my guys to leave school. Some others got expelled due to cult activities, and a few others dropped out. I told myself I had to sit up.

How did that go?

I had to start from scratch. I had about 30+ carryovers at that time, and I wrote about 10 in one semester, hoping that my results would come out.

Meanwhile, I was still hustling during the holidays to raise my school fees. I briefly worked with a man who sold chicken feed and used gadgets. He had a store in a plaza where I helped sell his products.

He paid me ₦20k for the one month. I worked with him. I also made a little extra from tips, about ₦10k. My tuition was like ₦20k.

After that, I had a one-month stint as a marketing executive at a microfinance bank for ₦30k/month. I had a target of bringing in 20-30 customers, but I didn’t manage to bring anyone in. When it was salary day, my employer said, “We’re just paying you this money. You didn’t do anything.”

Skrimm

When I was in 400 level, my friends and I started reselling flight tickets. We got the idea from a friend’s uncle, who worked at the airport and suggested that we could make money by buying tickets online and reselling them at the airport. The whole operation was essentially racketeering.

So, we’d buy tickets online a few days or a week before the flight. An airline we used ran a promo where you could book early tickets online for around ₦10k instead of ₦30k or ₦35k. Then, on the departure day, we’d print out the tickets and give them to the airline agents and staff to sell for us. We’d then split profits amongst ourselves.

I’m still stuck on the fact that plane tickets were as cheap as ₦10k

We even bought some for ₦9k. This was around 2010/2011. The business only lasted a few months. The airline agents started claiming that passengers didn’t buy the tickets on the departure day.

There was no way to confirm this, as we’d already given them the ticket booking number, and they could’ve sold it without telling us. Additionally, since we didn’t work with the airline, we couldn’t verify if the ticket had been used or not. That’s how we lost the capital and couldn’t buy any more tickets to resell.

That was the last business I did in school. However, I wrote exams for someone once for ₦50k to cover the cost of my extra year.

My set graduated in 2011, but the combination of my extra year, missing scripts and delayed NYSC mobilisation meant I got called up for service in 2015.

My Place of Primary Assignment (PPA) was a government school, and my income during this period was ₦29,800/month — ₦19,800 from NYSC and ₦10k from the state government.

What was service year like?

It was good. My PPA was located in a remote area, and I was only required to go to the school once or twice a week. So, I didn’t have many expenses. I lived well on the ₦19,800 allawee and saved the ₦10k from the state.

2015 was also an election year, and I earned an additional ₦60k from working during the elections; ₦20k from INEC, and the rest from a politician who shared money in my ward. I saved that as well. By the end of my service year in 2016, I had ₦150k in my savings.

What did you do next?

I initially planned to stay in the state where I served, but after about a week, my savings had dwindled to ₦120k. I told myself I needed to return home and open a gaming centre with the money before I spent it all.

However, when I returned home, I bought a laptop to learn a couple of digital skills instead. I figured that would serve me better in the long run while I job-hunted. Unfortunately, it wasn’t the right decision.

My laptop cost ₦50k, and I planned to learn graphic design. Unfortunately, the laptop was faulty, and I couldn’t use it for more than a few weeks. Then, I began visiting government institutions and large offices to drop off my CV, hoping to land a job. The problem was that I was spending a lot on transportation, naively believing that my efforts would yield results.

I eventually stopped when a security guard at one of the offices told me that those government recruitment announcements were just for formalities and that I was wasting my time. He showed me where I was dropping my CV, and I saw five full Ghana-must-go bags filled with CVs. He said, “Every two months, we take these bags to the back of the office and burn them in the incinerator.”

Ah. That’s wild

I just accepted I’d been foolish and returned home. It would’ve been better if I’d established a small business. At least, my profits would have been funding my job-hunting efforts instead of just burning my savings.

Fortunately, this was the period that Buhari launched the N-power initiative. I applied and got in. N-Power paid me ₦30k/month for two years, and I used the income to fund a postgraduate diploma. I’d graduated from uni with a third class and needed something to upgrade my degree and improve my chances of getting a good job.

At the same time, I revived my dad’s printing press and was trying to scale it. I was looking out for government grants and opportunities. Some of my friends had received ₦5m – ₦10m worth of grants during the Goodluck Jonathan Administration — I think it was through SURE-P — but I didn’t know or get to apply early before he lost the election. So, I was always on the lookout for anything similar under Buhari’s government.

Did you find something?

I didn’t find the grant I was looking for, but I participated in a government-funded entrepreneurship training program in 2017. They fed us twice a day during the one-week program and gave certificates, but we didn’t see any money. I even officially registered the printing press with the CAC, hoping we’d get a loan as promised. Nothing.

When that didn’t work out as I hoped, I focused on the occasional printing business I got from the area. Fortunately, my dad still had his machines, so I didn’t need too much to begin small-scale operations. I also put the business on Google and slowly built traction.

I still run the business today. I work with paper, so I print items like memos, cards, flyers, folders, invitations, wedding cards, and other similar materials. The thing with a printing press is you can go a full two weeks without making anything, then get a job that brings you ₦100k out of nowhere.

One of my returning clients is a school that brings jobs worth about ₦400k every four months.

Is the printing press your primary source of income?

Oh, no. I got a marketing job with an insurance company in 2019. My pay was based on commissions. That said, they paid a base pay of ₦35k/month for the first three months. I worked there for a year, and the highest I made in commissions in a month was ₦100k.

I left in 2020 to work with my current employer, another insurance company, and the marketing job comes with the same commission-based pay structure. The difference is that my company offers pension packages, and selling those earns me more commissions. Basically, if someone retires and I process their pension, I get a commission. These commissions can be as high as ₦500k. If I process two in a month, that’s ₦1m. My monthly income is usually around ₦500k, though.

Besides my insurance job, I took up a ₦120k/month research assistant job with a medical institution in April 2025. It’s part-time, and most of what I do is to input data they send me into a database.

In addition, I set up a POS business near my printing press. Someone handles the POS device, and I make about ₦150k/month from that. The cash flow isn’t consistent, though. Staff often steal or leave to do something else. So, I lock the shop up until I find someone else.

That’s two jobs and two side businesses

What can I say? Money must be made. Besides, they’re not all consistent. Some months can be really dry. Altogether, I can be sure of at least ₦620k/month from my two jobs. If the other businesses do well, my income can go up to ₦800k in a month.

What kind of life does your income afford you?

Independence. I can simply wake up and decide to treat myself to something.

In 2025, I made a few million from insurance commissions and partnered with someone to invest in land. We bought some land for ₦500k in a rural area and resold it for ₦1m. Then we bought another for ₦2m and resold it at ₦3m. We split the profits, but I can’t even remember what I did with my half.

I currently own two personal landed properties. I plan to make enough money to continue buying land, especially in remote areas, and leave it for 10 or so years so I can resell it when the area develops.

Besides land, are there other investments you’re considering?

Hmm, my ideal investment is to leave Nigeria. You can keep money now, and one government policy will change everything, and you will start looking for better opportunities. I don’t see much of a future here. My next move is to get a car, get married and leave the country. I’m fine with whichever comes first.

Also, I’ve tried other investments before. I once invested in a fixed deposit savings plan with a commercial bank because they promised high returns. I started my savings with ₦1m and grew it by about ₦100k monthly until it reached ₦2m. The return on investment was negligible compared to what they promised, so I stopped and moved the money to a savings account.

Currently, I have about ₦2.5m in my savings. I don’t have a specific approach to savings. If I receive a lump sum from commissions or have extra money, I direct it there.

How would you describe your spending habits?

I’m an impulsive spender. In December, I made ₦300k from a printing job, and I really can’t pinpoint what I spent it on. I save at times, but I know I’m not consistent. If I were, I would have easily saved at least ₦5m in 2025.

Interestingly, I mostly spend my money on data, food, transportation, and hanging out with friends. I think my main problem is that I struggle with keeping track of my expenses. I’ll think I have a particular amount in my bank account, only to open it and see something else.

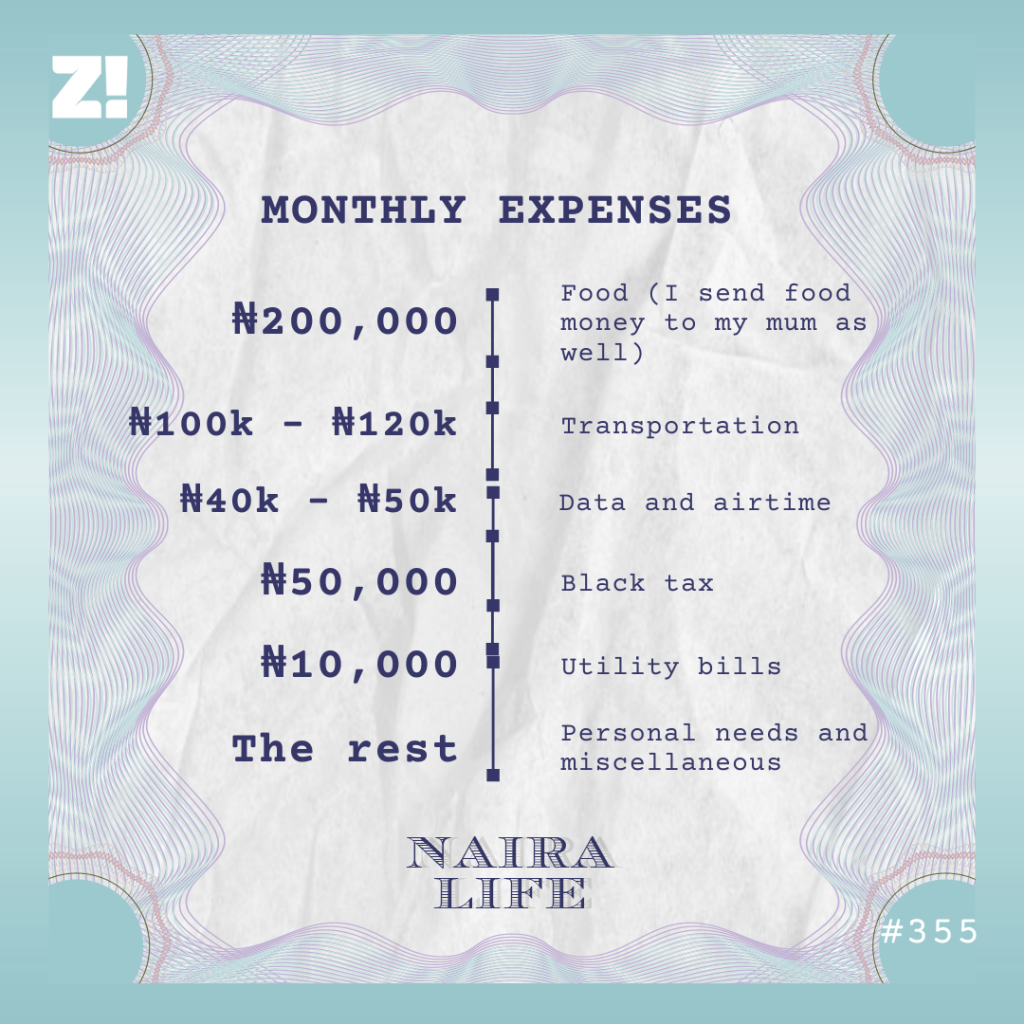

Let’s break down your typical monthly expenses

I live alone, so I buy furniture and home gadgets occasionally. The last thing I got was a solar power system for ₦350k.

Is there an ideal amount of money you think you should be earning now?

I don’t really have a target, but I think one needs at least ₦1m/month to be comfortable in Nigeria today. That said, I believe I can live around what I earn. In the months when I don’t make as much money, I still do okay.

Is there anything you want right now but can’t afford?

Two things: a house and my dream car.

Out of curiosity, do you have any money regrets?

Not really. If I regret anything, it would be the career opportunities I missed out on because of my third-class degree, as well as the business opportunities I didn’t get for various reasons. I’ve also lost a lot of money through my POS business because I trusted the wrong people.

To manage my compulsive spending, I recently downloaded an app that helps me better understand how I spend my money. However, my focus isn’t on starting to track my expenses. I’ve built this year around purposes. Two of those purposes are to get a car and get married. So, I’m making sure that I’m pushing money into those purposes.

Basically, I don’t have a tracking plan. Expenses come as the money comes. My money management goal is to ensure that whatever comes in big goes into solving one problem or one goal at a time.

Alright then. How would you rate your financial happiness on a scale of 1-10?

6 or 7. There’s still much more to do. I have a colleague who earns up to ₦5m/month from insurance commissions. I don’t measure my life by other people’s realities, but if there is a ceiling and you can hit it, why not go for it?

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.