All you have to do in this quiz is to pick the odd ingredient out. That’s it.

-

-

If you ask the average Nigerian to give you a list of people they only tolerate because they really can’t live without them, odds that the following people will make the list:

1. Landlords/Agents

Everyone already knows that these people don’t have the fear of God. Your landlord wants to milk you dry because of rent. And may God help you if you’re looking for a new apartment because you can’t escape the daredevil agents. Like why is their commission(s) almost as much as the rent itself. Like breaking your savings to raise money for rent is not enough, your landlord wants you to pay for service charge too. And what does that even cover? Water and “security”

Yes, they deserve all the hate.

2. Cab drivers/Conductors/ Bolt/Uber drivers

If there’s anything these ones know how to do, it’s how to collect your money and waste your time. You won’t know how much the mere existence of these people is affecting the quality of your life until you get home at the end of the day and realize how much you spent on transportation.

Tears!

3. Food vendors

We know we live in a capitalist society where everyone makes money off themselves. Food vendors have hacked how to make money off you — yes, they provide a service. But why do I pay for food and wait hours before it gets to me? And wait, what is this bill I’m looking at? No, we definitely can’t be friends,

4. Online vendors

These ones are a different beast. Some of them will make you pay an arm and a leg for an item and it won’t be the only torture they will put you through. You may not get your order and if you reach out to them to ask “How far”, you might “chop insult and block”.

If you do indeed get your order, what you find inside the package may not be what you paid for. Apeke Closet, please fear God. We are in this Buhari times together.

5. Laundry businesses

If it’s not that I’m so lazy, what are clothes that I cannot wash. But why are you charging so much. Life is not that hard, oga.

-

As told to Toheeb

It’s scary how a life event can disrupt other seemingly well-laid plans and affect the trajectory of the subsequent years. This was all I was thinking about as this woman narrated her story. There’s something else I can’t get out of my mind. At the beginning of the conversation, I asked her why she wanted to share this story. She said: “I have a couple of things on my mind, and I just want someone to listen.”

And that’s what I did. I listened.

My father’s greatest dream was to see his four daughters get a good education. Back when I was young, he told me that I was going to be a doctor. I don’t know how much he earned as a soldier in the Nigerian Army, but he had a separate savings account for me and my sisters’ school fees. We were one of the first people to pay our fees every term.

He was killed in action in 2011. He was in Maiduguri, fighting Boko Haram. And his dreams died with him. I was only 16.

One of the last things he said to us as he left the house to report for duty was that we pray for his return. We prayed, but it wasn’t enough. I was in the living room watching TV with my mum and my sisters when the phone rang. The person on the other end informed my mother that my father had been among a group of soldiers that was caught in a Boko Haram ambush. They wanted her to identify his body.

He was interred alongside the others who died with him in a mass burial.

He died in active service and was entitled to benefits. This was where things got tricky. My mum wasn’t his next of kin because she was battling some health challenges. His next of kin used to be me and one of my sisters. However, a few months before he passed, he removed my name and included his younger brother, my uncle.

My sister was still a minor when they started processing his benefits. So my uncle, who was the co-signatory, was the next in line to sign before his benefits would be released to us. He took advantage of that. At first, it was about how we couldn’t be entitled to the money because none of us was a boy.

It was more than that, though. My uncle wanted to marry my mother. She refused and that hurt his ego, so he thought he could make life hell for us. After a while, he and the rest of my father’s family agreed to release half of the money to us.

But that wasn’t the only problem we had to deal with.

We were living in the barracks when my father died. After some time, the authorities asked us to move out of the apartment. Why? There were men in active service who needed accommodation. Now this shouldn’t have been a problem because my father had built a house in our village in Benue state. My uncle stood in the way of getting that too. He kicked us out of the house.

I don’t know how much my father’s family gave us, but it wasn’t going to be enough to send all of us to school. My mother used part of the money to build a new house, too, so all of us had to make sacrifices. We agreed that my eldest sister would go to university. The rest of us would find our way.

I started learning hairdressing in 2014. On the side, I also learned how to make soap. Whatever hopes I had of returning to school died when my eldest sister — the one in university — fell sick. What remained of the money my father left was used to nurse her back to health.

There was a little glint of hope for me in 2015. The Nigerian Army was recruiting, and I applied. I was invited to write an exam at one of the barracks in Abuja. I had ₦20k in my savings and my sister supported me with ₦5k. However, this was only enough to get me to Abuja and back. Not anything else.

I arrived in Abuja on the eve of the exam. The best option for me was to sleep at a chapel in the barracks if I hoped to meet up with the exam the following day. Sometime during the evening, the catechist at the church sent me on an errand to buy a drink for him. He called me into the vestry when I returned. I handed the drink to him and made to leave, but he asked me to sit down. I thought he wanted to pray for me or have a short conversation.

Minutes later, he started making advances at me, and I got uncomfortable. As I stood to leave, he blocked the exit and didn’t let me leave until he had his way with me. This man sexually assaulted me. He knew there were people in the church that could catch him, but that didn’t stop him. It didn’t save me.

I wasn’t prepared to let the incident go without a fight. On the morning of my exam, I looked for the Major-General in charge of the church to tell him what had happened to me. I found him but the queue of people who wanted to see him that morning was long. I had an exam to write and was hungry. My heart boiled with rage as I left. I wasn’t going to get any form of justice.

The moment I finished writing my exam, I left the barracks. I couldn’t go back home to Benue immediately, so I went to stay with my sister at her school. I didn’t tell her what happened. I didn’t tell my mum either. I was scared that they would blame me. I still remember the man’s name and haven’t gotten over the fact that he got away with what he did to me.

It was all for nothing, too. The exam results came out a few weeks later, and I didn’t make it to the next stage. There was nothing to show for my trip to Abuja and everything that happened there.

There was also nothing in the village for me, soI left sometime that year and moved to Lagos. One of my people in the village had moved here earlier and she took me in. I stayed with her and looked for work. I found one as an office assistant in a job agency. My salary was ₦15k.

I was at the job for a couple of months. I had to quit because the person I lived with was moving out. Like that, I was homeless. However, I was fortunate to find another friend who agreed to house me. The only problem was that she was married and only agreed to take me in because her husband was away at the time. We both understood that I would leave the moment her husband returned.

I found another job with some vegetable farmers at Ojo. Every morning, a vehicle would come and transport the produce to Oyingbo market. My job was to weed the farm and apply manure. I woke up early every morning to cover as much ground as possible. It was a stressful job, but it brought ₦25k-₦30k every month.

After about eight months of living with my friend and working on the farm, her husband returned and I had to move out agan. Thankfully, I had about ₦200k in savings. It was more than enough to rent a house. I moved into a small room in Oshodi and the rent was ₦37k.

I met the man that would become my husband in 2017, and we fell in love. We got married later that year. Our first child was born in 2018.

It wasn’t my happily ever after — at least not yet. The government had demolished his shop in Oshodi, where he repaired electronic devices in 2016. I couldn’t sit idly by. I wanted to do something, anything to support him while he figured out how to get back on his feet. I went back to the farm at Ojo. I was pregnant with my second child at the time.

2020 ended up being one of the worst years of my life. There were complications during childbirth. The doctor said it was because of all the stress I’d put my body through on the farm. When it became clear that I couldn’t deliver the baby by myself, I was wheeled off to the theatre for the Caesarean section procedure. This alone cost ₦200k. That was money we didn’t have, but we managed to raise it.

The operation didn’t save my baby, and I never got to meet him. He died inside me.

I’m still dealing with the aftermath of that. The event took a toll on our already struggling finances and things haven’t been the same since then. My husband blames me for everything that happened. We argue more than ever these days. The first thing he mentions in an argument is how the operation is affecting his life. It’s almost as though he believes I wanted it to happen. I won’t lie, I’ve thought about leaving the marriage.

The only thing I want right now is figuring out how to restart my hairdressing and soap-making business. My husband had promised to set me up but with everything that’s happened, I don’t know if that’s still going to happen.

On the other hand, he is my husband and he asked me to wait for him to set me up, so I will wait. Sometimes, I just wish I could have it easier.

-

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by Quick credit. With Quick credit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

Between 2019 and 2021, this 22-year-old investment analyst grew her income by almost 400%. What’s her trick? Going after the right internships, building important relationships and leveraging her network.

What’s your oldest memory of money?

It was my primary school allowance for me. I started getting pocket money for school in 2005. I was six years old at the time. The money was a nice touch because I took lunch and was driven to school. It started with ₦30 and increased in the subsequent years. When I left secondary school, I was getting ₦250 to school every day. My friends thought I was rich because I always had money in my pocket. But I didn’t understand what they meant for the longest time.

Baller. Why didn’t you think you were rich though?

I grew up in a small town and went to a cheap school. I thought if my parents were rich, I would go to a more expensive school. I started to understand why they thought I was the rich girl as I grew older. A car dropped me at school while others took the school bus. In comparison to most of my classmates, I had money.

To be honest, I never lacked anything growing up even though my family is a large one — my parents have five children. The first time I got familiar with lack was after I finished secondary school and found out that I couldn’t go to my dream school because we couldn’t afford it.

Tell me more about that.

I wanted to go to uni abroad. I got an admission offer and a 70% scholarship. But my mum insisted that I wrote JAMB. Later, she sat me down and told me that I couldn’t go. I was like, “But I have a 70% scholarship.”

Wiun.

She said the best they could at the time was to send me to a private university in Nigeria. My father even kicked against that for a bit and told me to consider a federal university.

Why?

He was managing a family business and farming on the side. I grew up in a civil service state and the governor wasn’t paying salaries; that affected pretty much everybody in the state, so there was nobody to sell his farm produce to. There were also a series of unfortunate events — his farm flooded one time and he was dealing with family disputes as well.

My mother, on the other hand, was an administrator at a manufacturing company and she was still working and getting promoted. Anyway, we eventually decided that I would go to the private university.

So uni?

I got my allowance at the beginning of each semester, and when I broke it down, it was ₦15k a month. By the time I was in final year, it was ₦25k. There were other allowances too courtesy of my aunts and elder siblings.

I was careful with money in university. I only spent on essentials. For example, the cafeteria food was terrible, but I went there anyway because we had paid for it.

I got a scholarship in my second year that paid me ₦100k every session until I left uni. I also started going after internships in my second year.

Your first work experience?

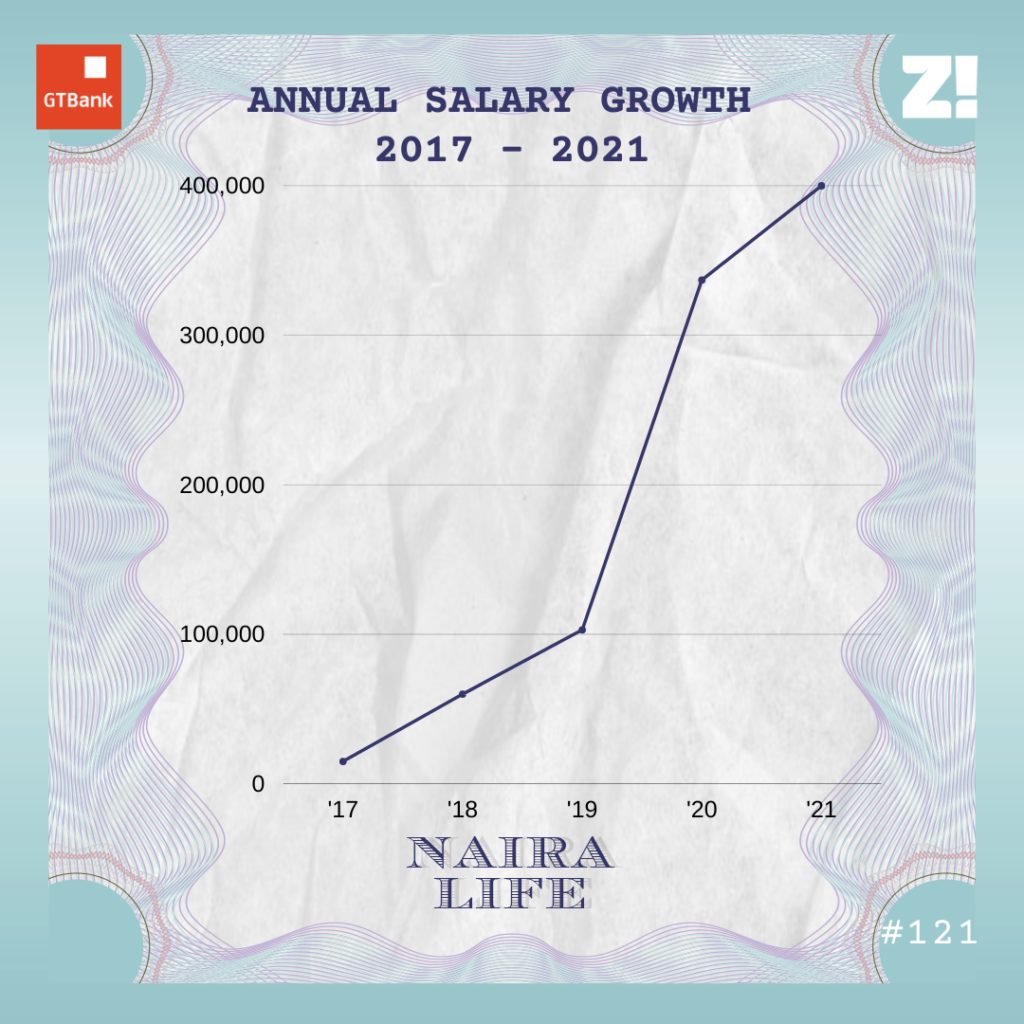

Yes. I went for the first one in 2017. I wanted to intern with one of the “Big 4” but it didn’t work out. I found work in a family friend’s audit firm and spent the two-month session break there, earning ₦15k per month. I didn’t incur a lot of expenses because I took food to work and transportation in the town was cheap.

The second internship happened in my third year. This time, it was with an asset management firm in Lagos. They paid me ₦60k per month. Most of my earnings went into transportation, a little into flexing, and the rest went into my savings. I returned to school after the internship for my final year and got elected into the student council. This came with a ₦100k allowance every semester.

Your school paid you to be on the student council?

Yes.

Greatest Gba Gba is shaking. What did your finances look like when you left uni?

I had about ₦400k in savings. One of my sisters had warned me that my allowances would stop coming the moment I finished from uni and she was right. I hadn’t even gotten a job when my parents cut me off.

Lmao. When did you find a job post-uni?

June 2019 — about two months after I left uni. It was an internship at one of the Big 4s and it paid ₦60k. I was there for two months before I left for NYSC. And I’d gotten a job elsewhere before I left. This is how it happened: during my internship days at school, I networked a lot and maintained relationships with the people I worked with. Right as I was preparing for NYSC, one of those people texted me to inform me that she was leaving her job, and they were looking for someone to replace her. She wanted to know if I was interested in the role. The company was well-known in the finance industry and I was like, “Yeah, sure.” The interview was a breeze. My offer letter followed. ₦70k net.

Lit.

I earned ₦103k during NYSC — ₦70k from the company and ₦33k from the federal government. As my service year drew to a close, it started looking like I wasn’t going to get a full-time offer at the company. My boss was saying that he wanted me on the team but HR wasn’t saying anything. I started looking for a new job in June 2020 though my service year was going to end in October. I filled out tons of work applications, got a couple of interviews, but none of it came through. Companies were still trying to navigate Covid, so recruitment was weird. Anyway, I had no job when NYSC ended.

Wiun. How long were you unemployed for?

Three long weeks. I didn’t have a lot of money saved up anymore. I live with two of my siblings but I’d started contributing more towards housekeeping because their incomes were fluctuating. I had ₦300k saved up but during those weeks, the only thing I was thinking about was, “What will I do when this money finishes?”

Thankfully, that didn’t happen before I got my next job. I actually got two offers almost at the same time.

Again, my relationships with people helped me here. Someone else I knew was leaving a company and left my name as a possible replacement. I was still serving when I got a Linkedin request from someone at the company. The man who reached out said that they were looking for someone to fill the role and were wondering if I would be interested in having a chat with them. Of course, I was even though I didn’t think I qualified for the role. The first interview happened, then the second. But nothing happened after that, so I thought they went with another candidate.

A month after, they reached out and went, “You’re not who we were looking for but we like you. Do you want to join our team?”

My heart.

My God, I was so excited. I think I almost cried. The second offer came in the same week.

Let’s talk about benefits.

The first company isn’t Nigerian owned and they offered me a gross salary of ₦5m/annum. My take home every month would be ₦337k. The second company wanted to start with ₦2.5m per annum. That’s about ₦150k/month.

I decided to go with the first company. The money wasn’t the only factor that made me choose them though.

Fair enough.

Right before I resumed work at the company, I contributed ₦220k towards rent for 2021. I was at square 0 when I started work in December 2020. There was hardly anything in my savings.

What’s happened between then and now?

I was hired as an investment analyst and was on probation when I started. Then someone left the team and an opportunity to take some of her responsibilities presented itself. I wasn’t sure if I could do them, but I said yes when they asked me if I wanted to. They were impressed with my work and when it was time to confirm me, they increased my pay by 20%. My gross annual salary shot up to ₦6m. My current net is ₦400k per month.

Mad. You’ve come a long way in such a short time.

I’ve been fortunate. When I graduated from uni in 2019 and moved to Lagos, I carried one box of luggage because I wasn’t sure if I was going to stay but it’s been about two years and I’m still here. Also, I’m lucky I had siblings who could house me. I think I got a soft landing.

However, I won’t discount the work I’ve put in. I graduated from uni with a first class. When I was in uni, I sacrificed my session breaks from my second year up to my final year for internships. The work experience looks good on my CV. Also, I networked ridiculously. I’m here because people have reached out to me when they were leaving their roles or put my name on the potential candidate list when their company is hiring. Another good thing that has helped me is that people are comfortable telling me their salaries, so I know what to ask for during negotiations.

Oh, I also get ₦50k-₦150k from contract work from time to time. This mostly comes from the more experienced people I have worked with when they need an extra person on their projects.

Lit. What does ₦400k/month do for you?

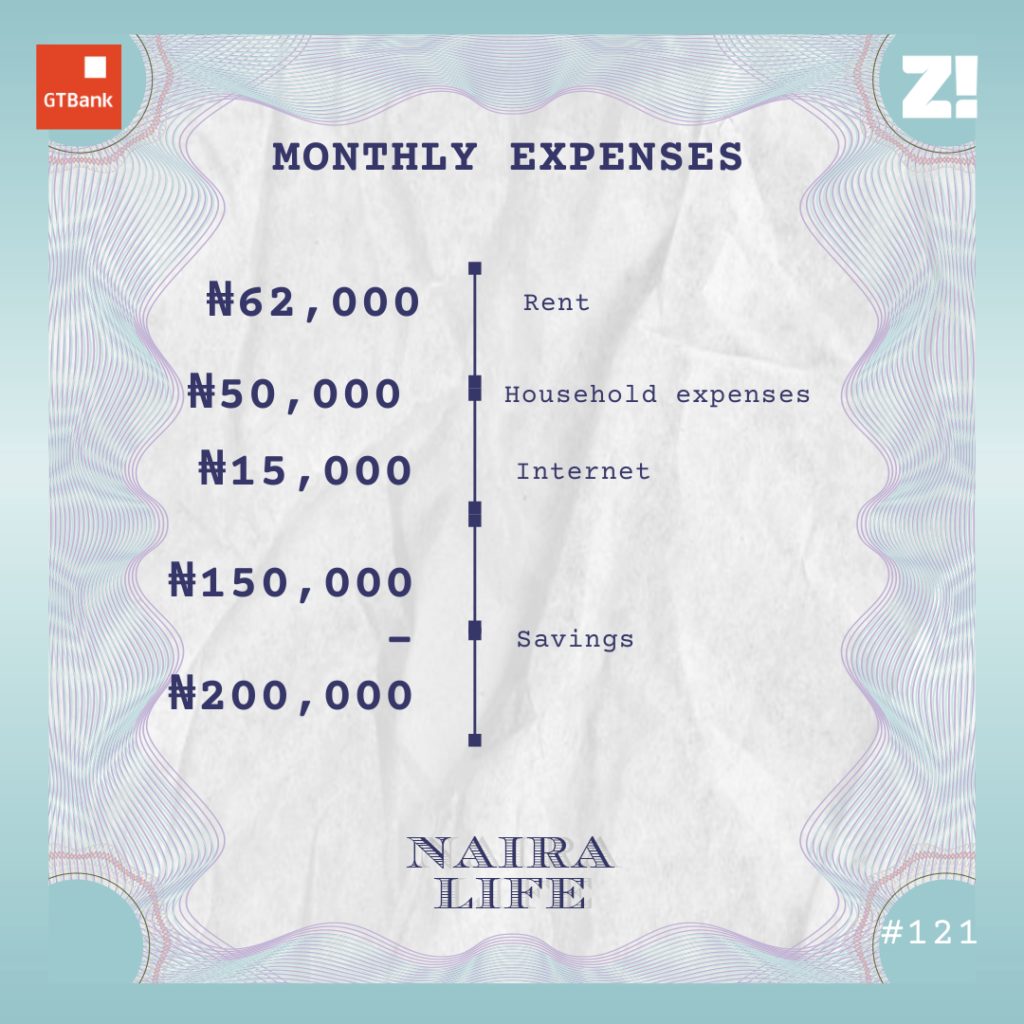

I put ₦62k aside for my accommodation expenses because my living arrangement will change next year. At the moment, I contribute ₦50k for things we need in the house. When I first started living with my siblings, I wasn’t contributing anything at all. Bit by bit, I started contributing some money because I realised that resentment can begin to set in if I wasn’t pulling my weight. As my income increased, my contributions increased.

There are skin care expenses, but it doesn’t happen every month. There are courses I pay for too. I spend money on food when people invite me out for stuff, so that’s also not fixed. I clear the basic bills first and whatever remains after this can go into whatever comes up.

How do you approach wealth-building tools, especially savings and investments?

My savings and investments are looking good right now. I have a target to build my wealth portfolio to ₦2m by the end of the year. So far so good, I have a little over $1000 in dollar savings, a few hundred dollars in crypto. There’s another ₦60k in cash and ₦100k in stocks — about ₦800k in total naira value. All of this is separate from my rent savings which is in mutual funds

I plan to save at least ₦150k every month and when I’m comfortable with my liquid cash position, I can expand my investment portfolio to dollar stock and maybe increase my crypto holdings.

How has your experience shaped your perspective about money?

I know that because of my background in finance, I don’t spend money anyhow. I want to buy things I like, but I can’t let go. Yes, I’m still very anxious about money. Like what would happen if I lost my job?

But I also know that I can be financially independent with a 9-5 though a lot of discipline will come into play. I believe money is a tool I can make work for me. Also because of my work in asset management, I’ve seen how rich people deploy their funds. I’ve heard an asset manager talk about portfolios worth over ₦500m, and I was like, “In this same Nigeria?”

Haha. How has your work in finance influenced the way you manage money?

I already have my personal stock portfolio, and I use the skills and knowledge I learn on the job to manage it. I’m wiser with the way I approach what I earn and what I spend. Now if I earmark an amount of money to something, it has to go into it. I trust my financial decisions because a lot of thought goes into them.

Interesting. How much do you think you should be earning now?

That’s tricky. I’m earning above ₦200k-₦250k, which is the industry average for my level of experience. There are companies that can pay me as high as ₦800k. The only problem is the options are limited to a few places and it’s hard to get into those companies. If I leave my current company now without a good exit strategy, I’d most likely get a pay cut. When I was looking for a job, I went to an interview and told them that my salary expectation was ₦200k, and the guy burst into laughter. I’m good right now but to put it out there to the universe, ₦800k-₦1m will be great.

Where do you see all of this in five years?

I hope I’m out of this country. I want to go for my MBA in 2023. I’ll spend two years in grad school, so in five years I should have gotten a better paying job and be earning about $150k/annum.

I’m saving hard right now so I can raise something for my MBA — at least for the application fees and initial deposit. Most of the rest will come from scholarships and loans. There are organisations that give international students loans and they start to get their money back when you get a job.

What part of your finances do you think you could be better at?

I’ve noticed a pattern in the last two years — I save a lot of money then something comes along and deflates my savings. It was my phone in 2019. It was the rent contribution in 2020. I think I should have a separate emergency fund, so I won’t have to touch my core and long term savings if something comes up. I need to build that armour tank.

What’s something you want right now but can’t afford?

I want a bone straight wig but my mind won’t let me rest if I take the money out of my account. I don’t think it’s a good use of my resources at the moment. I also need an AC for my room but I can’t buy it yet — maybe in a few months.

Hmm. Anything you bought recently that improved the quality of your life?

A headset. I’m in a lot of work meetings, and it’s made the experience much better. It’s only ₦10k but serves me well.

On a scale of 1-10, how will you rate your financial happiness?

5. I hate that I have to think and plan a lot before I spend money on things I want or even need. For example, my accommodation arrangement is going to change next year. Although I’ve set up a separate savings plan for it, it’s still a big expense and that makes me a bit uncomfortable. I’m not really sure if I will stop being anxious about money. My biggest fear is becoming a burden to the people that care about me.

But I think earning between ₦800k and ₦1m can improve my financial happiness and take the number to an 8. It’s very rare for people in my experience level to earn up to that, but it’s possible. I probably won’t leave my current employers if I get an offer like that. I’m careful about my career choices and I really like my job. But I can use an offer like that to negotiate a higher pay.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld

-

Apparently, the tweet below is the mood of every Nigerian who trades crypto right now:

They said crypto is acting up and people are losing money. But this is Nigeria — we can’t help but make jokes about our Ws and Ls. These are some of the funniest tweets we found about this crypto situation.

1. This tweet >>>

2. Safelock definitely won’t do this to you

3. Every Nigerian right now

4. Xri bou dat, boss

5. But can you blame them?

6. Insert a deep quote about time

7. “Blood everywhere”

8. This slaps

9. The category is dip

10. Hot tears

11. Not today boss

12. This looks like something out of the bible ngl

13. But wait, Has it turned to fight?

14. The man who saw the future

-

More than ever, lending companies and other credit facilities are operating in Nigeria. And in many ways, they’ve changed how accessible loans are. A number of them operate mostly online; offer collateral-free loans; approve and disburse the funds within minutes. So I thought to talk to some Nigerians about how they use these credit facilities. These are the answers I got.

Kolapo

I started taking loans from these online loan companies sometime last year, and it’s been recurring since that time. The first time I took one, something urgent had come up and I needed to travel to my village. I talked to everyone I could take a short-term loan from but nobody came through. A friend advised me to give one of these credit companies a chance, and I did. They offered to loan me ₦5k and I would pay them back ₦7k in five days.

I thought it was outrageous — the interest was high and the duration was short, but I was desperate so I took it. I got a small job later that week and made ₦8k in profit from it. But most of it went into clearing the debt. I was back to 0.

I’ve been taking short term loans since that time — between ₦5- ₦10k. I don’t like to but it always ends up being my only option. It’s not even easy for me to pay back. I’ve missed payments. There was a time I didn’t pay back on time and they sent threatening messages to me and some of my contacts. Then they called my brother.

I think taking loans from these companies is a bad idea. I know I have to stop, but I just haven’t figured out how to stay away from them.

Ikechukwu

I was always sceptical about loans. I thought the typical timeframe for repayment was unrealistic. This was my stance until I needed to buy land in Abuja in 2018. My first choice would have been the federal mortgage bank since they’re supposed to play this role, but they’re not very effective. The next best thing was to go through the private mortgage operators.

Fortunately, I didn’t have to go down that route — I got the ₦3m I needed from a cooperative. The terms were fair too. I was going to pay ₦120k back in interest and repayment was spread over 60 months. I’ve been paying ₦52k every month and I’ll finish paying it off by February next year.

I’ll admit that for the first few months, I found it a little hard to take ₦52k out of my salary. But like Le Chatelier’s principle, I adjusted my spending habits and got used to it. For context, my salary is ₦190k.

I’m more open to taking loans these days. I think the sector is becoming more competitive, and that might be a good thing.

Martha

I took a loan for the first time in 2017. At the time, I was a broke final year student. I randomly googled “How to get a loan in Nigeria” and I got a lot of results. None of them asked for collateral and that drew me in.

The first company I tried claimed I was ineligible for their loan offers and declined my requests. I got around that by asking a friend who was eligible to apply for a loan on my behalf. Later that year, I switched to another company, and it became my go-to. Once I ran out of my allowance in school, I applied for a short term loan.

I continued taking loans even after I left school, got my first job and moved out of my parents’ house. The good thing was that as I took the loans and paid them back, they increased the amount I was eligible for. Within a couple of months, I could take up to ₦60k.

Something weird happened in 2018 — I was curious about what would happen if I defaulted on payment. I took a ₦60k loan and decided not to pay it back. They sent me a series of reminders as the due date approached and I ignored all of them. A few days after the due date, they notified me that they had added a late-payment penalty to my initial payment and extended my grace period. When I didn’t clear the balance, they told me they would start sending texts to my contacts. Again, I called their bluff. Then a friend called me to ask whom I owed money. They sent threatening messages to about five people on my contact list, including my boss at the time.

This was when I realised that they could read my phone contacts. For some reason, they stopped contacting me. And I still didn’t pay because I thought they’d done their worst already.

When they started contacting me again in 2020, I decided to clear the debt and move on. The whole situation affected my credit score as I can’t borrow a lot of money from them anymore. I still don’t know why I did it, and I understand that it was reckless behaviour. But I’ll live. I’d rather take a loan from someone I know now.

Precious

I’ve taken a loan but it was a one-time thing. I needed capital to trade forex and I was short of cash even after pulling everything out of my bank account. It was quite easy to get the loan — I downloaded an app, answered a few questions and they calculated my credit score. Oh, I should add that the first two loan companies I tried declined my request. The third and fourth companies offered me ₦10k and ₦5k and interest on the loans within 30 days was ₦2k and ₦500 respectively. Now that I think about it, it was rather high. But I respect it. Also, I made money on my forex investment so it was easy to pay back the loan.

I think credit facilities will continue to grow. The returns are great, so I think more players will come into the space in the future. I can’t say I mind — they are easily accessible, and that’s not a bad thing.

-

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

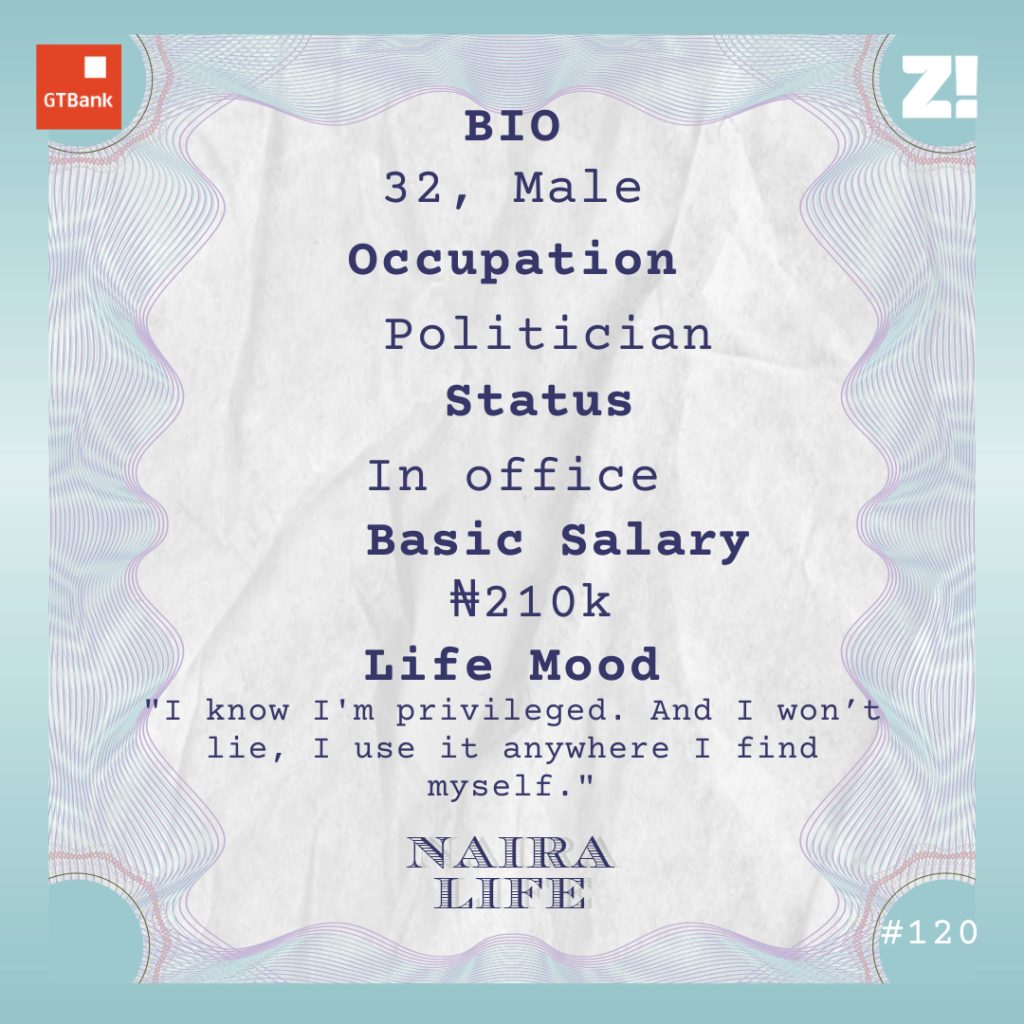

The 32-year-old politician in this story ran for office in 2018 after years of being a businessman. Now he’s the vice chairman of his local government. He shares details of how his monthly allowance is barely enough to cater for his needs and how his privilege and network is keeping him afloat.

Let’s take back a little. What’s your oldest memory of money?

In 1992, during sallah, my uncles gave me money. I was four, but I remember that I made close to N2500.

What could ₦2500 do for a four-year-old kid in 1992?

I loved Coca-Cola and the 25cl bottle was sold for ₦2. There was this balloon game I played a lot too — where you attempt to win the biggest balloon — and a round was ₦1.

₦2500 was a lot of money and it would have gotten me a long way. Of course, my mum took all of it.

Speaking of parents, what did yours do for money?

My mother was a full housewife. My father was the quintessential Nigerian businessman. He did everything and took advantage of government policies at different times. He started as a tailor, then he sold textile materials. He made some money at a young age and that gave him the opportunity to mingle and build relationships with the aristocratic kids. They helped him later in life. People might call it nepotism, and I agree, but it worked because he was only trying to be enterprising and turn a profit. He acquired a controlling stake in a construction company much later, and that became his main gig.

I grew up with money and privilege. I understood what privilege meant very early on. It was a polygamous home though — my father had 15 kids, so there was a bit of competition too. The privilege didn’t mean I wasn’t humbled a few times.

What do you mean?

Living in a polygamous family meant everyone had their favourites. I wasn’t our driver’s favourite. He left me at school once or twice when I was in primary two, and I had to trek home. He claimed he didn’t notice that I wasn’t in the car which was bullshit. But it got me thinking about how privilege shouldn’t be an excuse for naivete. It was a good lesson to learn.

Hmm. When did you start working for money?

2004. I had just finished secondary school and tried going to the Nigerian Defence Academy, but it didn’t work out. Then I decided to go to Finland for uni because they offered free tuition at the time. But the thing is, my father paid for our education, but he would never give you a penny if you wanted to go to school out of Nigeria. I really wanted to go to school abroad, so I was determined to figure it out myself.

While this was going on, I needed a job and I got one in 2005. Our next door neighbor and a friend of the family owned a domestic airline. I approached him and he offered me a job as a ticketing officer. My salary was ₦11k. I worked there for a year before I travelled to England.

England?

Finland didn’t work out either. One of my cousins who was living in England reached out and asked me to consider a diploma course in England. I did the whole process myself and was offered admission to a college affiliated with a major university in the UK. My father was just looking at me like I was a mad man. My mother sold some of her jewelry to pay for my flight. In January 2007, I left and had only $500 in my pockets.

How did you figure things like tuition out?

First, my tuition was £1950 per semester. I negotiated a payment plan with the school and they allowed me to pay £190 a month. I got a job at a warehouse as soon as I settled in and was paid £720 each month. The job paid for my tuition and rent. I sent about £100 home to my mother every month too. Man, every penny had to be calculated to do all of this.

Was that the only job you had in the UK?

No, I got a customer service job after that. It paid better and it wasn’t as stressful. The first customer service job I got paid me £800 per month. After a year, I got a second customer service job and my monthly earnings increased to about £1600. When I stopped working in my final year to focus on my dissertation, I had about £3500 in savings. My father finally realised I was serious and paid my tuition in my last year.

Haha. When did you finish your programme?

July 2010. I returned to Nigeria a day after I wrote my final exam. My parents had divorced a month prior so I wanted to come back as soon as possible. My mother was a housewife when she was with my father and was trying to restart her life, so I had to be there for her.

When I got back to Nigeria, I started importing cars from the UK.

Interesting.

My father had sold cars in the past, so this gave me a head start because I knew a couple of people in his network. I hit them up and told them about cars I think would sell. The numbers made sense and they signed on. We began shipping cars in and making a healthy sum. Man, it was some quick money. Nigerians still had money to spend at the time, so we sold these cars in record time.

Talk to me about the numbers.

A Peugeot 406 car cost £1000. The shipping fee was £700. We spent an additional ₦180k (~£256) to clear a car at the port. After settling all this and changing the driving system to left-hand drive, everything would have run into ₦900k. After that, we would sell the car to a car dealer at a profit of ₦300k. That was it.

I started with one or two cars. But when people started chipping in money, I increased the volume to five cars a month. I don’t suppose cars sell as fast anymore because the pull has greatly reduced. More people are selling cars and less people are buying.

I had the car business on lock but I was also a fashion designer. I would buy yards of materials at the market and make them into outfits. A trip usually cost me about ₦100k-₦200k but I made up to 1000 per cent in profit.

HOW?

I was a big boy designer, so I sold my outfits to high-end users. I did a couple of other things too — bought iphones in Dubai and resold here; bought onions during their on-season and sold them during the off-seasons. Pretty much everything. However, I stopped all of these things in 2018.

Why?

I entered politics. I grew up around politics enthusiasts, so the interest has been there for as long as I can remember. Before my dad passed away in 2012, he was a treasurer and major financier of a political party. Also, one of my adopted brothers ran for political office in the 90s.

In 2018, I came out looking to be elected as the chairman of my local government. My privilege played a role here. I won’t lie, I use it anywhere I find myself.

That’s very honest.

I put in the work too. I wanted to run for a councillorship seat in 2011 but I didn’t get it. I chinned up and continued politicking. In 2015, I was too up in my businesses to run for anything but I was involved in local politics. When the talk of local government elections came up in 2018, I presented myself.

How did it go?

Well, I created my team and started my campaign. But it didn’t work out. Privilege and connections are good, but sometimes, there’s only so much they can do. The powers that be didn’t think I was the most politically-acceptable candidate. And to be honest, I wasn’t.

Why?

I was relatively new to the race. I started my campaign 12 weeks before the primaries and there were people who had begun their campaign two years earlier. I hadn’t done the rounds or built a solid base.

Anyway, the stakeholders held a meeting a few days before the primaries and told me I wasn’t the best candidate the party could present in the polls. However, they told me to run as the vice-chairman. By that time, I had spent about ₦10m on my campaign but I agreed to it.

Omo. Do you remember what that ₦10m went into?

Consultation with stakeholders: ₦5m

Ticket:₦ 650k

Publicity: ₦3m

Team logistics:₦1.5m

I guess your political party won the local government elections.

Yes. I’m currently the vice chairman of my local government.

I have so many questions. But first, how much do you earn as the vice-chairman?

Well, there’s the basic salary and there are allowances, which are mostly the running cost of the statutory committees and projects I manage as the vice chairman. My salary is ₦210k after tax. But when you add up the allowances, it runs into about ₦750k per month.

However, I received the allowances for only eight months after I resumed office.

Ah, why?

The chairman and I fell out. Our working relationship was borne out of a political marriage of convenience. We had different ideas on how things should be and he probably thought I was trying to undermine his authority or trying too hard to be popular.

Uh-oh.

When this happened and our relationship wasn’t as good anymore, the local government council started paying me my basic salary only. And this was a problem because if I wanted to have at least a 50% approval rating in the local government, I needed to spend at least ₦300k for my constituency needs — from mini infrastructure and development projects to other welfare stuff. Before I fell out with the chairman, I had enough money to cater for these needs.

How are you navigating this?

At first, I dipped into my savings. But now, it’s donations. I rely on my family and friends to find the money to fund these projects.

Back to this in a bit. How does money move in a local government?

Most of it comes from the federal government. There is a Federal Allocation Account Committee (FAC) meeting every month, and that’s where Nigeria’s money is shared among the states. At the state level, there is the Joint Account Allocation Committee meeting and that’s where each local government council knows how much is due to them. Typically, my local government gets ₦220m every month.

Unfortunately, we don’t generate a lot of Internally Generated Revenue. So what we get from the federal government is hardly enough. We pay about 1900 teachers, 240 staff at the local government secretariat, 400 healthcare workers at the primary care centre. After everything, we end up with a deficit of about ₦20m. The state government clears that for us.

I’m very concerned about how we’re not tapping into the IGR potential in the local government. That alone could bring us an additional ₦100m every month, but the chairman doesn’t want to see it. That’s one of the reasons we fell out.

Sounds hectic. What about your businesses, anything coming from those?

No. Everything is on hold. The law doesn’t allow me to run a business while in office. And yes, that has affected my lifestyle. I’ve gone from being a top boy to begging for alms from my friends and family. I used to go on vacation at least once a year, but I can’t afford to do that anymore. I’m living a spartan life.

How do you reconcile with that?

Man, I see my job as a service and a privilege. I know it sounds like bullshit coming from a politician, and I understand that. It is what it is. I have gone through life to understand that I love having money but I get most of my satisfaction from looking back at how I’ve made people’s lives better.

Tell me more about this.

Sometimes, it’s the ₦500,000 spent to drill a borehole for a community of 2000 people; to the culvert or drainage system you construct to make a road passable for a community of more than 1000 people. There are also the annual JAMB and WAEC fees for over 200 students to give them a shot at tertiary institutions.

This is the sort of satisfaction I’m talking about. It’s the whole reason I’m in this politics business in the first place. I believe politics is the biggest tool for social change. Also, I know that the privilege I have is a responsibility and I need to give something back to the society in the best way I can.

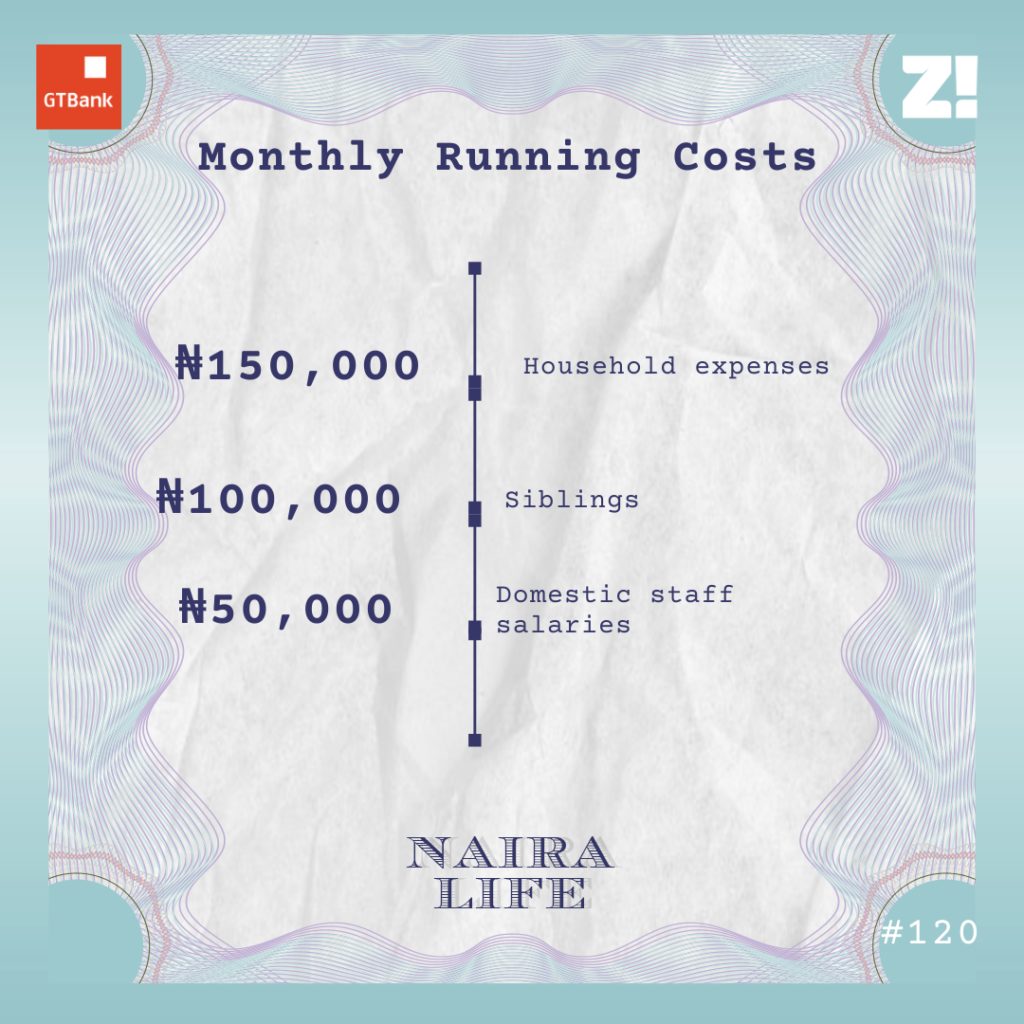

Interesting. This is a good place to talk about your monthly running costs.

Haha. I spend about ₦300k on my immediate needs and family. My basic household expenses, including feeding, cable subscriptions, and other utilities cost about ₦150k. I support two of my siblings and send them ₦50k each per month. My security guard and my kids’ nanny salaries take another ₦50k.

On the political front, at least ₦300k gets me through each month. I talked about what the money goes into earlier.

Your monthly outflow is about ₦600k but your income is ₦210k, how does that work?

I know people I can always count on, and they’ve not stopped helping. I’m not really the person currently funding my life. Sometimes I don’t even ask, I just get a credit alert.

Mad. So how much do you have in your savings now?

₦70k

Huh?

Since I’ve gotten into office, I haven’t had more than ₦200k in my account for a long period of time. The money that comes in goes out almost as quickly. Also, we just finished the primary elections in my party. I’m vying for the chairman of the local government this time.

That’s going to cost money.

Yes. But I’ll be fine; donations will keep me afloat. I’ve received a significant amount already.

How much?

I wouldn’t want to say disclose that at the moment because it’s an ongoing process. I’ll tell you something though.

I’m listening.

If you want to run a robust citizen-focused campaign for this office, from the primaries up to the general elections, you may have to spend about ₦50m. Politics is a people and numbers game — who you know and how much you can raise through them matters a lot.

Interesting. Where do you see all of this in five years?

I’ve gotten the ticket to represent my party at the polls for the chairman seat. We’ll see what happens after that. I don’t know if I’ll be in a political office in five years, but I’d like to be one of the people that will decide who will govern my state. I’m not an Abuja guy. I just want to be involved in the local politics of my state as much as possible.

Back to your personal finances. If you weren’t in office, how much do you imagine you will be earning per month?

Nothing less than ₦3m. Also, I know I would have started a couple of other businesses. But it is what it is.

What part of your finances do you think you could be better at?

Maybe not letting my emotions dictate how I spend money. I do that a lot, and it’s not helping me. I could see people in trouble and go all out to spend money to fix whatever it is without giving it much thought.

What do you want right now but can’t afford?

I want to go for Hajj. It’s high up on my bucket list but I can’t afford to right now. I would need about ₦2.5m – ₦3m on that. Another thing I could use right now is a bigger house because I have two kids now and my family is growing.

Speaking of family, how does your wife deal with your irregular finances?

My wife is a businesswoman with her own money. She understands where I’m at. Sometimes, she chips in and supports me financially too.

Lit. What’s something you bought recently that improved the quality of your life?

I bought an iPhone 12 Pro Max about three months ago. It cost about ₦700k and the money was even a gift. This is a good place to add that these gifts don’t come from people who have financial dealings in the local government.

Ah, I see. I find it interesting that you live on donations and gifts. How has this shaped your perspective about money?

See, I’ve learned that the greatest source of wealth is from a network. It’s not how much you own personally because things change quickly and that can affect what you can and can’t afford. However, with a network of reasonable and successful people, you can afford everything without actually having the money.

On the other hand, I shudder at the amount of wealth inequality in the country, and it’s a time bomb. But I see more young people becoming more interested in politics and coming into the system. I can be optimistic that this will start to change things.

Fingers crossed on that. How will you rate your financial happiness on a scale of 1-10?

7. I’m very content with what I spend my money on. The problem is I always have to rely on other people to raise most of it. I will probably move to a 10 If I’m on an improved salary.

Last question. How much is a good salary to you right now?

₦800k.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld

-

If you have friends who are guilty of what you will find in this article, you might be in danger. This goes without saying, but you need to run for dear life.

1. When you start a show together, they leave you behind without waiting for you to catch up

Deep down, they think you are too much baggage. Trust us, they are constantly thinking about the best way to take you out so they can watch at their own pace. Don’t wait for that to happen. Run!

2. They cancel plans with you so they can watch shows

A friend who cancels plans with you to sit in front of a TV doesn’t rate you and can murder you if they think you’re too much of an inconvenience. Make of that what you will.

3. On the rare occasion you watch something together, they comment on every scene

This is a test. They want to see your reaction and see if it’s enough justification to carry out the plan they have set in motion for you. Don’t fall for it. In fact, send them a “Goodbyes are hard” text as soon as you can because you will eventually fall into that trap

4. They turn their subtitles off. All. The. Time.

This one is easy. Research has shown that people who do this also exhibit behavioural patterns that have been traced to people who feel nothing. Now tell me, what can’t a person who feels nothing do?

5. They give you spoilers, even though you didn’t ask for them

Refer to point 3.

6. The show can be the next best thing since the first four seasons of Game of Thrones but they are never attached to the characters

They’re dead inside, which makes sense because of “you-know-that-thing-they-are-in-but-can’t-talk-about”.

7. When the show ends, they move on to a new one immediately

Who does that to a great show? There should be a moment of mourning. But if your friend starts a new show seconds after they finish one, I’ve got news for you. YOUR LIFE MIGHT BE IN DANGER.

-

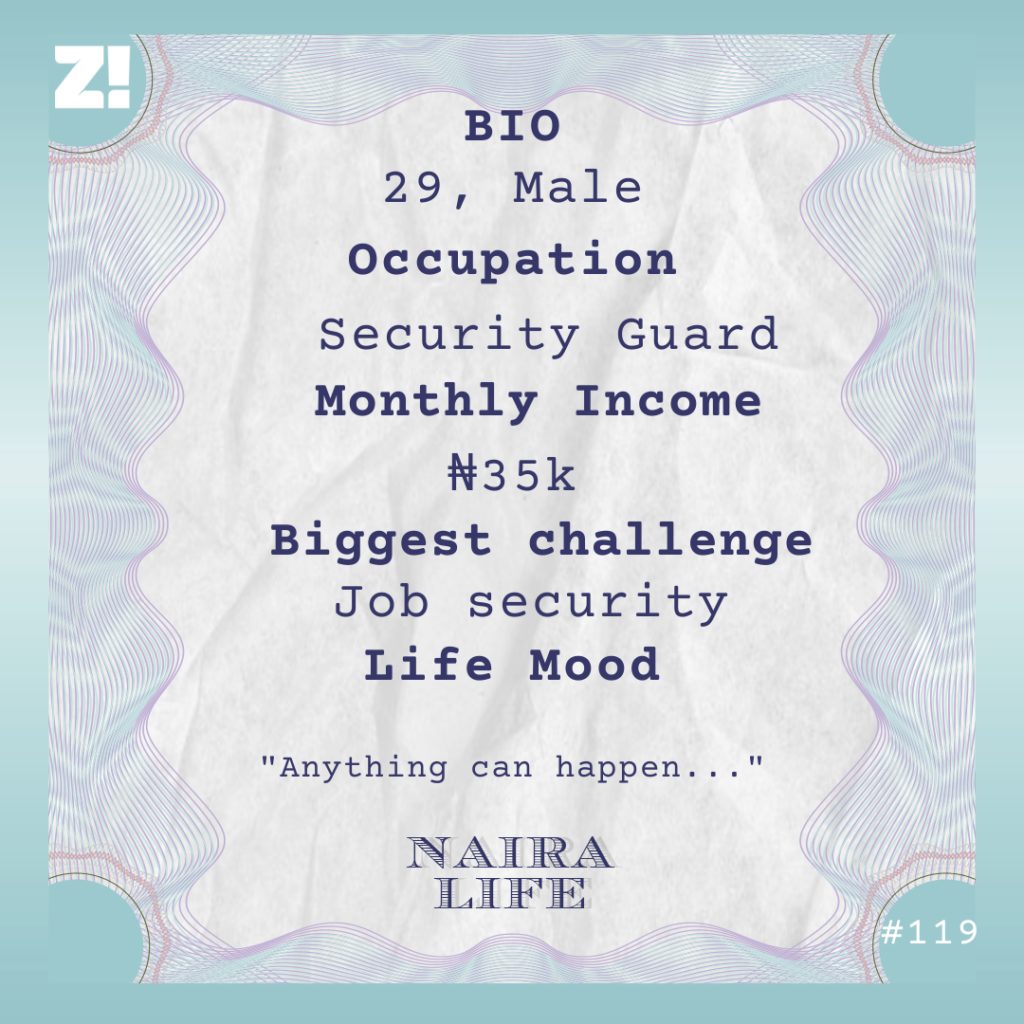

The 29-year-old in this story lives on ₦35k/month, but that’s not everything there is to him. It’s also about how he’s trying to make things work for his family. His biggest challenge though? Job security.

When did the hustle start for you?

It was after my dad died in 2005. He was a retired soldier and married many wives. After he died, we saw that we didn’t know the number of children he had. This one would come and say he was his son. Another one would come and say she was his wife. Trouble started when they started sharing his property, and I knew I had to start my own life.

What happened?

My mother had already warned my three brothers and me not to drag anything with them. She said it would cause a fight. True true, that fight started. One person would say, “Na me be the second born. You know when them born me?” Another person would also talk about their age and how it should decide what they got. That’s how they started carrying knives to wound themselves. My father had some boats, cows, and pieces of land. I didn’t take anything.

I left his house with my things.

My mother had a piece of land she farmed on. That’s where I started to farm.

If you didn’t want to farm, what were your options?

School. I was in JSS 3 when my father died. His plan for me was to go to NDA and join the Army. I wanted it too, and I continued school for a while. But there was nobody to pay my school fees again, so I dropped out in SS 1.

And you faced farming.

Yes. I started my hustle at the farm and was planting guinea corn and rice. I didn’t need money like that in the village, so we ate most of the goods. If someone needed money or one person was sick, I would just carry one or two bags of goods to sell. One bag of corn was ₦6500, and one bag of rice was ₦5500 that year.

By 2012, my mother was already telling me to go and marry.

Haha. Why?

That’s how things work in my village. If you spend a lot of time on the farm, you marry a wife to take care of things at home. My mother was tired of how hard I was working. After spending all day on the farm, I would return home, to still fetch water and cook food. The stress was too much, and my brothers weren’t helpful.

I see. I imagine getting married cost money.

Yes. I started working on people’s farms and helping them make ridges. I got ₦3500 for every 2000 ridges I made. Within a month, I got the money I needed to buy the things my in-laws asked for. I think I spent about ₦35k on that but there were additional expenses.

That’s how I got a wife, we gave birth to our first child in 2014 but he died about a year after. He fell sick and didn’t survive it. It hurt but life had to continue.

Damn. I’m sorry.

In 2016, I started thinking about leaving the village.

Why?

I thought I could hustle better in a big city like Abuja or Lagos. I went to Abuja first because someone from my village was there and he told me that there was work. When I got to Abuja, he took me to his boss, and that one asked for my CV. Before the end of my first week, I got a job as a security man in an estate. My salary was ₦15k.

How did that go?

The money wasn’t bad. But the job? Very bad. From midnight, we would start blowing whistle every hour. That’s how they knew we were working. When it’s morning, they still won’t allow anyone to sleep. If they saw you trying to close your eyes, they would book and fine you. The mosquitoes were doing their own too. After two months, I left the place.

Did you find another job in Abuja?

No, I returned to my farm in Jos. But one time in 2017, I travelled to Taraba state with a group of five people from my village to work on rice plantations. They plant rice very well there, so it was easy to find work on someone’s farm when it was time to harvest them. The job took like three weeks, and at the end of it, each person got ₦30k. I went back home but I didn’t stay for long this time. In 2018, I moved to Lagos.

Because there were better opportunities there?

Many of my people from the village who had come to Lagos always told us about how the place was good and how the jobs paid more. They said I could be earning up to ₦50k in a month. So I thought I could achieve something here. I left my mother and wife again and came here. I returned to bring my wife in 2019.

You found a job in Lagos then?

I have an in-law here. I’m living with him and his family. He helped me find a job. He knew a supervisor at a security company and he took me there. Sharp sharp, they did an interview for me and gave me a uniform. Then they assigned me to a house on the Island. That was the first place I worked in Lagos.

How much?

₦45k. I liked the job and the money was enough for everything I wanted to do. But I quit in 2020.

Why?

Covid. Before it started, if I slept at work this night, I would sleep in my house the following night. But because of Covid, my boss said I had to be sleeping at work everyday. My wife was pregnant at the time, so I told her that it wouldn’t work for me. We spoke to the security company and they transferred me to a bank. That’s where I’m still working now. I’m managing this one because the work is too much and the money is less.

How much are you being paid?

₦35k. The only good thing now is that I’m not spending a lot of money on transportation. When I was working on the island, I used to spend about ₦600 on transport everyday, but now I’m spending ₦150. However, I prefer my previous job because it wasn’t as stressful as this one. The only thing I had to do was open the gate when my boss wanted to go out. It’s not that way at the bank — you have to be everywhere all the time.

What does ₦35k do for you now?

I give my wife ₦15k to buy food in the house, but she recently travelled back to the village to visit her family. I save ₦20k every month and put it inside an Ajo with five other people at work and one person takes it all at the end of the month. I also try to send money home, but that’s not fixed.

Where do you find money to take care of other daily expenses?

Everyday, I hope some of the bank customers give us money. On a very good day, I can get up to ₦1500. I also do another Ajo with the same people, and that one is ₦500 every day. At the end of the week, someone takes ₦15k. That’s how I manage every month.

Interesting.

But I don’t like working at the bank because of the way people treat us — from the bank manager, to the supervisor, to the customers. If anything happens, they will blame the security men even if it’s not our fault. You can tell a customer to use a face mask and they will start cursing you. If you react and it gets to the manager, they can report you to the supervisor and tell them to change you. I’ve seen it happen to people and every time, I always wonder when it’s going to be my turn.

Did I tell you that I give my supervisor ₦1k out of my salary every month?

No. What’s it for?

That’s the way things are done. The supervisors are the ones making the money. They collect at least ₦1k from each person they are managing. Some people even pay more than ₦1k.

I’m curious, what happens if you don’t pay?

I don’t want to know. They can transfer you to another place over any small matter or even sack you. They have the power to do that, so the money is for them to help you keep your job. That’s why I want to leave and find something else where I won’t have to fear every day like this.

Omo. But how much do you have in your bank account right now?

I’ve saved about ₦180k, and it’s for the house I want to get. I’ve seen a one room and parlour apartment and they said it’s ₦250k. When I get my money from the Ajo I’m doing in two months, I’ll use the money to settle that and start all over again.

How much will be enough for you as salary right now?

₦50k will be good for me. There’ll be enough left after taking care of the house and saving.

Do you ever think about how much you want to earn in five years?

I don’t know. I hope I’ll be earning more, but also, anything can happen. But I’ll be so happy if I have saved up to ₦800k by that time. My biggest fear is someone falling sick because I know how hospitals take all your money. It won’t matter how much the job is paying. I even forgot to talk about my wife’s second delivery.

I’m listening.

We registered her at a hospital close to the house. In my mind, I thought ₦40k would be enough for delivery. When it was time, the baby refused to come out. When the hospital got tired, they transferred us to a hospital on the island, and that one was more expensive. The baby finally came but we spent about ₦135k. The money I had wasn’t enough and I had to borrow ₦50k from my neighbour to pay them. So anything that involves the hospital like this, I don’t pray for it.

Do you have a plan for when anyone falls sick?

Ah, I pray it doesn’t happen. But if it happens, it’s my savings. The only problem is that it will affect other plans.

How has all of this shaped your perspective about money?

Money is important. For me now, it’s how to manage and save what I make in a way that I will always have something to take care of my wife and my boy. He’s a year and five months now, and every day, I’m thinking about what I can do to make sure that he won’t meet things the way they are when he grows up. I’ve suffered for money, and I don’t want him to suffer like this. But as I’ve not made it yet, the little I make, I try to save it. It’s hard but I know that God will do it and things will get better.

Rooting for you. What’s the last thing you spent money on that made you feel good?

Sometimes, I tell my wife not to cook and take her out to a restaurant. That makes me feel good. But in December last year, I bought clothes for my wife and my boy. I spent about ₦50k on that, but I happy die. I didn’t care that it took me months to save the money.

What was the last thing you bought that required serious planning?

I sent money home to the village and asked them to buy me a cow and three sheep. I didn’t have the ₦65k I sent like that, but I wanted to have something waiting for me if God forbid something happens and I lose this job.

This fear you have about losing your job, where’s it from?

Oga, many things happen at this job. For example now, because of Covid, we’ve reduced the number of people inside the bank at a time. So when a customer comes and the bank is too full, we tell them to take a number and sit down outside until those inside the bank come out.

A few weeks ago, some customers got angry because we asked them to take a number and they forced their way into the bank. When the manager heard about it, he called the supervisor and told him to remove all of us. When they eventually realised that it wasn’t our fault, they died the matter. But I know we won’t always be lucky.

I was recently transferred to a new branch and I know I’m here to replace someone who had been sacked. It can happen to anyone. As I am now, I won’t mind going back to working at a residence. Those ones are not this hard. But as I’ve not seen one yet, I have to manage this one.

Omo. On a scale of 1-10, how would you rate your financial happiness?

5. I’ve only spent about three years in Lagos and I have some money saved up and already thinking about getting my own place. I hope it gets better from here so I can move to the next level, which is having enough to send my boy to school when he grows older. As long as nobody falls sick and I don’t lose my job, I know I’ll reach 10 one day.

UPDATE: Upon request from readers, we’ve added a payment link for people interested in sending him some love and light here.

-

You can’t be online these days and escape conversations about Bitcoin. We will leave the serious takes for the analysts (for now) and just go right into the hilarious stuff.

1. Cheers to waking up and choosing violence.

2. When they say life is a pot of beans, this is probably what they mean.

3. This too.

4. Your country in the mud… as usual.

5. We move. Buy the dip next time :).

6. May the force be with you.

7. We learn everyday, boss.

8. Wahala for who no dey get birthday gift.

9. Same sis. Same.

10. All of us right now.