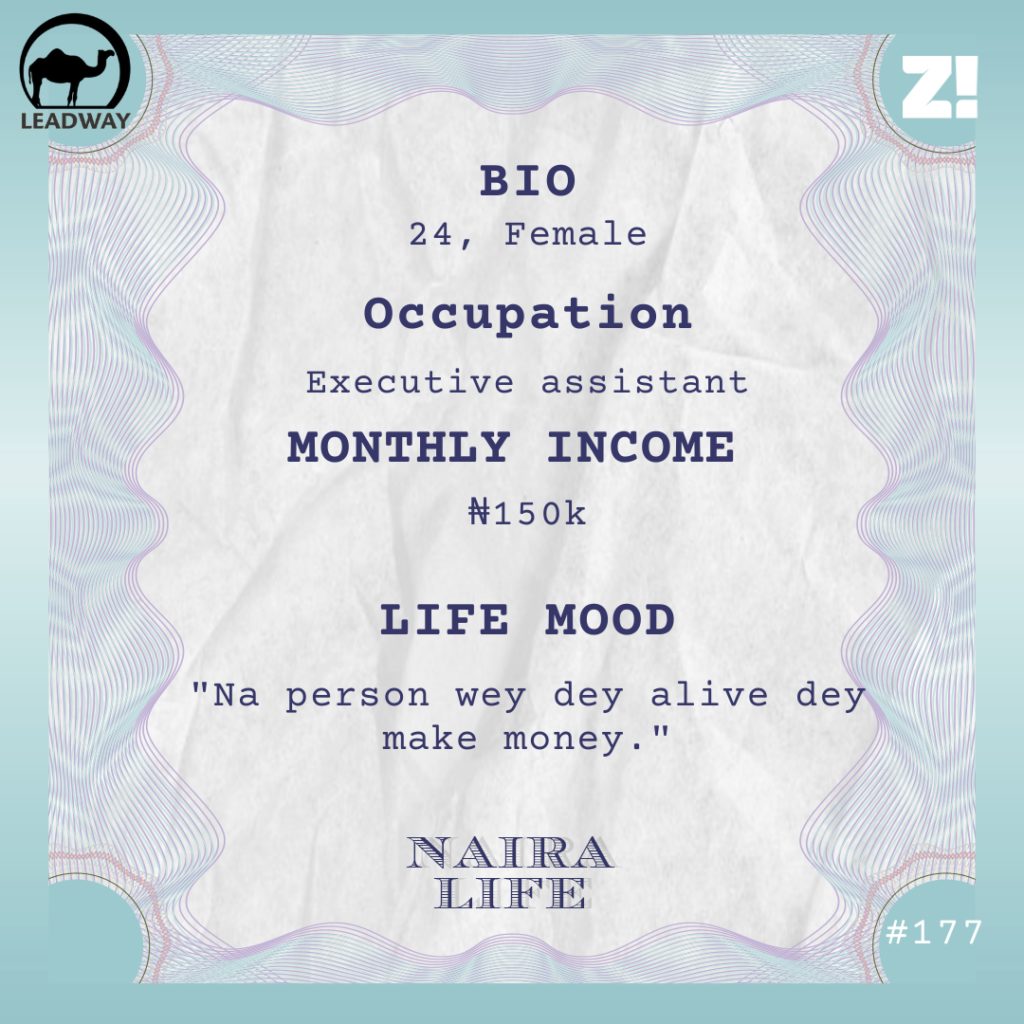

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Leadway offers simple insurance products that protect you and everything you care about. From your personal belongings, to your health, your life, and that of your family. Sign up on Leadway Assurance to learn more and get started.

When you earn ₦150k and you’re 24, being the breadwinner of your family of five can’t be easy. But this week’s subject on #NairaLife does it despite the many challenges her family is faced with.

What’s your earliest memory of money?

My dad used to give my brother money to share with me, and even though he’s just a year older than me, he shared it so unfairly. I remember getting frustrated all the time and looking forward to making my own money when I become an adult. Because my mum was also “keeping” whatever money relatives gave me. So I hardly had money as a child.

What was home like?

We were a comfortable family. Father, mother, three children, one car, light at home, generator, proper education and good food. We didn’t have enough money for luxuries like travelling abroad, but we weren’t poor.

When I was about 13, things started to get better. We even moved to a better neighbourhood. By the time I turned 15, I was sent to a private university where my brother already was.

But in my 200 level, 2014, things took a nosedive. My dad lost the job he’d had for 18 years. Things weren’t so bad at first because my parents had savings and my mum still had her job. Then, exactly a year after, my mum lost hers too. That’s when things started to get scary.

Had your dad gotten another job?

Let’s just say the situation surrounding the termination of his job made it difficult for him to get another one. Also, he was in his 50s. People hardly hire someone in their 50s.

By 2016, we’d burnt through our family savings and only survived on my dad’s ₦60k pension. Imagine a family of five surviving on ₦60k.

Sounds tough

See, tough doesn’t even begin to explain it. First, my brother and I dropped out of school in 2016. I was just about to start my fourth year, and he was just about to start his fifth.

Leaving school was difficult, but staying home was worse. In our estate, we had to pay a service charge for connection to the generator or NEPA. When we couldn’t pay, they cut us off. We didn’t have any form of electricity for six months. We could only charge our phones in neighbours’ houses. Eating three meals a day was impossible. We struggled to eat two meals. It got so bad that there was a time we could afford only one bar of bathing soap for the entire family, so we took turns bathing with it. Another time, the car spoilt and we just stopped going anywhere — even church.

In 2017, my younger brother had to drop out of secondary school for a whole term because we couldn’t afford his fees.

So there was absolutely no money

Apart from my dad’s pension, he also did a thing where he found people who wanted to buy houses or land and got a referral bonus of like ₦200k. But that only happened once in several months. Some other times, family members would send some money. That’s how we survived.

The only good thing that came out of that period was my family got closer. My dad wasn’t too involved in parenting when we were younger, so being at home with him helped us know each other better. Everyone learnt to look out for everyone else.

I’m curious about how this affected you socially

It didn’t. I’m great at keeping what happened within my family. Maybe only one friend knew what was going on. I just put on a front and smiled whenever I had to come in contact with people. I didn’t want people pitying me and making me a charity case.

When did things get better?

By 2018, my dad did some real estate thing and got just enough money to send us back to school. This time, not to a school in Nigeria but a much cheaper one in Benin Republic.

How did that go?

Let’s just say it’s the grace of God that kept me going. I can count the number of times my parents were able to give me money in that period. I only survived through my friends and boyfriend. And I learnt how to be prudent.

When did you graduate?

I graduated and returned to Nigeria in September 2019, and by January 2020, I got a front desk receptionist job whose ad I saw on Instagram. That was my second receptionist job.

Wait, what was the first?

Oh, it was in 2017. It paid ₦40k, and I did it for only a few months. I contributed all of it to my family’s survival.

How much did this one pay?

₦60k. I started NYSC in March and was collecting an extra ₦33k from the government. COVID meant they had to cut our wages in August. Tell me what I should do after they removed 40%. I’d have almost run at a loss when I removed my transport fare, which was like ₦1k a day. So I just quit.

What was happening at home?

Things still weren’t great. Sometime in 2019, my mum, who’s a nurse, got a job at a hospital. Her initial pay was ₦150k and she was supposed to get promoted after a few months, but office politics made them promote another person, treat her harshly and even reduce her salary to ₦100k. So we both quit our jobs in that same period.

Did you find another job?

In January 2021, I did. I started as a customer service rep for a therapist, at ₦60k, and as the year progressed, my role, responsibilities and pay kept changing. Now, I’m an executive assistant and office administrator, and I earn ₦150k.

Love it for you

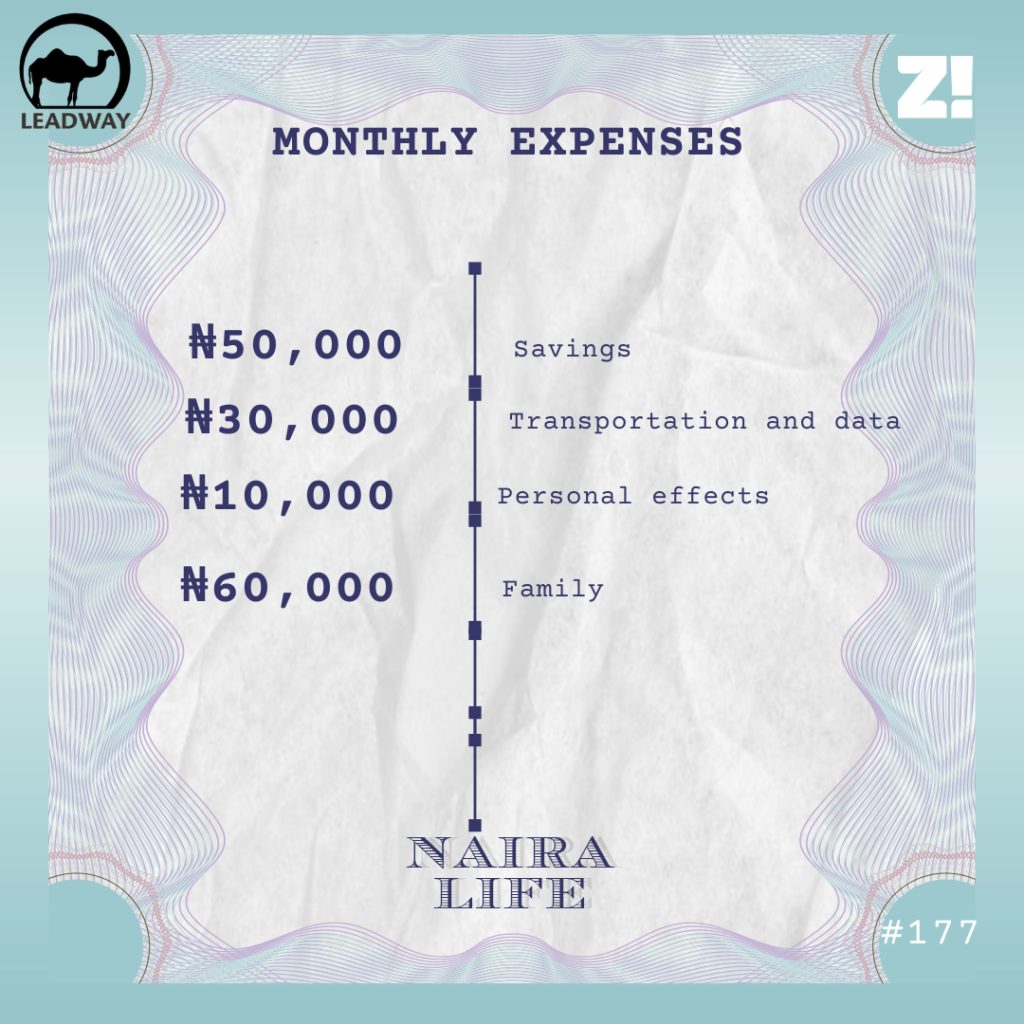

But 2021 was also the beginning of me being the breadwinner for my family. My brother’s still trying to get a steady income, so whenever the family needs anything, they come to me. I’m talking food for the house, utility bills, almost everything.

I started staying with a friend in 2021 because my family’s house was far from the job I got. Here, there’s food and internet. I don’t have to spend much money on myself, so most of the money I make goes to my family. I can barely save because I can’t bring myself to keep money when my family needs it.

But just when I thought things were beginning to even out, they took another terrible nosedive recently.

How?

Long story short, my family got kicked out of our home because we couldn’t pay rent. Over the years, we’ve struggled to meet rent and we’ve had to beg the landlord, but this time, he wasn’t having it. He literally brought people to bundle our belongings out and try to seize them. We had to pay ₦150k for them to release our stuff.

Where’s everyone now?

My dad is in the village, my mum and younger brother are with an uncle and my older brother is with a friend. But you know what I tell myself to make myself feel better? Homelessness is probably the worst thing that can happen. It can only get better from here. But it’s really painful o. I can’t imagine how my parents feel not being able to take care of their children or even house them. I think of my dad — his ego must be very bruised.

He wants us to come to the village, but I’m not having any of that. Right now, the plan is to find a cheaper area for us to stay. I have a total savings of ₦400k. If my brother or anyone else brings ₦100k, we can find somewhere decent.

How are you managing all of this with work?

I’m not managing it well o. In fact, I already sent in my one-month notice. I’m leaving at the end of this month (July 2022).

Why?

First of all, I’m tired. Going through family stress while working full time is a lot. And my bosses aren’t the kindest people. They don’t have consideration for my personal life. Even when I complain about family issues without going too deep into details, they say stuff like, “You’re not the first to have family issues.”

That’s terrible. How do you intend to survive when you leave the job?

Omo, na person wey dey alive dey make money o. Once we get this house thing sorted this month, I’ll relax for another month or two and look for another job..

What are your plans for the future, financially?

When my family settles, and I get a new job, my brother and I should each be able to set aside ₦20k monthly to cover rent. Other than that, I’m probably going to be out of this country within the next year. I got married in December and my husband is in Canada. We’re working on me joining him ASAP.

You got what?

LMAO. Remember my boyfriend from earlier? Yep, we got married last year.

I’m curious — does he help with your family’s finances?

Remember how I said I like to keep family secrets within the family? He found out how bad things really were when my family got kicked out. Before then, he just knew things weren’t great. He’s offered to help us cover some of the rent and cost of moving.

Most of my friends don’t know how bad things are. I tweeted how I was feeling about a month ago when my family got kicked out, and a friend reached out and pestered me until I told them how things were going. Yesterday, I opened my bank app and saw that I was ₦100k richer because they sent me money. I almost broke down in tears.

Do you have a breakdown of what you spend in a month?

Tell me something you want but can’t afford

If a house could fall from heaven for my family to live in, I’d cry tears of joy.

How happy are you on a scale of 1-10?

It’s a 2. Things are not great, but I’m happy I can contribute to keep things working for my family. I’ll tell you a fun fact — I haven’t made my hair in months. I’ll probably cut it again. When I cut it the first time, people thought I was experimenting, but the truth is I just couldn’t afford to take care of it. So yeah, things are not great at all.

Leadway offers simple insurance products that protect you and everything you care about. From your personal belongings, to your health, your life, and that of your family. Sign up on Leadway Assurance to learn more and get started.