Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

When I was 8, my dad gave my brother and me our first allowance. I can’t remember how much, but it was enough for each of us to buy a carton of biscuits. My brother came up with the idea of spending the full amount on biscuits, and I was down.

We had snacks at home, but we had limited access to them. My mum only gave us one at a time to take to school, but the biscuits were ours to do whatever we wanted. My mum didn’t even care that we spent all the money on biscuits. It was like, “It’s your money. You have the freedom to do as you please.”

Speaking of, what did your parents do for money?

My dad was a big-shot executive at an FMCG company, and my mum ran a large-scale poultry farm. Growing up, things were super smooth. We had big cars, and I attended nice private schools. The only reason we didn’t travel for vacations was that my parents didn’t like air travel.

Our financial situation changed around 2011/2012 though. The classic story: My dad lost his job, which forced us to move to a new city and a new neighbourhood. While it wasn’t exactly a slum, the people were unexposed. I honestly believe moving to that area set us back and impacted our growth. We just couldn’t grow.

How do you mean?

So, my mum moved her poultry farm there and also started a school. But she had to reduce school fees to ₦10k because the parents in the area couldn’t fathom paying more than that. It was either ₦10k or they wouldn’t send their kids to school.

There was this general nonchalance about education. I was around 10, and I couldn’t play with the other kids because they didn’t speak English. My parents couldn’t even interact with the neighbours because everyone just had a mediocre sense of thinking. I don’t even know how to explain it. The rot in that area was deep, and I genuinely believe it affected our momentum.

Also, my dad never got his spark back after he lost his job. I don’t remember him having a stable job after that. He still provided, but it was usually through income made from selling his properties. My dad had multiple properties when he was wealthy, so he could sell one today, use the money for a year or two, then sell another if he needed money again. That’s how he sent me and my siblings to school.

When was the first time you worked for money?

After secondary school in 2018, but there’s a funny context to how I started thinking about making money. My older brother and I entered secondary school at the same time, and when we were in SS 3, my dad put forth a challenge: He’d send whoever had the best scores in JAMB and WAEC abroad to school.

I was so excited and studied so hard that I broke all the academic records in my school. My brother, on the other hand, failed so badly that his results couldn’t have gotten him into a Nigerian university. So, my dad sent him abroad instead.

Ah

I’m sure part of the reason was that he’s the first son. You know, standard misogyny. I was devastated. On top of that, I didn’t get an admission offer for my desired course, so I stayed home for an extra year. I decided I’d make enough money to send myself to school abroad if my dad couldn’t afford to send two children.

So, I scoured the internet for ways to make money online. I watched YouTube videos and started learning web development, creating websites and blogs. Writing was the first option that paid me, though. I got a writing gig that paid me ₦2k per article. I didn’t have a bank account, so they paid me in airtime.

I also started teaching at my mum’s school. She paid me ₦10k/month to teach junior secondary students. I mostly spent the money on lunch and data. I worked there until I got into uni in 2019.

Did you keep trying to make money in uni?

Oh yes. I got a ₦8k weekly allowance from home, but it never felt enough. Between transport costs and little purchases, the money always finished. I remember being so shocked when I saw ₦18k in someone’s account. It was like, how can someone have this kind of money in their account at once?

So, I was always thinking about ways to make money. Also, my plan to send myself abroad still fueled my money-making intentions. I once gave a friend ₦6k to gamble for me, but he lost it all. I even tried the Racksterli “double your money in two weeks “ scheme. I made some money from it, but I ended up getting scammed.

Omo. Sorry about that

Thanks. Besides trying different things for money, I also applied for international scholarships everywhere. I even applied to a school in China. I just wanted to achieve my goal.

Then 2020 came. The lockdown was a really transformative period for me. It was when I first got into crypto. The first one I tried was a platform called Electroneum. Their coin was called ETN, and you could rack up points by completing tasks on the app and cash out ETN as airtime. I was steadily cashing out airtime that period.

I also did a bit of crypto buying and selling for small profits here and there. One day, someone from my school posted on a group chat, asking people who had international passports and bank accounts to DM him for a gig that could pay as much as ₦200k. I had an international passport because of all my efforts to travel abroad, so I reached out to him.

What was the gig?

He wanted me to register on an app, purchase crypto (he gave me the money), and send it to him, then I’d keep the profit. I was confused, but I did it. We tried a couple of times, but it didn’t work because my debit card didn’t work for international transactions.

However, I eventually figured out what he wanted to do. It was crypto arbitrage. Here’s how it was supposed to work: There was a significant difference in dollar price at the bank rate and on the black market. If I could get dollars at the bank rate and sell on the black market, I could make money just appear. Crypto was one way to get dollars at the bank rate. I just needed to make the purchase as an international transaction with my Nigerian bank.

When I figured out the plan, I went to my friend and we did some calculations. If we bought $500 crypto, we could make ₦200k after selling it on Nigerian crypto exchange platforms. So, we decided to try it. But we had two problems.

What were these problems?

We didn’t have $500 capital, and we didn’t have a working card for international transactions.

Initially, we considered starting small with $50, but eventually, we convinced ourselves to raise money. I told an older friend about the idea, and he decided to invest in it. He gave me some bitcoin, which was worth about ₦800k at the time, and I was supposed to return it with a 30% interest after a few months. Unfortunately, we lost the money.

Yikes. How?

My friend and I were looking for a cheap place to buy crypto, and the regular platforms had a limit on how much we could buy per day. In our search for more options, we found a coursemate who promised to get us $1k worth of bitcoin for ₦400k. We gave him the money, and he disappeared.

It was funny because we were in the same class and would see each other after the lockdown. We eventually tracked him down to his state and discovered he’d spent the money on an iPhone and other things. We seized the phone, but only got ₦190k from selling it.

Long story short, I couldn’t repay my friend the full ₦800k. We told him the business crashed and returned 50% of his investment. He wasn’t happy, but he forgave me.

So, the business didn’t last a month?

We only told him it crashed; it didn’t actually crash. We had a setback because of the money we lost, and had to re-strategise. We agreed it had been foolish to borrow money to start large-scale, so we returned to the original plan of starting small.

At the same time, banks had started limiting international transactions, so we built something like a conglomerate of cards. We got friends and coursemates who had cards that could do international transactions to allow us to use their cards, and we gave them a share of the profit.

In the first month, we made about ₦100k in profit. In subsequent months, we made between ₦500k – ₦1m/month and my friend and I split the money 50-50. We continued even after school resumed, but towards 2022, more people started to get in on arbitrage, and we stopped making as much.

Plus, the government suspended international transactions on naira cards, which affected our business model. Despite the challenges, my friend still kept at it, but I wasn’t too keen anymore. I just contributed passively and made the odd ₦100k – ₦150k most months.

Why the change of heart?

I’d taken web development more seriously and started making money from it. The first major earning was from a 2022 hackathon I participated in and won $2k. It was crazy money.

At this point, I should mention I was terrible at handling money. While we were making arbitrage money, my friend was saving, but I was buying everything fancy that crossed my mind. When I won the $2k from the hackathon, I bought a MacBook for $700, a ₦19k fridge, gave my mum ₦50k and another ₦50k to my siblings. I also bought my parents’ phones, which cost me ₦140k. Then I bought myself an iPhone 11 Pro for ₦300k, a camera and an iPad. In conclusion, I spent all the $2k.

Wild

After the hackathon, I worked with the organisers for a few months and earned an extra $2k. When that contract ended, I decided to work with foreign companies instead of Nigerians since they were more likely to pay well for my skills.

So, I focused on upskilling. I was coding up to 12 hours every day, to the point that I felt school and exams were stopping me from coding as much as I wanted. I was also constantly applying for jobs and started learning cybersecurity on the side.

In 2023, I attended an event held by the organiser of a cybersecurity course I was taking. I participated in a CTF competition there and won the $200 prize. Beyond the money, it was validation that I really knew this tech thing. Also, I got a cybersecurity internship. I had actually flown to a different state for that event, and accepting the internship meant I’d need to leave school for six weeks to work.

I accepted the offer and reasoned I could decide whether to return to school after the internship ended.

Was it a paid internship?

It was unpaid, but I was doing it for the experience. Plus, I still had money. I was also working as a technical writer with a company in Europe, and they paid me $150 – $300 per article. I lived in a student hostel for the duration of the internship, and my pay covered the ₦600k rent, and I still had enough left to ball.

After the internship ended, the company offered to retain me, but I couldn’t take the offer. First, I didn’t have an NYSC certificate and didn’t plan to finish school. Second, they were offering ₦150k, which was bullshit.

Wait. You mentioned not planning to finish school. You had decided already?

Yeah, after the internship, I decided that I wasn’t returning to school. My parents weren’t thrilled, but it was nothing dramatic. At this point, I wasn’t collecting any money from them or disturbing for allowance. I was independent and able to make my own decisions.

I got a job from someone who wanted me to teach cybersecurity at his training school. He was a terrible boss, but he didn’t delay my ₦450k/month salary. I worked there for about three months before returning home to determine what I wanted to do next.

I was still applying to jobs and getting offers, but I was determined not to work for a Nigerian enterprise again. Two months of job-hunting later, I landed a super sweet position as a security consultant for a US company at $1300/month. They paid weekly, so it was about $300 weekly. This was in 2024.

Three months into the job, I realised I was being underpaid.

How so?

I got the job through a friend, and payment came through him. The pay was actually $900 weekly, but he was sending me $300-ish. We went back and forth on the matter, and later agreed he’d send me $500 weekly, bringing my income to $2k/month. I still work with the company, and that’s still my salary today.

Early this year, I took on a side job that pays $1200/month, so currently my fixed monthly income is $3200, which is about ₦4.9m. I still do freelance projects and other side gigs that often push my income to over ₦5m. It can be up to ₦6m or ₦7m in really good months. I still want to push more to ₦10m/month. To be honest, I’d be making that now if I didn’t reject so many offers for one reason or another.

What kind of life does your income afford you?

A super comfortable one. Right now, I’m looking at my super high-end laptop, which I got for about ₦3m. I spend my money on gadgets the most. I have the entire Apple suite: watch, laptop, phone, everything. I also travel sometimes.

The biggest thing money has given me is that I no longer think the same way. I think that money is unlimited, and I don’t relate to struggle or hardship. I smile when I hear the price of things because I can afford everything I want.

I’m super comfortable, and I’m still super young. In a year or two, I should most likely double my current earnings. If I were in the US, with my experience level, I could easily earn $150k/year. So, yeah, I’m very happy with where I’m at. I’m in the top percentage of Nigerians, and it feels good.

Have your spending and saving habits changed since you started earning more?

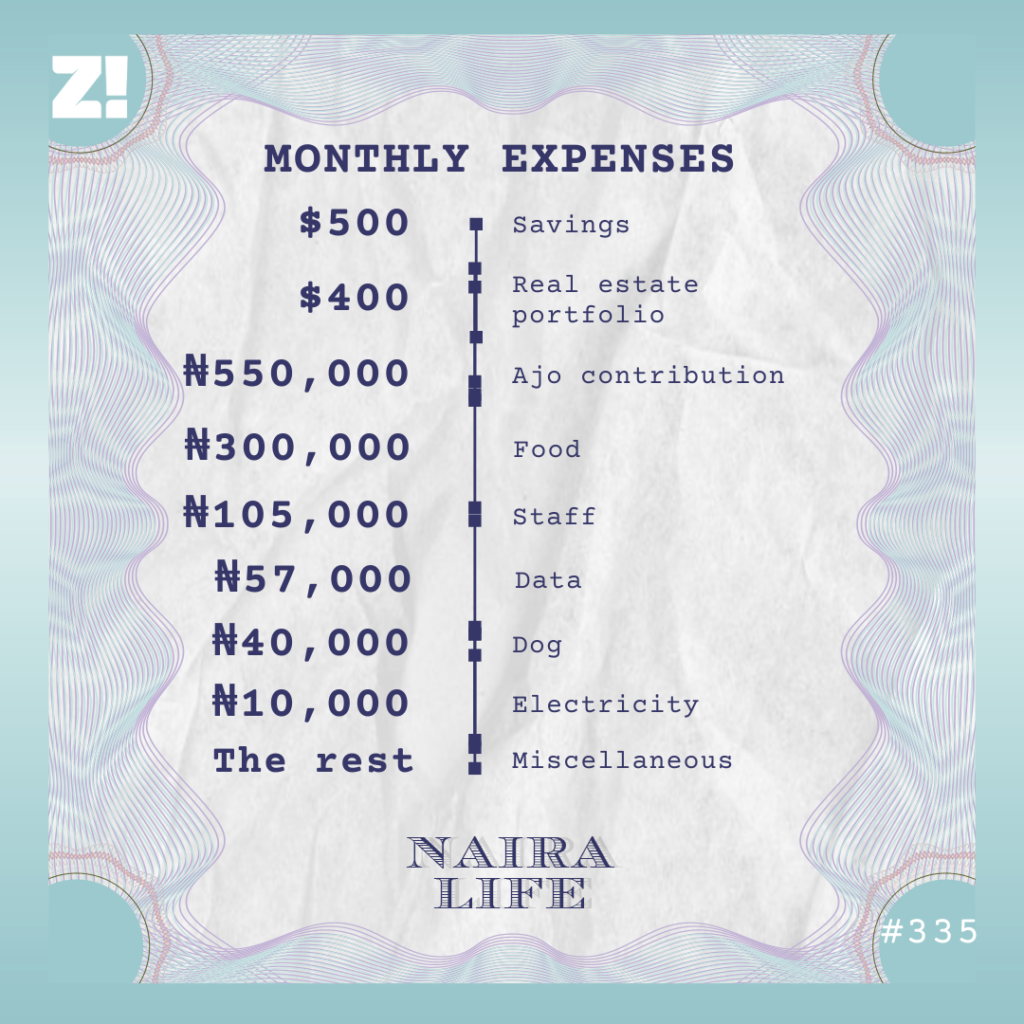

I’m somewhat better at saving. I’m not as aggressive as I should be, but it’s not too bad. I try to save $500 monthly and do a ₦550k ajo contribution monthly to pack ₦5.5m. I also have $5k in a real estate portfolio with my friend’s company that’s supposed to give me 20% returns yearly. I have $8k in my portfolio: $3k in savings and the rest in real estate. Nothing too serious.

How would you describe your relationship with money?

It’s sweet, but also bad. I say sweet because I don’t deny myself of anything. I work hard to reward myself. But it’s bad because I never have enough money after spending on what I want. It’s usually like ₦1m-ish left in my account. I want to get to a point where I have like ₦10m – ₦20m in my account.

Let’s break down your typical monthly expenses

My expenses typically vary from month to month. For instance, I don’t give my family money regularly, so they’re not dependent on me. But last month, I gave them about ₦200k. I also travel often to see my partner and friends, but it’s not every month. I last travelled in June, and flights cost me ₦600k. I might not travel again until September.

I’m most likely forgetting some expenses because tracking them is difficult for me. I get paid weekly, so putting all those expenses together is hard. But it’s something I’m working on.

I’m curious. How does it feel to have this much success at 22?

I feel like I’m kind of cheating the system. If I’d stayed in school and graduated, maybe I’d feel like I need to be responsible. But my classmates are still in school, so I feel like a child. Like what I’m making now is just extra, and I’m waiting for my life to finally start.

I feel like I can still afford to squander my money for a few more years. Or maybe until next year at least. I can start being responsible then. I sometimes feel like I’d be super comfortable going to zero and starting afresh again. I don’t know why I think that or where I got it from.

How has making money so early impacted how you think about money?

I feel like the world is at my feet and I can do whatever I want. I feel like I’ll always have money. You know that saying, “I’ll never be poor”? That’s how I feel. It’s such a strong conviction in my mind.

I sometimes get anxious, though. What if I lose my job or no one wants to hear from me again? I think the anxiety comes with the money. I didn’t use to get anxious like this when I was broke, but now the stakes are higher. I’m constantly thinking about how to make more money.

Interesting. Is there anything you want right now but can’t afford?

I want a car so bad. Actually, I’m just manifesting it; I want someone to dash me. The car I want would probably cost me around $10k – $15k.

Do you have any financial regrets?

I loan people money a lot, and sometimes, I regret it. I have almost $3k of my money in people’s hands, and I’m not sure I’ll get it back.

Is there anything you’d like to be better at financially?

My savings and investments are pretty slim, and I want to improve. I want to invest in stocks, but haven’t had time to study the market. Once I do, I’ll probably get into stocks.

How would you rate your financial happiness on a scale of 1 -10?

6. There’s not a lot of structure around my money now, and I know I can do better.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.