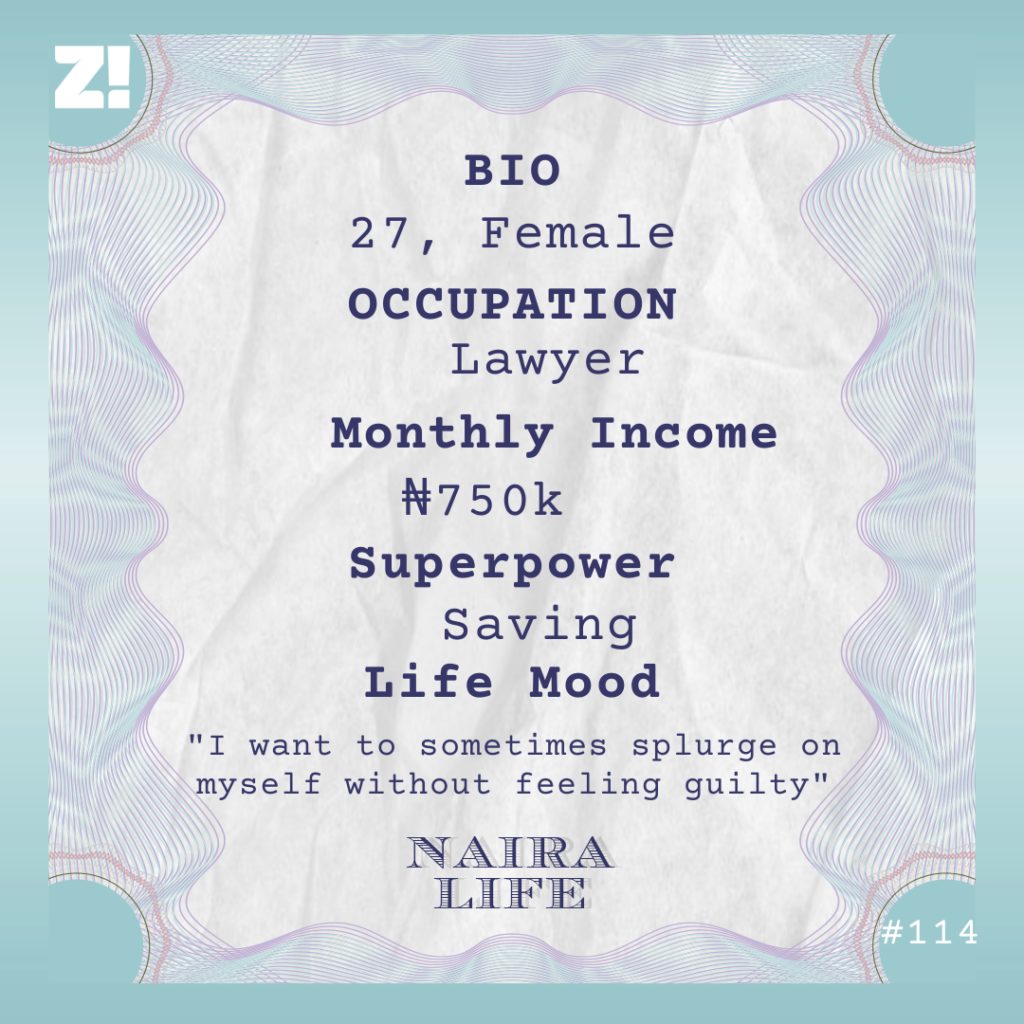

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Do you remember the first time you knew what money meant?

2005 or 2006. I went to a government secondary school and lived in a boarding house. My folks gave me just enough allowance to survive — about ₦2k per term. One day, my dad drove to my school and gave me ₦500, which I was supposed to survive on for 25 days. He probably thought I still had money and wanted to top it up. I lived on ₦20 a day, basically buying biscuits and a sachet of water. At the time, I was somewhat afraid to ask my parents for anything, so I didn’t say anything or ask them for more.

Omo. What was it like growing up, financially?

My dad runs a couple of businesses and my mum has a nonprofit she manages. For as long as I’ve existed, my parents have worked for themselves. I was born around the time they were still getting on their feet. We weren’t very comfortable, but they managed to do the basic things. Things consistently got better over the years. We moved to more decent apartments and did. more than we used to. I mean, all of my parents’ kids went to university outside of Nigeria. I did mine in the UK.

Oh. How did it happen?

After my A-Level, everyone at my school was applying to universities in the UK. I told my parents I’d like to apply too, and they went, “We don’t have UK money oh.” But they let me try my luck with the application process. When they saw how good my A-Level results were, they relented, researched school fees and started planning. I continued the application process and got an offer to study law, and that was it. The tuition was £11k and my accommodation was £3600. The exchange rate was around ₦270 at the time.

Fun times! So, how was uni?

My parents gave me £200 every month, which was enough for me to get groceries, pay my phone bill, buy a nice dress once in a while, and purchase standard train tickets to neighbouring cities.

Lit. Do you remember the first time you worked for money?

My first internship in 2013. I’d just finished my first year of university and came back to Nigeria for the holidays. I always knew I wanted to work in Nigeria, so it was important to build a network here. I got a job at a multinational company as a legal intern, and they paid me ₦30k per month. I spent a month and a half on the job before I returned to school. That meant ₦45k in total for the time I worked there.

I graduated from uni in 2015, returned to Nigeria and went to law school. I went through quite a number of recruitment processes immediately after completing law school, and I got a job at a law firm during my service year in 2016. They paid me ₦150k per month. The federal government paid ₦19800.

You were balling, weren’t you?

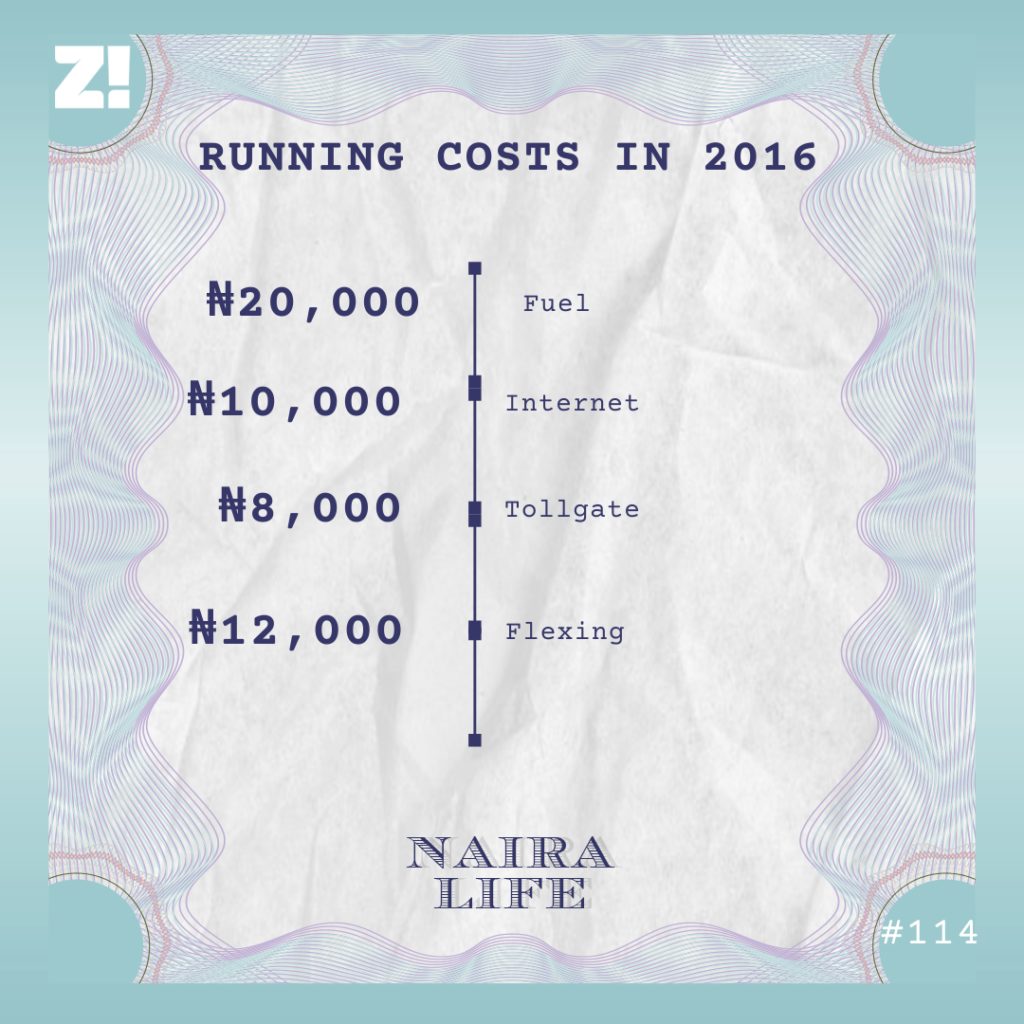

Well, all my expenses were capped at ₦50k, and the rest went into my savings. I didn’t always stay on the budget, but for the most part, I was easily saving ₦100k out of my salary. I didn’t touch my allawee at all.

What did your monthly running costs look like in 2016?

My idea of flexing was buying shawarma or dining out once a month. I used to go out with my friends who were doing better than me financially and they’d foot the bill.

What happened after NYSC?

I was promoted to full staff at the law firm and my salary increased to ₦200k. My expenses didn’t change, so I added an extra ₦50k to my savings every month. By the time I left the job, I had saved about ₦2.5m.

Why did you leave the job?

I was going back to school for my master’s. I got a full scholarship, so tuition was covered. But my savings went into every cost that was associated with going to the US — application fees, transcript processing, medicals, plane tickets, enrollment deposits, and all of that. I had about ₦500k left in my savings when I travelled.

Oh wow. How did it go in the US?

My parents came through again and put me on an allowance of $400 per month. My running costs were about $200, and the other half went straight into my savings. My recurring expenses at the time was $120 for groceries and my $40 phone bill.

Also, I picked up a job at the school kitchen to supplement my allowance, and the pay was $13/hour. I worked 5-hour shifts, three days a week. The first time I got my paycheck, I was like, “What’s this?”

Why was that?

Taxes. I was getting paid about $160 after tax. Anyway, it was still extra cash and it mostly went to shopping. I didn’t have guilty pleasures and I wasn’t one to splurge on things, but I could go to the store, see something I liked and buy it.

Ah, lit. When did you finish your masters?

2019. I worked in the public service for a year after. My annual salary was $37k before tax, and I got about $2300 every month. My major expense at the time was rent, and it was $600. I consistently saved at least $1k every month. I knew I was going to come back to Nigeria, so I wanted to save as much as I could in dollars before I returned. I didn’t meet my $15k savings goal, but I was very close. Then I returned to Nigeria in 2020.

How much was “close”?

I had $13k right before I started preparing to return. But my travelling costs were expensive because of the pandemic and my account took a hit. I had $11k after everything was done. I took ₦300k out of it because I wasn’t sure how long it would take me to find a job here. The rest is still in my US account.

How long before you found a job in Nigeria.

Omo. It took about four months. I took some time to rest before I started job hunting. I thought it would take one or two months because it didn’t take me that long to find my entry-level job. The joke was on me.

What were those months like?

A lot of tears and second-guessing my decision to move back. Doing the right thing can be very painful sometimes. I applied to jobs, friends referred me to jobs, and headhunters reached out to me. I did multiple interviews and made it through various stages, but it wasn’t just clicking.

Money wasn’t coming in, what was that like?

I lived on the ₦300k I took out of my savings. I reduced my monthly running costs to ₦30k, which was great. I ran out of money last month, but thankfully, I had gotten a job in February.

Yay! How did you get the job?

A friend referred me, and it is a multinational company. I made it to the final stage of their recruitment process and was offered a job in their legal department.

How much?

₦750k.

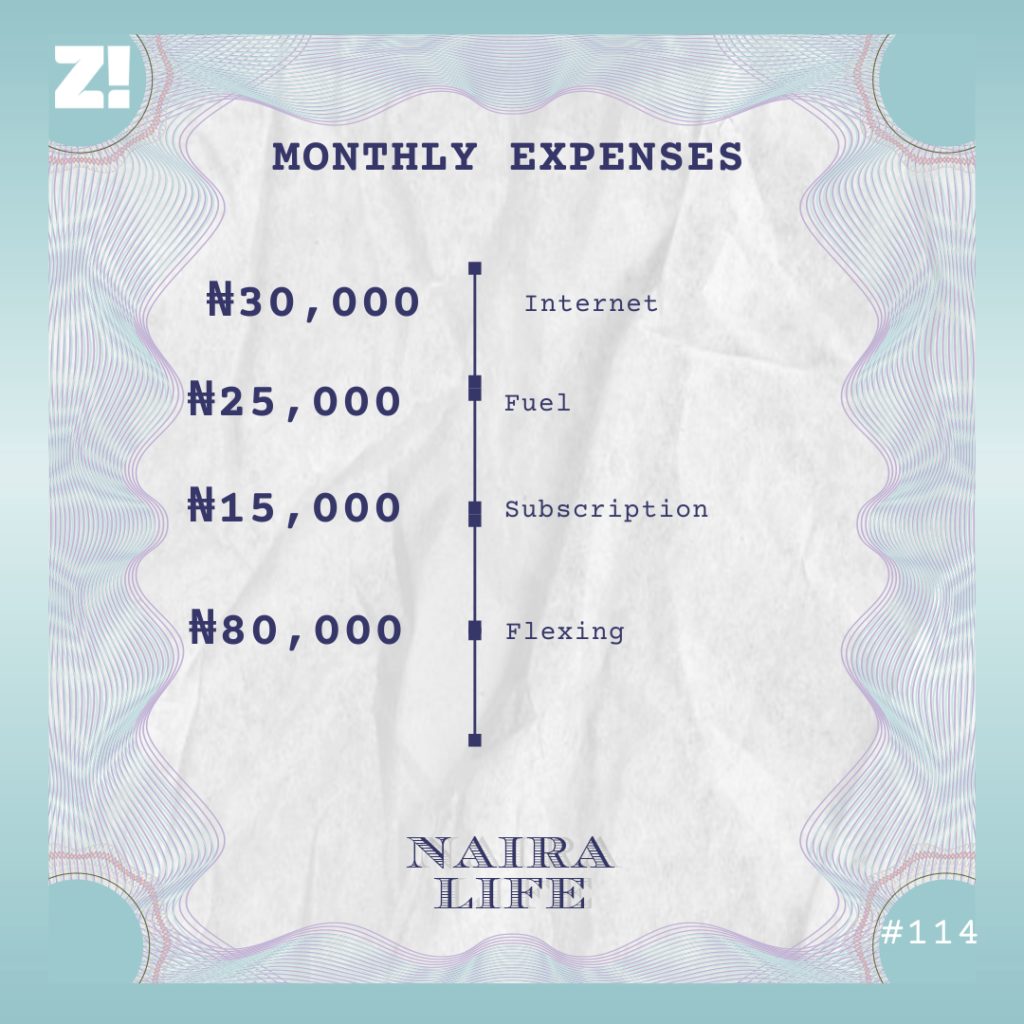

Litttt! So what does an ideal month look like these days?

I haven’t yet figured everything out but my expenses are pegged at ₦150k, and that’s even me being extravagant. I’m on track to save about ₦600k every month.

The cable subscription is for my parents because I’m living with them and want to start contributing to the house bills in my little way. Flexing for me is still buying shawarma or going out to eat in restaurants. But I don’t eat out anymore because of the pandemic. Chances are that the ₦80k will still go back into my account.

Your spending power is relatively low compared to what you earn.

I don’t know how to explain it, but I don’t get the urge to spend money. For starters, I don’t pay rent. I hardly buy clothes and shoes. Apart from a few work clothes and shoes I bought when I was moving back, I haven’t changed my wardrobe in a few years — my size has remained the same, and when making purchases, I focus more on buying quality items that last for years.

In an ideal situation, I could squeeze my monthly expenses to ₦100k if I wanted to, but spending ₦150k every month doesn’t sound bad, and it won’t affect my savings goal. People have told me that I might be frugal. But I happily spend money on other people; it’s a problem to spend anything on myself because there aren’t a lot of things I like.

Ah, I see. What was the biggest amount you’ve spent on someone?

About $300. I bought a phone for my partner at the time.

Where do you think this “frugality” came from?

My parents never gave me the kind of money that afforded me the luxury of splurging for no reason. I couldn’t be living on £200 a month and buying Jimmy Choo shoes. Also, I truly don’t have guilty pleasures. One of my siblings tells me all the time that when you earn more, your taste improves and you spend more. That hasn’t been very accurate for me.

Mad!

I’ll be honest and say that I’m probably pulling this off because I don’t worry about my parents’ finances, and that has taken a huge burden off my shoulders. What that does is motivate me to earn more money so I can spoil them. The best part is that I can pace myself and have enough time to plan for whatever I want to do for them. I’m also grateful that I get to live with them, and there’s mutual respect between us. I can move out if I want to but that’s an additional and unnecessary expense. Like, have you seen the price of curtains?

Lmao. How do you think all of these experiences have shaped your perspective about money?

I understand that money is a good thing to have although it’s not something to hold on tightly to. It’s also made me curious about investing and growing my money. I used to think that you need to have a certain amount of money saved up before you think of investing. Now I know that’s not true. I’m trying to get educated on the right options for my level of income. But maybe I’ll need to save a little less to pull it off.

Speaking of savings, how much do you have in your stash?

About $12k. I’m very broke in Naira. I don’t have up to ₦50k in my bank account right now: I’ve sent the bulk of it into my savings account.

Savings is the core of your personal finances, do you have a savings goal?

I want to consistently save ₦5m every year for the next three years. Then I’ll see what next I want to do. That means I have to grow my income because I also want to have an investment goal, though I’m risk-averse and wary of putting money I can lose in anything. I’m trying to see if I can invest $2k in something every year. If I see the compounding effect of that in the next three years, I’ll be happy to increase my goal. Right now, I’m focused on growing my savings and gaining investment knowledge. Not something like, “They say agric is the hottest thing now, let me put money in it.”

DFKM. What investment options are you looking at?

At the moment, it’s stocks and real estate. I put $500 in my Risevest account. I’ll see how it does in the next six months and go from there.

Cool. How much do you think you should be earning to cater to your savings and investment plans?

About ₦1.2m. I can conveniently save ₦1m every month if that happens.

What needs to happen for you to unlock your next level of income?

Promotion or a job change. But since I just started at this job and really like it, promotions are my best bet. In the next three years, my goal is to be earning at least double of what I’m currently earning.

What’s something you need but can’t afford?

Would it be weird if I said a new phone? I’ve been using my phone for almost three years now, and it’s about to give up on me. I checked the prices of phones the other day and decided that I can’t afford it. I mean, I have the money, but I can’t bring myself to splash it on a phone.

What’s something you want but can’t afford?

Something I want but I really can’t afford right now is a second passport. I want access to the world in a way that’s not limited by borders, so a passport that gives me access to 180+ countries will bang so much. It would be great to be able to afford citizenship by investment in such countries, but I’d need more than $100k for that. Omo.

Haha. What’s something you wish you could be better at financially?

Spending money on something without feeling like it’s an unnecessary expense. I almost feel like I have to justify spending money. The recurring question I ask myself is, “Do I have to?” I’m struggling to move between the different layers of comfort and finding the balance between planning my finances and living my best life. I want to sometimes splurge on myself without feeling guilty. But I understand that it’s a journey.

I have to ask, what’s something you bought recently that improved the quality of your life?

Wait, it’s not recent but I bought an Amazon Echo Dot when I was in the US, and it’s improved the quality of my sleep. I was dealing with insomnia at the time, and it was the worst. That cost me $30.

Nice. How would you rate your financial happiness on a scale of 1-10?

7. I don’t worry about money and I’m not in debt. I have good health insurance courtesy of my job, so I’m not worried about a health emergency. I’m in a good place to grow my savings. However, I still want to start investing in order to make my money work for me, earn more and save more. And more importantly, get to a place where I can actually start splurging on things without feeling any guilt.