Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Today’s #NairaLife subject decided at 8 that he wasn’t going to ask his parents for money if it wasn’t an absolute necessity. 20 years later, he’s mastered the art of job-hopping and gotten himself to $7,000 monthly.

Let’s start with your first memory of money.

I was five years old, and I’d just discovered the art of finding loose change around the house and spending it on sweets. This was 1998. I didn’t think I was stealing, but nobody knew I was taking these monies. It didn’t last long though, because one day my mum saw me eating a snack she didn’t buy for me, and when I told her how I could afford it, she beat me. That was how I started having opinions about money.

What were these opinions?

I figured, if you needed money, you had to make it yourself. I had to ask my parents for money if I needed to buy anything like snacks or a ball, and most of the time, I was told no. Being told no when I asked for money was super frustrating for me, so I decided that I wasn’t going to ask anymore. My goal was to grow up and make a lot of money so I would never have to ask anyone for money again. In retrospect, I realise that things were not so great at home at the time. My mum was a stay-at-home mum, and my dad worked in construction, so they couldn’t always afford everything I wanted.

So what did you do?

By the time I got into secondary school at eight, I stopped asking for money if it wasn’t for an absolute necessity like school supplies and my standard pocket money. This went on until I finished university.

In university, I got between ₦15k and ₦30k monthly from my parents, and that was enough for me. Because I’m introverted, not having extra money didn’t affect me badly because I wasn’t trying to go out or buy something to impress anyone. To make my own money, I tried business but quit after two months.

What kind of business?

Food selling. I had a friend that lived off-campus who would buy packs of food from a restaurant and bring them into school for me to resell at a profit every day. The business was doing pretty well. We bought packs at ₦300 and sold them at ₦500, and we did about 100 packs every day.

Why did you stop?

I got tired because I wasn’t super enthusiastic about business in the first place. Also, the business got popular in school, so competition was fierce. And with food business, if you don’t find buyers, you have to sell at extremely low prices to make sure the food doesn’t go to waste.

What happened after university?

NYSC. I stayed in Lagos and got a “job” at a photography studio where I paid them to teach me photography. Once in a while, I’d follow them to events and get ₦10k, but that was it. After NYSC, I went to the UK for my master’s. At this point, my parents’ finances had gotten better, so they sponsored me through my master’s.

I should probably have started asking them for extra money at this point, but I stuck with my decision to be independent. To make some extra bucks in the UK, I took a sales job that had me go from door to door advertising and selling products like window cleaning services.

What was that like?

It was terrible. I had little to no interpersonal skills, so I was bad at the job. Also, the area where I schooled and worked was very white, so if I was knocking on a white man’s door, that was probably the first time he was seeing a black person in weeks and you could see the confusion on their faces.

Having to go past that awkwardness in the first place was hard enough, but convincing them to spend money on stuff they probably didn’t need? I was making £100 a week on average, and it was a terrible wage for the amount of work I was doing. Towards the end of my master’s programme, I got on a run of sales that was so unyielding, I got frustrated and quit.

What was your plan?

Right after I finished my master’s in 2017, I started applying for bank jobs and I got a job in the customer service department of a bank in the UK. It paid £1,500 a month. I didn’t stay there for long though, because I returned to Nigeria. Shortly after I returned to Nigeria another bank in the UK reached out to me for a much better role, but it was already too late.

Why did you return?

I wanted to be with my family. A lot of the foreigners that were my colleagues in school were also returning to their countries, so it seemed like a good idea.

What did you do once you got back?

A friend introduced me to Coursera and data science, and I went fully into learning mode. Because I didn’t want my dad to think I was just at home doing nothing, I applied for the graduate training programme for one of the Nigerian banks. I got a callback, and they were offering ₦250k, but I rejected it and explained to my dad that I wanted to learn data science instead. Afterwards, all I did was sit at home and watch data science videos online.

By the end of 2017, I got a data science-related job that offered ₦72k for the first three months and then ₦120k afterwards. It was less than the ₦250k I could have been earning at a bank, but I knew getting a job in data science would be good entrance into the field. The salary was the sacrifice I had to pay. With my ₦120k, I fuelled my car, bought data and bought online courses. I saved whatever was left, and when issues came up with the car, I used my savings to fix them.

My role at the job was data solutions architect, but because it was a trainee role, I had a lot of free time, so I clocked into work on most days and just kept watching data science videos online. I earned ₦120k until December 2018 when I got a new job.

What was the job?

It was a similar role to the one I’d just left, but this time, at a bigger tech company. They found me on LinkedIn. This might be a good time to say that every job I’ve had since I moved back to Nigeria came through LinkedIn. I don’t post anything on there, but somehow, companies keep sending me DMs. The pay for the role was ₦400k. Because this job brought more money, I could afford to move out of my parents’. I got an apartment close to work that cost me ₦120k monthly, ate out every day, and that cost about ₦100k monthly, paid utilities which cost about ₦40k monthly and had a gym subscription which was ₦10k monthly. I saved the rest of the money.

Later in 2019, I realised eating out was too expensive, so I hired someone to cook in bulk for me. This reduced my expenses for feeding to about ₦50k monthly.

How were things at work?

I was growing and realising that I needed to earn more. I tried to discuss a raise with my boss, but I was just hearing stories, so I dropped the issue. At that point, I’d made a rule for myself — never spend more than two years at a job because there’s always someone willing to pay you more out there. By April 2020, lockdown happened and my pay was cut to ₦320k. I earned ₦320k until July 2020 when I got another job that paid ₦750k.

That’s double your previous pay.

Yup! It was a bit overwhelming. I’d interviewed with the company a few months earlier, and they didn’t pick me because their priority was to hire someone outside Nigeria. When they reached out, they said they were now hiring from within the country, and I’d done well on my tests. After my probation period, they increased my pay to ₦800k. It took some time to get used to earning that much money at a job where I was doing much less work. I didn’t know what to do with the money. Even if I tried, I couldn’t spend all of it in a month because my lifestyle didn’t change.

What were your finances like in this period?

I decided to keep my monthly spendings at ₦300k at the maximum like I did at my last job, so nothing really changed. I stayed in the same apartment, worked from home and did everything almost the same. The remaining ₦500k was going into investments.

After a few months earning ₦800k, I started thinking about how I could increase my earnings even more. I was enjoying my job, but I knew there were opportunities for more money out there.

Did you find anything?

Companies kept reaching out to me on LinkedIn, and I kept doing interviews. There was a promising job offer from Dubai in July 2021, which was about ₦4m monthly, but when we got into talking about details, I got scared. They said they were having problems sponsoring visas for Africans, so I needed to sponsor myself to their country first before we made any final agreements. I didn’t like how it sounded, so I rejected the job offer.

The next day, another company I’d interviewed for reached out and offered me a job. It was in another African country, so when they asked what I wanted for salary, I asked for $4,000. They negotiated and we agreed on $3,000, but with bonuses, it went up to $3,500. I took the job.

Best in job-hopping.

When I told my former employer I got a different job and would be moving outside the country to take the role, they told me they still wanted my services. They didn’t mind hiring me as a contract employee, so I gave them a few conditions — I would work from abroad, we would renegotiate my salary, and I would earn in dollars. They agreed, and by the time we were done negotiating, my new pay was $3,500. That brings a total of my current earnings to $7,000 monthly.

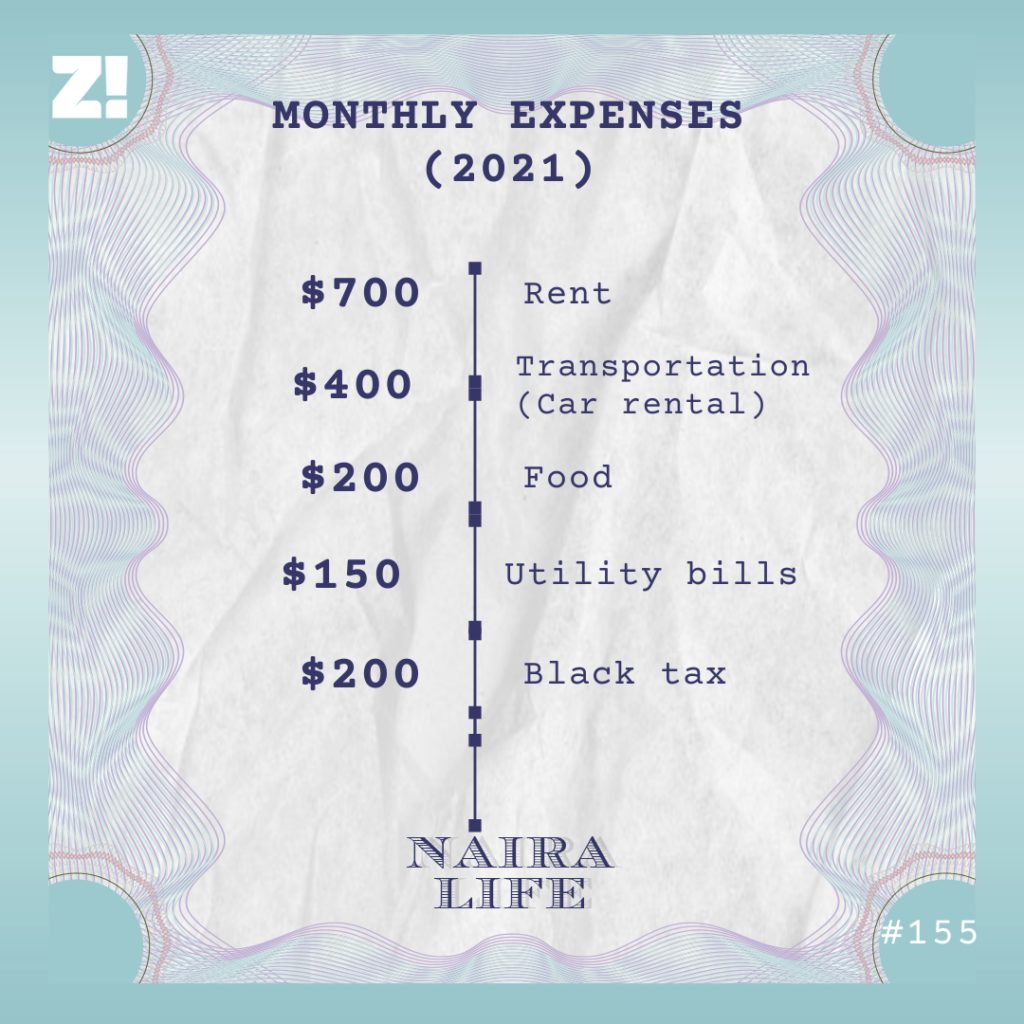

Let’s do a breakdown of your expenses.

The rest of the money is split between cash savings and investments.

How about a breakdown of the investments?

30% cash, 20% crypto and 50% stock and real estate, but I’m switching all of this to a fund with a private banker soon. I’m not good at managing money, so it’s best if I have the pros do it.

How has your income journey affected your view on money?

My view on money hasn’t changed a lot over the years. I just see it as a tool to purchase things. Amidst all of this, I’m learning to live with self-doubt, anxiety, and the irrational worry that I could lose my job at any time even if my results at work are excellent. Sometimes, the anxiety gets so bad my productivity drops to zero. But I’m looking to go to therapy.

Is there something you want but can’t afford right now?

I found a house here for about $500k, and I’m working towards buying it. I’m considering taking a mortgage and not paying up-front cash.

Let’s talk about your financial happiness on a scale of 1-10.

It’s at a 7. I’m currently satisfied right now, but in a few months, I’m sure I’ll desire an upscale job and leave these two jobs for one that pays more than both of them combined. Getting that and improving my total savings and investments over the next year will get me to an 8.5.