Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Grow your wealth in both dollar and naira, earning up to 15% in USD and 25% in naira. With flexible rates that move with the market, you can switch between wallets anytime to match your financial goals. Start here.

Let’s start from the beginning. What was growing up like?

There was no money growing up. For example, I started using glasses in Primary Three to manage short-sightedness, and I remember the series of beatings I got when I lost them in Primary Five. My mum kept saying, “Do you know how much I bought those glasses? I’m not getting you another one.”

I didn’t get another pair of glasses until I was in JSS1, and when I did, the lenses were too strong for me. After I complained, the ophthalmologist retrieved the glasses, but my mum didn’t have money to get me another pair, so I went without glasses for four years. I didn’t get another pair until I was in SS 2.

Phew. What was it like going without glasses for so long?

I’d sit close to the board, yet strain my eyes to make out what’s on it. Other times, I copied notes from classmates.

Once, we were doing class work, and I asked a friend to dictate what was on the board to me. When we all lined up to submit, I went closer to the board to read the questions. It turned out my friend had dictated rubbish to me. Luckily, I still had time to correct my answers, but I felt bad. Someone I considered a friend actually wanted me to fail.

Besides having to rely on people, I also had to endure headaches and watery eyes due to the strain. It was a lot, but I had no choice but to live with it. My parents were civil servants, but my mum handled most of the financial responsibilities and always complained about the economy.

That’s why I started thinking about making money immediately after I finished secondary school in 1999. I didn’t want to depend on my parents or have to explain why I needed something. At least if I made my own money, I could spend it however I wanted.

So, what did you do to make money?

I started assisting my hairdresser aunt in braiding her clients’ hair. At the time, the “one million braids” hairstyle was popular, and hairdressers always needed assistants to complete it. So, I’d join my aunt, and we’d take about two days to finish one person’s hair. Then she’d pay me ₦400 – ₦600.

This was the 90s, so ₦400 wasn’t bad. Helping my aunt braid two people’s hair meant I could make enough money to go to Underbridge Oshodi and get a body hug top and Lycra trousers, which went for ₦1k.

I was admitted to university in 2000, and I used the first year to explore the environment and see what I could sell. By the time I resumed for my second year, I’d found a business opportunity: selling undies to the ladies in the hostels. I can’t remember exactly how much the business brought me, but I know I no longer depended on my ₦4k/month pocket money.

I ran the business for a year until I completely lost my sight in 2003, when I was in my third year of school.

How did that happen?

I don’t know. I was on my way to get new glasses. One lens had gotten lost two weeks earlier, and my mum had just given me ₦4k to replace it. I was walking when my vision suddenly went blurry. I could make out reflections and rays, but couldn’t see people. Like, the imagery wasn’t forming.

I thought it was a joke and kept rubbing my eyes, hoping my sight would “reset”. I’d sometimes deal with blurry sight if a car’s headlight shone into my eyes. This one was different. I managed to get a bike to a friend’s place and begged her to take me to an optician. When we got there, the doctor said there was water retention in my eyes. I was like, “How did water enter my eyes?”

He gave me some medications and said he’d recommend surgery if there was no improvement. I took the medication for days, but nothing changed. My mum and I sought different opinions at eye clinics and did multiple scans. At some point, someone recommended an eye foundation to us, and those ones told me there was no guarantee surgery would bring my sight back. They didn’t even explain the test results; they just said they didn’t see any ray of light. It was LUTH who told us it was retina detachment, and there was no fix, so I had to learn to live with it.

Hmmm. How did that feel?

In the beginning, I was hopeful. I kept hoping we’d find a solution. After the doctors told us there was no hope, my mum and I turned to religion and spiritual houses.

We went from prophets to alfas, and spent a whole lot of money. My mum would drop ₦15k here, ₦17k there. One time, we killed a ram. I think we spent ₦30k on that. All of them promised I’d regain my sight in a few days. Nothing changed.

This went on for about five years. Also, my mum handled all these expenses; there was no support from anywhere. Besides her civil service job, my mum had a fabrics and jewellery business, and everything she made went into trying to find a solution for me.

As each spiritualist promised and failed, I went from feeling hopeful to feeling lost and agitated. I felt rejected. Would I have to depend on people all my life? Would I turn out to be a beggar? Every bad thing you can imagine, I thought about it. I attempted suicide twice. Each time I woke up, I asked God why he had to return me to life. I was so overwhelmed.

I’m so sorry you went through that

Thanks. In 2008, someone introduced my mum to blind education. I applied and was accepted into a rehab school. I think it was ₦50k for the year I spent there, but the school changed my outlook on life.

They taught me how to live with my new reality, how to move and navigate my environment with my white cane, how to use a typewriter and computer, how to read and write Braille, and general life and hygiene skills. They also taught me vocational skills, like how to make bags and shoes.

While in school, I took JAMB again and got admitted to study guidance and counselling in 2009.

Amazing

I might not have even applied if people hadn’t encouraged me to try. I kept thinking, “How do I return to school without my sight?” But I had support. I’d just started dating my husband then, and he’d take me to and from school for registrations.

When I moved into the hostel, I made friends with classmates who helped me navigate attending classes and returning safely to my room. I had one friend who never let me just sit in the hostel. She dragged me along when she went out for shows, campus activities, or just to have fun. I think when you’re good to people, you attract good people too. My friends helped me record notes with my midget recorder so I could listen and use the recordings to read.

During exams, I either went with a reader to read out the questions for me, or the school provided one while I typed out the answers with a typewriter. I should also note that I had to provide everything I needed to study: typing sheets, a recorder, and even my typewriter. The university didn’t owe me anything. As usual, my mum was my main source of financial support.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

What happened after uni?

I started job-hunting after I graduated in 2014. I reasoned that it’d be better for me to find government employment. I specifically wanted to teach, so I applied to government schools and the Ministry of Education. When nothing positive came after a few months, I decided to apply for a master’s degree instead of just sitting at home.

I got an admission offer in 2015, but it came with a major challenge: how to fund it. My mum didn’t have the capacity to support me anymore, so I turned to people for help. It took a couple of close calls, but I raised the almost ₦140k I needed for admission acceptance and tuition fees. A lecturer even paid my ₦44k hostel fee. God and people really came through for me that year. A fellow student also befriended me and took all my expenses on her head, from food to clothing.

Towards the end of my master’s program, I saw an advertisement for state government teachers. I applied and got employed as a Level 8 teacher in 2016. My salary was around ₦52k/month after deductions.

You got the job you wanted. That must’ve been so exciting

I can’t even describe how I felt. I knew people around me who, despite their sight, couldn’t get an education or a job. But there I was, with two degrees and a government job just like that. I felt so many emotions: fulfilment, happiness, joy and gratitude.

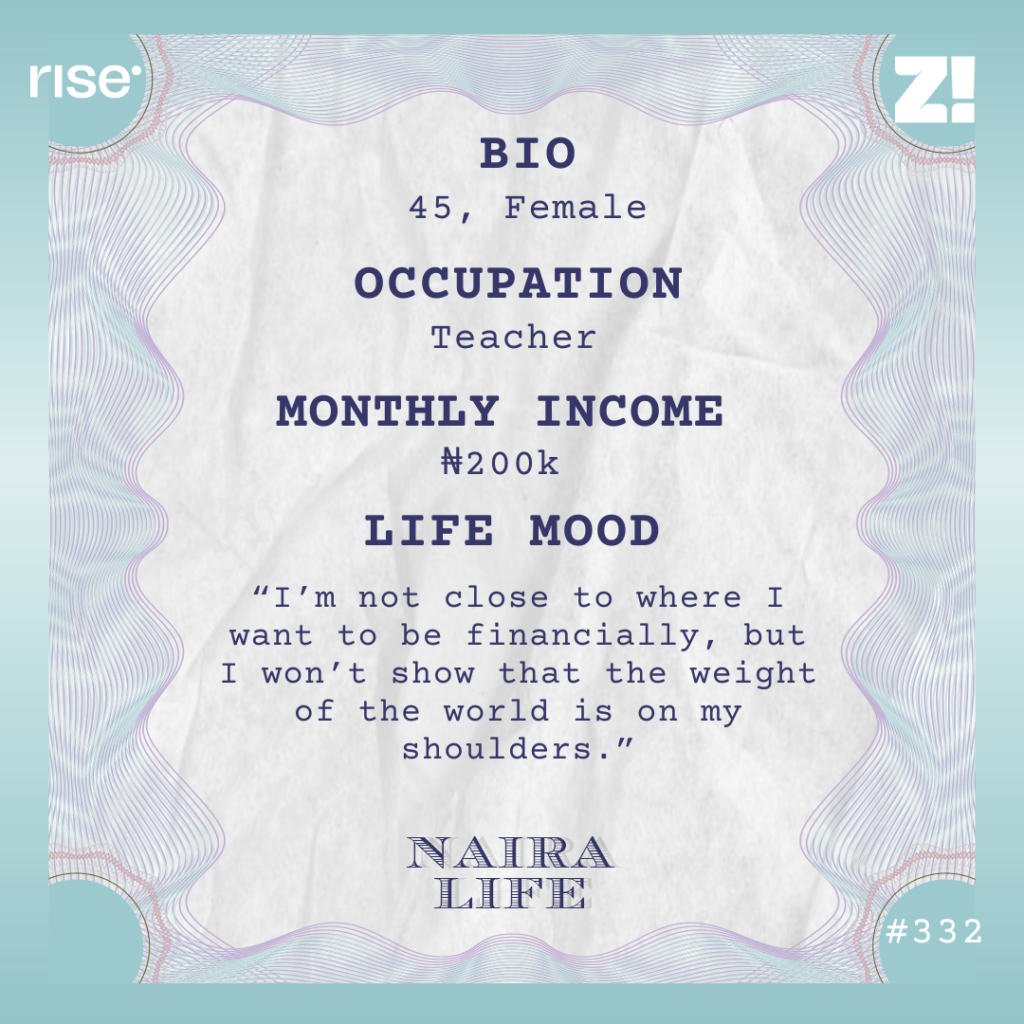

I’m now a Level 12 teacher, and my salary has grown to ₦200k/month. It should be slightly more than that, but I’m part of three cooperatives, and they deduct my monthly contributions from the source.

What kind of life does your income afford you?

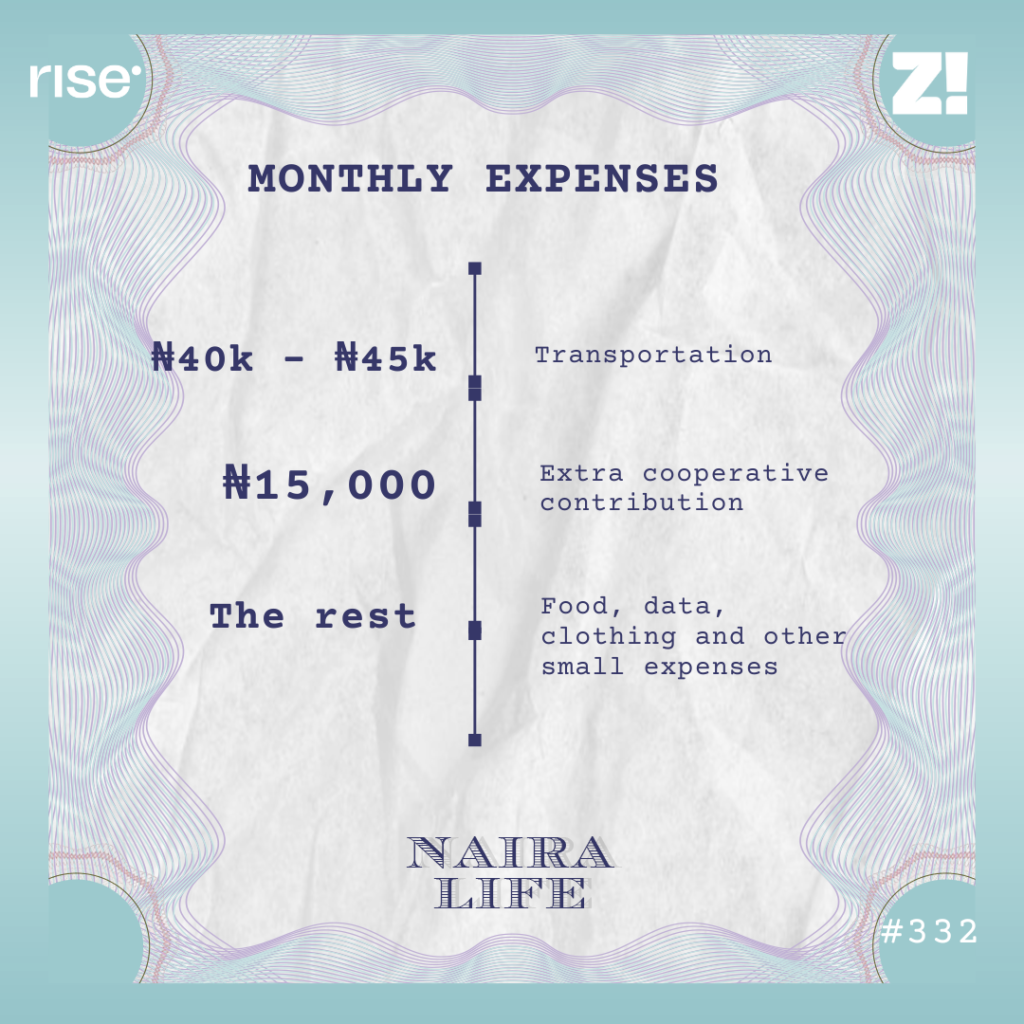

I’m surviving and can take care of my family to some extent. It’s good to have something consistent, but with the economy, my salary is barely enough. Plus, my expenses are higher than the average person’s. My husband isn’t always comfortable with me using public transportation alone for security reasons.

So, when he can’t go with me or I can’t go alone, I often have to travel with someone. This is especially necessary when I’m at work or need to go for documentation. Of course, I have to pay for their transportation and also feed them that day. So, while someone else is spending ₦1k/day on fare, I’m spending ₦5k-₦10k.

If I could, I’d have explored side hustles like my colleagues, but I don’t have that luxury. During my undergraduate days, I had a stint selling provisions, but someone cheated me, and I stopped.

What happened?

I used to arrange different cash denominations in a particular way so I could handle transactions. Then, one day, a girl came to buy an egg and handed me what she said was ₦50.

I gave her ₦20 change, but my instincts told me she didn’t give me ₦50, so I kept her money aside. When my roommate returned, I asked her to confirm the note, and it was actually ₦20. So, she essentially bought the egg for free and collected her money back. I decided I couldn’t continue doing business if people would just keep cheating me.

So, even while I want to explore other income opportunities, I’m still limited. I once told someone that I wished I could borrow money from my cooperative to buy a keke so I could ride it and make my money. I’d make enough to support my husband and child. But of course, I can’t do that. I also can’t consider anything involving sales because people will take advantage of my condition.

That’s awful. Let’s go over these expenses you mentioned earlier. What do they look like in a typical month?

The cooperative contribution on this list is different from the three that get taken out at source. I just make these two additional contributions personally. I participate in so many cooperatives because they’re the only way I can save and prepare for the future. When I retire, I can have something to keep me before gratuity comes in.

What’s an ideal amount you think would give you a comfortable life?

I can’t say there’s an ideal amount. If my salary increases to ₦1m tomorrow, my expenses will grow to match it. A higher income will definitely help my family live better, but I don’t have a particular figure in mind.

I’m curious. What’s navigating work and students like as a visually impaired teacher?

Teaching is actually much easier now. The state has an online platform where teachers can download their materials. So, I use a text-to-speech app on my phone to read the materials.

Before, we mostly had printed textbooks, and I had to get someone to snap the pages before my app could read them to me. Whenever I need to use a print material, I can get someone around me to help take photos of the notes. Also, my students are sighted, but I don’t have problems managing them.

Interesting. What’s something you want right now but can’t afford?

A two-storey building.

That’s very specific

It’s actually a childhood dream. Growing up, we lived on the ground floor, and the landlord’s family, who lived upstairs, kept throwing things at us. That’s when I decided that if I ever built my own house, it had to be a two-storey building — not to intimidate my neighbours, but to be on top of my building and just enjoy the environment.

What’s something you bought recently that improved the quality of your life?

I equipped my kitchen with things to make my life easier. I love pounded yam, but I can’t pound. Other people with visual impairments can do it o, I just can’t. I also don’t like frying because of the hot oil. So, I bought an air fryer for ₦35k and a yam pounder for ₦22k.

How would you rate your financial happiness on a scale of 1-10?

7.5. I’m a happy person, and I don’t allow things to get to me. I’ve grown past the point of wallowing in my condition. It has happened, and life moves on. I’m not close to where I want to be financially, but I won’t show that the weight of the world is on my shoulders. Also, can I say something to people reading this?

Sure

Please, don’t run away from people with disabilities. When you see people standing by the road with their white canes, they probably need help crossing the road or a bridge. It doesn’t hurt to offer help. I’ve had people run away from me when I call out for help. Disability isn’t communicable, and the stigma doesn’t help. There are many of us out here, and we need as much assistance and financial help as possible.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.