Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s start from the beginning. What’s your earliest introduction to money?

When I was in primary school, my dad would give me money every morning to give to my mum. That was the family’s money for that day’s basic expenses. I’m the eldest of five children, so I get why he always sent me this errand. But I never understood why he didn’t just give my mum the money himself.

I didn’t know the true value of money at the time, but this daily ritual was reassuring — it meant that as long as my dad did this, we’d have food to eat every day.

Did you always have food to eat?

Until my dad died, yes. I grew up with a silver spoon. In the early 2000s, my dad ran a clearing and forwarding business for motorcycle spare parts, and he also had a shop where he sold them. The business did well, and I knew this because I took interest in it. I’d look at the sales book in the evenings to see what the numbers were that day, and sales were usually between ₦300k – ₦1m worth of goods.

We had a car, lived in a 3-bedroom flat and were the first family to own a generator in our neighbourhood.

But the business started struggling— I don’t know why — shortly before my dad died in 2008. I was 15 years old and in SS 1. A lot of things changed after these events.

I’m sorry about your dad

Thank you. Before my dad’s death, my mum was the stay-at-home parent, but she did many things on the side over the years. From selling zobo and kunu to ice-blocks and a couple of other quick small businesses that showed up. She eventually settled for baking and catering for events. But we didn’t have to depend on her earnings.

Following my dad’s death, my mum became the breadwinner, even though she didn’t have a stable source of income. The sudden switch was hard on us, going from a comfortable middle-class family to a low-income household. I remember times when my mum’s friend brought us food and bowls of soup so that we could have something to eat.

Man. How did the family navigate this period?

My mum made some changes to her catering business. Instead of waiting for contracts, she started selling cooked food. Her friends raised money for her to get a shop, and we were in business. But sales were slow because the foot traffic wasn’t significant in the location, so she found another stall in the market.

Then she put me in charge of the first shop. It’s fair to say this was the first thing I did for money.

After school, I’d open the shop and sell until 6:30 p.m. before my mum would join me from the other stall in the market. We’d be there until 9 pm. Also when my mum was away, it was my job to cook and keep the business open for the day. Before I left secondary school, I could cook for as many as 100 people at a time.

Do you remember how much was coming in from this?

Between ₦20k and ₦50k – ₦ 60k, depending on how good the day’s sales were. The profit margin wasn’t that great, though. Or maybe the money just wasn’t enough to cater for a family of six with no other source of income.

Two of my brothers dropped out of school because of this. And I didn’t go to the university until 2015, even though I graduated from secondary school in 2010.

That’s hard. Did you do anything in the five years that passed before uni?

I was always involved in my mum’s food business. I also tried a couple of other things — a diploma in desktop publishing, learned hairdressing and tried to get another diploma in education, but I had to drop out because my mum couldn’t complete the school fees.

I eventually got into a federal university in 2015 — tuition was ₦20k/year and accommodation in the school hostel was ₦3,600.

How did uni go?

I didn’t do anything for the first two years because I wanted to face schoolwork. During this time, I made do with the foodstuff I brought from home and the occasional ₦2k that came. After sorting groceries, I usually had about ₦300 to ₦500 left to last me through the month.

But it became unsustainable by my third year because the money wasn’t forthcoming — my mum had four other siblings that needed to be taken care of.

So I started baking cakes, which I learned from my mum. People in my campus fellowship and my class were my first sets of customers, and I’d make between ₦500 and ₦2k on every order. An ex bought me an electric oven, which was a huge help.

I also got contracts to cook for student and fellowship events, and I’d make ₦2k-₦5k. At some point, I was hiring other students to help with the orders, and I’d give them food and pay them ₦1k after we were done.

I was also saving money when I could. When I graduated from university in 2019, I had about ₦12k saved up.

Nice. What came after?

A few weeks after submitting my project, I travelled to Lagos to live with a family member and look for HR internships.

Why HR?

I was a people person and led teams in church and associations in uni, so it felt like the thing for me. Also, I got active on LinkedIn in uni and followed many HR thought leaders to grow my knowledge in Human Resources.

An acquaintance from the university gave me a lead at their company’s HR outsourcing company, and I applied for the role and got it.

My monthly stipend was ₦20k. It’s funny because I mentioned that I was willing to work for free in my application email. I had no idea how much it’d cost to live in Lagos.

Haha

Two weeks into the job, I realised that my stipend was only enough to cover my transportation expenses. Thankfully, I was a hard worker. Two months into the job, my stipend was increased to ₦40k. Subsequently, ₦25k went into transportation, ₦10k into lunch and ₦5k for plus snacks when I was in traffic.

I was living from stipend to stipend, but it was something. Then I had to leave the job after four months.

Why?

NYSC. I was mobilised out of Lagos and didn’t have the money to redeploy back. So I had to leave the ₦40k job. My PPA was a media house, and the benefits were ₦15k monthly stipend and accommodation. The federal government also paid ₦19,800.

My primary station was the newsroom, but I still wanted to do something related to HR. However, my workplace didn’t have an HR department — just an accountant who handled payroll. Two months into the job, the accountant resigned. I saw an opportunity there and pitched myself to the Assistant General Manager, showing proof of my knowledge of payroll management from my internship at the recruiting company. He bought it and let me take up payroll responsibilities.

Do you know why he agreed to it?

I was the cheaper option. The last accountant earned ₦50k while they paid me ₦15k. The new responsibilities didn’t reflect in my pay, but I didn’t mind. I did it for the experience.

How did NYSC go?

I became the AGM’s right-hand person and learned every possible administrative task from him. Before my service year ended, I was handling five other sister companies’ payrolls and filling the tax returns.

Everything was going well until I was nine months into NYSC and Covid struck. The company stopped paying, so I was left with the government allowance, which had just been increased to ₦33k. Since everything was shut down at work, I went back home to my family and stayed there until my service year ended.

Before I left for home, I was saving ₦15k/month. But when I was at home, I increased my monthly savings to ₦30k. When my service year ended in June, I had saved up ₦150k.

From my savings, I took ₦78k to buy a new phone because I had started building content and social media skills because of an NGO I was volunteering for.

Now NYSC was over

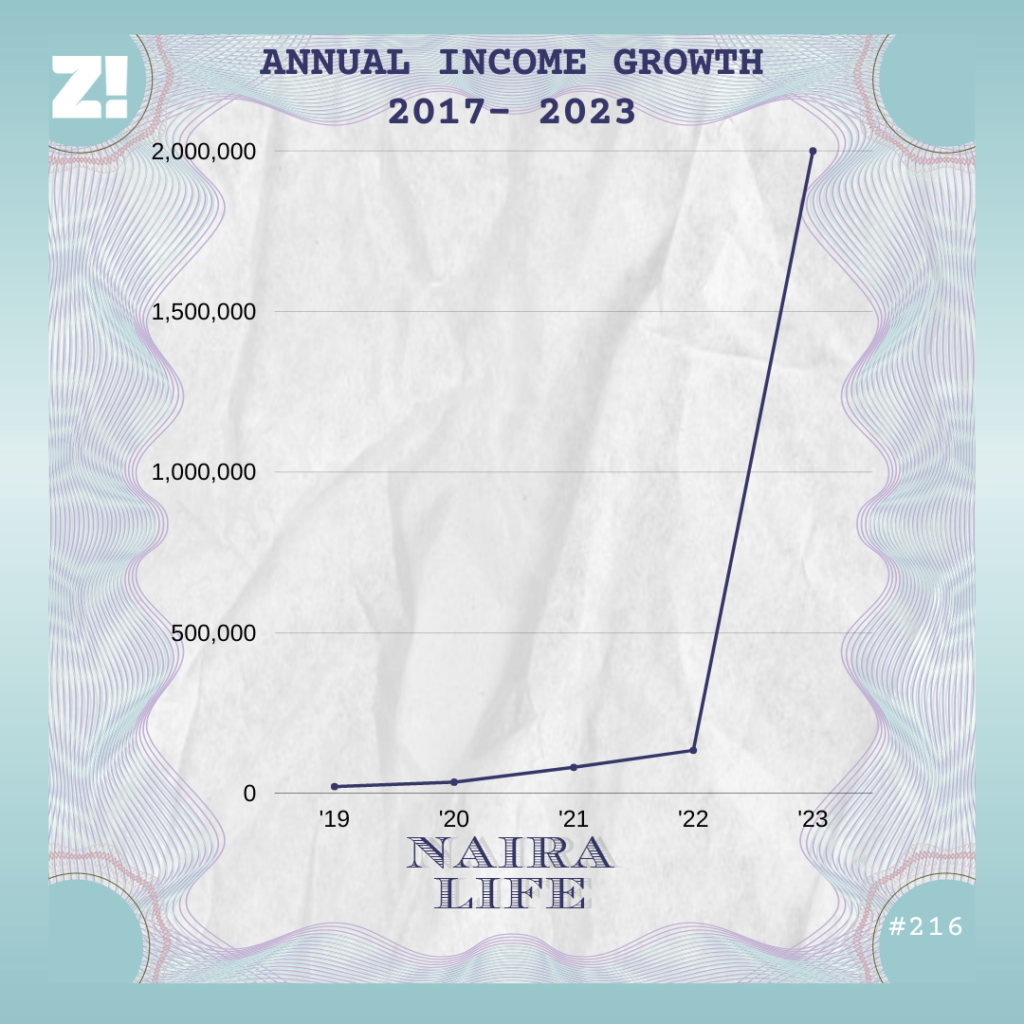

And I needed to find a new job. I returned to Lagos in July 2020, but it was the wrong time to hunt for jobs. Covid had slowed things down and no one was hiring. I applied for full-time roles and internships but none were forthcoming. Not until October when I found a job as an executive assistant at an investment management company, and my salary was ₦50k.

Only three people worked at this company, so I was punching above my weight. I was handling business operations and also doing brand communications — content and social media. In January 2021, I got a raise to ₦80k.

Sadly, I lost my job in the same H1. The company ran out of money.

Damn

Again, I had been saving — ₦15k/month when my salary was ₦50k and ₦30k when it increased to ₦80k, which mitigated the impact of losing my job. It took me six months before I found another full-time job.

What happened during those months?

I kept looking for a job, but I couldn’t find one. Then a friend gave me a lifeline in June 2021. He owned a consulting company and brought me on as a contract staff on a project he was working on. My role here was as a business development officer — another pivot because I hadn’t done that professionally. But I came from a family of business people and had managed and grown businesses. The first contract work I did paid me ₦120k.

While this was happening, the tech buzz was also getting stronger. I’ve always been a fan of innovation and technology, so I started looking for ways to find myself in the tech industry. I attended a couple of industry events to find work. But ultimately, I shot my shot at a company on Twitter. Things aligned here because I was operating in a business development capacity at my contract job and they had an open biz-dev role.

I took the job to help them drive sales on a monthly salary of ₦133k. I was there for nine months before I joined my current company.

I’m curious how you got the job

I’m very active on Linkedin, and this was the tool I used. During the japa wave of 2022, I started applying for several jobs abroad, hoping one of them would sponsor my relocation. Instead, I got a ton of rejections. They mostly said the same thing — they liked my experience but were not willing to sponsor my relocation.

I was scrolling through Linkedin one day when I saw an ad for a remote business and partnerships manager role. Not the job that’d open a path to relocation that I was looking for, but I decided to start from here. I applied and sent my CV. They reached out to me and after a couple of interviews, I got the mail.

Welcome to the team.

Congratulations. How much?

$2500. It’s about ₦1.5m when you convert it to Naira. One job change and I’m earning my one-year salary in one month.

Wild

See, when I received my first salary, I thought it was a joke. I was just jumping and shouting up and down. It was almost unbelievable.

Some months in, I got a raise to $2800/month. I do a lot of hard work — from product to operations to marketing and sales — so I deserve it.

What has this jump meant in this little time?

I’m the only one in my family who has gotten to this income level. So I put my mum on a monthly allowance of ₦50k, pay the rent and have taken on a couple of projects in the past couple of months. They don’t know how much I earn, but they know my financial situation has improved.

As for me, I moved from my tiny and loud ₦250k self-con to a bigger and much quieter 2-bedroom apartment. My rent is now ₦1m.

It also means that when I think about travelling these days, I think about flying, not going by road. I’ve gone on two trips this year already and should do a few more by the end of the year.

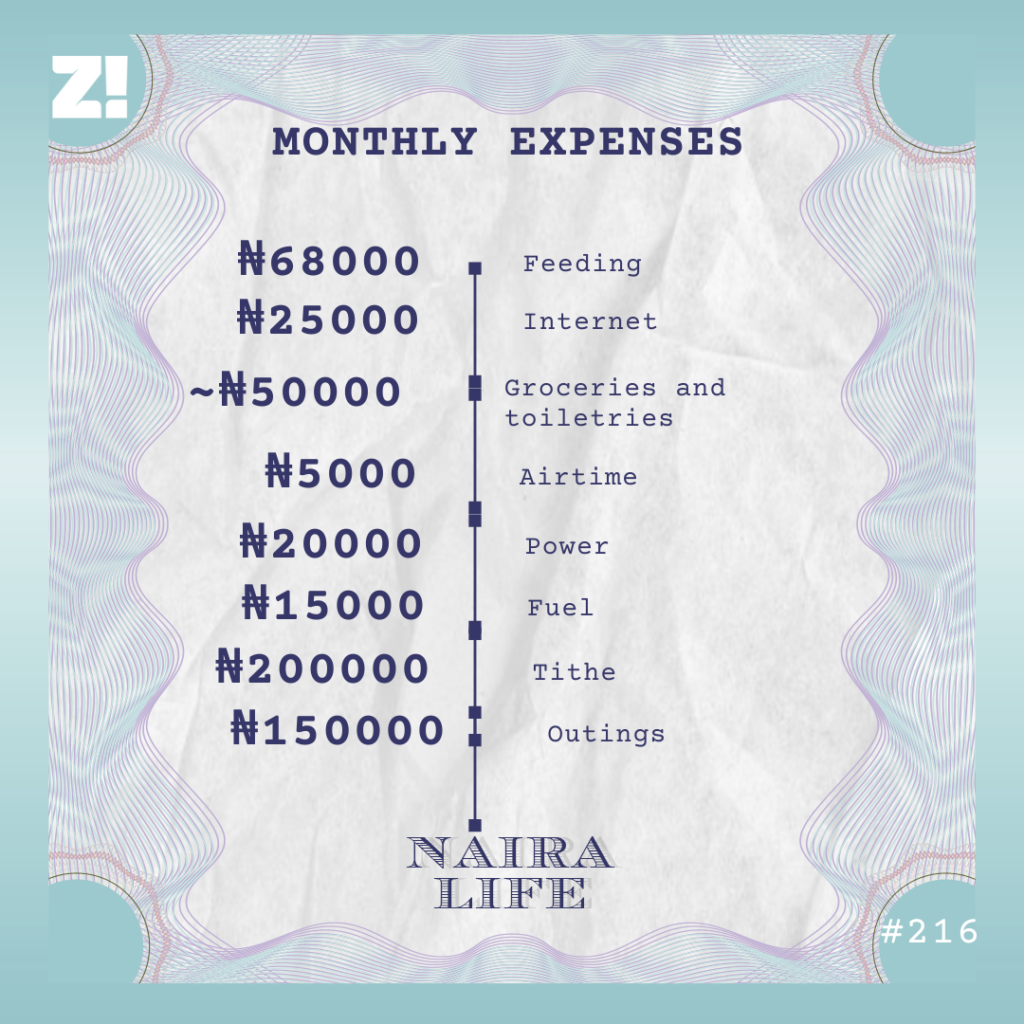

Where does your money go every month?

Additionally, I spend between ₦50k-₦100k every three months on skincare.

These expenses may not seem like a lot compared to what I earn, but it’s a lot compared to where I’m coming from. I always remember that.

What about your savings muscle in the past couple of months?

Between June and December last year, I saved ₦500k every month for my rent. Now, I have ₦3m in that savings account, and it will cover rent for the next three years.

In the last quarter of 2022, I made a financial plan for 2023, including the things I wanted to do this year and how to spread them over the year. The core of it is that I now invest $1k/month in real estate investment via a financial management app I use. The ROI is 10%/annum.

My naira savings is for short and medium-term expenses. I promised myself to go on vacation every quarter, and I’m saving ₦300k every month into that account. There’s another account where I save ₦150k — this one is for my mum’s rent. Also, I have a target saving account for my car; I put ₦400k in every month, and it will be due by Q3.

So yeah, I save a shit-ton of money. $1k goes into my core investments. Another $1k goes into my naira savings, and I live on the rest.

It appears that you plan everything to the tiniest detail

A part of it is driven by my anxiety about money. I’ve struggled financially; I never want to go back there. Also, I deal with this gnawing feeling that something might go wrong.

I came from a family where the silver spoon disappeared all of a sudden. I’ve also woken up to being told I no longer had a job. So my thinking is still, what if I wake up and the job is no longer there?

I’m trying to have so much buffer that even if a rainy day comes, I’m stacked up for at least a year. It’s also the reason I buy things in twos and threes.

The only thing I can control is planning everything around my finances. and it keeps me sane.

Now I want to ask how your experiences have shaped your thinking about money

I’ve always been a hard worker. I’ve been trained that hard work brings money, and I’ve seen it happen first-hand. So I don’t joke with work because I want to be sure nothing is happening to my salary — it’s how I can pay for everything.

How much do you think you should be earning now?

I earn reasonably well. But if it comes to the work I do, I should be earning between $3k – $4k. My next promotion should get me there or close. I do a lot of work for my employers. I have some bargaining power.

Energy! What did you spend money on recently that improved the quality of your life?

My eyesight. I visited the optician recently and they recommended new lenses and frames. A pair of the lens cost ₦65k and the frame ₦35k. I bought two pairs of both, totalling ₦200k. Also, I paid a consultation fee of ₦10k.

Love it! Is there a question you think I should have asked but didn’t?

My financial happiness?

Hehe. I was coming to that

It’s a solid 8/10. I don’t wake up to think about what to eat or how I would deal with any financial situation that may come from home. It’s not even pride, but there’s barely anything I want to buy that I can’t afford. It’s interesting how much can change in a year. Right now, I describe myself as comfortable and content.

This number might move to a 9 when I get my car. And a 10 when I get an MBA which, when I think about it, is probably the only thing I can’t afford very easily right now.

Soon come.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Yes, I want to do a Naira Life

Find all the past Naira Life stories here.