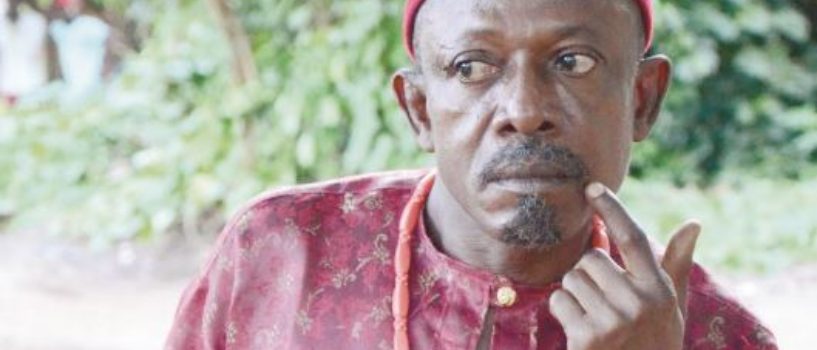

We all know that one onigbese who refuses to clear their debt until they get dragged through intense stages of embarrassment, but I never thought I’d live to see the day that Nigerian banks would become that onigbese.

If you’ve been relying on Unstructured Supplementary Service Data (USSD) codes to quickly send urgent ₦2k to your friend or to check your account to figure out how you’ll survive until salary day, you might want to brace yourself because telcos are threatening to suspend USSD payments.

Nigerian banks are responsible for the looming suspension because they reportedly owe telecom companies over ₦200 billion for USSD services. Apparently, the banks have been enjoying the service for years but have been acting strangely when it’s time to pay.

The Nigerian Communications Commission (NCC) on Wednesday, January 15, confirmed that nine of the 18 banks owing money to the telecommunication sector have fully cleared their debt, while the other nine have refused to pay up. NCC also added that some of them have been owing for as far back as 2020, and as a result, they (NCC) have decided to punish this coconut head behaviour with the suspension of USSD codes for the following banks – Fidelity Bank Plc, First City Monument Bank, Jaiz Bank Plc, Polaris Bank Limited, Sterling Bank Limited, United Bank for Africa Plc, Unity Bank Plc, Wema Bank Plc, and Zenith Bank Plc.

When will the suspension kick-off?

The NCC announced the suspension on Wednesday, January 15, but it is gracious about the possible suspension because it will not take effect until January 27. That gives your faves enough time to save face since their names are now publicly associated with an unnecessary debt.

What does this matter?

According to the Central Bank of Nigeria, 252.06 million transactions worth ₦2.19 trillion were processed via USSD between January and June 2024. That gives you an idea of how loved and necessary this easy payment method is, especially in rural areas where about 68% of Nigerians cannot afford smartphones for mobile banking. Now, paint a mental picture and imagine the millions of people that will be affected.

This is even more triggering because USSD services are supposed to be straightforward: the telcos provide the platform, the banks use it to serve their customers, and everyone plays their part. But what the banks listed above are doing is a classic case of institutions prioritising profits over accountability even though they continue to charge you for everything—SMS alerts, transfer fees, maintenance charges, and even USSD transactions.

Are these banks going to get away with this misbehaviour?

The only form of punishment the NCC is proposing, for now, is suspending USSD codes for the customers of the listed banks. However, the NCC will likely impose stricter punishments if the banks refuse to clear their debt.

News is boring, but we make it fun. Subscribe to The Big Daily to be the first to know the day’s biggest news.

[ad]