Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

In 2016, this subject made a difficult but necessary decision to move to Nigeria from the UK where she was born and raised. How long did it take her to find her feet in the country? About four years? What made all the difference? Linkedin.

What’s your oldest memory of money?

That would be my pocket money when I was in primary school. It was about £2.5 every week. I was born and grew up in the UK. I don’t remember what I did with the money, but I knew to expect an allowance every week.

What was it like growing up in the UK?

I was taught independence very early on. By law, I was allowed to get a job at 16. So I always kind of knew that I would start making my own money at that age. I was motivated to get a job because I wanted to be able to buy all the things I couldn’t ask my parents for.

Haha. Do you remember your first job?

A weekend behind-the-counter job at an electronics store, and my pay was £4 per hour. At the end of each month, I was making around £400. That was good money for a 16-year-old. It also meant that I could make some of my own decisions and didn’t have to run everything by my parents. I did a couple of those kinds of jobs before I went to university.

What year was this?

2008. My parents wanted me to focus on my studies, and they put me on £250 per month. But I took a student loan from the government to pay my tuition.

Did you need to get it though?

I was trying to play it safe. My dad had just started a business and wasn’t working for a company at the time. His income wasn’t as regular. I didn’t want a situation where there was no money for tuition. A student loan promised stability. Interestingly, I don’t think my dad and I had that conversation. He’d relocated to Nigeria the previous year.

Anyway, I was getting about £4000 in student loans per term. My dad was paying rent, which was £1000. I definitely mismanaged money. After paying tuition, the rest of the money went into living large. I remember a time when my friend and I were buying hair attachments directly from Cambodia and spending like £1000 on weaves. Ask me where all of that hair is now?

Lmao. I have an idea what the answer to this question is.

I was always almost broke by the end of each term. But I could ask my parents, and they would happily send me £50-£100.

So after uni?

I graduated in 2012. I studied a finance-related course, and my dad wanted me to work in the finance industry. But I knew very early that I didn’t want to do that. When I was working those part-time retail jobs, I always thought that there must be a backend to everything that’s happening on the store floor. I did some research and found out that there’s a lot of different roles in retail. I had some experience, and I was like, “Okay, I’m going to work in the retail industry.”

I started actively job hunting in the summer of 2012. I applied to the big retailers in the UK and got so many rejection emails. Someone advised me to submit my CV to a recruitment agency. I did that, and they got back to me and went: “Your CV looks great. Can you start next week as contract staff at this retail company?” It was one of the biggest retailers in the UK. They had at least 3000 stores across the country at the time. Of course, I said yes. I started the job in September 2012.

What was your role and how much did it pay?

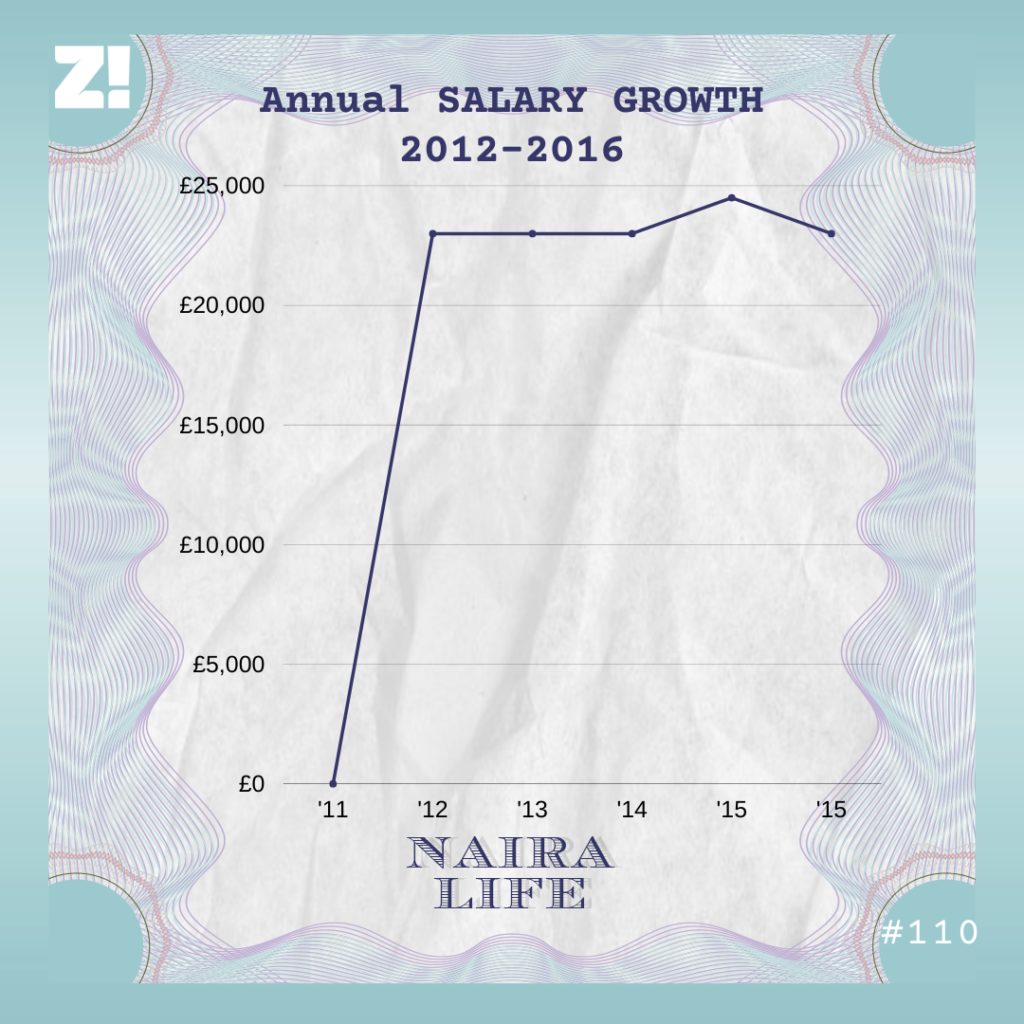

I was doing a lot of simple things — data entry and sending out orders to suppliers. £8.50 per hour and working for 36 hours a week. That was bringing in £1200 a month after tax. I liked the job and started asking questions about how to make it permanent. They had a graduate scheme for people who had left university. I applied for it, did the assessment, and I passed. By the end of that year, I’d moved from contract staff to permanent staff.

Lit.

Now I was a demand planner and merchandiser. My job was basically managing the demand and supply process of products in my department. My salary increased to £23k per annum. I was taking £1500 home every month. Also, there were appraisals every six months, and if you did well, you got a raise. I got a few of those and my salary had increased to £24500 when I finally left in 2015.

Why did you leave?

I got pregnant.

Whoa.

I didn’t leave immediately. I went on maternity leave in August 2014, which was great because it was a paid one. For the first six months, my company paid me my full salary. After that, they stopped paying, but I was getting a maternity allowance of £700 from the government. It was half my normal salary, but it was something. My daughter was born in October 2014.

How did this change things?

In the beginning, I was living in my mum’s house and wasn’t spending money on rent and groceries. But she decided that she wanted to be with my dad and relocated to Nigeria. I moved out to find my own place to rent. That was when the expenses started coming in. My siblings and friends helped out when they could, so that made things easier. My daughter’s dad wasn’t giving me actual upkeep, but he contributed to buying her clothes, food and those kinds of things.

After my maternity leave ended, I hadn’t yet figured out the daycare plans for my daughter. Then something happened — the company was dealing with some profit issues and offered everyone voluntary redundancy. I took it and got a £6000 – £7000 payout. This bought me some more time.

When did you finally return to work?

2016. I moved to the outskirts of the city and found a job as a forecast analyst at a distribution company — it was similar to what I did at my previous job. This one paid £23k per year. I couldn’t afford daycare on that salary. I finally found a childcare service, which was much cheaper but safe. It was £250 every month.

I returned to work, and it was a lot. I wasn’t spending time with my daughter as I’d have liked, and my salary was only enough to get us through each month. It was so exhausting. Earlier that year, my parents had advised me to move to Nigeria and find work here, so my daughter would always be around family and I would stop spending so much on rent. I discussed it with my daughter’s dad and he wasn’t a fan of the idea. I let it go.

But it became more difficult. I always had little money left after paying my bills. And my daughter was unhappy because she was spending so much time at the childcare arrangement. She cried all the time. It just wasn’t working out.

Mahn. What did you do?

I started giving more thought to relocating to Nigeria. I never thought I would, but I now had a child and raising her in the UK was a struggle. By the end of 2016, I’d had enough. I discussed it with my daughter’s dad again and made him understand why I had to do it. I moved back here in December 2016.

Was there a plan?

First, I didn’t have much savings. I came with £1500. And did I have a job waiting for me? Nah. All I knew was that my family was in Nigeria. I was running on vibes.

Aren’t we all.

But you know, I had retail experience and wanted to continue working in that industry. I started looking for supply chain, retail and consumer goods jobs. I got many rejection emails. One time, I got to the final stage at an e-commerce company but I wasn’t successful.

I finally met this woman who had a clothing store. I performed well in the interview and she really liked me. She was talking about how she wanted me to be her right-hand and travel with her all over the world. Okay, sounds great. But what’s the salary?

Brace for impact.

Lol. She said ₦50k. I was so confused. I had four years of retail experience. There was no way I was going to take that offer.

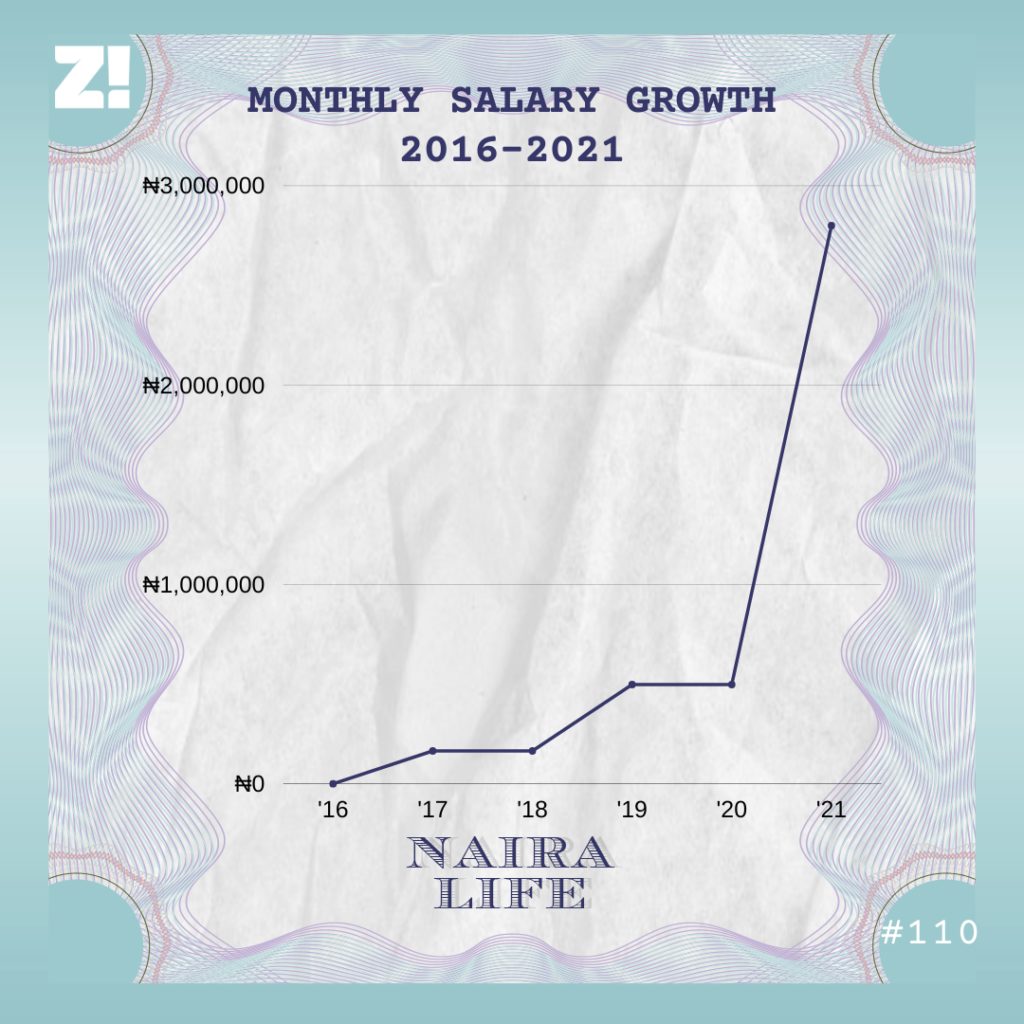

My dad knew someone who had a distribution company and was trying to do business with the retail company I first worked with when I left uni, and he linked us up. The fact that I understood how the company worked drew him to me, and he hired me as a sourcing manager. My job was to source new products they could add to their portfolio and distribute across the city. I don’t remember what the actual offer was, but my salary at the end of each month was ₦165k. I started in February 2017.

Ah, nice.

I was there for a year and a half before I got bored. I wasn’t doing a lot, and the company wasn’t very structured. Before I left, I’d started NYSC and that affected my salary at my next job.

How?

It was a head-buyer role at a supermarket. Initially, they gave me an offer of ₦220k, but when they heard that I was serving, they were like, “We are going to give you ₦80k.” I refused, and they finally increased it to ₦130k gross. After all the deductions, I was getting ₦113k in my account.

I’m curious, did they promise to increase it after your service year?

Scam! After POP, I took my certificate to HR and told her, “See, I’ve finished service, so I’m expecting my full salary.” ₦113K entered my account at the end of that month and the following month. They kept promising to look at it, but I never got that money until I left. That was one of the reasons I decided to leave. I was like, “Since you don’t want to pay me, I’m just going to leave.”

Energy. When did you leave?

September 2019. I connected with a lady on Linkedin, and she told me that she had a friend who was looking for a demand planner at a pharmaceutical distribution company. I thought it might be interesting and gave it a try. I got the job, and their initial offer was ₦500k. I negotiated for a higher salary, and they increased it to ₦605k gross. But I was getting around ₦450k + ₦48k transport allowance.

Your first significant pay jump in Nigeria.

Honestly, it was bittersweet. Yes, it was more money and everyone was telling me that it was a good salary by Nigerian standards. But for me, it still wasn’t enough. Don’t get me wrong, I was very grateful for it. But after a while, I just thought I could do better.

I get that.

Something happened a month after I started at the job. My parents travelled to the UK. They told me that they were going for routine tests, but then it turned out that my dad had cancer.

Oh damn. I’m sorry.

Oh, it’s fine. He’s a UK citizen, and he’s getting free treatment. He was working as a consultant for a Nigerian company before he left. But after he was in the UK for a while, they terminated his contract. I became responsible for more things at home — utility bills and things like that. Thank God I was earning more.

So… 2020?

I started working remotely because of the pandemic. The more I got used to it, the more I started thinking about getting a fully remote job. Two things really gingered me.

What were those?

First, it was NairaLife. I’d read about people who talked about earning dollars or pounds while living in Nigeria. I remember thinking to myself, “These people don’t have two heads.”

Lmao. Am shy. What was the second reason?

The EndSars protests. At that point, I realised that Nigeria is not a serious place. We heard gunshots all the time, and I was thinking about how this isn’t a sane place for me to raise a child. I felt guilty for bringing her here. I wanted to move back to the UK, but I looked at my calculations and figured that I would need to be earning at least £60k per year to live comfortably with my daughter in the UK. The offers I was getting were between £35k and £45k. I decided to go all-in and look for a remote job and earn in pounds. In my mind, if I was going to stay here, there was no way I could be earning in naira in 2021.

Energy.

I went back to Linkedin and updated and fully optimised my page — good profile picture, highlighted key skills and achievements and recommendations from other people.

I was sending at least 10 applications every day. Eventually, I was in talks with four companies, and each of them offered me different salaries.

It came down to one company, and I had a couple of interviews with them, then an Excel sheet assessment, and a final interview after that. I applied to be a demand planner, but they gave me an inventory manager role — that’s a level up and it’s a management position. I was ecstatic. I was going to be working from home in Nigeria and collecting pounds.

The Nigerian dream.

Haha. I started the job in January 2021, and my new salary was £4000. That’s around ₦2.8m in total every month at the current exchange rate.

Man! Two significant bumps in less than two years, what does that do to someone?

I thought I deserved it. When people around me started saying things like, “Look how far you’ve come. Four years ago, you were offered ₦50k.” I was like, “Yes, this is how it should be.” But when I took the time to sit back and look at the journey, I realised how amazing it is. I know that I pushed for these opportunities, but not everyone is that lucky.

I also decided to be more serious with my financial planning. I’m in my 30s now and can’t vibe and inshallah my way out of everything. For the first time in forever, I sat down and created a budget.

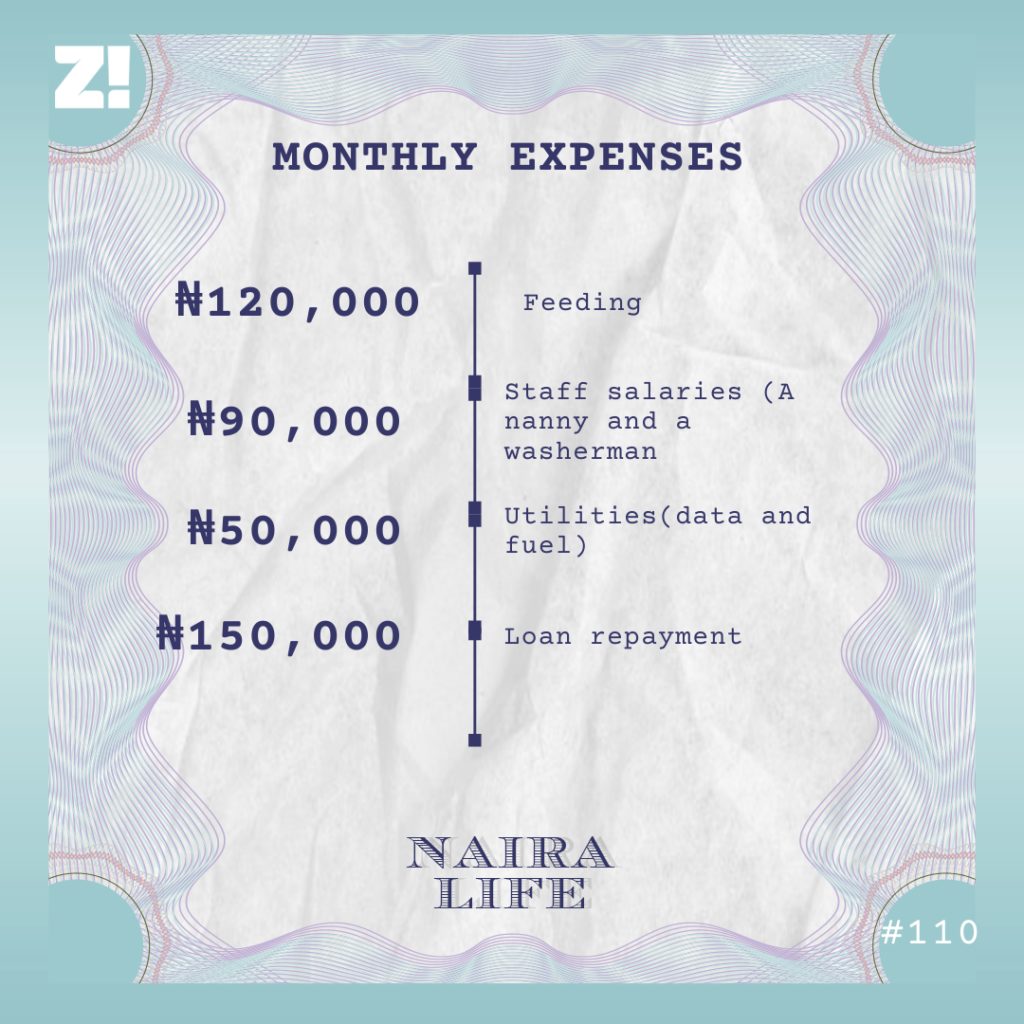

What does it currently look like?

Do you want to talk about the loan?

This goes way back. I wanted to start a clothing line and took a loan. But I had some issues with my suppliers in China and lost the money. The interest on the loan was really high, so I took a low-interest loan — about ₦2m— to offset the previous loan, and I’m paying it back now.

Speaking of loans, what about your student loans?

Ah, that! They used to write to me a lot. I sent them proof of how much I was earning in Nigeria. They obviously converted it to pounds and realised that they can’t take money from me at that moment. That one is currently on hold.

Heh. What does your new salary mean for your savings plan?

My plan is to keep as much money as I can in my UK savings account. I’m allowing myself ₦1.2m every month and sending the rest into my UK savings account.

Investments?

I think I have £8k in my pension account in the UK and ₦1.8m in my pension account in Nigeria. I’ve been talking to a friend who works in an investment management company, and he advised me to get my personal investment account and build a bulk amount of money. So in the future when I’m ready to retire — let’s say around 55 — I can live off the interest. The plan now is to build that up to £1m.

Also, I want to start investing £400 a month in stocks and all of that. No major naira investments. I might do a bit of those agricultural investments, but for the most part, everything is going to the UK.

Is there an annoying expense you wish you don’t have?

The loan. The ₦150k should be going into my savings. But it will be over in nine months.

What’s something you spent money on recently that significantly improved the quality of your life?

My room renovations. I work from my room because my daughter controls the rest of the house. The cost of doing that was about ₦400k — the paint job, wallpaper, new wardrobe and furniture. It was so worth it.

How have all of these experiences shaped your perspective about money?

I used to be driven by impulse when I was younger. I didn’t think about saving for a rainy day. But now, I understand that there’s a time for everything. You don’t need to have everything straight away, and it’s okay to save up to buy something. I’ve learned the value of money, especially now that I’m a parent and there’s a lot of long-term planning involved.

Last question…

How do I rate my financial happiness?

LMAO. Yup.

I’m currently at a 7. Yes, I’m earning good money, but I still can’t afford my dream car. But again, I know I’m in a comfortable position. That’s a win, and I’ll take it.

What will get you to a 10?

They say that money can make you happy if you earn at least $75k every year. So that kind of money will get me to an 8 or a 9, maybe even a 10. But you know what? It’s only a matter of time.

The next Naira Life drops on Monday next week at 9 am. This is what you get when you subscribe to Zikoko’s Money Newsletter:

- You get it before everybody else, plus all the things that didn’t make the cut.

- You also get a #NairaLife throwback, where we check in with someone from the past, and see how they’re doing now.

Find all the past Naira Life stories here.