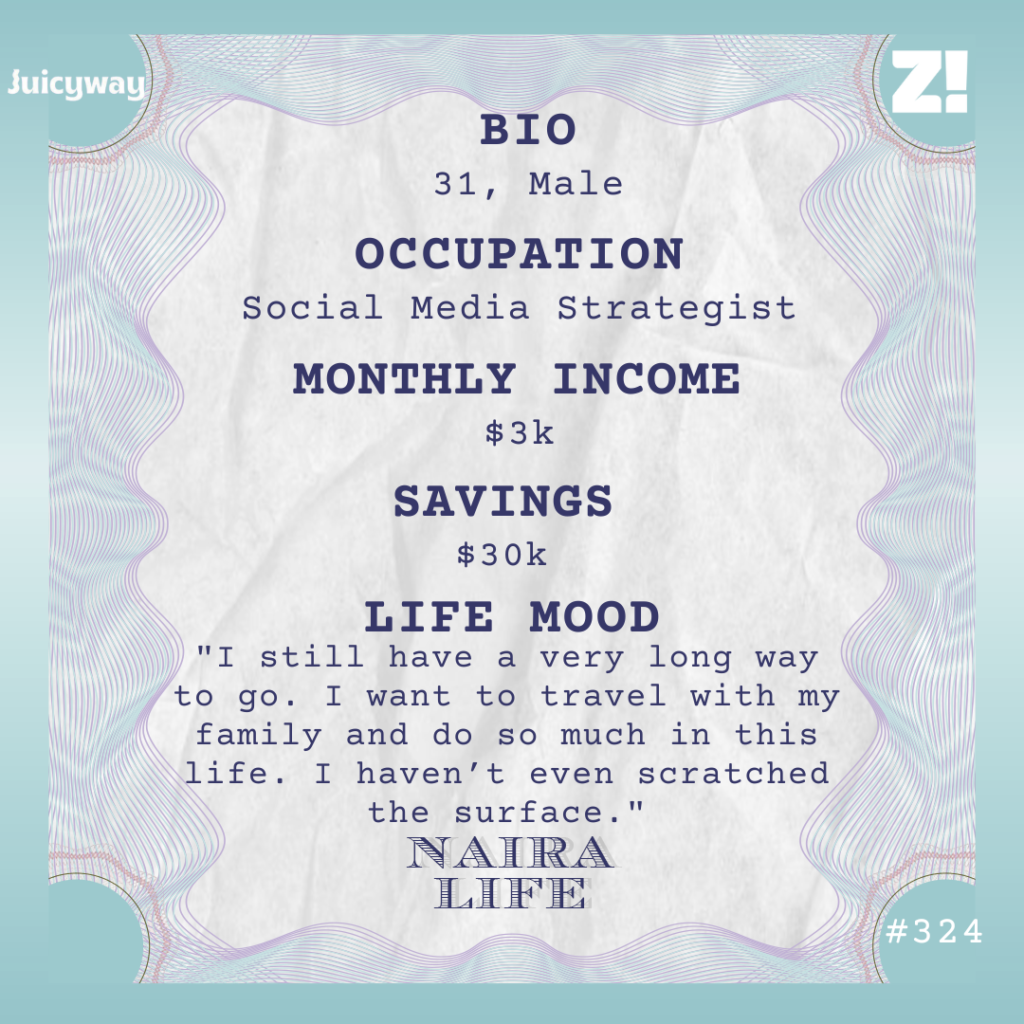

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Put your money to work with as little as ₦5,000. Invest Naija’s SEC-registered Money Market Fund delivers quarterly income, liquidity, capital preservation, and returns that beat savings and fixed deposits. Start here.

What’s your earliest memory of money?

This is probably not my earliest experience with money, but I remember how I used to get ₦100 daily for snacks in secondary school. Then I switched to a boarding school in SS 3, and only got access to cash on Sundays.

The school didn’t allow students to spend money during the weekdays, so getting my ₦500 – ₦1k bursary allowance every Sunday was my only opportunity to buy what I needed.

What about the first time you worked for money?

This was also in secondary school, but wasn’t exactly “work”. I’ve always liked fashion, and my parents allowed me to explore my interest. So, I started learning fashion design during the holidays in JSS 3.

My lawyer dad lived and worked in a different state, so whenever I spent school holidays with him, I continued my fashion design training in a different institute. I went to about three places in total. The practicals usually involved sewing simple designs and clothes, and I sold some to family. I mostly wore the rest of the clothes I made, though.

I got into business proper when I entered the university.

Tell me about that

I started a scarf business in 2023 when I was in 200/300 level. The business idea didn’t come out of necessity; my mum convinced me to try a business.

I received a ₦5k/week pocket money from home, and my parents still paid for my food, gas and school printing needs. So, I didn’t really need extra money.

My mum, though, is a businesswoman and she thought it’d be good for me, too. Also, I love scarves. I thought, “If I’m going to do this, it might as well be with something I like.”

I told my dad about my idea, and he gave me ₦100k to start. I can’t remember how much stock the money got me, but it was a lot. I got everything from crinkle scarves to jersey scarves, pashminas, and scarf accessories.

You were all set for business

I was, and business was good at first. My customers were fellow students, and my school is in a predominantly northern state, so sales were lucrative. I could buy a jersey scarf for ₦2500 and sell it for ₦3500.

The problem started when I needed to replace the items I sold. Almost every time I called my supplier for a replacement, she said that the price had increased by ₦500.

I also didn’t keep proper financial records or separate my profit from the business capital. I was just spending the money small small; ₦500 here, ₦1k there. I held on to the business for a year before stopping in 2024.

Did you try another business?

I didn’t, but by then, I’d found a different hustle: social media management and content creation.

Let me backtrack a bit. In 2023, I joined my school’s Google Developer Students community and volunteered on the media team for an event they held. I connected with several tech people in that community and became interested in opportunities in the industry, specifically front-end development. I like design, and the idea of coding something that could turn beautiful appealed to me.

I applied for a free training program, but the problem was that they taught us both front-end and back-end development together. The HTML and CSS part of the training was fine, but I got confused when we reached Python Programming. At some point, the training organisers brought out another option for just front-end development, and I joined, thinking I could start afresh. Then I heard the criteria were that prospective learners needed to know how to use the React programming language. I didn’t know that either, so I gave up.

Then I turned to Udemy courses and YouTube tutorials. But that was so stressful. Imagine watching tutorials and coding for hours, only to get a result different from what you just watched. I kept trying for about six months, but it became difficult to juggle it with schoolwork. So, I paused my learning efforts.

However, I maintained my participation in the Google community, and towards the end of 2023, I applied to be a core member of the management team. I got in, and my role was to help with content for the social media platforms. Interestingly, around the same time, I got another role to lead the social media team of another tech community in school.

Did you have any experience with social media management at this point?

Not exactly, which is why it was surprising that I got those roles. To be fair, I’d started creating random content on Instagram and TikTok, so I guess the community took it to mean I could lead a social media team.

I also had some knowledge from a beginner social media management course I took a while back. I didn’t know things like content strategy, but at least I knew the different platforms, and together with my team from both communities, we made it work. Wherever we attended events, we’d post summaries on LinkedIn and share the links on our WhatsApp statuses.

We also had different content types for different days of the week. For instance, we’d do motivational posts on Mondays, tips on Thursdays, spotlight people on Fridays, and so on.

These were volunteer roles, right?

Yes. I didn’t get paid for either, but it was valuable experience, and I learnt I was good at social media management. I also applied what I had learned to my personal social media pages and created better content.

By March 2024, I started applying for social media management jobs and internships. I wanted to experience working with an actual organisation and gain outside-school experience. I got a couple of rejections and unsuccessful interviews, which were understandable, as I was essentially a self-taught social media manager. But whenever an interview went badly, I went back to read up on the things I missed. I also learned how to perform better in interviews and maintain confidence.

My efforts paid off. In May, I landed a social media manager role with a book club. My job was to handle Instagram and TikTok, co-handle YouTube with another social media manager and manage the WhatsApp community.

How much was the pay?

₦30k/month. Honestly, I was happy because I wasn’t even looking for pay. I wanted something to validate my skill and was prepared for an unpaid internship.

Besides managing the social media platforms and communities, I often created short videos for the book club. Since I didn’t have an iPhone, I’d use my roommate’s phone to record the videos and send them to the book club’s video editor.

While at this job, I also managed schoolwork, two community leadership positions, a few other student communities, and my scarf business (which I stopped around the end of 2024).

How did you manage all these?

I like working in an overstimulated environment. I don’t know how to explain it, but I always want my brain to be active.

In July 2024, I added another content creation role to my list of responsibilities. I’d seen the vacancy on one of the communities I’m part of, and I applied with a portfolio of videos I’d created for my personal page. The portfolio was just a Google Drive where I dumped the links of every video I shared online. The job paid ₦50k, and I had to show up at the office once or twice weekly to shoot videos.

When I first started, I had to borrow my friend’s iPhone to shoot videos. I eventually gathered ₦100k to buy an iPhone XR (it cost about ₦250k, and my dad paid the rest), but there was a lot of back and forth I had to do in the beginning, so that I could create good videos.

I worked there until January 2025, when my employer let me go because they wanted someone who didn’t have to divide their time with school. I’d also left the book club a month earlier because I wanted something bigger.

So, you didn’t have any paying jobs at this time?

I was doing several stints at different places. I’m not sure there was a point when I had just one job or none at all.

Back in September, I had a one-month stint with someone who was supposed to pay me ₦100k/month to manage several social media accounts and create video moodboards to guide the video editor. I say “supposed” because I didn’t get any salary.

After I completed the first month and didn’t see any money, I asked, and they said they paid salaries at the end of the following month. This meant I wouldn’t get my September salary until the end of October. Funny enough, they’d noted this in the employment contract, but I somehow overlooked it. Anyway, I just told them I wasn’t doing again.

When I left the book club in December, I tweeted about manifesting a new job and got two jobs from that post. Around the same time, someone else also referred me to another job. I resumed all three jobs in January. Two were social media management roles, and one was for video editing.

Mad o. I’m still trying to wrap my head around why and how you do multiple gigs at once

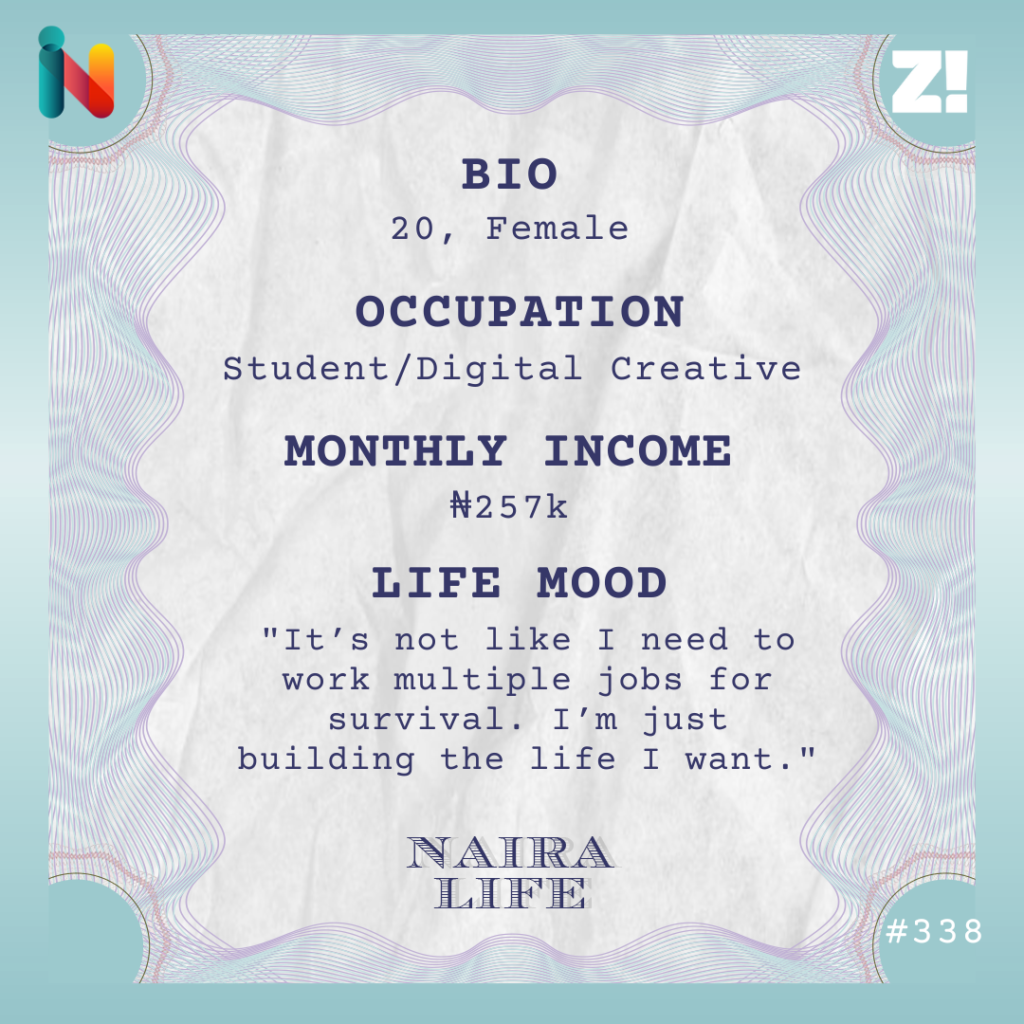

Haha. Like I said, I just like being active. It’s not like I need the money for survival. I’m just building the life I want. I can manage multiple roles at once, so I do them.

There are sometimes downsides to doing so many things simultaneously, though. For instance, I only spent about five months altogether at the three jobs I started in January. I was getting overworked, and the pay wasn’t great.

The video editing one paid me ₦50k/month to edit one YouTube video and four shorts weekly. I still designed thumbnails and carousels. One of the social media management roles paid ₦70k/month, and I was also something like a virtual assistant. I left that one in the same January.

The third job paid me ₦80k/month to manage three platforms, but I did far more than what I was employed to do. Also, the communication process was draining. I’d need something urgently, and no one would respond. By May, I’d left all of them.

Phew. How many jobs are you juggling these days?

I’m currently working two jobs: a ₦150k/month social media management role I started in May and a ₦75k/month video editing role I started in June. Also, I often get paid for influencing on my personal page. Most of this “pay” is PR packages, but I did get a ₦200k gig sometime in March.

Additionally, I offer training sessions based on request. The last one I held was a content creation class for six people, and I charged ₦50k per person. I still need to figure out a proper structure for these classes, so I’m not pushing them aggressively yet. Maybe next year.

Then I maintain my social media team lead role at one of my tech communities in school, but I’ve mostly scaled down my community volunteering.

I should mention that I still get a weekly allowance from my parents, which has increased to ₦8k weekly.

What kind of lifestyle does your income afford you?

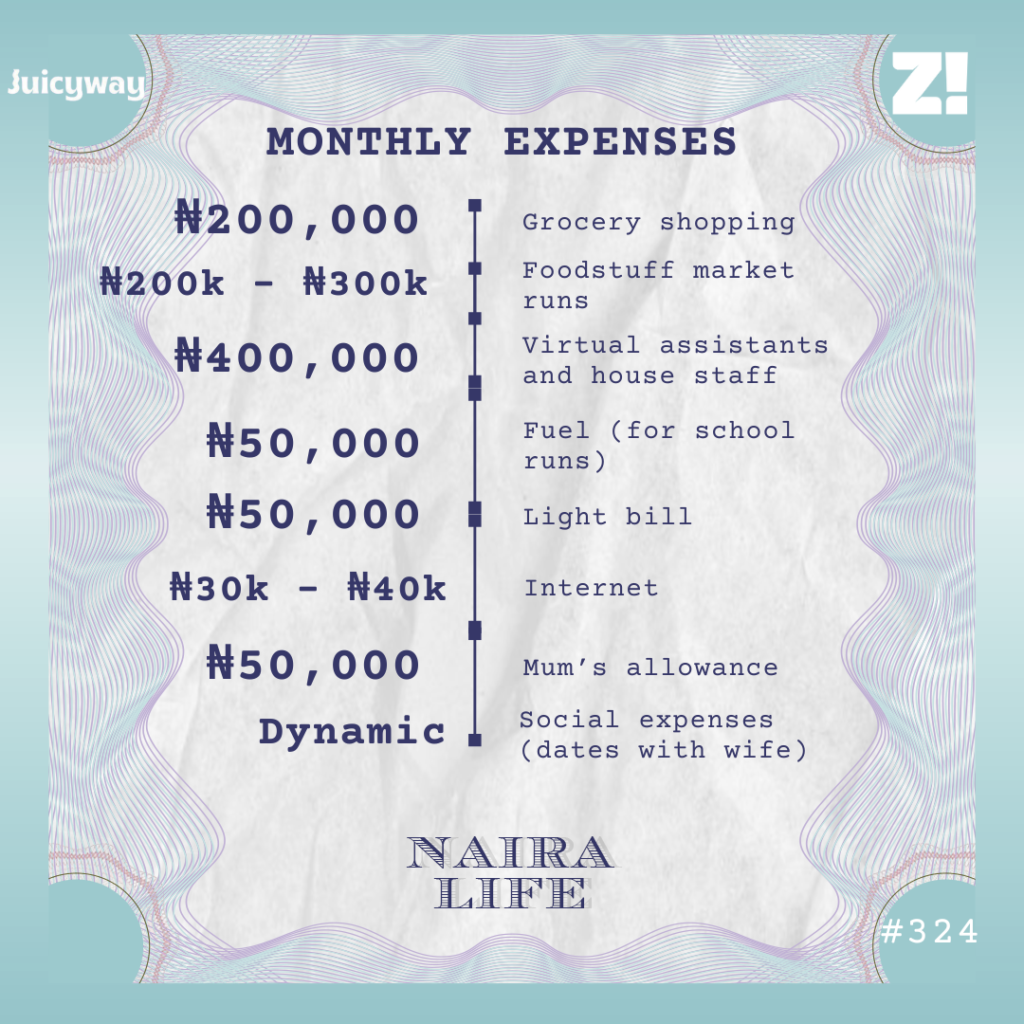

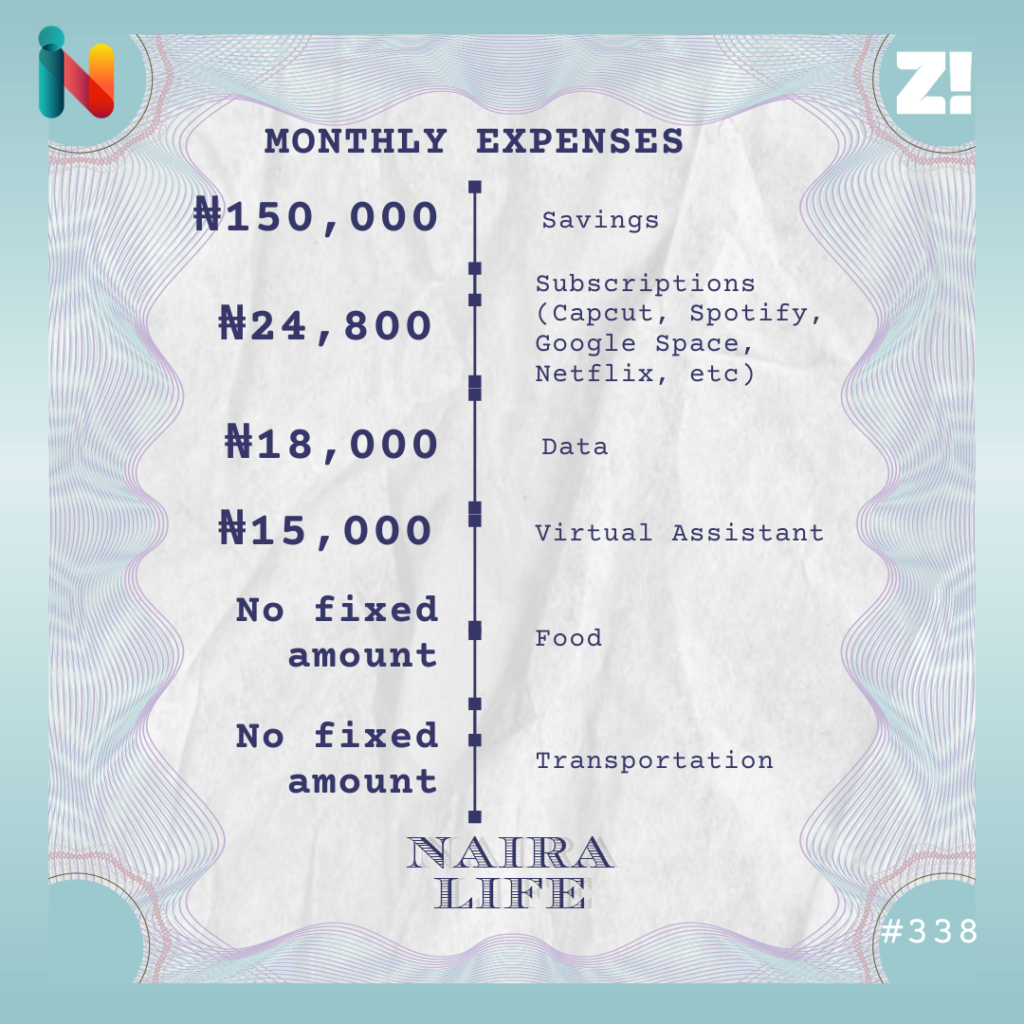

I typically don’t spend from my income; most of my money goes into savings. Now that I earn ₦225k, I save about ₦150k and divide the rest across app subscriptions, data and maybe takeout when I feel lazy to cook. I don’t really spend money like that.

Let’s break down these expenses in a typical month

I don’t have a fixed amount for food and transportation because I spend as I go. My transport costs are typically for when I need to move around school, and that’s just about ₦100 a day.

I hired a virtual assistant in June because I needed help with work due to a class I had at the time. She’s quite efficient, and I plan to increase her pay. The only thing keeping me from doing that now is that I still struggle with delegating tasks, so she doesn’t do so much.

How would you describe your relationship with money?

I think I save a lot because I don’t have a big spending need at the moment. Again, I don’t need to earn to survive or pay school fees or anything like that. I’m just earning money because I have a skill and can’t just leave it lying around.

I currently have about ₦730k saved up. It’d be more than that, but I dipped into my savings a few times between December and June to buy a Redmi tab and content creation tools like tripods (mini and normal size), LED lights, and a microphone. The tab cost me about ₦320k (including a keyboard and stylus pen), and the others cost about ₦104k in total.

I haven’t explored investing yet, but I might do so soon.

Do you think digital creation is an income source you’ll continue to explore after school?

I think I will, but I’m a little conflicted. I’m a law student, and by the time I graduate, I’ll have to give up all my jobs to focus on law school. I’ll probably return to creative work, but I want to practice law, too.

I also plan to restart my business soon, and my savings will be handy when I’m ready. I think I’ve learned from my early business mistakes, and I know better now, so I have a better shot.

Is there an ideal amount you think you should be earning?

I don’t earn badly, but considering my experience and how much I put into work, ₦700k – ₦1m monthly should be a decent amount. That said, I’m not actively job-hunting just to increase my income. I’m open to opportunities to increase my income, but I’m no longer just taking any job for the sake of it.

I have much more clarity on what I do and how to charge for my work. I’m no longer taking jobs where I have to manage multiple platforms, and if I have to, I should get paid well for that level of work.

I get that. Is there anything you want right now but can’t afford?

Travel. I want to travel and see places, but I can’t afford that now. However, I’m doing well for my age, so I don’t want to rush myself. I have time to grow into that level.

How would you rate your financial happiness on a scale of 1-10?

Right now, it’s a 5. Around the beginning of the year, all my multiple jobs brought my income to around ₦500k, so ₦225k feels like a downgrade now.

However, I have two more gigs lined up for September, so my income should reach the ₦650k mark by the end of the month. That’s good, I guess.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]