Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Grow your wealth in both dollar and naira, earning up to 15% in USD and 25% in naira. With flexible rates that move with the market, you can switch between wallets anytime to match your financial goals. Start here.

What’s your earliest memory of money?

When I was in primary school, my dad would give my sister and me ₦20 daily for school. We always took food to school, so we usually spent the money on Goody Goody and other sweets.

My parents also gave our teacher extra money weekly in case we needed anything else. It was more like a safety net. They didn’t want us to handle “big” money because they feared we’d lose it, so they gave it to a trusted person instead.

We hardly went to the teacher to collect more money, though. We were too shy to ask, so the teacher bought stuff for us most of the time. That’s the first time I realised you needed money to buy nice things.

What was growing up like financially?

My family was middle-class. My dad was a civil servant, and my mum was a nurse at a teaching hospital. They both had cars, we lived in our home, and I attended private school up until university. There was never a time I felt like we didn’t have money.

The only thing was that my parents never wanted us kids to handle money. They preferred to give us money whenever we needed it, but that idea stopped working for me as I moved through secondary school. Asking for money from my parents usually went like:

Me: “I need money”

My parents: “What do you need it for? Haven’t you eaten?”

Haha. Because why do you need money when you aren’t hungry?

Exactly. They didn’t understand that I needed money as a young boy in secondary school. Sometimes, I wanted to buy airtime for my phone, and other times, I just wanted money to get things without having to explain.

This need drove me to do one of the first things I did for money. My parents had a building project near our house. So, whenever the labourers came to work, I convinced them to allow me to assist in pushing wheelbarrows or picking up cement.

My parents and other people would look at me like, “What is this boy doing?” I didn’t mind. The labourers gave me ₦500 – ₦1k for my work, and I was happy. It wasn’t much money, but it gave me a sense of self-worth and relief.

The next time I did a proper job for money was in uni.

Tell me about it

I got a transcribing gig by chance during my student internship at 300 level, around 2016/2017. A few other students and I were posted to the same place, and one day during break, one of them just asked, “Which one of you sabi write for here?”

The guy was also a graphics designer who used to get random gigs. That day, he got a connect asking for someone who could transcribe interviews. I’d never done anything like it, but I said I could do it. He connected me to the client, and I made ₦5k – ₦10k per gig, depending on the length of the interview. It was a good addition to my ₦30k – ₦50k monthly allowance from my parents.

I got my next job during NYSC in 2019. That’s where my career started.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

What was the job?

Public relations in a PR firm. NYSC posted me to a school, but I didn’t want that, so I searched for other placements. I spoke to a friend who served in a creative agency, and he encouraged me to see his boss.

When I got there, there were no more spaces left for corps members. However, the boss liked how intentional I was about finding an opportunity, so he referred me to his friend, who owned a PR firm. The man hired me on the spot after looking at my practically empty CV and paid me ₦30k/month to do basic PR stuff: write press releases and a little copywriting.

My boss also owned a digital business magazine, and he gave me a few tasks when there wasn’t much to work on the PR side. Three months into the job, he came to the office and said he wanted me to try investigative reporting on the police at the Third Mainland Bridge. He wanted me to find out why they typically stayed there and get them to share their experiences with criminals.

So, I went there, related well with the officers, and got stories out of them. My boss was so impressed when I gave him the final story that he gave me $100 and said he’d retain me. He increased my salary to ₦50k, and then after NYSC, he promoted me to PR officer. The promotion came with another salary bump to ₦100k.

Not bad

It wasn’t bad at all. Within a few months, I got another increase to ₦150k. That job taught me everything I know about PR. My boss also enrolled me in a course with the Nigerian Institute of Public Relations (NIPR) to help me upskill and gain more knowledge. He saw my commitment to the job and was willing to invest in me.

In 2021, someone on the account management team resigned, and my boss didn’t want to hire someone new. So, he asked if I could manage accounts. I hesitated and said, “I can, but I don’t have the contacts of the different media guys I’d need to work with.” He just hissed and was like, “Is that all?” He sent me different media contacts, and that’s how work started.

I became an account manager, interacting with the clients and working on PR and marketing proposals and pitch decks. The new role came with a salary increase: ₦250k.

Was that good money?

Oh, it was. At that point, I was living with my parents and spending money anyhow — I had no responsibilities.

I stayed at that job for two more years and left in 2023 when I felt good enough to chase better opportunities. After I left, I took a six-month contract gig with a new real estate development company as their PR and comms manager.

My job was basically to set them up, overhaul their website copy, and provide PR and communications strategy for their executives and directors. They paid me ₦1m for the six months, which was technically less than what I would’ve earned at my previous job, but I wanted the experience to boost my CV and LinkedIn.

I also started living alone in 2023. I rented a ₦500k/year self-contained apartment and furnished it a bit. After the real estate contract ended, I moved to another agency as a PR consultant/account manager. My pay was ₦300k/month. I worked there for a year until I was unexpectedly laid off.

Darn. What happened?

I had a minor issue with the founder while working on a client’s brief. We’d travelled to another state for the project, and when I returned to Lagos, I saw the lay-off notice. It was three days to the month’s end, and there was no notice period or severance pay.

That’s when it dawned on me how terrible I was with money. I was the “salary is coming, let me spend money” guy. I had zero naira saved, and the money left in my account didn’t last two weeks. It was so bad that I couldn’t afford data and had to rely on the WiFi in my compound. I had to turn off all the lights in the house because I couldn’t buy electricity units.

I also started asking people for urgent ₦2k. These were people who used to ask me for money. I couldn’t tell people I lost my job; I just said salaries were delayed. I didn’t even tell my parents immediately. They only found out because they came to see me after I switched off my phone for three days, just crying and feeling bad for myself.

So sorry you went through that

Thanks. It was very difficult. I also had to deal with neighbours constantly asking, “You no go work today?” I’d just give them lamba and be like, “Oh. I’m working from home today.”

I was jobless for about three months. I kept applying for jobs but didn’t get past the interview stage.

To survive, I relied on loans and whatever my parents sent me. I had to turn to loans because my landlord increased my rent to ₦700k, and the rent was due.

I borrowed over ₦1m in those three months: ₦500k from my bank, ₦300k from a microfinance bank, $200 from my friend in the US and some other small money here and there. It was a whole thing. Thankfully, my unemployed stint ended in February 2024, and I started repaying the loans gradually.

Phew. You got another job?

Yeah. One of many applications finally panned out, and I got the role of PR consultant for ₦400k/month. I still work there today.

My experience changed how I approach my relationship with money and employers. For the latter, I now understand that they can let anybody go whenever they please, so I need to stay prepared for that. It’s one reason I happily took on another ₦255k/month job when the recruiter contacted me on LinkedIn three months after I started the first.

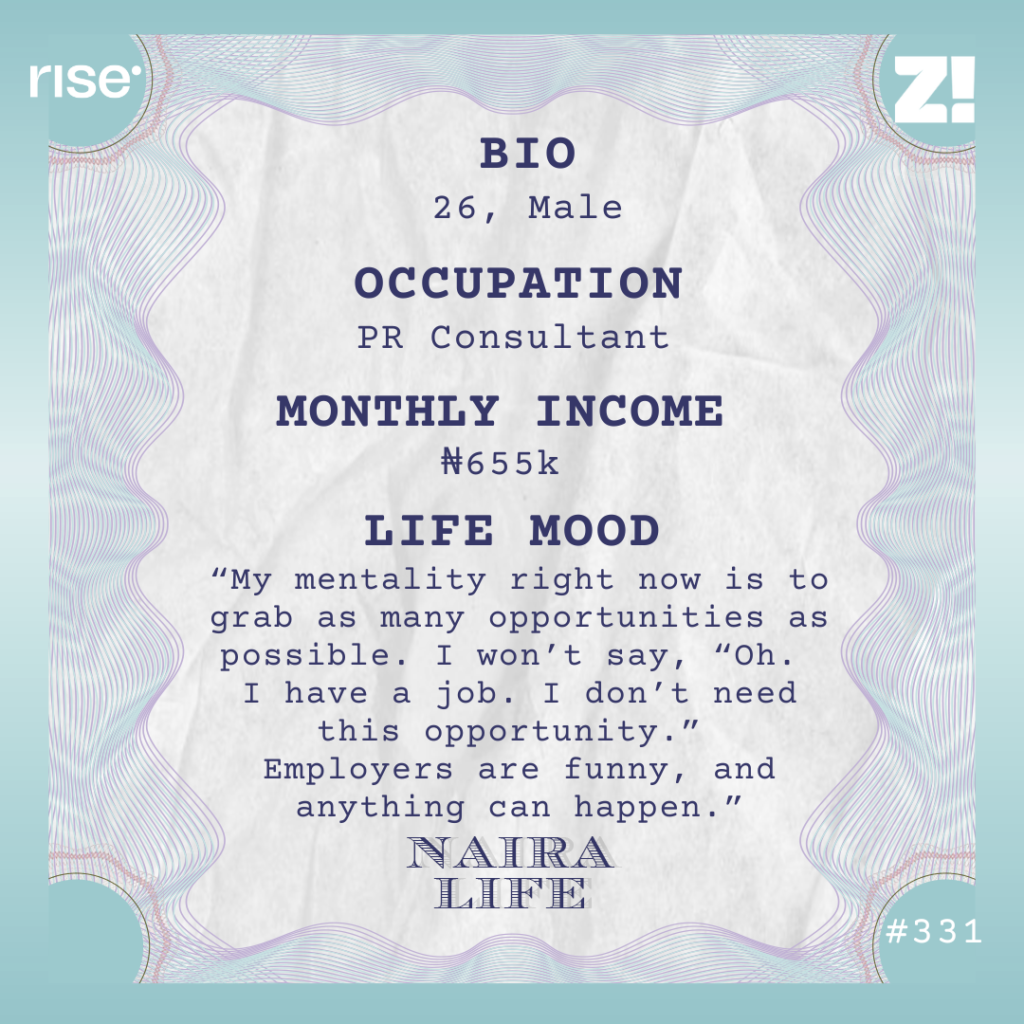

So, I juggle two jobs right now, bringing my income to ₦655k/month. Both jobs are hybrid, and they don’t know I work elsewhere. My mentality right now is to grab as many opportunities as possible. I won’t say, “Oh. I have a job. I don’t need this opportunity.” Employers are funny, and anything can happen, so I need to have as many safety nets as possible. I still plan to sue the employer who laid me off, but let me get my money up first.

So, are you debt-free now?

I still owe my bank about ₦450k. My biggest challenge with the loans is the interest, especially with the microfinance bank. The interest increased whenever I missed any payment, and I struggled to remain on schedule.

Also, when I borrowed $200 from my friend, I got ₦210k after conversion. But the exchange rate keeps changing, so after I finished repaying her, I paid ₦340k in total. I prioritised settling my friend and the microfinance bank first because they were on my neck. My bank has been pretty chill — they just keep adding interest. I’m trying to pay a monthly amount to settle the debt, though.

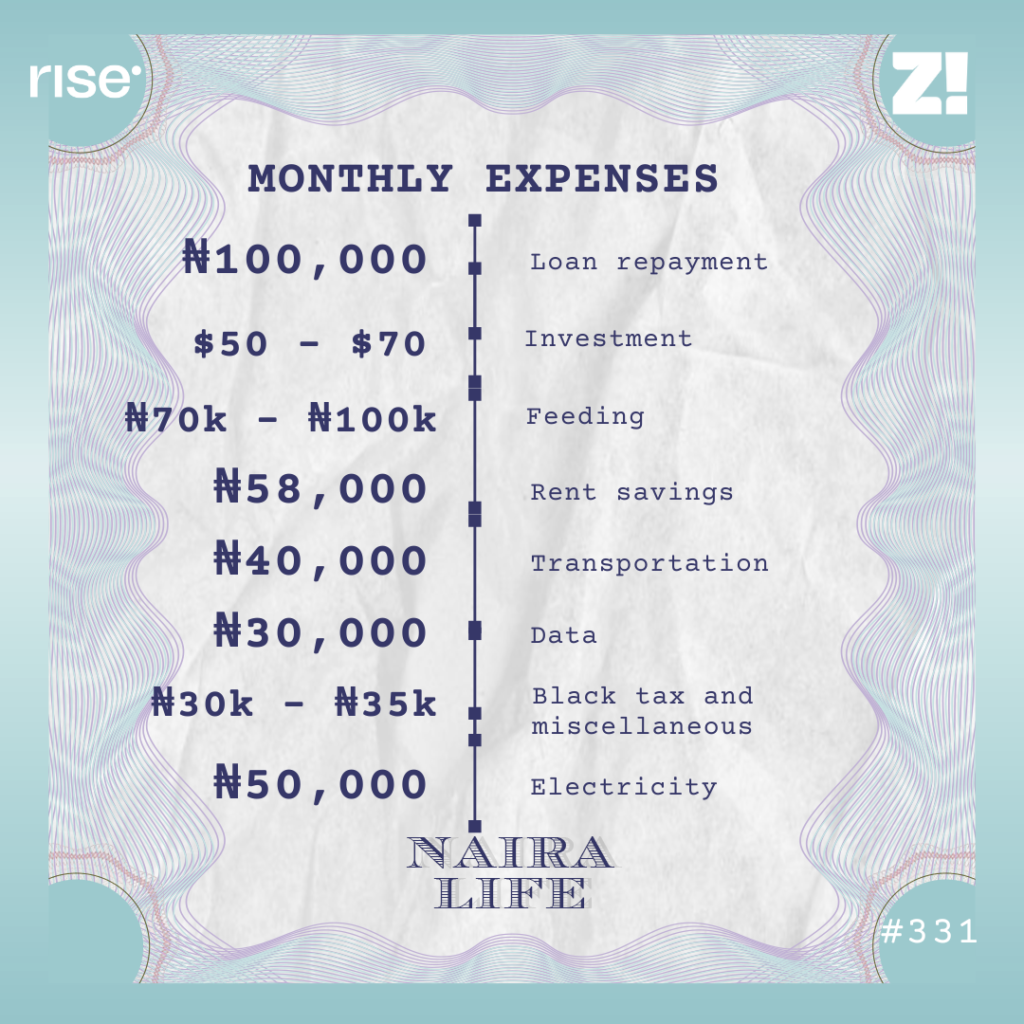

Let’s break down your expenses in a typical month

After making these expenses, I usually leave the rest of my salary in another account as an emergency fund. I currently have ₦150k in that account. I don’t touch it unless absolutely necessary.

How would you describe your relationship with money?

I’ve definitely become better. I’ve become more curious about finances. I read other Naira Life stories and seek out resources to improve my knowledge. I now know I’m not supposed to spend everything I earn in a month; I need to leave something aside and prioritise needs instead of wants.

My priority this year is to get even more serious with my finances. My sister doesn’t earn as much as I do, but she has really healthy savings. Even people who used to tax me for money before are doing well with their finances now. I need to become more intentional.

So far, I’ve noticed I might be more of an investor than a saver. I currently keep my money in two platforms: one to save for rent and the other for dollar investments. I save ₦58k/month for rent and put around $50 – $70 in my Risevest.

What do you invest in?

I don’t have a particular investment tool in which I put the money. I just indicated I want medium-risk investments, so when I put money in my account, the platform spreads it out for me, and I get monthly returns. My portfolio is worth $250 now. Even if I don’t get returns, I’m happy that my money is in dollars, so it’s safe from inflation.

What kind of life would you say your income affords you?

My life hasn’t changed much between when I earned ₦250k and now that I earn ₦655k. Inflation has messed everything up such that even things I could afford then, I can’t try them now.

Before, I could enter Urban Jungle or Mr Price, a clothing store at the mall on my way home from work and get a nice shirt or pair of jeans. I can’t do that now. To be fair, I lived with my parents then. Now I have responsibilities and bills to pay. Still, things are much more expensive.

That said, I’ll also admit my salary makes me a bit more relaxed. I can repay loans and not worry about how I’ll survive the rest of the month without asking for urgent ₦2k.

Do you think you’d have a different lifestyle if you didn’t have debt?

Definitely. My one-month salary would pay most of my rent, and I’d have a little more leeway. I’d also be able to invest more.

I’m already picturing how my December would look because I’d have cleared my debt by then. I’ve been through a lot, and I just want to relax. I’ll probably buy a new phone and go on a three-day staycation.

What’s an ideal amount you think you should be earning?

I’ll be fine with ₦1m/month. I’m constantly looking for jobs to earn more, partly because of my layoff PTSD and not wanting to ever be in a situation where I’m penniless again.

I’m working towards upskilling and getting more certifications so I can get there. Interestingly, I would’ve gotten a ₦1m/month job a few months ago, but they wanted someone with more marketing experience. I intend to build myself so I’m better positioned for these kinds of jobs in the future.

Is there anything you want right now but can’t afford?

A car. This isn’t coming from a “wanting to be a big boy” angle. Living and working in Lagos without a car is very stressful and frankly unsustainable. I can’t be jumping buses every time. A car would just make it easier to move.

The kind of car I want costs around ₦15m. It’s expensive, but I don’t want a smaller car. Perhaps when I clear my debt, I’ll explore car financing options where I can pay part of the cost upfront and pay the rest over a few years.

What was the last thing you bought that made you happy?

I bought my home appliances in 2023: a TV, fridge, gas cooker, and air conditioner. The whole thing cost around ₦780k.

How would you rate your financial happiness on a scale of 1 – 10?

6. I’m in a better place and no longer need to ask people for small loans. It will increase to a 7.5 or 8/10 when I clear my debt.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.