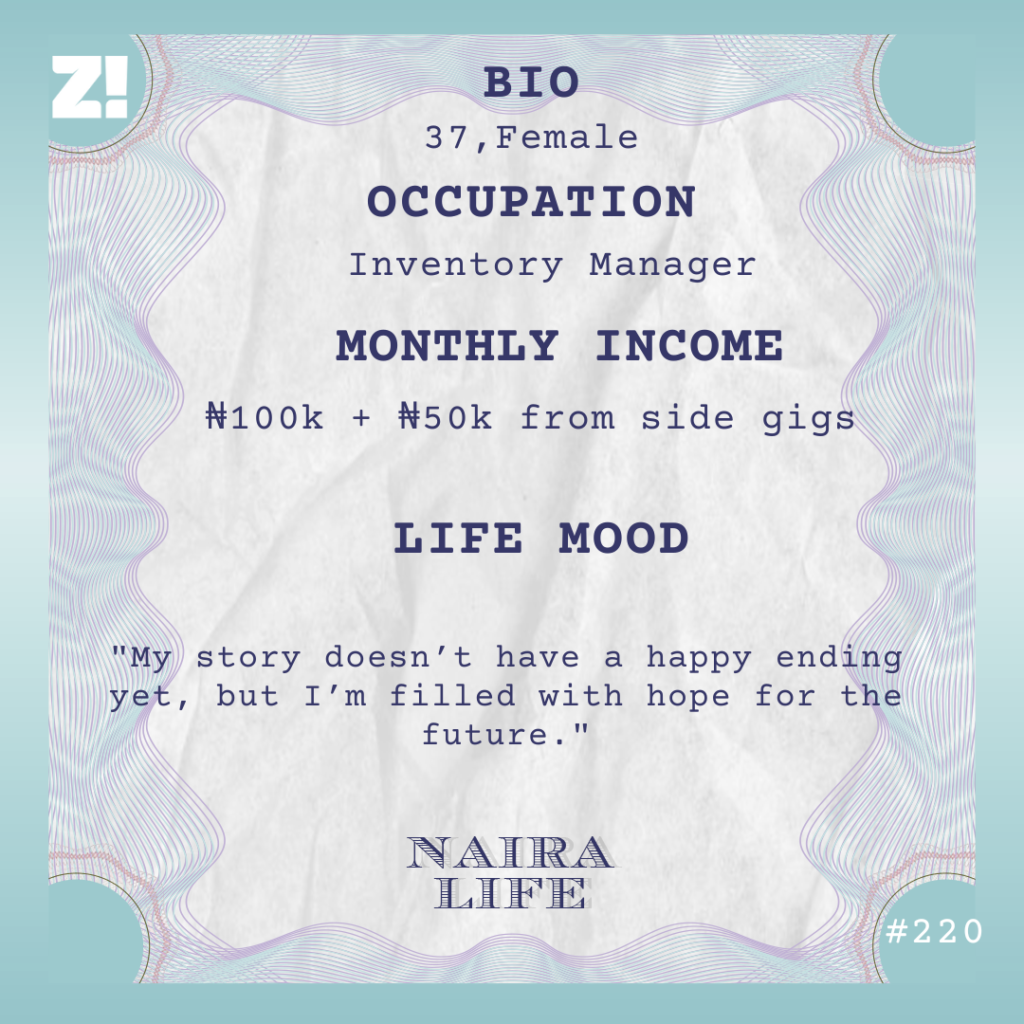

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was money like growing up?

Money wasn’t an issue for the first seven years of my life. I was a big spender for my age. My primary school allowance was between ₦1 and ₦10 daily. The kuli-kuli and sweets I liked cost 50 kobo or ₦1, and I always bought more than I needed and gave the excess to my brother’s friends.

What did your parents do for money?

They both worked in the civil service. My mum, the bigger earner, was an accountant, while my dad was an environmental health officer. My mum paid my school fees, the rent for our three-bedroom apartment in Benin and most of the expenses that went into raising nine children.

Nine children?

My dad married two wives — my mum had five children, and my stepmum had four. For some reason, my stepmum’s bride price was returned and she left my dad. My mum took care of all of us from that point.

This changed in 1993 when we lost her. I was seven years old.

I’m sorry

My dad struggled without her. He worked in a different local government at the time and visited us every once in a while because he was broke. It didn’t help that the government wouldn’t pay him on time. The things we used to afford comfortably, especially feeding and rent, became a struggle. Then my dad died in 1999, six years after my mum. I was an orphan at 13; me and my siblings’ lives changed forever.

What was it like adjusting to this?

My parents didn’t own a house, so the children had to split. My step-siblings were adults already, so they went on their ways. But My eldest sister had just started working as a secretary, so, my sister and brother went to live with her in a face-to-face apartment. My other sister, who was training to be a nurse, got pregnant and went to live with her boyfriend.

I was the pampered bookworm, so I was shielded from selling newspapers on the street to make extra money like my brother and sister. I focused on finishing secondary school, which I did at 15. But in the seven years that it took before getting into the university, I realised that things would never go back to what they were when my parents were alive.

Why did it take seven years to get into uni?

I wanted to study medicine, and every year I didn’t meet the cutoff mark, I would wait another year to write JAMB again. When I eventually made the cut-off, I still didn’t get medicine.

What happened in those seven years?

In 2002, my pregnant sister got married and moved to Kaduna with her husband. I left with them and took care of the kid when it came, so my sister could work. I also found my first job, as a teacher in a primary school, and it paid ₦10k.

About three years later, my eldest sister also got married and had a kid, so I moved to Port Harcourt, where she now lived, to take care of the child until I got into university. Our relationship changed in the years that I was there. I got a sense that she’d begun to resent me and my other siblings.

What do you mean?

She was just starting her life when my dad died and she suddenly had to be the primary breadwinner. I think the weight of the responsibility got to her, and she felt bitter that she sacrificed some of her life for us. At some point, she told her house help to hide her food when she wasn’t around. And when I finally got admitted into the university in 2008, she gave me ₦10k.

I imagine you needed more than that

My acceptance fee was ₦20k, tuition was ₦51k and accommodation was ₦35k. I had to look elsewhere for the money to sort out school bills, and it put me in a very vulnerable situation.

Do you want to talk about it?

In my first year, a family friend offered to pay for my accommodation. But after giving me the money, he demanded that I kissed him. He was married.

Another family friend — also a married man — paid my school fees for a session, but it was only because he wanted to sleep with me. It was so exhausting saying no to him all the time.

Thankfully, a church member paid my fees in my third year, and I didn’t have to go to this family friend’s house anymore. I also worked for a full year to raise money for my next tuition.

RELATED: The Exhausting #NairaLife Of An Outlier Struggling At ₦100k/month

How?

My IT. I worked as a secretary in a gas plant on a ₦25k/month salary. But the job wasn’t related to my degree in petrochemical technology, so I had to find another in a drilling company after a month. The pay there was ₦15k.

I had a strict budget. 50% of my income went into my school needs. Feeding, transportation and tithing took 25%, 15% and 10% respectively.

Before the year ended, I got into a relationship with someone who supported me until I finished university. He liked giving and took the responsibility very seriously. We got married immediately after I graduated in 2013.

Sweet

The plan was to look for a job, but I got pregnant three months after our wedding and gave birth to our first child in 2014. During my pregnancy, I started an online business selling wedding accessories. I made ₦150k – ₦200k in six months.

About a year later, our second child was conceived, and I had to remain at home for a little while longer. I did my NYSC during this time. As soon as my second child was a year and six months, I started job hunting and found a teaching job. The pay was ₦35k/month. This was in 2016.

What was it like earning a salary for the first time in years?

I don’t know because all the money went into feeding the house. We were supposed to be a family of four, but we had a house help, a church member and a family friend living with us. I wasn’t sure why we had extra people, but my husband didn’t bother about the cost we incurred because they were around. He was a natural giver, which was the same quality I loved in him. But now, it was a bit of an issue. Money matters almost tore us apart.

Tell me more about that

His salary was about ₦130k, and ₦100k went into a monthly contribution. He had a side gig that brought in ₦50k monthly, and that was it. Our combined income was less than ₦250k, but he always wanted to take care of everyone, which worried me.

He had an easier experience with money growing up, so the stakes were never high for him. On the other hand, I’d struggled for money and had learnt to look out for myself. Not having money meant relying on other people for help, and I didn’t want to be that person anymore.

How did you navigate your frustrations with your husband?

I figured I might be happier if I looked for something else to do on the side. So I returned to selling jewellery, averaging about ₦40k/month. It was what I fell back on when I quit my teaching job in 2018. I’d get to work in the morning and be greeted with frowns. It was toxic, with no chance for growth, and when I couldn’t take it anymore, I was like “I’m out”.

What came after?

I was home for seven months, running my online business and making ₦30k – ₦40k/month. This was about the same I earned from my job, but I was working fewer hours and spending more time with my kids.

I also taught myself graphic design because I was sure I could monetise it.

But when I got restless about not having the structure of a 9-5, I started job hunting again and got a teaching job at another school. My salary was ₦40k, and I was there for about two years.

I was promoted to operations supervisor after my first six months, and my salary was increased to ₦50k. We had conversations about another raise, but it didn’t materialise before I left in December 2021.

What else happened in those two years?

I was making extra money from my side businesses — freelance graphic design and selling wedding accessories, perfumes and female clothing — all of this brought in about ₦30k/month. The thing is, not all of them brought in money every single month.

Sometime in 2021, I found a freelance writing job with a media company. The pay was low, but I took it for the experience.

How much?

They paid ₦1.25/word, and I wrote four 2k-word articles/month, so that brought in an extra ₦10k. But even with so many income sources, I was making less than ₦100k/month.

Phew. How were you moving money though?

There was barely anything to save. I could do more things than I did when I was earning ₦35k, but all the expenses were still tied to being a wife and mother. For example, my two boys were growing fast and always needed a change of clothes and shoes. While my husband paid their school fees, everything else was on me. Thankfully, the only person living with us this time was our house help.

On one side, I was frustrated. On the other, I was happy I could do the small things by myself, although they took everything I made every month.

In December 2021, someone recommended me for an inventory manager job in a manufacturing company, and I got it. The pay was ₦100k/month.

That’s double your previous 9-5 income

I made an extra ₦50k from what I do on the side. These days, I shop for people too. I stopped the writing gig sometime in 2022 because the company said they weren’t making enough money to pay freelancers any longer.

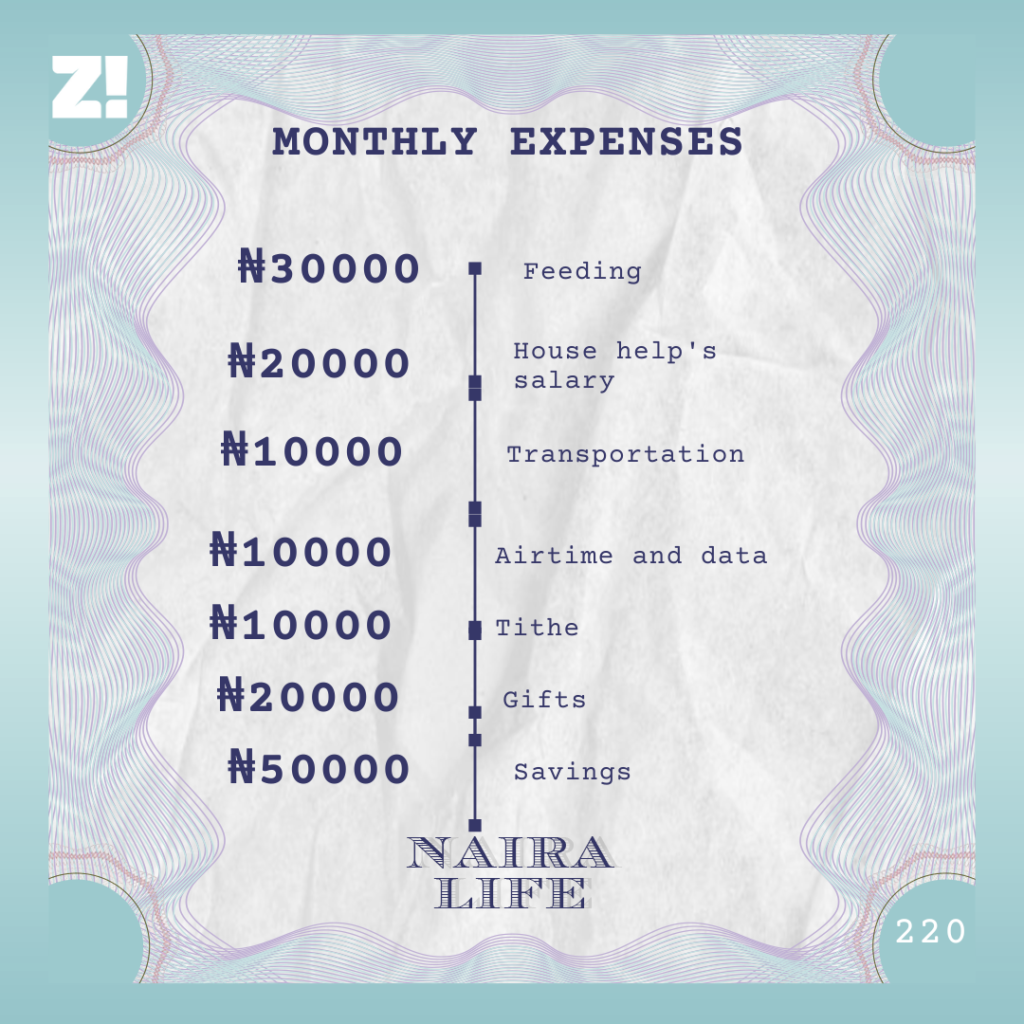

Can we attempt a breakdown of your monthly running costs?

Curious. Do you feel like you’re making enough money now?

No. But at least, I can save now, which is satisfying. I save ₦50k every month. It’s a non-negotiable.

How much do you have saved altogether?

About ₦400k in savings and emergency funds. Although I’ve been talking to an investment company about putting money in the money market with an ROI of 13%, I haven’t taken the jump. I don’t think I’m ready for or can even afford to put money to work yet.

It’s taken me this long to get here, but I rest a little knowing I have a little something of myself to fall back on if I need to.

What do you see when you think about your financial future?

I don’t expect much of a breakthrough if we continue living in Port Harcourt. My husband earns about ₦300k/month, but he works almost every day; I also work Mondays to Saturdays. We’ve worked so hard and don’t really have much to show for it, except the things we’ve done to give the kids a decent life. The rent for our three-bedroom apartment is ₦750k/year, and our kids’ tuition/term is about ₦150k. We should be able to do more considering how hard we work.

We’ve been talking about japa, but it’ll cost us about ₦21m to move the whole family. There is no clear path to raising that amount at the moment.

What do you wish you earned right now?

It’d be great if my husband earns ₦1m/month and I make ₦500k. I’ve never stopped learning or gaining new skills to bridge the gap that may stand between me and a high-paying job. In 2022, I got a scholarship for a UI/UX course. I may be able to get a job that’d pay up to ₦500k if I complete the course and build my portfolio. But with the schedule at my current job, I can’t pay much attention to it.

When was the last time you felt broke?

Right now. I’ve only about ₦20k in my bank account; most of it will go into feeding and transportation, and I won’t get paid for another two weeks.

I imagine there’s something you want but can’t afford

A vacation. I’m so exhausted. I don’t even need to go somewhere fancy; I just need the break. I’m thinking about going on a road trip when next I go on leave. My budget is ₦150k and my leave allowance, which is 75% of my monthly income, will cover some of the expenses. I’ll take the rest from my savings.

What was the last thing you paid for that improved the quality of your life?

I spent about ₦90k for my eyeglasses replacement, and I didn’t have to struggle to raise the money because I’d started saving. My vision is better for it.

How have your experiences over the years shaped your perspective of money?

Money is your first line of defence. There’s a certain sense of security and satisfaction that comes with having enough of it — I don’t know what that feels like, but I know it’s there. But I’ve also learnt it’s best to control the things you can. At the moment, that means saving whatever I can and looking for other ways to make money.

On a scale of 1-10, how would you rate your financial happiness?

It’s a 3. I want to be in a position where I’m making money even when I’m sleeping. At the moment, I’m working almost every hour I’m up, and it doesn’t feel like I’m making enough. It gets really exhausting sometimes.

My story doesn’t have a happy ending yet, but I’m filled with hope for the future.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

READ NEXT: The #NairaLife Of An Investment Manager Intent On Building Generational Wealth