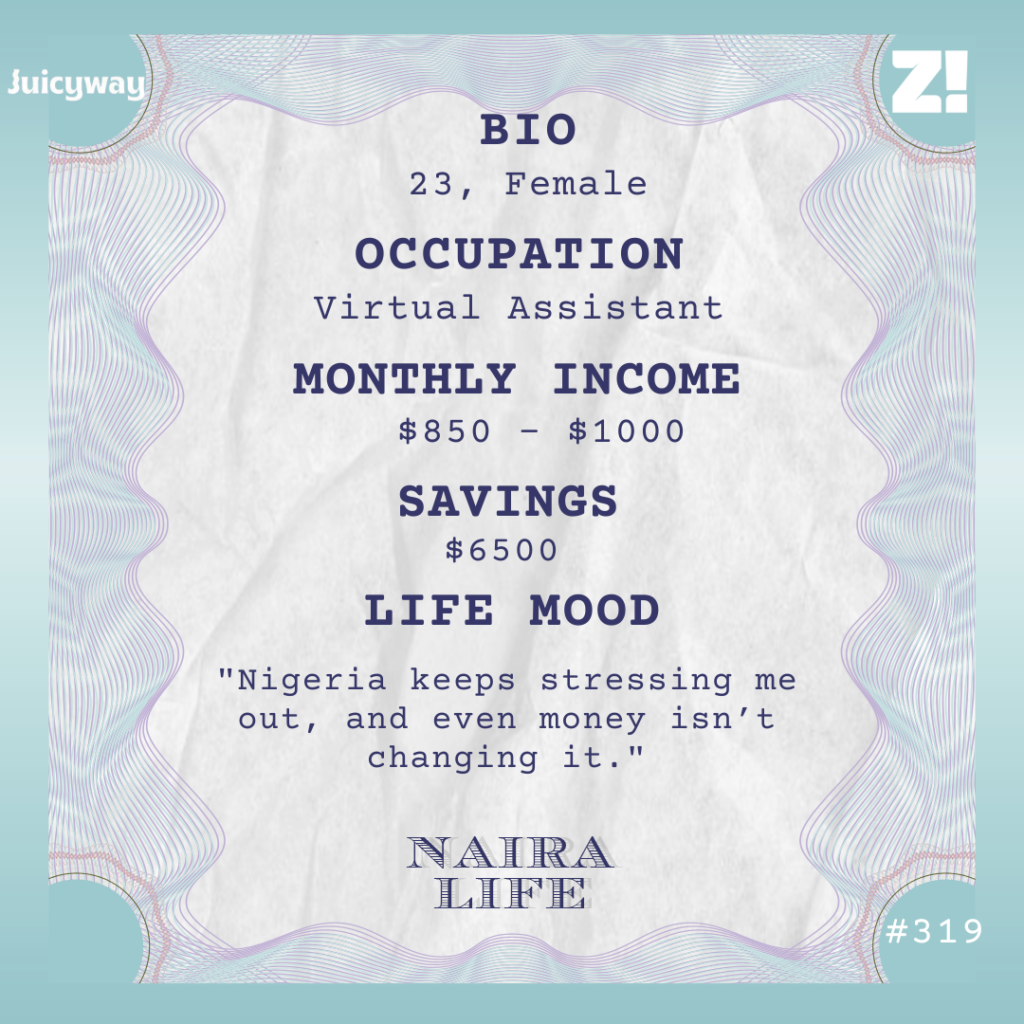

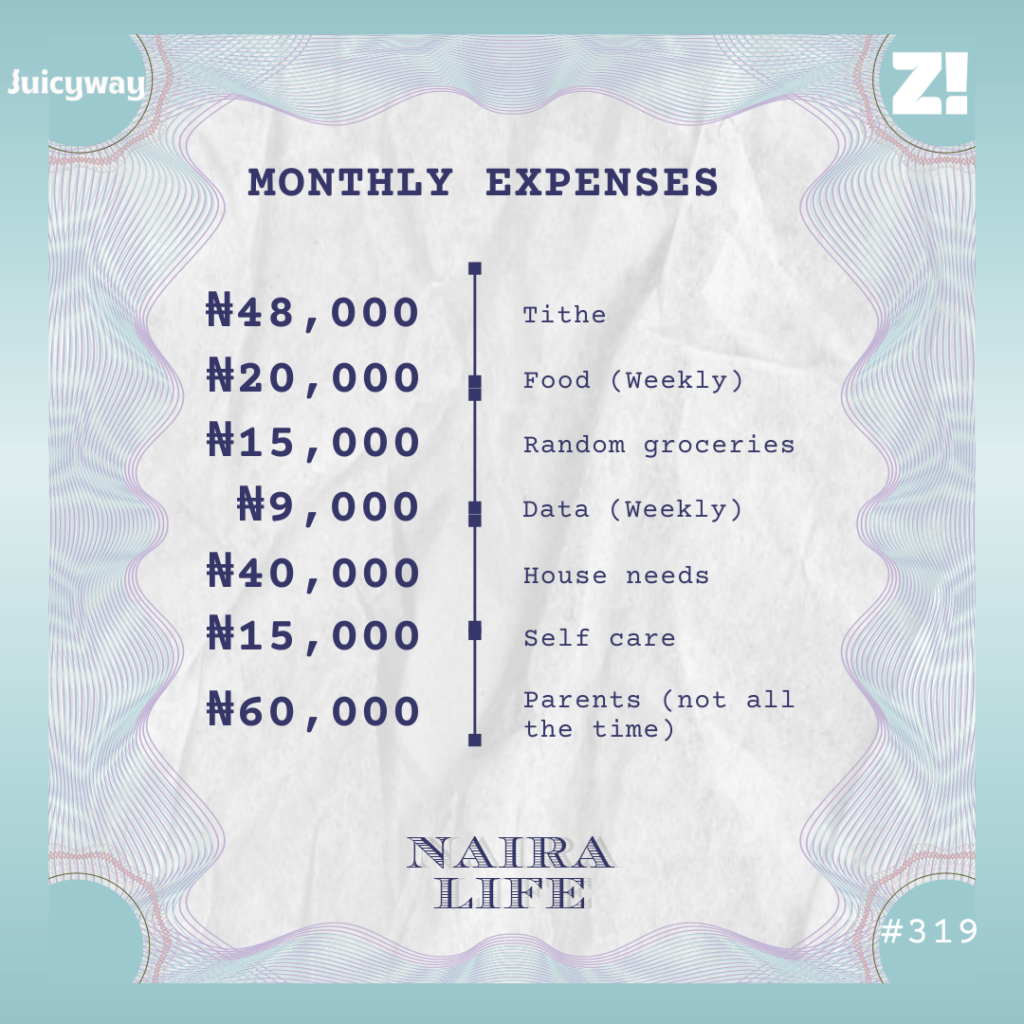

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Tired of the stress of moving money across borders? With Juicyway, you can seamlessly send, receive, and convert fiat or stablecoins like USD, CAD, USDT, and USDC in Nigeria—at great rates. Free multi-currency accounts, instant transfers, and top-tier security? Say no more. Click here to get started!

What’s your earliest memory of money?

It was 2003 — the year my mother died — and I was 8. My aunt, her boyfriend and I were on the bus, and her boyfriend asked me to read a figure in the newspaper. I think it was 15 million and something-something thousand. When I pronounced it correctly, he gave me ₦15, and I used it to buy sweets.

I’m sorry about your mum

Thank you. The newspaper incident happened because my aunt’s boyfriend was trying to cheer me up. We were going to my aunt’s workplace, and I think he wanted to take my mind off the whole thing.

I imagine your mum’s passing away led to some changes at home

It stirred me into independence. My dad remarried a few years later and had four more children. I had to transition from being an only child to an elder sister to my siblings. Plus, my step-mum and I didn’t get along at all, so I was pretty much independent.

Things didn’t change much on the financial side. My mum worked at a bank, and my dad was a contractor. I didn’t grow up looking for food to eat or anything like that. Even after my mum passed, my dad still made enough to keep us comfortable. I had a BlackBerry phone at 15. We were above average.

Do you remember the first time you earned money?

I do. I’m really good at explaining stuff, so at uni, people came to me to simplify lecture notes and explain things in a way they could understand. At first, I did it for free until people started becoming entitled. I’d go home during the holidays or school breaks, and people would ask me, “Why weren’t you available to teach us?”

At some point, I thought to myself, “You know what? I can charge these people.” So, I started charging each person between ₦200 and ₦500 per lecture. I did that from 200 level to my final year. That said, it didn’t bring serious money, so I lived on my ₦20k monthly allowance, which was enough for whatever I needed in school.

I also had a few internships during school holidays at an NGO. I only worked there when school was out and got paid ₦15k/month each time. I think I did that twice. Then, after I graduated from university in 2017, I got an opportunity to travel to the US for a five-month work and travel program.

How did that happen?

Someone at my uni organised work and travel programs for students in my department — a student exchange program. I can’t remember how much the process cost, but I know my round-trip ticket was ridiculously cheap. It was just ₦350k, but it also came with insane layovers. I spent three days travelling through different cities before finally reaching my destination. The point is, I got there.

A few days after I arrived, I got a job flipping burgers in the food section of an amusement park, earning $5/hour for 30 hours/week.

Wait. I thought it was an academic program

They didn’t really send us like that. It didn’t matter where we worked; they just wanted us to meet people from around the world and experience other cultures.

Plus, each person had to pay for their accommodation from the money they earned. I stayed in an extended-stay apartment with five other Nigerians. I think the rent was $750/month, and we split it equally. So, I had to make money.

A few weeks after I started the amusement park job, I found another at a Wendy’s restaurant. The program didn’t allow us to work more than 40 hours/week, so I cut my hours at my first job so I could do 20-20 at each job. Wendy’s paid $7/hour, bringing my income from both jobs to around $800/month, minus tips. The tips were so good. Sometimes, I earned up to half of my income just from tips.

So the money was good

It was, but the work was hell. Both jobs had me standing 16 hours every day. At some point, I even broke down.

To be fair, maybe I didn’t need to work that hard. My aunt had encouraged me to save as much money as possible, but I also wanted to balance it with having a good time. So, one salary was for spending and shopping, and the other was for saving.

I returned to Nigeria in November 2017 with about $2k in my account, which I gave to my aunt to keep. For context, I started living with her when I got into uni, and she had sponsored me for the US program.

What happened after you returned to Nigeria?

NYSC was the next step. Service year taught me hunger. Allawee was ₦19800, plus another ₦4k from my PPA that was always delayed. It was ridiculous.

By this time, my aunt had stopped giving me an allowance because I stubbornly refused to do my NYSC in the same state, so I had to make do with allawee. Thankfully, she paid my rent, but it was a real struggle surviving on ₦19,800. I learnt a new dimension of independence. Interestingly, my service year also changed the trajectory of my life.

How so?

Corp members learned blue-collar skills as side hustles, but it didn’t make sense to me. I thought, “There have to be more lucrative options”. I came across a place where people learnt digital marketing and how to build websites; it intrigued me.

I joined them and learnt how to code on Adobe Dreamweaver using HTML and a few other languages. Throughout the service year, I attended weekend classes and learnt even more.

After NYSC in 2018, I got a job at a publishing firm. My salary was ₦50k/month to build websites and do digital marketing for them. The job made me realise my skills were pretty basic, so I learned a lot on the job and watched YouTube videos to keep up.

I learnt everything from SEO to digital marketing and website building. I was intrigued by the advent of digital marketing and how small businesses were moving from traditional marketing to digital. I knew that was where I wanted to be, so I kept honing my skills.

Unfortunately, my employer was an asshole who owed salaries and never paid in full. After he withheld my salary for three months, I just left. This was in 2019.

Did you have other income opportunities?

Somehow, I found myself offering freelance services. I met my first client at a supermarket, and we entered into a conversation. He said he was a lawyer and also sold books. I mentioned I could build websites, and that’s how he said he needed an e-commerce website for his books. Before I knew it, he sent me ₦100k, and I remember staring at my account balance in shock.

I built the website, and he settled the domain and hosting. It turned out super nice. I wanted to do even more, so I got certified in digital marketing and kept learning. I was also applying for jobs and found one on LinkedIn towards the end of 2019. It was an on-site role, so I had to move to Lagos. I moved in with a friend, and we shared the ₦600k rent. My aunt paid for my half.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

How much did your job pay?

My salary as a digital marketer was ₦125k/month. I also took on the occasional social media management and website-building side gig for anything between ₦50k – ₦150k. I kept my 9-5 job until 2021, when something very funny happened.

What was that?

I got pregnant. My job became hard to manage with pregnancy, especially with the late nights, and my partner wasn’t having it. We decided I’d quit, and he’d support me pending when I could get a new job.

However, he became super distant and annoying after I had my child. He struggled to sustain us as a family, and I knew I needed to find a job immediately. I couldn’t depend on him for money.

A few months later, in 2022, I got a job heading the digital marketing team in a fintech company.

Energy!

My starting salary was ₦350k, and it increased to ₦420k in 2023. That same year, I took on an additional remote role with a foreign company that paid ₦300k, bringing my income to ₦720k.

My new income allowed me to afford nicer things for my child and live independently of my partner. I didn’t have to ask him for the smallest things like data anymore, and I think he couldn’t handle that switch. We eventually separated, so we co-parent now, and fantastically at that.

I switched jobs in 2024 to one that paid $800/month, and about six months later, I got a contract offer that really improved my life. I worked with that client for three months, making $3k/month. It was such a fun time. I bought things I needed and even started buying stupid things.

Within those three months, I bought a car, changed my apartment, and put my daughter in a better school. I even got on Ozempic. Like I said, stupid things.

I’m screaming. Curious, how much was your pay in naira at the time?

It fluctuated a lot. The $800 from my 9-5 was usually about ₦1m, and the $3k was ₦4m and some change.

My 9-5 salary was paid to my traditional domiciliary account, and I often converted it by transferring dollars to the black market BDCs; they also had domiciliary accounts. However, I received the $3k from my client through a payment platform that allowed me to convert the funds to naira on the platform or transfer dollars to my domiciliary account. They had good rates, so it was pretty seamless.

I still go through the same process. The three-month contract was extended by a year, so I still work with the client today.

What’s your monthly income like these days?

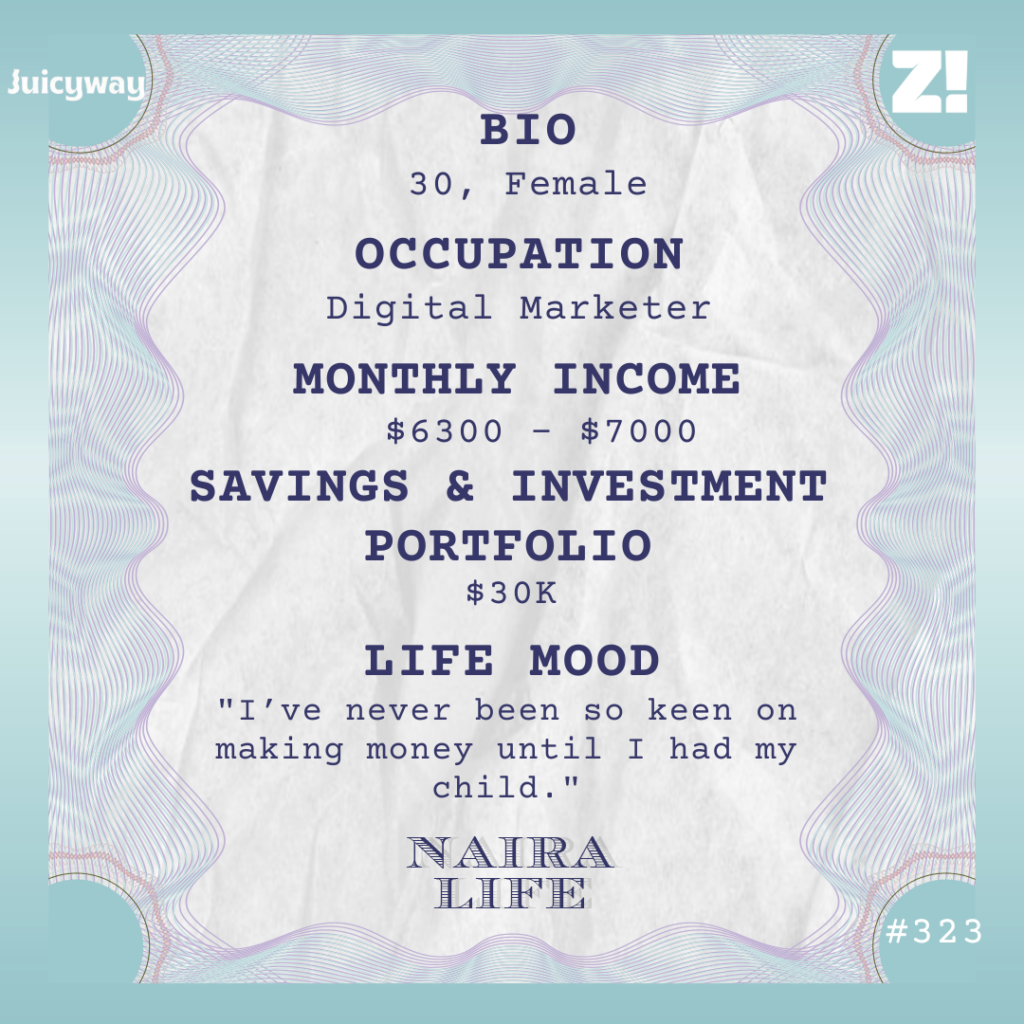

I currently work three full-time jobs, which is actually crazy. My income from all three is $6300/month. Bonuses sometimes push that to $7k, which is about ₦11m after conversion.

Also, I recently founded a marketing agency with a Mexican friend. The agency is based in Mexico, and my friend is white-passing, so she helps us close leads faster. She’s the face of our company, and I’m the brains.

We currently have about 7 clients we charge between $2k- $4k per month, depending on the scope of work. We share the profit 40:40:20 — 40% for each of us, and 20% back to the business and to pay staff. I don’t consider the agency as an income source. It’s more like a contingency plan; I save whatever profit I make for my child’s future.

I’m still stuck on the three full-time jobs part

See, I have an obsessive need to work. I don’t ever want to return to a time when I cannot provide for my daughter.

Plus, I plan to japa to Mexico to fully scale my agency so I can “retire” from full-time work. So, I need the money from my three jobs as well. I just want to be comfortable to the point where I can afford anything my child wants.

What do these japa plans look like now?

It should happen sometime next year. My child will be done with kindergarten and transitioning to primary school, so it’ll be the perfect time to move. I also got her a Spanish tutor, so she already speaks Spanish as a second language.

I save ₦5m/month from my income and have about $30k in my total portfolio. I have about $5k in investments using online financial services platforms. I also bought about $5k worth of foreign stocks in my daughter’s name in 2024. I get pretty good ROI on my investments, and they’ve helped with my portfolio.

So, I’m pretty much set for the move. The cost of living in Lagos and the city I plan to move to is similar. Rent, groceries, and everything else are pretty much the same. So, I’ll maintain my current lifestyle there.

Speaking of lifestyle, how has your income growth impacted your relationship with money?

I used to be really bad with money. I like to eat, so I have this bad habit of visiting restaurants people have reviewed on TikTok just to have a personal experience. I actually have a spreadsheet of all the restaurants I’ve visited in Lagos. I go on these dates with my child.

But now I’m becoming more reasonable. I need to save for the rainy days, so once I go grocery shopping every month, I buy my kid’s stuff, pay bills, pay my staff salaries, and buy the things I need, I save the rest. Now I have like ₦400k budgeted for miscellaneous expenses every month. If e finish, e finish.

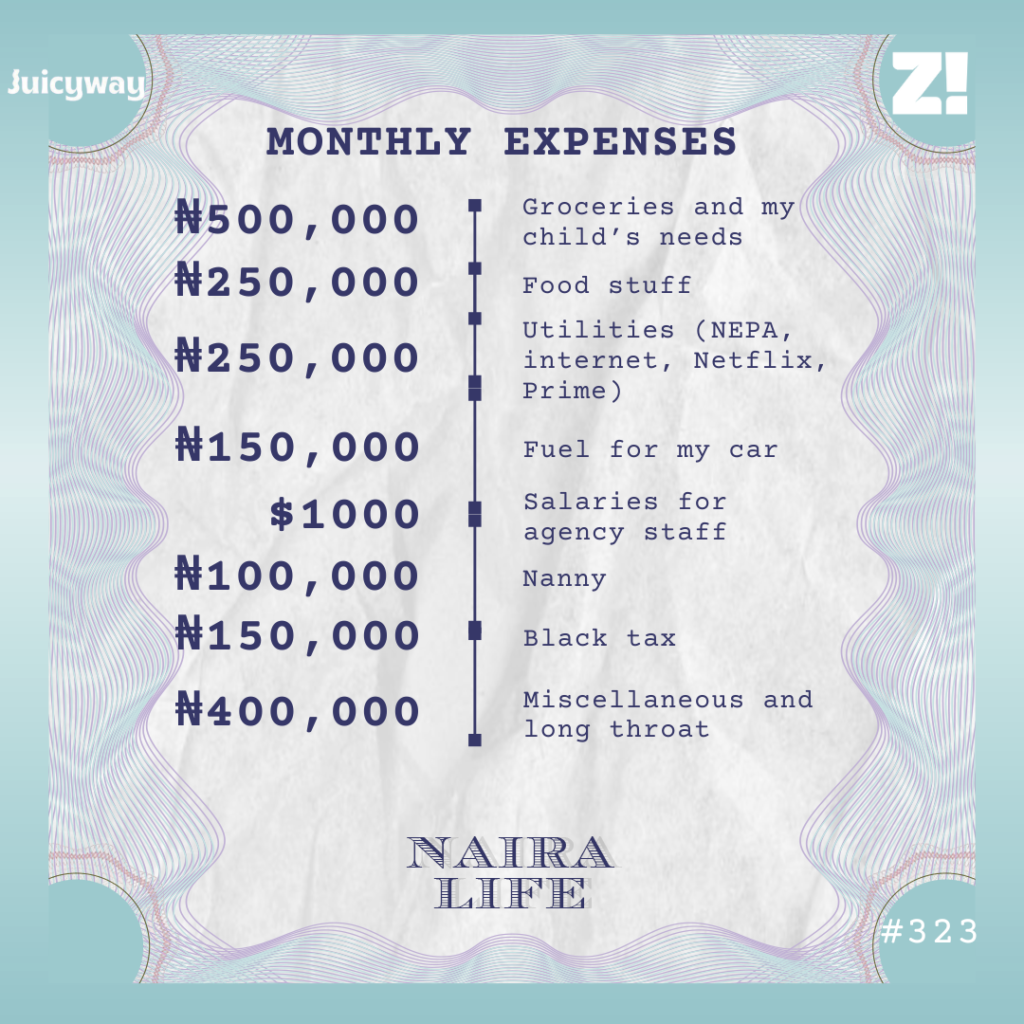

Walk me through your typical monthly expenses

This is after I take out my savings. I also sponsor my nanny through university. The black tax is to three of my step-siblings in university. I give them ₦50k each. I also send my dad money occasionally.

You know the saying, “more money, more problems”? That’s my life right now. Every time I open WhatsApp, one family member asks me for stuff. But my daughter is why I work so hard. I’ve never been so keen on making money until I had my child.

What was the last thing you bought that made you happy?

I got a new phone a few weeks ago. My phone started acting weird, and I didn’t think of fixing it; I just bought a brand new one, which made me really happy. It was an iPhone 15 Pro, and it cost ₦1.7m.

Also, buying my car last year was one of my proudest moments. I bought it for ₦10m, and it was a birthday present to myself.

Is there anything you want right now but can’t afford?

Probably a citizenship by investment in one of the Island countries like St Kitts. That costs $500k. But honestly, I’m very content with the life I have right now. Not bad for a single mum.

Not bad at all. How would you rate your financial happiness on a scale of 1 -10?

9. I want to scale even further to the point where I know my child has everything she needs if I’m not here anymore.

I have an insane fear of dying. Because I lost my mom at a young age, I worry that my child may not have me for long (even though I know say I gallant until 88 haha) but all in all, once I get to a point where I’ve saved enough for my child — I honestly don’t know when or how much that is — then I’ll finally get to a 10.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]