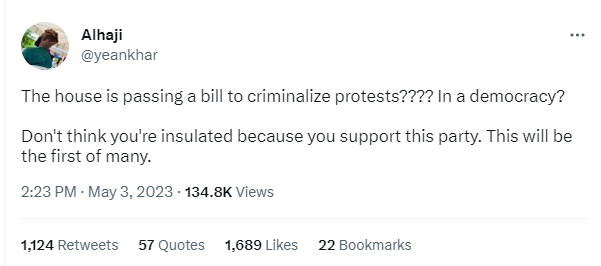

On May 3, 2023, Twitter user @yeankhar claimed the House [of Representatives] (HOR) was passing a Bill to criminalise protests. The tweet has been viewed over 134k times at the time of writing.

On Wait First, we divide claims into three categories. A valid claim is fresh banana. A false claim is burnt dodo. And a misleading claim is cold zobo.

So, how valid is this claim?

Verification

We looked into news reports to see if any Bills banning protests had recently been passed. There were none. The Policy and Legal Advocacy Centre (PLAC), an NGO that promotes civic participation by, among other ways, tracking Bills being read at the National Assembly, had no report on this Bill. We also looked at the Twitter handle of the HOR. It has no record of this Bill.

We were, however, able to identify a news report by The Guardian from July 2021. It mentioned a Bill that claimed to propose a five-year jail term for unlawful protesters. This Bill, which generated controversy, was sponsored by Emeka Chinedu, representing Ahiazu Mbaise and Ehinihitte Mbaise Federal Constituency of Imo state. In an interview with Punch, Chinedu clarified that his sponsored Bill only condemned mob action, not protesters.

His words

“The caption of the Bill that went viral was never my intent or opinion. Neither was it an embodiment of the Bill I sponsored that passed the first reading on the floor of the National Assembly on Tuesday, July 6, 2021. Hence, a clear case of misunderstanding, misconception and misrepresentation of the facts.

“As a representative of the people, whose political idealogy is rooted in democratic tenets, I can never be a party to a system that seeks to stifle or cripple dissenting voices whose right to freedom of assembly, expression and protest is guaranteed by the combined effort of section 39 and 40 of 1999 Constitution as amended, as well as Article 11 of the African Charter on Human and People’s Right to assemble freely.

“While I urge Nigerians to imbibe the culture of reading beyond newspaper captions to comprehend the body of a message, it is imperative to put the record straight to douse tension and allay the concerns of my teeming adherents.

“The Criminal Code Amendment Bill, 2021, did not discuss criminalising protests or protesters in Nigeria. Rather, it is a Bill that proactively seeks to preserve life and protect the killing of the innocent through mob action, known as ‘jungle justice’ in our local parlance.”

Verdict

The tweet about a Bill to criminalise protests is based on events that happened in 2021 that have been debunked. The poster presented it as new information that no available evidence can support. The claim is, therefore, misleading and is cold zobo.

Did Peter Obi Pay a Visit to BAT, Gbaja, Sanwo and Dangote?

On April 28, 2023, a Twitter user @donortez shared a photo that appeared to show the Labour Party (LP) presidential candidate, Peter Obi, in company with the president-elect, Bola Ahmed Tinubu (BAT), businessman Aliko Dangote, Speaker of the HOR, Femi Gbajabiamila and Lagos state governor, Babajide Sanwo-Olu.

The poster claimed that the meeting took place after Jumat, which refers to the prayers by Muslims on Friday. This tweet which was still up at the time of writing, has been viewed over 95,000 times.

So how valid is this claim?

Verification

Our partners at FactCheck Elections looked into this claim, and here’s what they found:

“The original photograph featured Aliko Dangote and BAT, but not Peter Obi. The photograph was taken during a previous meeting between the two men, which has been misrepresented by the person who manipulated the image.

“No credible evidence supports the claim that Peter Obi visited BAT recently. No major news outlet or credible source has reported such a meeting, and no photographic or video evidence has been produced to support the claim.

“Upon closer examination, it is clear that the photograph has been manipulated. The image of Peter Obi has been superimposed onto the photograph, creating the false impression that he was present at the meeting. This manipulation is common on social media, where users frequently create and share false or misleading images to gain attention or spread false information.”

Verdict

No evidence exists of any such meeting taking place between Obi and BAT. The photo has been dismissed as a doctored one. Therefore this is burnt dodo and should be treated as false.