Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s start at the beginning; your oldest memory of money.

Christmas. I remember going house to house with my sister to collect money at the end of the day we’ll settle to count and see how much we made.

I always looked forward to moments like that, or when my dad dashes us money whenever he’s around.

Whenever he’s around?

Yeah. He was a police officer, so he was hardly at home – at least while I was still a kid. One year, he’s in Lagos next year Kano or a different state.

You see daddy, you see money.

If I remember correctly, we had an allowance. It wasn’t much sha – when I was in secondary school, I remember getting ₦1k for like two weeks. And since we are plenty we get the money according to our age.

Hmm, plenty.

Five children; I’m the second child. This routine was from 2005 to 2011 for me – my entire secondary school years. My mum, on the other hand, was the type that’ll say “bring the money, let me keep for you,” and you know how that eventually goes.

We all had the same childhood.

Yep. Mums don’t disappoint.

Let’s do a big jump to when you got paid for work for the first time ever.

Ah yes. During my undergraduate Industrial Training, I worked as my uncle’s personal assistant.

Wait, what did you study?

Computer Science. Anyway, all I did was type his documents, help to reply to his emails and stuff.

It’s interesting looking back, I feel like I was lucky, to be honest. My dad asked me to tell my uncle I needed I.T. placement, but I refused because I felt I could hustle myself. I decided to ask and he employed me.

How much were you getting paid?

He was paying me ₦30k. The firm also paid me ₦20k. Every weekend, I got ₦10k allowance. I was also living with his family, so I didn’t spend anything on transportation or food.

You were earning ₦90k as an IT student. Mad.

Well, yeah but sadly it was just for two months – I already spent the first month of the three-month I.T. looking for placement before choosing my uncle. This was in 2014.

Anyway, I used part of the money to buy a phone, because a girl needed an upgrade. I bought a Q10 when Blackberry was still a thing. I think it was ₦40k.

Smooth. After Uni?

NYSC in 2016. I was a teacher at a secondary school in the North Central. You know, they were going to retain me and I was considering staying back o, but I ain’t gonna be a teacher for life. No offence to teachers out there.

How much did they want to pay you?

₦100k, I heard. It was a well-funded government school, and Level 8 (BSc) people earn about ₦100-₦150k.

That is interesting. First job post-NYSC?

Ah, it was an internship, and they didn’t pay me. I was supposed to start as an intern, but novice like me, I got the job and started without discussing salary.

After the first month, me and my Oga dey look each other.

Ouch.

I spent my NYSC savings coping and managing. The next month, after the same thing happened, I decided to leave.

Some background, I started learning how to code in my final year in 2015 and continued into NYSC.

Ah, code.

Yeah, I needed experience, so I had to work as an intern for a couple of months. The second one paid ₦50k at first, then I got a raise to ₦80k. It felt so good because, at that point in my life, the money was enough.

This was barely two years ago. I spent 10 months at that second gig – I left.

Did you get another job?

To be honest, I had another gig alongside the second one. It was getting me relatively more money than the full time one. Also, I wasn’t happy there, so I figured I should move.

See ehn, the one thing I’ve realised over the years is to hustle and have multiple streams of income. I’m not there yet, but I’m still hustling.

Since I got that second full-time job, I’ve always had a side gig.

Noted. What was the time between your second and third job?

Five months. So my side gig sustained me throughout that period. Also, the pay was dependent on the number of hours I worked, but it always ranged from ₦150k to ₦200k.

Eventually, I got another gig. But something interesting happened.

What?

My salary was ₦75k. But I did it because of the company. The dreams were big o, and to be honest, that was enough compensation at the time. To be honest, I don’t regret moving and joining the company because it helped shape who I am today. But things didn’t go well while I was there.

What happened?

The things we were supposed to be building just wasn’t coming. And, I spent one year, doing next to nothing.

Wollop.

Well, I took a product management role on an internal project at least, which I liked because it built my skills in different areas. After the first year, I was like fuck it. I’m not doing again. But I didn’t quit, I started picking up other skills and opportunities. For example, in 2019 I started doing technical writing on the side. The first gig was $150 per article.

Lit!

The highest-paid has been about $500 per article. I was doing about 2 or 3 articles a month. But I really was lazy, because I could have done more and gotten more. But anyway, it was okay, and I was happy. My salary at the office, even though much wasn’t happening, had increased to ₦150k. On the side, I started earning about ₦300-500k. Although there were months where I couldn’t create any content, so I had nothing but my salary.

This is interesting.

I haven’t even gotten to the best part. Anyway, in 2019, I started job hunting, because I clearly wasn’t happy at my job.

At the beginning of 2020, I finally got another job. The best part was that it was remote – I got a job with a foreign company.

Ah, this is about to get interesting. I –

This one pays $4,400.

You didn’t let me land.

Hahaha. I also got another side gig that is paying me $1500. I’m mostly doing their technical writing.

So, how much are you netting monthly now?

It’s not fixed, but my last full month, I did $7,000:

- Main Job: $4,400

- Part time job + small gigs: $2,600

I like to think I’m just getting started. More wins to come.

I’m excited about your future, but tell me about now. Tell me how $7,000 will go in a month.

First of all, I saved roughly 60%.

The rest went to my needs and family’s needs. Whenever there’s a need at home and I can afford it, I’m the go-to person. My baby sister is trying to follow in my footsteps, so I replaced her dying laptop. Also, I stay with my parents, so I honestly don’t spend money on rent or food.

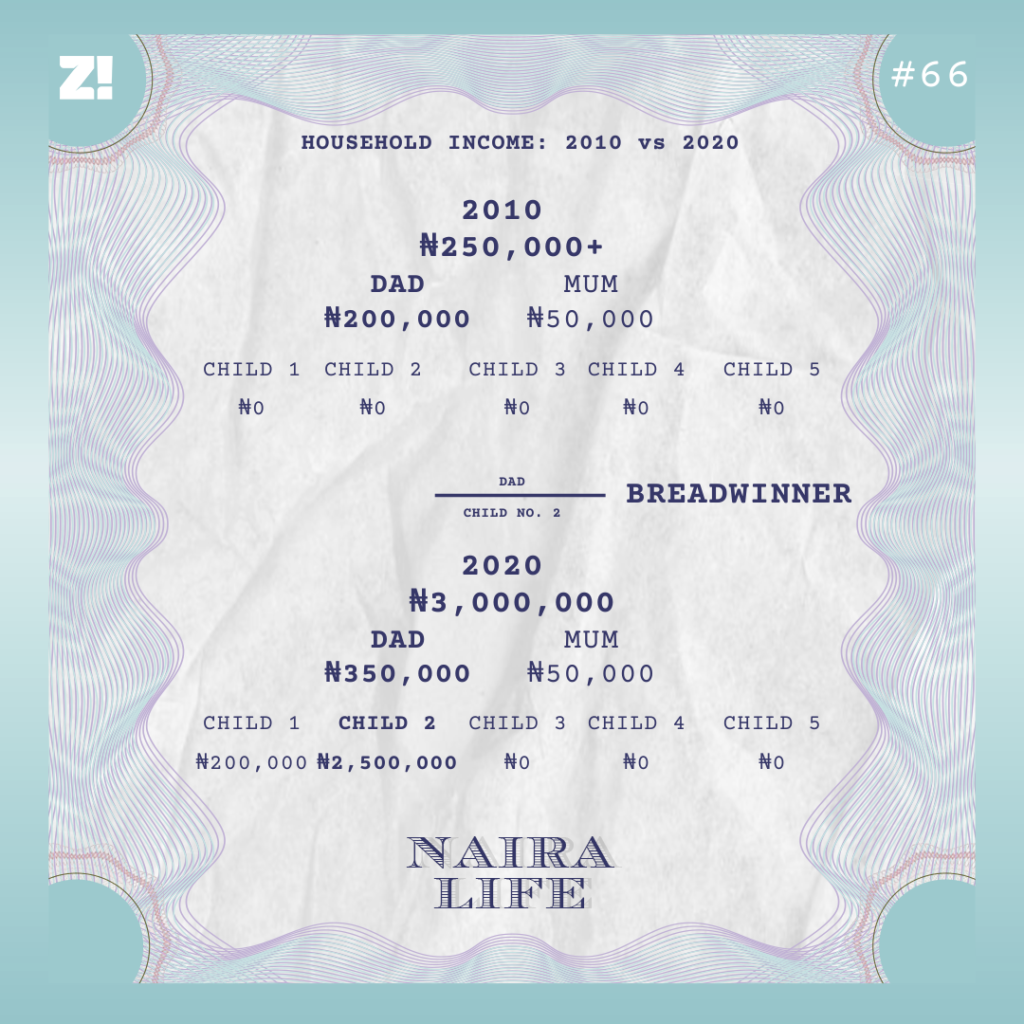

Has it ever clocked in your mind that you’re actually the new breadwinner?

Haha! I know this already. Things were a bit rough for my folks in 2018. So, my sister and I took care of the expenses.

Did you and your sister ever sit down to discuss this new quo?

Yes, we did o. We had to pay for school fees. I still had a sibling in secondary and another one in University – ₦250k each. We split the bill; I paid one, my sister paid the other. It was tough, but we survived. I think things eased down a bit when my dad got his gratuity and found a new job. He now works as a private security personnel.

How much did he get for his gratuity?

₦5 million, but the way that money went ehn. I think he still gets a monthly pension, but I don’t know how much. For me, I don’t think it’s worth it. I’ll save my money myself for the future.

35 years of service?

Yes o. We moved to a new house in 2018. The house wasn’t done and still needed to be furnished – painting, furniture, etc. I’m just glad we never went into any debt.

The space is also massive, and so, for it not to look empty, we had to furnish the whole place. That cost a lot.

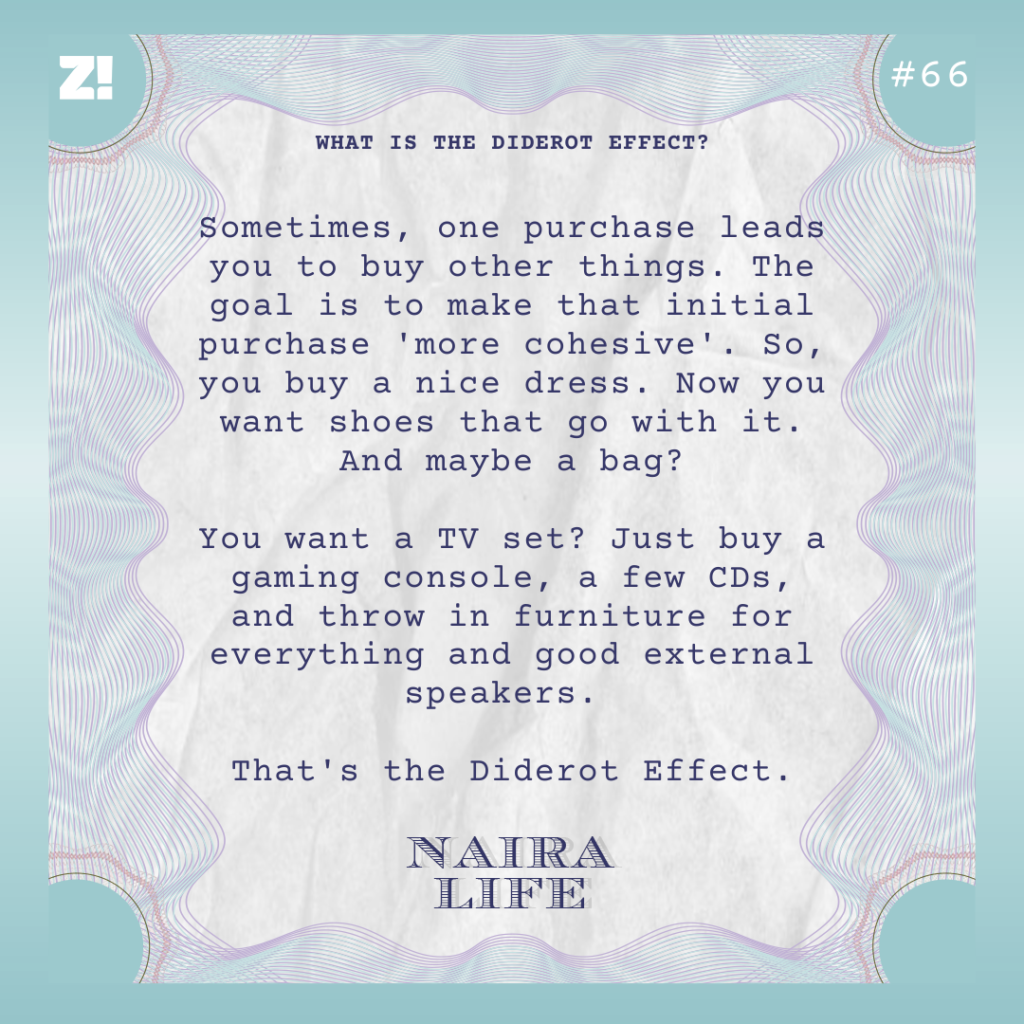

Ah, the Diderot Effect.

I think it’s amazing; going from zero code skills to becoming breadwinner in 5 years.

This money thing, what’s it for you?

A friend shared his perspective on how he managed money – I know you asked for mine, but here I am giving you someone else’s take. He says money shouldn’t sit in your account, but should instead be working for you.

I totally agree with that. But for me, I prefer to save and still invest my money.

Tell me about that.

Just thinking of the money I have saved up somewhere gives me joy, especially when I have no immediate need for it. But of course, I understand that investing the money can get me more money in return.

I’m a low-risk person, so I’ll save some and invest some.

Fair enough. How do you save?

- My bank account: 30%,

- PiggyVest: 10%,

- Cowrywise 20%

- Domiciliary account: 40%

I still need to learn more about money management and investment, but so far, I’m not doing a bad job.

Did you ever think back at 2017 and imagine you’d be earning this now?

To be honest, my brain was still operating in naira. So, I used to believe that I had to be a manager working for up to 5 years to earn ₦1 million. It feels good.

I’m feeling good on your behalf. What’s something you really want right now but can’t afford?

I don’t really have any super expensive thing I need. Well, I need a car and in a few months, I should be able to get one. My budget is 2 million.

Fair e –

Oh, wait! I have one actually. I need to get a standing desk, because of the back pains from sitting too long. but shipping to Nigeria isn’t available, and it’s also twice the price. To be honest, I think it’s less about it being expensive, and more about not having access to it.

What’s the last thing you paid for that required serious planning?

I plan everything in advance, to be honest. But the last thing I remember would be getting a new computer and creating a home office.

The home office set up:

- Monitor: ₦60k

- Desk and chair cost ₦35k

- Keyboard and mouse: ₦15k

It’s super simple now, and I’ll occasionally add more things, but nothing extra.

Fair enough. What’s something you struggle with though?

Procrastination and ample rest.

Ah, working or feeling guilty for not working eh?

That’s exactly how I feel today. I haven’t done any work and I haven’t also rested like I wanted to. But we move.

On a scale of 1-10, how would you rate your happiness levels?

I’ll say 7. I’m financially stable, which is great. I don’t think I need anything that I can’t afford, but the twist to this to be honest, I still have struggles in other areas of my life.

Have you ever had to process all of this at once?

I don’t think I have. I think that was a big takeaway from doing this.

Thank you for taking the time.

Her quick hacks to earn in dollars:

- Find a skill that’s in global demand, and can be done remotely.

- Make a lot of noise about your skills, so you get noticed.

- Stay consistent in delivering, and the gigs will come.