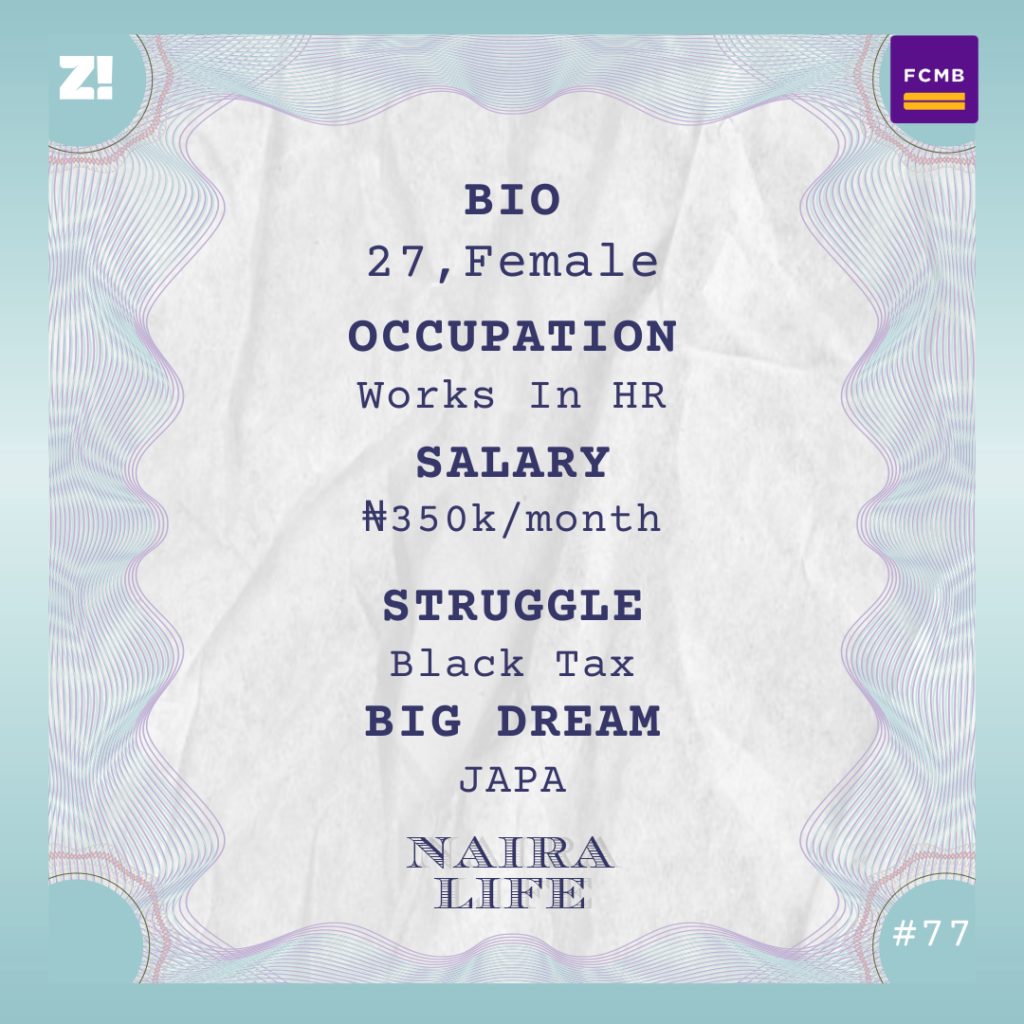

In this #NairaLife story, we talk to a lady working in HR, with relentless ambition and a strong sense of duty to family. This #NairaLife was made possible by FCMB.

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was money like growing up?

It wasn’t constant. My father, even though he has a first degree, refused to get a job as advised by my mum. He chose to become an Alfa. That means there was no constant source of income.

So when there was money, we ate good and everyone felt the impact. And when there was no money, we ate Semo or Eba in the morning before going to school.

As for my mum, she had a degree and worked in publishing in those days. She was pretty much established before her husband said no to work. She sold nylon to complement the family income. It was a very lucrative business and the main source of the family income.

So my mum would buy, roll it out, my dad would cut, while my mum would package and drop off at bakeries, shops and the likes.

This is interesting.

Let me give you a quick background to both of them. Mum was the more educated one when they met. She went to a technical college and was one of the best. My dad, however, finished Standard Six and couldn’t proceed because his family could barely cater for him.

So he went to an Arabic school where he studied for almost 16 years. She pushed for him to write GCE, do a university diploma, and eventually had a degree. But e no dey ever finish from king pikin body.

I’m listening.

There was someone that got him recommended for a teaching position. He didn’t show up.

Reason: he can’t do “yes boss for someone”. He’d rather be his own man. He studied Arabic and Islamic studies and because he was sound in Arabic he did translation jobs in Dubai as early as 2001 which brought in plenty of USD.

If I should go into what that is, we would be deflecting from our focus – me.

Agreed. What’s the first thing you ever did for money?

Makeup. 2011. I was 18/19. It was my mum’s idea; it wasn’t like I was enthusiastic about it but she needed me to have a vocation asides schooling. So she enrolled me. The only things that interested me were books and school. I exerted all my energies into this.

My memory fails me these days or maybe I’m deliberately archiving difficult times and hardship.

She was trying to make sure you had financial safety nets, correct?

Yes. She hasn’t had it easy. Also, during NYSC, I was starting to get scared of where the money would come from – 2014. So I marked WAEC scripts – English and Literature. Invigilated GCE. Worked during the election as a PO. Sold food to my Corp members. Did data collection and immunization for Polio. I made enough money during my service year. Also, my dad used to send me a weekly allowance while I was in school. The culmination of my weekly allowance was higher than my monthly allowee during NYSC. He made sure I never lacked.

My mum would send foodstuff to me every month. So I had enough money in school. But I never saved.

What was it like, post-NYSC?

My parents moved to their house a month before my pass out. It wasn’t anything grand. But it was decent enough for us to have 3 rooms and have it painted. When I came back to Lagos, I had barely ₦10k left with me. Or maybe ₦20k. I can’t remember. But I knew that I would ‘die’ if I continued living with them without a steady income. Especially as the place was in the middle of nowhere.

So, what did you do?

My mum and I went from school to school seeking vacancies for an English teacher. The schools wanted me because I was “hot cake”, or so they said. I graduated with a 2:1 and was very young and articulate. And they could see my burning passion for teaching. I’ve wanted to teach since secondary school.

How did the search turn out?

The highest offer I got from one of the schools in this new site was ₦30k. I was encouraged to take it as I’d spend as little as ₦5k on transport monthly and there’d be food at home. But I couldn’t take it because I couldn’t imagine myself a local champion, in the middle of nowhere. So I started extending my search to outside of our new area.

Interesting thing is, retirement homes work better for parents, but not exactly for the children.

Yes. It affected my siblings too. The schools there are subpar.

Tell me about your first salary.

₦80k. It was like film trick. When I got home, my dad asked to see my conditions of employment. And that’s how my whole family knew how much I earned. Wrong move. I’ll never recommend this to anyone, especially if you are the first child or potential breadwinner. Anyway, I finished NYSC in October. I got a job as a front-desk officer in November – my job search was 3 weeks and some days. In December, boom; I got a bonus of ₦500k.

Mad o!

I been wan mad. For the first time in a long time, I put myself first and bought something for me; a phone that cost ₦320k.

I decided it was worth buying because I learnt our bonuses were quarterly. My pension made me cry sha.

Take home after tax and pension was ₦73k. By 2016 April, I got another alert was ₦525k.

Oluwa, wetin dey happen?

I mentioned that bonuses were paid quarterly. And the more sales and profit in a quarter, based on your level. I was entry-level. When I got the second bonus, I gave my mum ₦300k out of it. I was a front desk officer. I still work there, because job security is important while I plan my escape from Nigeria.

What’s the highest bonus you’ve received?

₦2.3 million. December 2018. I bought land from this money, Then divided the money into 3. Used 1/3 to start a business in January 2019. By Q1 2019, the bonus was ₦325k.

The way the bonus thing is written in your employment letter, you can’t go and request it. It’s at the discretion of the management. By mid-2017, many people were not feeling the bonus thing anymore.

We preferred it was broken into bits in our salary. Our pension was suffering, and we couldn’t continue to plan our lives on quarterly monies you can’t bank on. Eventually in 2019, we did a proper HR restructuring.

We had our Annual revised and had bonuses replaced by 13th month. And I got a job upgrade. All this while, I was doing my MSc and Personnel Certification exam. So when I finished, it was easy for me to move internally. I have a passion for people.

Interesting. So, you joined HR last year?

Yes. But before then, I volunteered in the department since 2017. So yeah I was given two options; head Admin or be a senior staff in HR. I was the best fit for both, but I went for the latter.

Energy.

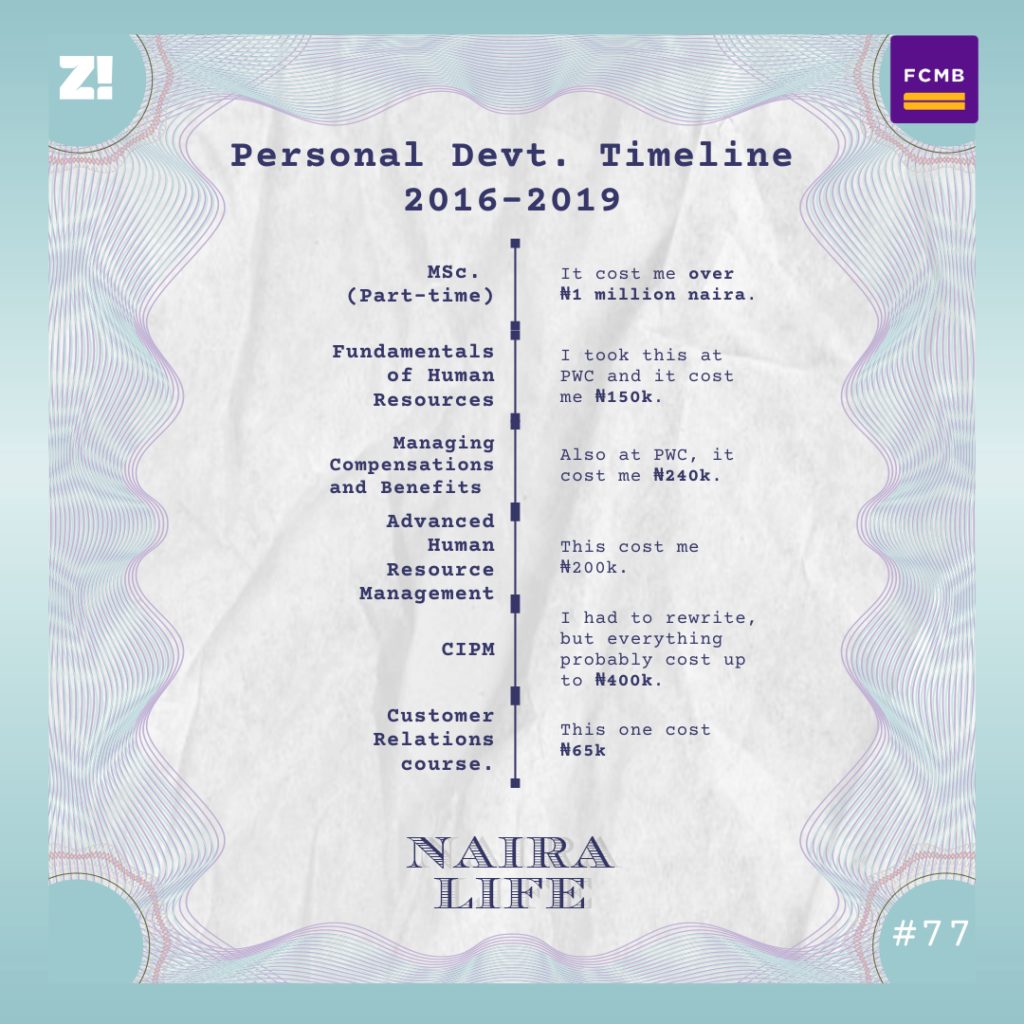

Yes, I used a lot of my money to develop myself please.

Give me a breakdown of all the courses you’ve taken

Insane.

These were paid by myself. My company also trains us a minimum of one course every year. Now add the company-sponsored training to what I’ve had.

What’s your current salary?

₦350k. I’d have spent 5 years in less than 4 months. I’m now an HR Technical Lead. Although I know people in similar companies at the same level, earning ₦500k. With other fringe benefits.

But let me mention that my company bought us cars. Senior staff and all.

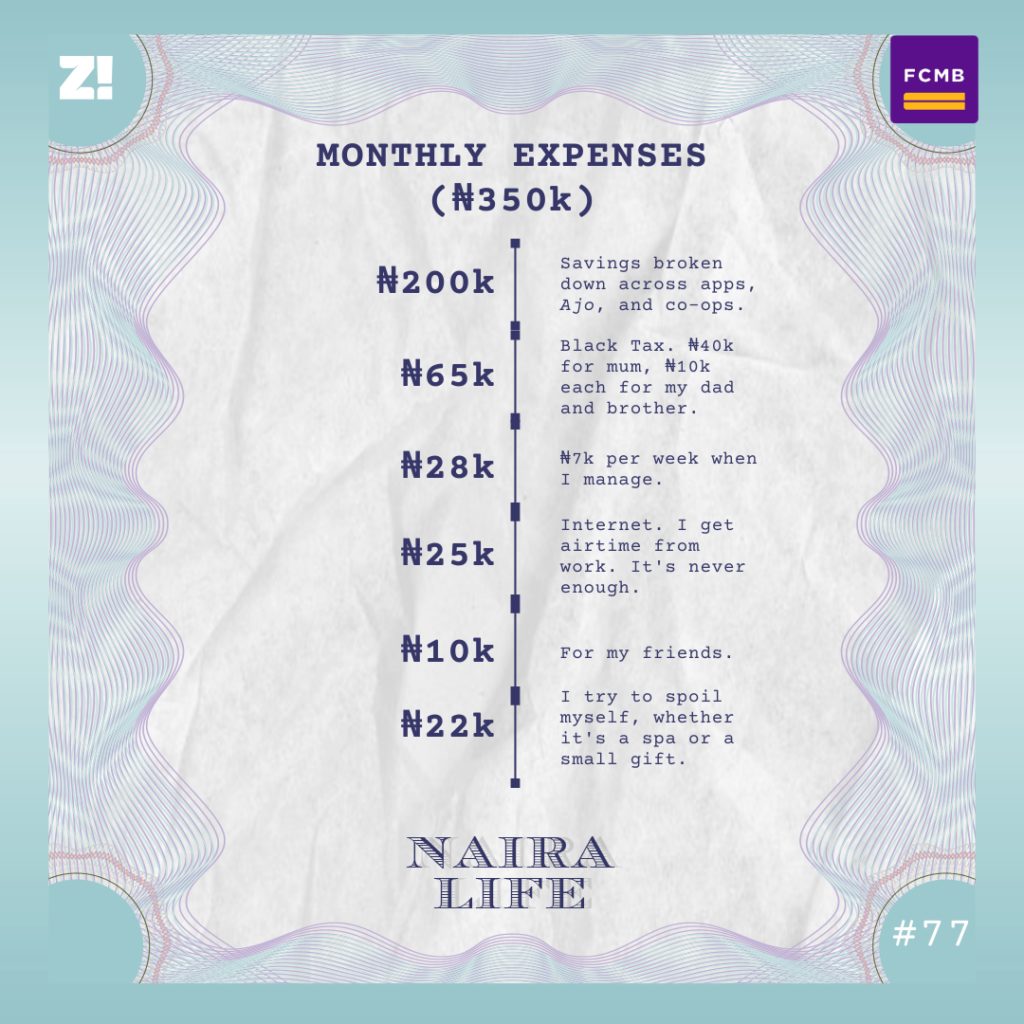

Let’s break down your ₦350k.

More recently my money dynamics have changed.

Why?

My mum is ill and it’s a money-draining illness.

I’m so sorry. You have health insurance?

HMO only covers me. And even if they allowed my mum there’s no way it would cover the cost of her treatment.

How has your perspective about money changed? After all these years?

Savings is not going to cut it if you earn very little. Remember when I earned ₦73k net and I saved ₦10k monthly to amount to ₦120k a year.

Now I save over ₦200k a month. I’m looking to taking more investment risks and build something on my land that can generate passive income.

Like, how much do you have altogether?

I have just ₦2 million. When I get my ₦100k from Ajo in September that’s another ₦1 million. I have some other savings locked up in an app with ₦700k at the moment. My land is worth ₦1.8 million now. The extra liquid cash I have is if I have anything sold on my business.

Tell me about your business

I sell fashion items. Based on inventory, the current worth is ₦800k, but I’m very terrible at this business thing and business has gotten worse.

While I am good with human relations and physical marketing – my friends recommended me for a sales role once – I don’t seem to get this digital marketing and how to turn it to my favour especially as my business is mainly online and the warehouse is my room/sitting room

What’s the biggest misconception people have about HR?

That HR equals recruitment. Not like recruitment is easy, but reducing the totality of Human Resources to this ticks me off. My favourite part of HR is strategy & Talent Management. Compensation & Benefits? I am the master at it. I love that my manager vouches for me especially when I’m not there and is always tabling my case where it matters. Salaries, pensions, leave allowances, leave days, out of station allowances, HMO, Regulatory compliances (PENCOM, NSITF, ITF, Combined Group Life Insurance), staff welfare, I am the go-to person.

Let me ask, how do you decide when to give a raise?

It differs from company to company. In my company naturally, there’s a review of all staff salaries at least once in two years to align with current living realities. Another is profit sharing (kinda). When we get crude lifting contracts or a huge job you get a few dollars. And finally, performance appraisal. Exceptional people get their salaries reviewed independently.

No one has officially come to HR to seek a raise though.

Why don’t people do it?

Organizational culture impacts people a lot. The work environment is mostly relaxed, informal and makes HR work easier. People come unofficially to discuss things with us and we table it to management. People get a lot of unofficial cash benefits, including taking care of some staff’s personal expenses.

Wow. So, your boss is running the company like an extended family.

You get. We (HR) are trying to do things by the book because of restructuring. This style has its merits and demerits. But the merits have overshadowed the demerits so far. One demerit is that employees know they can always bypass protocol to go meet the chairman himself. This causes an imbalance and subordination is the order of the day. When you eventually decide to leave such an organization, tell me how you’d cope with organizations with structures in place. I don’t want to be a local champion so I am always seeking ways to develop myself for the global market.

What’s something you want right now but can’t afford?

I want a fully-furnished house and money in my account – say ₦5 million. I’m gonna just japa. But I want a house to keep my mind at rest. I want one, especially before I marry. I currently rent a mini flat at ₦500k. Furnishing it even passed the ₦500k sef.

What’s the last thing you paid for that required serious planning?

Bought a friend a watch. He passed his exams after failing this first time and I promised myself to get him something to celebrate him if he passed the second time. I saved the ₦10k friend budget from last year November till I got news of his success and bought him a Swatch.

Cute. When was the last time you felt broke?

I’m currently broke. You would never know though. I have a total of ₦8k left. ₦7k which will serve as my fuel money till my next payday. There’s food at home. I have data. The past few months have left me with almost nothing in my account always because of mum’s health.

Sorry :(. What’s something you bought recently that significantly improved the quality of some aspect of your life?

I bought myself a new mattress. And new pillows. I felt like a king and it helped improve my sleep. My previous mattress was already pressed in the middle.

What’s a major expense you have that doesn’t come monthly?

Skincare products. I’ve spent up to 250k this year. Don’t shout o.

Ahhhh. So, skincare takes up how much in a year?

Please don’t make me calculate it 😭😭. I’m so scared to put a cap on it but maybe ₦500k to ₦600k. This became elaborate last year. Before last year, I barely spent up to ₦200k a year.

Why did you up the game?

Financial upgrade. It afforded me to buy products that tackle my skin issues. It’s an elaborate something. In the morning, I spend an average of 30 minutes. But at night time I take 45mins. Weekends, up to 1 hour, 15mins.

How would you rate your happiness levels, on a scale of 1-10?

It’s 6. I’m doing good but it could be better. I don’t want to get paranoid about not having money. When I have my own house and ₦5 million in addition to the little I have. And most importantly premium health insurance for my nuclear family. Health emergencies disrupt your balance and plans. You could go from being a mini-millionaire to penniless in a month because of health. So those are my fears.

Your fear of not having money is mostly triggered by your commitment to your family, is that correct?

Mostly. I still have 3 siblings in school. And my parents are getting older and weaker.

That’s heavy.

I know. That’s my reality and there’s no shying away from it. Sometimes I get grumpy and it affects my mood. Thankfully I have a friend that serves as my outlet. He senses when I’m tense about things and there’s a way he makes me open up and when I do, there’s momentary relief for me. Until the next one.

I cannot even japa without factoring at least one of my siblings in this. If I don’t do this, who will?

Hmm.

This also feels like a therapy session. Thank you for this opportunity.

Thank you too.