All the supermarkets and online vendors have started packing their red-coloured Valentine’s Day gift items and decorations inside because the season is over. But your account balance is now red because you went a “little” overboard trying to show love. We rate it, but you’re probably experiencing the following phases now.

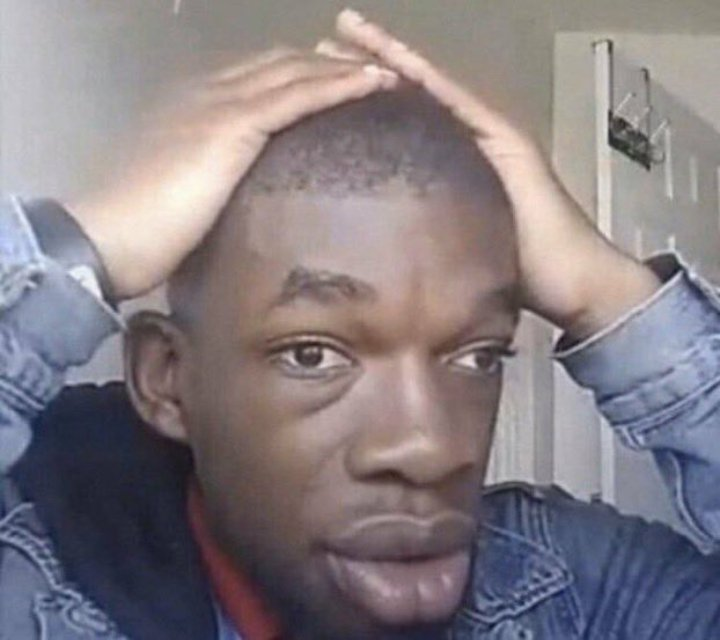

The realisation phase

You’re looking at your account balance and suddenly remembering the amount there is supposed to take you through the remaining days of the month. And internet service providers just increased the cost of data. Wahala.

The rationing phase

You start reminding yourself there’s garri at home whenever you’re tempted to eat out. Do you even need to turn on the air conditioner or stream movies? Maybe you should even trek small before taking a bus to work.

The regret phase

Now you’re wondering whether you really needed to spend ₦150k on flowers. What happened to “less is more” and buying a small bouquet instead? Or even plastic flowers and sticking on a cliché note about gifting plastic flowers because your “love will never die”?

The acceptance phase

Well, it has happened, and since you can’t turn back the hands of time, you might as well deal with the consequences of your actions.

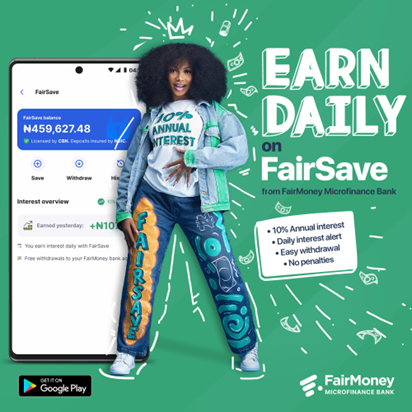

But there’s actually something you can do at this phase. You can start saving little by little with a FairMoney high-yield savings plan so next year doesn’t catch you off guard, and you can even use the returns on your savings to guide in case of emergency expenses.

The encouragement phase

You try to encourage yourself that you did it for love so you don’t feel bad about your financial situation.

That’s great, but allow us to encourage you to create a separate Valentine’s Day budget so affliction doesn’t arise again. FairMoney offers different savings options that allow you to automate savings for whatever goals you set. Whether it’s for Valentine’s Day or rent, you can now be more intentional with planning and creating an emergency fund. The best part, you get up to 30% annual interest on your savings.

The “trying to bounce back” phase

Now you’re praying for a miracle credit alert just so you can make it through the month without asking for urgent ₦2k.

All this could’ve been avoided if you’d planned your finances with FairMoney. It’s not too late, though.

Download the FairMoney app on the Google Play Store or the App Store and start saving with one of their high-yield savings plans so next Valentine’s doesn’t catch you off guard. Remember, love is sweet, but financial peace of mind is sweeter.

[ad]