Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

GrabrFi gives Nigerians access to open a US checking account, receive USD payments, spend globally with an international Mastercard, and convert funds to naira—all with no hidden fees. Built for remote workers, freelancers, and creators earning globally. Start here.

What’s your earliest memory of money?

Two events come to mind. When I was around 10, I started helping my dad keep stock records at his factory, and he paid me ₦20 or ₦50. I can’t remember how much exactly; I just know it was a very small amount of money.

The second event is also within the same period. My dad sat my brother and me down and gave us a book he titled “Be wise.” Then, he taught us about the Book of Proverbs and how to manage money. I think he saw how I was blowing money anyhow, and wanted me to be more intentional about how I spent. He talked a lot about saving. To be honest, I didn’t really care.

Ah. So his speech didn’t have any effect on your life?

Well, it did a little. At least, in secondary school, I saved for weeks to get my first phone: a Tecno L3 for ₦13500. I remember printing out the picture of the phone and putting it on my locker so I could see it when I woke up every day. I saved all my ₦1k/week pocket money and any extra money I got from relatives to get that phone.

Saving for the phone may have been an isolated event, though. After secondary school in 2014, I got a job working for my cousin. She was in a different state and needed someone to follow up on her clients for some training programs she organised. My job was basically to call the clients and schedule the training.

She paid me ₦10k/month and recharge card. I did that for three months and blew all the money on parties and other random things. See why my dad was trying to get me to make better financial choices?

Haha. I see. Speaking of, what was money like growing up? You mentioned your dad had a factory

Yeah. He made and supplied fragrance across the country. It was like our family business; my mum worked there, too. I was a nepo baby growing up. There was no stress about money or anything like that.

At some point after secondary school, things changed a bit. The insurgency in the north — apparently, northerners buy fragrance the most — and the fluctuating exchange rate affected business. My dad had to switch business models, and our living standards reduced slightly. But it was nothing major. We moved from about 17 cars (including personal and commercial) to about four.

I mean, there were still cars. Let’s go back to the stint with your cousin

I did the job for three months and didn’t do anything again for money until 2016. By then, I was in 200 level at uni. Does this classify as working for money, though? That was when MMM and its cousins were popping, and I used most of my ₦60k allowance to get in on the action too.

I actually made a lot of money in those Ponzi schemes. Money flowed in, and I lavished it on clothes, food, outings, and my babe. She was in Ireland, and I’d regularly send her money in Bitcoin. I had no plan for the money, so I didn’t even take note of how much I was making and spending. After the schemes crashed that year, I still had about ₦200k. I spent that one, too.

In 2018, I started getting a little serious about money. I was in 400 level, and decided to try some businesses with my friends.

What kind of businesses?

The first one we tried was importing electronic shisha pens from China. I told my parents, and my religious mum wanted to lose her mind. But my dad said, “Abeg, let’s run this thing.” He gave me the initial capital I used to import the first set of goods.

The profit was high. Each pen cost ₦500 and we sold it at ₦5k – ₦8k. It would’ve been great, but we sold too many on credit and getting paid became a hassle. Plus, shisha doesn’t hit like weed does. It’s just like puffing flavoured smoke. So, the pens weren’t too popular. Overall, we had a lot of operational inefficiency, and the business didn’t kick off. We did it for six months.

The next business I tried was a total failure.

What happened?

I went to school in a state that isn’t as developed as Lagos, and my business idea was that people could pay me a percentage to get them gadgets from Lagos. The first client I got wanted an iPhone 6.

He gave me ₦40k, and I found someone willing to sell me the phone on an online marketplace. I paid the person and never saw the phone. Long story short, I had to pay off the ₦40k gbese. That’s how the business ended.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

Phew. Did you try another?

No abeg. After uni in 2019, I returned to Lagos and chilled for a bit. I felt NYSC was a waste of time, so I didn’t go immediately. Instead, I took advantage of Buhari’s N-Power scheme to learn mixology. I didn’t pay for it; they still paid me ₦10k/month. My dad also supported me with pocket money that year.

To finish the training, I did a three-week internship at a hotel. I suffered in that hotel, sha. Imagine standing for hours to fold towels. I just kept thinking, “So people actually do this?” It was really depressing. It took me going to NYSC camp in November and blowing all the money I’d gathered — about ₦100k — for me to leave that depressive state. So, if you’re ever in a shitty head space, the key to recovery may be to blow money away.

Skrim. Results may vary. What did you do after camp?

I didn’t want to return to the hotel, so I called my cousin and told her I wanted to do digital marketing. I first learned about digital marketing in university when I attended a seminar on the topic. I liked its flexibility, and I continued gathering bits of knowledge about it over the years.

So, when it came to looking for a PPA, I knew that’s what I wanted to do. My cousin helped me land a ₦25k/month social media management internship with a design agency. This was in addition to NYSC’s ₦19800 stipend and the ₦10k from N-Power. The N-Power payments lasted a year. After about two months, the NYSC stipend also increased to ₦33k, bringing my total income to almost ₦70k.

Was this good money?

It was. I didn’t have major expenses; I lived with my parents and drove to work. My dad also paid for fuel, so my life was chill.

Things changed when COVID hit. My job slashed my salary to ₦20k, and the lockdown affected my dad’s business. By then, he’d switched from producing fragrance to running event centres, and no one was going to events. No money entered that house during that period. Omo, I touched suffer. For the first time in my life, my brother and I had to contribute money to support the home’s expenses.

Thankfully, things looked up towards the end of 2020. I got my first big boy job as an account executive at a marketing agency.

How much was the pay?

₦150k/month. I deployed paid media ads for national and international brands. It was a huge deal, but it was also stressful. At least the money made up for the stress. My family’s situation had improved, so I didn’t have to pick up bills. I was just sending money on outings and food.

You were balling

Yes, and it gets better. My brother is an ethical hacker, and he managed to find a loophole in the betting system.

I can’t really break it down, but it involved depositing naira and withdrawing the higher dollar equivalent before converting again at the black market rate. The exchange rate meant we made far more than we put in. We also kept the money in USDT and Bitcoin. Essentially, we were betting without losing money. In a day, we could make up to ₦500k.

You say?

See, there was money. We balled for five months before the loophole closed. We’d go for long drives, stock the fridge with chocolate and do whatever we wanted. My brother was the brains of the operation, so he had a higher share of the loot. While he used his money to buy lands, I was just balling mine.

I had a girlfriend, and we could just wake up on a random day and decide to chill at hotels. I still saved a little sha. I had ₦1.2m saved when the operation finally crashed. Losing that income source pained me, but it is what it is. I also quit my job. This was in 2021.

Wait. Why did you quit?

The job stressed me too much. Agency work is a lot. My blood pressure consistently spiked, and it was too much for me. So, I quit and crashed at my friend’s place.

For about two months, my routine was to wake up, smoke, spend the day lying down on my friend’s couch, and eat noodles. After I got that out of my system, I turned to freelancing. I figured it’d give me more control over my time, and I could still do digital marketing without an agency breathing down my neck.

How did that go?

I had a good start. A friend I’d made at the agency called and offered me a gig. It was for a brand I’d worked with before, so the campaign went well. The downside to freelancing was the pay, which is based on the campaign budget.

For instance, the campaign budget could be ₦10m for a quarter. The agency takes 10%, which is ₦1m. Out of that ₦1m, my pay is 30%, which is ₦300k, and that’s it for the quarter. Sometimes the agency won’t even pay on time and pile up payments for months.

On a good month, I was averaging ₦75k – ₦100k/month. Other months, I was poor as they come. I had the time I wanted, but money? That was another story. After freelancing for about 10 months, I decided it was enough. I applied for my current job at a government-owned agency and got the role.

What was the role?

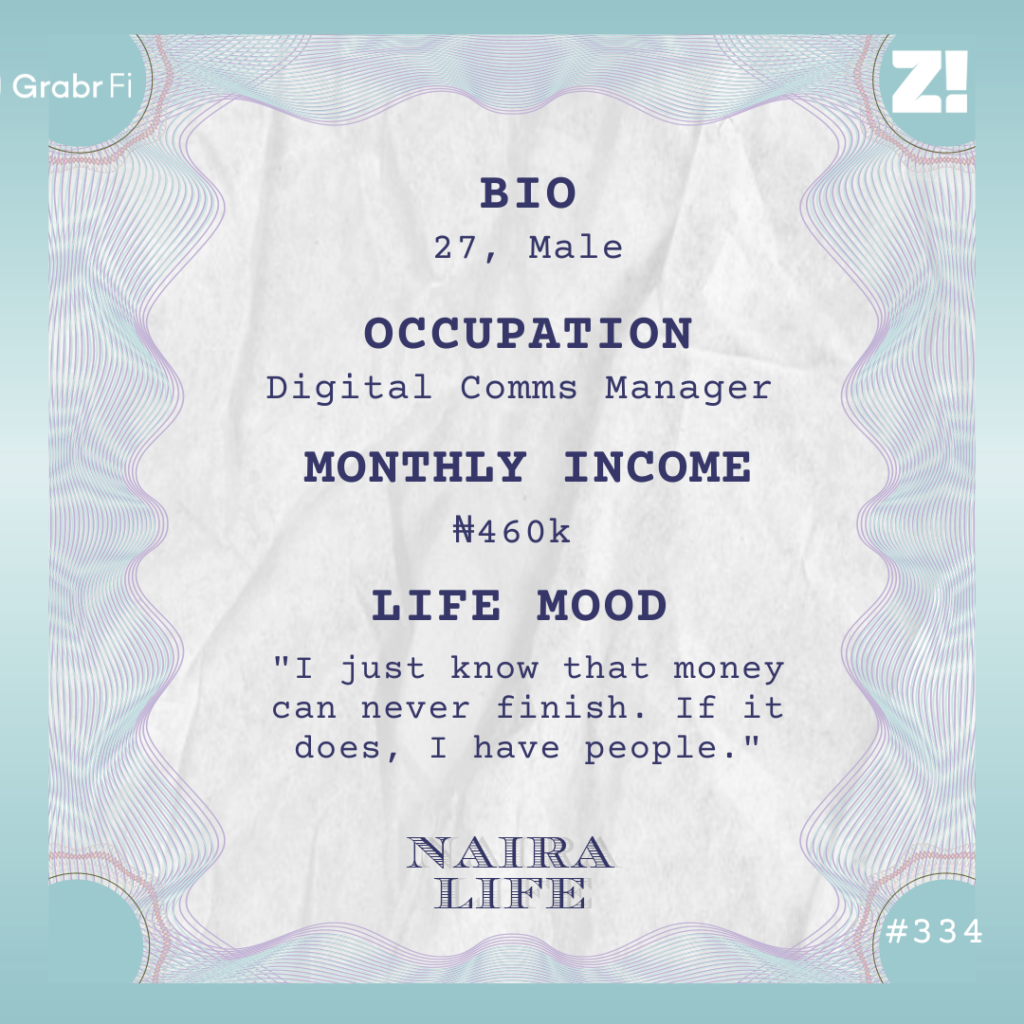

Digital communications manager. When I joined in 2022, my net salary was ₦350k with allowances as high as ₦100k/month. I just got promoted this year, and my net salary has increased to ₦460k. Allowances are an extra ₦140k-ish monthly, but it’s paid in bulk at the beginning of the year. This windfall is around ₦1.6m/year.

Not bad

I won’t even lie; I live a comfortable life. I mean, I still want far more than what I currently have. I want to drive a Mercedes-Benz and travel to Casablanca. But I have the basics. I live in a shared apartment and pay ₦450k for rent. My transportation costs aren’t too crazy.

I also don’t have any black tax nonsense. I still get financial support from my dad and brother. For instance, they just increased my house rent, and I’ll probably have to leave. I know I can rely on my dad and brother for support. He also readily sponsors my personal development plans.

I’m a part of the Toastmasters community, and my dad paid the initial ₦145k fee for me to join. He also sent me ₦100k for my birthday. My dad randomly sends money to my brother and me. We don’t ask, but he does it. Who am I to reject free money?

I understand like mad. How would you describe your relationship with money?

Very chaotic. I just know that money can never finish. If it does, I have people. I believe in borrowing money from friends to make considerably large purchases. So, instead of using 100% of my funds, I can borrow like 50%. That way, I don’t stretch my account too thin and can easily pay it back. I can’t spend my money and then start soaking garri. That’s nonsense.

I started this “strategy” when I was freelancing. When I noticed I could make money this month and make nothing the next, I borrowed. The money would help me guide until money came again. I also stretched the repayment plan so I could afford to repay without stress.

I don’t borrow often, only strategically, and my creditworthiness is very high. People know I always pay back, so they don’t have problems loaning me money. I recently borrowed ₦600k from a friend to buy an iPhone. I spaced the repayment into three months, and paying back was easy.

Interesting.

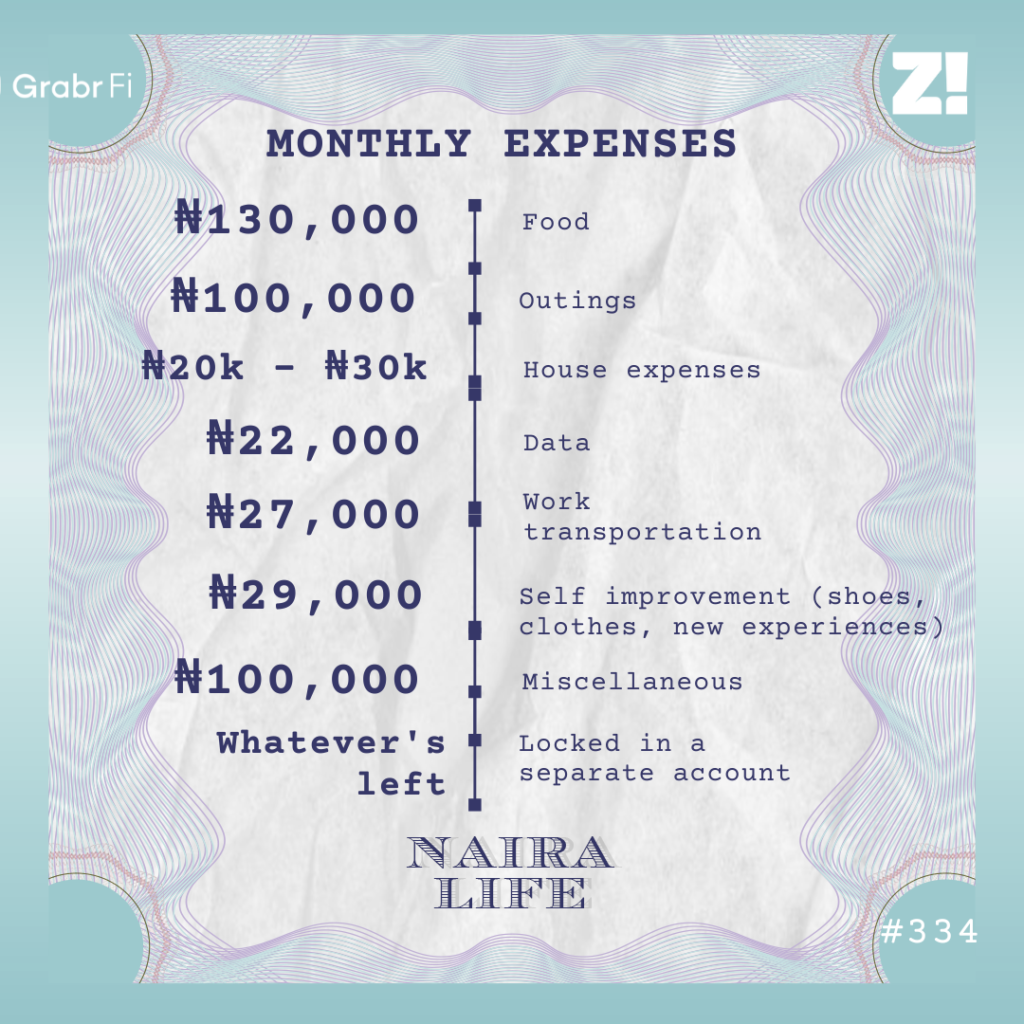

Also, still on my relationship with money, I’m the worst at keeping track of my expenses. I’ve tried, but it’s not working. So, I don’t overthink it. Once I’ve paid for a few necessary things, I lock my money in a separate account and keep it as a backup for rent or emergencies. It’s not really savings because I still take from it, if necessary.

What do these expenses look like in a typical month?

Tracking isn’t my strength, but I’ll try.

Is there anything you’d want to be better at regarding your finances?

I want to be better at managing it and having a tracking system so I know where my money is going.

Do you have any financial regrets?

Maybe I shouldn’t have gotten a 9-5 job. Freelancing would have given me more self-control because I’d know I don’t have a set amount of money coming every month.

Besides that, I don’t have any regrets. I’m comfortable. It can be a softer life, but I dey okay.

How much do you think would give you a softer life?

₦4.5m/month. I’m not necessarily expecting that from a salary. I’m thinking more in terms of starting my own business or joining the family business. I have a few ideas in mind, but I’ll wait for them to happen first before I share. But I definitely want to go into business. Let me have some free time and money to loaf around and allow the devil to use me small.

Screaming. Is there anything you want right now but can’t afford?

A Toyota Camry. I haven’t even checked the price.

How would you rate your financial happiness on a scale of 1-10?

7. I’m doing pretty well for myself. I don’t lack or want anything. I’m single, so no Nigerian babe to give me unnecessary expenses. I can be better, but I’m doing okay right now.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.